Blood Glucose Monitoring Devices Market Size 2025-2029

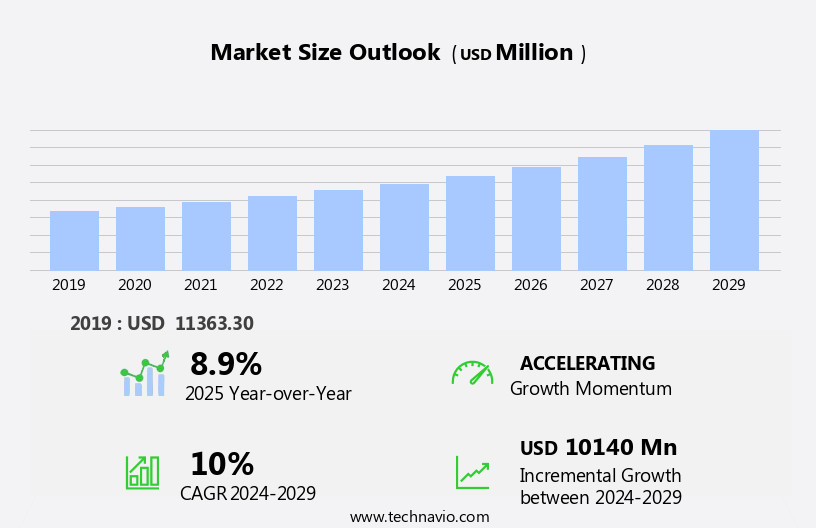

The blood glucose monitoring devices market size is forecast to increase by USD 10.14 billion at a CAGR of 10% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising global burden of diabetes and the increasing adoption of advanced technologies such as smart watch-based apps for continuous glucose monitoring. According to the International Diabetes Foundation, approximately 463 million adults were living with diabetes in 2019, and this number is projected to reach 700 million by 2045. This growing population of diabetes patients presents a substantial market opportunity for blood glucose monitoring device manufacturers. However, the market faces challenges that could hinder its growth potential. Regulatory hurdles impact adoption, as these devices must meet stringent regulatory requirements to ensure accuracy and safety.

- Additionally, supply chain inconsistencies can pose challenges, as the demand for these devices is often volatile and requires a reliable and flexible supply chain to meet patient needs effectively. To capitalize on market opportunities and navigate these challenges, companies must focus on regulatory compliance, supply chain optimization, and the development of user-friendly and accurate devices that meet the evolving needs of diabetes patients. Technological advances in this field have led to more sophisticated devices, such as continuous glucose monitoring systems, insulin syringe and pens, which offer enhanced functionality and improved patient outcomes. The hospital end-use segment supports inpatient monitoring, while home healthcare segment devices empower individuals with convenient glucose monitoring solutions. By addressing these challenges, market participants can position themselves for long-term success in the market.

What will be the Size of the Blood Glucose Monitoring Devices Market during the forecast period?

- The market is experiencing significant growth, driven by the increasing prevalence of diabetes and the demand for advanced technologies to support personalized diabetes management. Patient engagement is a key trend, with diabetes prevention programs emphasizing diet and exercise, and digital health solutions enabling remote patient monitoring through the Internet of Things. Artificial intelligence and machine learning are revolutionizing data analytics, enabling early detection of diabetes complications and improving quality of life through data interpretation. Diabetes research continues to advance, with innovation in sensor calibration and cloud computing enhancing the accuracy and accessibility of blood glucose monitoring.

- The market encompasses a range of essential tools including glucose meters, lancets, and test strips, crucial for managing conditions like Type 2 diabetes. Innovations like Insulin pumps and Continuous Glucose Monitoring (CGM) systems such as Eversense CGM utilize advanced sensor technologies and microminiaturization. Diabetes awareness and education programs are also crucial, leveraging digital platforms to reach larger audiences and promote lifestyle modifications. Overall, the market is dynamic and innovative, with a focus on improving diabetes management and preventing complications.

How is this Blood Glucose Monitoring Devices Industry segmented?

The blood glucose monitoring devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

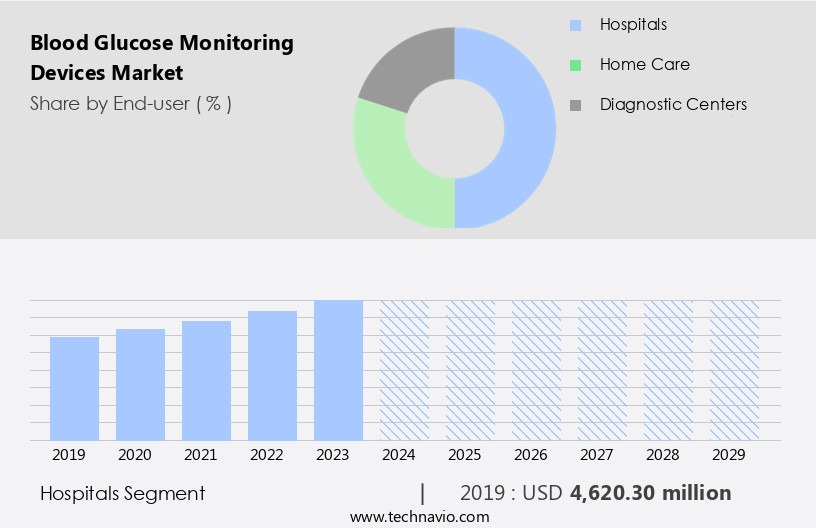

- End-user

- Hospitals

- Home care

- Diagnostic centers

- Product

- SMBG

- CGM

- Lancets

- Indication

- Type-2 diabetes population

- Type-1 diabetes population

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The hospitals segment is estimated to witness significant growth during the forecast period.

The diabetes care market encompasses various devices and technologies used for managing diabetes, with blood glucose monitoring devices being a crucial component. These devices include blood glucose meters, continuous glucose monitoring systems like Guardian Connect and Dexcom G6, and non-invasive glucose monitoring solutions. Diabetes educators and primary care physicians often recommend these tools for individuals with diabetes, including those with type 1, type 2, and gestational diabetes. Blood glucose meters provide instant readings, while continuous glucose monitoring systems offer real-time data logging and predictive capabilities. Wearable technology, such as insulin pumps and flash glucose monitoring systems like the Freestyle Libre, enable remote monitoring and data analysis.

Closed-loop systems, which combine insulin delivery and glucose sensing, represent the future of diabetes management. Healthcare professionals, including diabetes educators and healthcare providers, play a vital role in implementing these solutions. Home glucose monitoring is essential for managing diabetes outside of clinical settings, while point-of-care testing is valuable for quick assessments in various care environments. Insulin resistance, diabetes complications, and glycemic control are significant concerns that drive the demand for accurate and reliable glucose sensors. Sensor accuracy and sensor lifespan are essential factors in selecting blood glucose monitoring devices. Smartphone connectivity and mobile app integration facilitate data analysis and ease of use.

The diabetes supplies market is expanding as the need for continuous glucose monitors, diabetes technology, and diabetes education grows. Diabetes prevention efforts also contribute to the market's growth, as early detection and effective management can reduce healthcare costs and improve patient outcomes.

The Hospitals segment was valued at USD 4.62 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The diabetes care market in North America is experiencing significant growth due to the increasing prevalence of diabetes, particularly type 1 and type 2, and the rising awareness of the importance of monitoring blood glucose levels. Advanced technologies, such as continuous glucose monitoring (CGM) systems, non-invasive glucose monitoring, and flash glucose monitoring, are gaining popularity. CGM systems, including those with remote monitoring capabilities and smartphone connectivity, offer real-time data logging and predictive glucose monitoring, enabling better diabetes management. Wearable technology, such as insulin pumps and sensors, are also becoming more common, providing a more balanced integration into daily life.

Primary care physicians and healthcare professionals are increasingly recommending these devices to their patients for improved glycemic control and diabetes complications prevention. The diabetes supplies market is also growing, driven by the demand for home glucose monitoring, insulin resistance management, and diabetes prevention. The development of more accurate sensors, artificial pancreas systems, and closed-loop insulin delivery systems further enhances the market's potential. Additionally, the integration of mobile apps and data analysis tools facilitates easier data management and interpretation for both patients and healthcare providers. The market is also witnessing growth in the area of gestational diabetes monitoring and HbA1c testing, ensuring comprehensive diabetes care.

The sensor lifespan and data analysis capabilities are crucial factors influencing the market's development. Overall, the market in North America is poised for continued growth, driven by technological advancements, increasing diabetes prevalence, and the growing focus on diabetes education and prevention.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Blood Glucose Monitoring Devices market drivers leading to the rise in the adoption of Industry?

- The escalating global prevalence of diabetes serves as the primary catalyst for market growth. The global diabetes care market, specifically the blood glucose monitoring devices segment, is experiencing significant growth due to the increasing prevalence of diabetes. Diabetes, a chronic condition characterized by high blood sugar levels, impacts millions of adults globally. According to the International Diabetes Federation's Diabetes Atlas 11th edition, an estimated 589 million adults were living with diabetes in 2021, representing approximately 11.1% of the global adult population. Of this number, around 252 million remained undiagnosed. Diabetes educators play a crucial role in managing diabetes care, and blood glucose monitoring devices are essential tools they utilize to help their patients track their blood sugar levels and adjust treatment plans accordingly.

- These devices include blood glucose meters, continuous glucose monitoring systems like Guardian Connect, and point-of-care testing equipment. Non-invasive glucose monitoring and insulin pump technologies are also gaining popularity in the market. Diabetes supplies, including these devices, are essential components of diabetes care, making the market a vital sector within the healthcare industry.

What are the Blood Glucose Monitoring Devices market trends shaping the Industry?

- The trend in technology is leaning towards smart watch applications. These innovative tools are gaining significant traction in the market. The blood glucose monitoring market is witnessing significant growth with the integration of advanced technologies such as remote monitoring and wearable technology. Primary care physicians and diabetes healthcare professionals are increasingly adopting these innovative solutions for effective diabetes management. Two leading companies, Dexcom G6 and Freestyle Libre, offer closed-loop systems that automatically adjust insulin delivery based on real-time glucose data. These systems enable users to log and track their glucose levels, reducing the risk of diabetes complications. Wearable technology, including smartwatches, plays a crucial role in this market.

- For instance, some smartwatches have apps that use Continuous Glucose Monitoring (CGM) sensors to measure glucose levels in the interstitial fluid and transmit the data to the device for real-time monitoring. Smartwatches have become increasingly popular in recent years as they can track various activities such as heart rate, sleep, physical activity, and other health metrics. Overall, the trend toward smartwatch-based blood glucose monitoring apps will continue as more people adopt wearable technology and seek convenient and effective ways to manage their health during the forecast period. This data logging feature allows users to monitor their glucose levels continuously and take necessary actions to maintain optimal health.

How does Blood Glucose Monitoring Devices market faces challenges face during its growth?

- The stringent regulatory framework poses a significant challenge to the expansion and growth of the industry. The home blood glucose monitoring market is a critical segment of diabetes management solutions, with increasing prevalence of insulin resistance and diabetes driving demand. Advanced technologies, such as predictive glucose monitoring and flash glucose monitoring, offer enhanced accuracy and convenience for patients. Medtronic Minimed's continuous glucose monitoring systems and glucose sensors are leading innovations in this space.

- Regulatory bodies, including the FDA and European Medicines Agency, ensure stringent guidelines for device safety and efficacy. These regulations mandate extensive clinical trials and studies to validate product accuracy and reliability, which can result in lengthy market introduction timelines. Despite the challenges, the market continues to evolve, with data analysis and artificial pancreas systems offering promising advancements for diabetes management. Gestational diabetes patients also benefit significantly from home glucose monitoring devices.

Exclusive Customer Landscape

The blood glucose monitoring devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the blood glucose monitoring devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, blood glucose monitoring devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company offers blood glucose monitoring devices such as Freestyle Optium, Freestyle Lite, Freestyle Freedom Lite, Freestyle Insulinx.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- ACON Laboratories Inc.

- Agamatrix Inc.

- ARKRAY Inc.

- Ascensia Diabetes Care Holdings AG

- Atlas Medical GmbH

- Dexcom Inc.

- F. Hoffmann La Roche Ltd.

- LifeScan IP Holdings LLC

- medisana GmbH

- Medtronic Plc

- Murata Manufacturing Co. Ltd.

- Nipro Corp.

- Ok Biotech Co Ltd.

- Prodigy Diabetes Care LLC

- Rossmax International Ltd.

- TaiDoc Technology Corp.

- Tandem Diabetes Care Inc.

- Trivida Health Inc.

- Ypsomed Holding AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Blood Glucose Monitoring Devices Market

- In February 2024, Abbott Laboratories announced the launch of the FreeStyle Libre Pro, a continuous glucose monitoring system designed for healthcare professionals to remotely monitor their patients' glucose levels (Abbott Laboratories Press Release, 2024). This innovative device marks a significant advancement in remote patient monitoring, enabling healthcare providers to make informed decisions and intervene promptly to prevent potential complications.

- In March 2025, Dexcom and Apple collaborated to integrate Dexcom's G6 continuous glucose monitoring system with Apple's Health app, allowing users to view their glucose data directly on their iPhones (Apple Newsroom, 2025). This strategic partnership represents a major step towards seamless integration of healthcare technologies, enhancing user experience and convenience.

- In May 2024, Medtronic completed the acquisition of Minimed Technologies, a leading manufacturer of continuous glucose monitoring systems, significantly expanding Medtronic's portfolio and market presence in the market (Medtronic Press Release, 2024). This strategic move strengthened Medtronic's position as a key player in the industry, offering a comprehensive range of diabetes management solutions.

- In October 2025, the European Commission approved the marketing authorization for Senseonics' Eversense Continuous Glucose Monitoring System, marking its entry into the European market (European Commission Press Release, 2025). This approval signifies a significant expansion for Senseonics, allowing the company to tap into the large European market and cater to the growing demand for advanced blood glucose monitoring solutions.

Research Analyst Overview

The blood glucose monitoring market continues to evolve, driven by advancements in technology and the growing demand for effective diabetes management solutions. Remote monitoring and blood sugar monitoring are key areas of focus, with wearable technology playing an increasingly significant role. The Freestyle Libre and Dexcom G6 systems represent significant innovations in non-invasive glucose monitoring, offering real-time data logging and improved sensor accuracy. Primary care physicians and healthcare professionals are integrating these technologies into their practices to enhance diabetes care. Closed-loop systems, which combine continuous glucose monitoring with insulin delivery, are gaining traction as they offer improved glycemic control and potential complications prevention.

Data analysis and predictive glucose monitoring are also becoming essential components of diabetes management. Medtronic Minimed, Medtronic's insulin pump system, and other continuous glucose monitors are helping healthcare providers optimize treatment plans and improve patient outcomes. Insulin resistance, diabetes complications, and gestational diabetes are some of the conditions that these technologies aim to address. Home glucose monitoring and point-of-care testing continue to be crucial for diabetes management, with smartphone connectivity and mobile app integration streamlining data access and analysis. The diabetes supplies market is expanding to accommodate these advancements, with an emphasis on user-friendly, cost-effective solutions. Diabetes prevention and education remain critical components of diabetes care, with continuous glucose monitors and data analysis tools providing valuable insights for both patients and healthcare professionals.

Sensor accuracy, sensor lifespan, and artificial pancreas technology are ongoing areas of research and development, as the market continues to adapt to the evolving needs of diabetes management. The diabetes care market is poised for continued growth as technology advances and healthcare providers seek to improve patient outcomes and quality of life.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Blood Glucose Monitoring Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2025-2029 |

USD 10.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.9 |

|

Key countries |

US, UK, Germany, Canada, Japan, China, France, Mexico, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Blood Glucose Monitoring Devices Market Research and Growth Report?

- CAGR of the Blood Glucose Monitoring Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the blood glucose monitoring devices market growth and forecasting

We can help! Our analysts can customize this blood glucose monitoring devices market research report to meet your requirements.