India Blended Spices Market Size 2024-2028

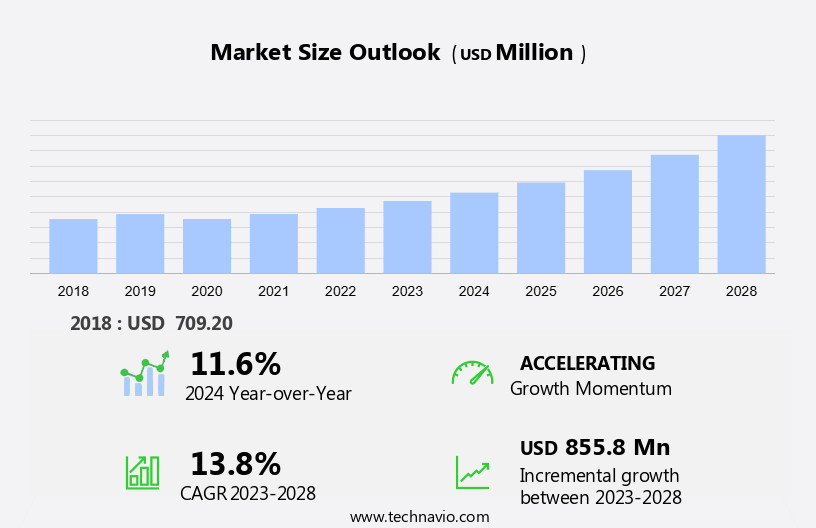

The India blended spices market size is forecast to increase by USD 855.8 million at a CAGR of 13.8% between 2023 and 2028.

- Blended spices, consisting of a mix of clove, cinnamon, cardamom, ginger, garlic, and others, continue to be a staple in Indian and ethnic cuisines. The market for these spices is witnessing significant growth due to several factors. Rising awareness about the health benefits associated with these spices, particularly their antioxidant properties, is driving demand. Additionally, the increasing popularity of plant-based meat and functional food items, which often incorporate blended spices, is fueling growth. In the food service industry, the use of these spices in meat dishes and soups is a trend, while In the health and wellness sector, they are being added to dietary fiber-rich content, such as online grocery and e-commerce labels, to enhance taste and nutritional value.

- The digital era has also led to the convenience of purchasing these spices online, making them easily accessible to consumers. However, fluctuations In the prices of key ingredients, such as clove, cinnamon, and cardamom, pose a challenge to market growth. Overall, the market is expected to witness steady growth, driven by health consciousness, changing consumer preferences, and the convenience of online purchasing.

What will be the size of the India Blended Spices Market during the forecast period?

- The market has experienced significant growth in recent years, driven by the increasing popularity of packaged foods and exotic cuisines among consumers. With a focus on health consciousness and the prevalence of digestion-related problems, blended spices are increasingly viewed as valuable health boosters and immune system enhancers. Turmeric, ginger, garlic, and other spices are prized for their nutritional benefits and unique flavors.

- India, the world's largest exporter of spices, offers a rich diversity of whole and ground spices, herbs, and pre-seasoned products, including garam masala, curry powder, chili powder, and various blends. The market is further fueled by the rise of home cooking, health and wellness trends, meat alternatives, plant-based diets, veganism, and the demand for convenient, flavorful, and nutritious food products. Blended spices offer a cost-effective and versatile solution for adding unique flavors to a wide range of dishes, making them an essential ingredient in both traditional and modern cuisines.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Supermarket

- Convenience store

- Online

- Type

- Garam masala

- Non-veg masala

- Chole and channa masala

- Others

- Geography

- India

By Distribution Channel Insights

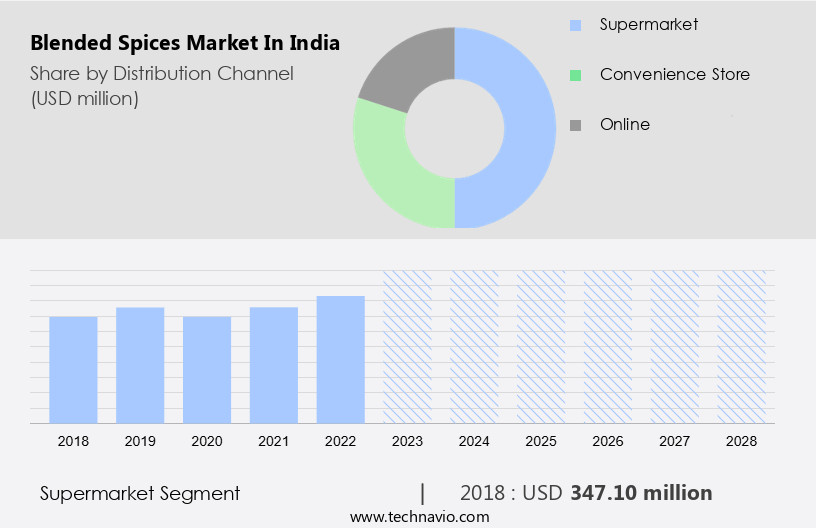

- The supermarket segment is estimated to witness significant growth during the forecast period. Blended spices have gained significant popularity in India's supermarkets, catering to consumers' increasing preference for convenience and diverse culinary experiences. Factors such as urbanization and rising disposable incomes have fueled demand for a wide range of products and convenient shopping experiences. The advent of digital platforms and e-commerce has further transformed the retail landscape, with many supermarkets integrating online shopping options. Health consciousness and digestion-related issues have led consumers to seek out high-quality and organic spice blends, including turmeric, ginger, garlic, and garam masala. Exotic cuisines, such as Ethiopian berbere and Chinese spices, have also gained traction, driving demand for ready-to-use spice blends and seasoning mixes.

- Supermarkets offer a vast array of spice blends, from premium blends to natural and organic options, catering to various dietary preferences, including meat alternatives, plant-based diets, and veganism. Spice exports have also grown, making Indian spices a staple in global markets. Functional food and customized blends have emerged as key trends, with consumers seeking spices for their nutritional benefits, antioxidant properties, and anti-inflammatory properties. The market for blended spices is expected to continue growing, driven by the appeal of unique flavors and the convenience they offer in home cooking and food service.

Get a glance at the market share of various segments Request Free Sample

- The supermarket segment was valued at USD 347.10 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of India Blended Spices Market?

- Rising awareness about health benefits of blended spices is the key driver of the market.

- Blended spices, a key component of packaged foods and exotic cuisines, offer numerous health benefits beyond their flavor-enhancing properties. These spice blends, which may include turmeric, ginger, garlic, and others, are recognized for their nutritional benefits, including antioxidant properties, anti-inflammatory effects, and potential immune system boosters. Garam masala, a popular Indian spice blend, is known for its antioxidant properties, as each ingredient contributes powerful antioxidants. Blended spices also contribute to heart health by regulating blood sugar levels and reducing the risk of heart disease and colon cancer.

- As consumers increasingly prioritize health consciousness, digestion-related problems, and meat alternatives, the demand for blended spices, particularly in plant-based diets and veganism, is expected to grow. This trend is driving the adoption of blended spices In the food and beverage sector, fueling the expansion of the market in India during the forecast period. Additionally, the availability of ready-to-use spice blends, natural ingredients, and customized blends catering to various ethnic cuisines, functional food applications, and food service industries further boosts market growth.

What are the market trends shaping the India Blended Spices Market?

- Increasing prominence of private-label brands is the upcoming trend In the market. The Indian market for private-label blended spices is experiencing significant growth as retailers capitalize on consumer demand. Retailers are developing their own brands of blended spices, such as garam masala, berbere, and curry powder, to increase profitability. These blends offer unique flavors for ethnic cuisines and cater to health-conscious consumers seeking digestion-related solutions, immune system boosters, and nutritional benefits from ingredients like turmeric, ginger, garlic, and chili powder. Private-label blends are also popular among those following plant-based diets, meat alternatives, veganism, and fusion cuisine. Convenience foods, processed meats, and ready-to-use spice blends are other market drivers. Spices like ginger, garlic, and turmeric have antioxidant and anti-inflammatory properties, making them functional food ingredients.

- Retailers offer a range of blends, including premium and organic options, to cater to various consumer preferences. Wholesale and ground spices are used for home cooking, while pre-seasoned products provide convenience. The market for blended spices extends to food service and confectionery products, as well as Chinese spices. The market's growth is driven by the increasing popularity of exotic cuisines and the desire for natural, high-quality ingredients.

What challenges does India Blended Spices Market face during the growth?

- Fluctuations in prices of blended masala ingredients is a key challenge affecting the market growth. The market is characterized by price volatility due to the unpredictable production of key spices such as cardamom, cinnamon, cloves, and peppercorns. These spices are integral to various blended spice varieties produced by leading global manufacturers, including those based in India. Price fluctuations occur when there is an overproduction or underproduction of these spices, impacting exports and imports and, in turn, the growth rate of the market. Blended spices, a crucial component of packaged foods and ethnic cuisines, offer health benefits and are used as immune boosters in various cultures. Turmeric, ginger, garlic, and chili powder are popular blended spices with antioxidant and anti-inflammatory properties.

- Other spices like garam masala, berbere, and curry powder add unique flavors to dishes. Health consciousness and digestion-related problems have led consumers to explore natural ingredients like spices for their nutritional benefits. The market for pre-seasoned products, convenience foods, and processed meats is growing, driving demand for natural, raw material-based spice blends. Spices are also used as flavoring and seasoning in various food products, including confectionery, Chinese, and fusion cuisines. The market for organic spice blends and customized blends is gaining traction as consumers seek healthier options. Spice exports from India contribute significantly to the economy, making it a key player In the global spice trade. The market for blended spices is expected to continue growing, driven by the increasing popularity of plant-based diets, meat alternatives, and veganism.

Exclusive India Blended Spices Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aachi Group

- Empire Spices and Foods Ltd.

- Everest Spices

- Gajanand Foods Pvt. Ltd.

- Great Value Foods LLP

- ITC Ltd.

- JK SPICES AND FOOD PRODUCTS

- Mahashian Di Hatti Pvt. Ltd.

- MTR Foods Pvt. Ltd.

- Patanjali Ayurved Ltd.

- Pushp Brand (India) Pvt. Ltd.

- Ramdev Food Products Pvt. Ltd.

- Suhana

- Suruchi International Pvt. Ltd

- Tata Consumer Products Ltd.

- VLC Spices

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Blended spices have gained significant traction In the Indian food market, driven by the growing popularity of packaged foods and the fascination with exotic cuisines. The health consciousness of consumers, particularly those experiencing digestion-related problems, has also contributed to the demand for these spice blends. Blended spices offer numerous health benefits, acting as immune boosters and providing antioxidant and anti-inflammatory properties. Turmeric, ginger, and garlic are some of the most commonly used spices in blends due to their distinct flavors and health advantages. These spices are integral to various ethnic cuisines, adding unique flavors and enhancing the taste of dishes.

The Indian subcontinent is known for its rich spice traditions, with garam masala, berbere, and curry powder being popular examples of blended spices. The spice exports sector in India has seen substantial growth due to the increasing global interest In these flavorful blends. The demand for natural ingredients in food products, including spice blends, seasonings, and flavorings, has fueled this growth. Home cooking and the rise of ethnic food have also contributed to the market's expansion. The health and wellness trend has influenced the food industry, leading to the development of meat alternatives, plant-based diets, and veganism. Blended spices play a crucial role In these diets, providing flavor and enhancing the taste of plant-based dishes.

Spice blends have also found applications in convenience foods, processed meats, and ready-to-use products, catering to consumers' desire for quick and easy meal solutions. The use of herbs in blended spices adds to their nutritional value and functional food properties. Pre-seasoned products and customized blends have gained popularity due to their convenience and versatility. The fusion of various cuisines and the creation of new flavor profiles have led to the development of premium blends, catering to the evolving preferences of consumers. The raw materials used in blended spices are sourced from various regions, ensuring a diverse range of flavors and aromas.

The Indian spice market is known for its high-quality raw materials and the expertise of its producers. Chinese spices have also gained popularity in recent years, adding to the market's diversity. The food service industry has embraced the use of blended spices, recognizing their potential to enhance the taste and appeal of dishes. Confectionery products have also incorporated spices, adding a unique twist to desserts and pastries. Thus, the market is driven by the growing demand for packaged foods, health consciousness, and the fascination with exotic cuisines. The market's expansion is fueled by the development of new flavor profiles, the use of natural ingredients, and the growing popularity of plant-based diets and veganism. The market's diversity is reflected In the wide range of applications for blended spices, from home cooking to food service and confectionery.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.8% |

|

Market growth 2024-2028 |

USD 855.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.6 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch