Insulin Syringes Market Size 2024-2028

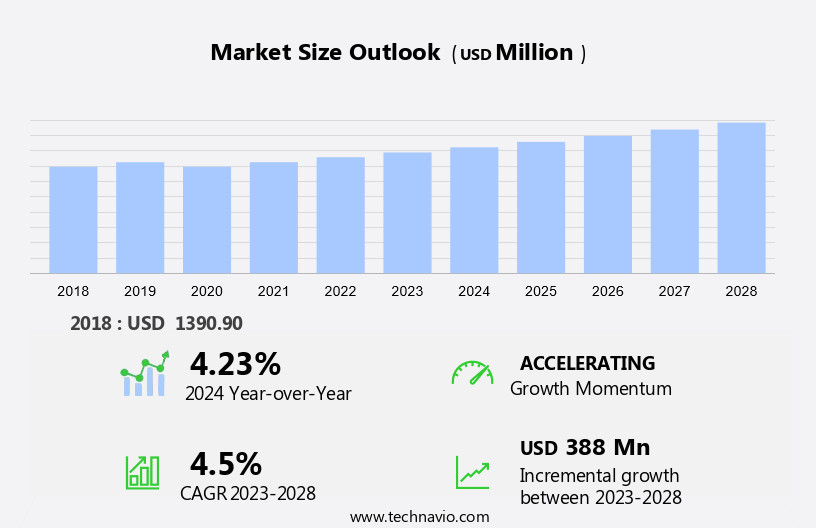

The insulin syringes market size is forecast to increase by USD 388 million at a CAGR of 4.5% between 2023 and 2028.

- Insulin syringes continue to be a crucial medical device for the management of diabetes, particularly for those with type 1 diabetes who require multiple daily insulin injections. The market is driven by the rising global burden of diabetes and the increase in awareness programs for diabetes. Additionally, non-adherence to insulin regimens remains a significant challenge, emphasizing the importance of user-friendly insulin delivery systems. Insulin pumps and insulin pens have gained popularity due to their convenience and ease of use, but insulin syringes remain an essential option for some patients. The market is also witnessing advancements in insulin syringe technology, such as the use of enzymes to improve insulin flow and glass syringes for enhanced accuracy and precision in insulin dosing.

- Blood glucose monitoring devices are increasingly being integrated with insulin syringes to provide a more comprehensive diabetes management solution. In summary, the market is expected to grow due to the rising prevalence of diabetes, the need for user-friendly insulin delivery systems, and technological advancements in insulin syringe design.

What will be the Size of the Insulin Syringes Market During the Forecast Period?

- The market encompasses the production and distribution of various types of insulin delivery devices, including traditional insulin syringes and insulin pens. These devices play a crucial role In the administration of insulin, a hormone essential for regulating glucose metabolism in individuals with diabetes, which affects the pancreas and the beta cells within the islets of Langerhans. The global population experiencing diabetes continues to rise, driven by an aging population and the increasing prevalence of obesity and chronic diseases. Insulin syringes come in various designs featuring needle, barrel, and plunger components and are available in silicone and calibrated units. Insulin syringes are utilized in both hospital and homecare settings, with the hospital segment primarily focusing on acute care and the homecare segment catering to long-term management.

- The market is expected to grow due to the increasing number of diabetic patients and advancements in biotechnology, such as insulin pens and needle technologies, which offer improved convenience and accuracy. The mortality rate among diabetic patients remains high, underscoring the importance of effective insulin delivery systems. Additionally, ongoing research into insulin delivery methods, such as the role of angiotensin-converting enzyme (ACE2) and the ACE2 enzyme, continues to shape the market landscape.

How is this Insulin Syringes Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Disease Type

- Type 2 diabetes

- Type 1 diabetes

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Disease Type Insights

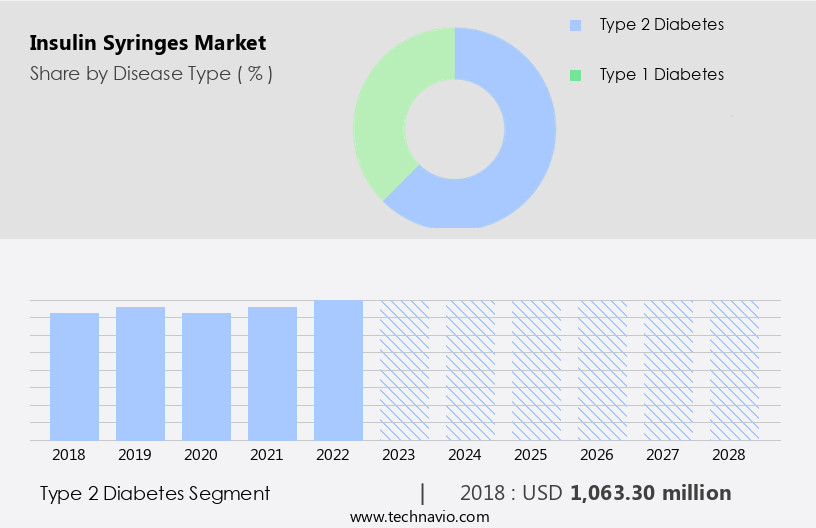

- The type 2 diabetes segment is estimated to witness significant growth during the forecast period.

Insulin syringes are essential diabetes care devices used by patients with type-2 diabetes to administer insulin subcutaneously. These syringes come in various types, including different needle lengths, gauges, and capacities. companies offer a range of affordable insulin syringes, which are often covered by reimbursement policies. The syringes allow for the mixing of two different types of insulin, as prescribed by doctors. For instance, Becton Dickinson and Co. Provides the BD Insulin Syringe with the BD Ultra-Fine 6-mm needle. Insulin syringes play a crucial role in managing glucose metabolism for diabetic patients. With the aging population and rising prevalence of chronic diseases, including obesity, the demand for insulin syringes is increasing.

The hospital segment is a significant application area for insulin syringes due to the large number of diabetic patients in this setting. Homecare applications are also growing as more patients manage their diabetes at home. Insulin pens are alternative devices gaining popularity, but insulin syringes remain a preferred option for some patients and healthcare providers. The market is expected to grow due to increasing diabetes awareness, disease prevalence, and advancements in biotechnology, such as the development of insulin analogs and continuous glucose monitoring systems.

Get a glance at the market report of share of various segments Request Free Sample

The Type 2 diabetes segment was valued at USD 1.06 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing growth due to the rising prevalence of diabetes, particularly Type 1 and Type 2, driven by an aging population and increasing obesity rates. Diabetic patients require insulin injections for glycemic control, which is facilitated by insulin syringes. These devices consist of a needle, barrel, and plunger, available in various sizes and pre-filled options. Insulin syringes are utilized in hospitals, clinics, and home care settings. The adoption of advanced technologies such as insulin pens and continuous glucose monitoring systems is also driving market growth. Favorable reimbursement policies and increasing awareness initiatives, like the CDC's National Diabetes Prevention Program, further fuel market expansion.

Key conditions associated with diabetes, such as cardiovascular diseases and physical inactivity, necessitate effective diabetes management, further boosting demand for insulin syringes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Insulin Syringes Industry?

The rising global burden of diabetes is the key driver of the market.

- Diabetes, a chronic condition characterized by impaired insulin production or utilization, affects over 460 million adults worldwide, with this number projected to reach 700 million by 2045 (IDF, 2019). The majority of these individuals reside in low- and middle-income countries. Among adults aged 65 and above, nearly one in five are diagnosed with diabetes. This disease can lead to severe complications, including cardiovascular diseases and increased mortality rates, if left unmanaged. Insulin, a hormone produced by the pancreas's beta cells or the Islets of Langerhans, plays a crucial role in glucose metabolism. These are essential tools for administering insulin to diabetic patients in various settings, such as hospitals, clinics, and home care.

- These devices consist of a needle, barrel, and plunger, available in various sizes and types, including conventional insulin and prefilled type. As the aging population and obesity rates continue to rise, the demand is expected to increase. Additionally, advancements in biotechnology, such as the Angiotensin converting enzyme (ACE2) and glycemic control through continuous glucose monitoring, are driving innovation in insulin delivery systems. Insulin syringes remain a vital component of diabetes care, enabling effective management of blood glucose levels and reducing hospital admissions.

What are the market trends shaping the Insulin Syringes Industry?

An increase in awareness programs for diabetes is the upcoming market trend.

- Diabetes, a chronic condition affecting the pancreas's ability to produce insulin from Beta cells In the Islets of Langerhans, impacts glucose metabolism In the body. Diabetic patients require regular insulin administration to manage their blood glucose levels. Insulin syringes, a crucial diabetes care device, consist of a needle, barrel, and plunger. Silicone with calibrations for accurate insulin unit measurements are widely used. The aging population and rising prevalence of chronic diseases, including obesity, are fueling the demand. According to Biotechnology Information, the ACE2 enzyme, which is associated with several diseases, including diabetes, may impact insulin syringe market dynamics.

- companies are organizing summits to spread awareness about diabetes management and generate insights for product development. For instance, the European Foundation for the Study of Diabetes (EFSD) and the Juvenile Diabetes Research Foundation (JDRF) are leading organizations advocating for diabetes research and patient support. These initiatives, along with the increasing awareness of glycemic control through continuous glucose monitoring, are expected to accelerate market growth. Insulin syringes find applications in hospitals, clinics, and home care settings. Prefilled insulin syringes and conventional insulin syringes cater to various disease types and syringe sizes. The hospital segment, with its large patient base and high adoption rate, dominates the market.

What challenges does the Insulin Syringes Industry face during its growth?

Non-adherence to insulin regimen is a key challenge affecting the industry growth.

- Diabetes, a chronic condition affecting the pancreas's ability to produce or utilize insulin, impacts millions of individuals worldwide. Insulin, produced by the beta cells In the Islets of Langerhans, plays a crucial role in glucose metabolism. InsulIn therapy is a common treatment for diabetes, yet adherence remains a significant challenge. Despite insulin's effectiveness in managing blood glucose levels, its underutilization persists due to various barriers. Provider barriers include inadequate education and resources, while patient barriers encompass fear of injections, lack of understanding, and inconvenience. The aging population, obesity, and the rise in chronic diseases further complicate insulin therapy adherence.

- Insulin syringes, a traditional insulin delivery method, consist of a needle, barrel, and plunger. Silicone type offer calibrations for precise insulin dosing, are available in various sizes and are suitable for different disease types. Insulin pens, an alternatives, have gained popularity due to their convenience. However, they remain essential in hospitals, clinics, and home care settings. The mortality rate for diabetic patients with poor glycemic control is higher, emphasizing the importance of effective insulin therapy. Biotechnology advancements, such as Angiotensin converting enzyme (ACE2) and glycemic control technologies, offer potential solutions to improve insulin therapy adherence. Continuous glucose monitoring systems and insulin pumps are other advanced diabetes care devices that doctors recommend for better diabetes management.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AdvaCare Pharma

- ASP Healthcare Pty Ltd.

- Avantor Inc.

- B.Braun SE

- Becton Dickinson and Co.

- Cardinal Health Inc.

- CODAN Medizinische Gerate GmbH and Co KG

- Gerresheimer AG

- Healthwarehouse.com Inc.

- Hi Tech Medics Pvt Ltd.

- Hindustan Syringes and Medical Devices Ltd.

- LAC Healthcare Solutions

- Nipro Corp.

- Novo Nordisk AS

- Poly Medicure Ltd.

- SCHOTT AG

- Smiths Group Plc

- Terumo Corp.

- Thermo Fisher Scientific Inc.

- UltiMed Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Insulin syringes are essential medical devices used for the administration of insulin, a hormone naturally produced by the pancreas's beta cells located In the islets of Langerhans. Insulin plays a crucial role in glucose metabolism by facilitating the absorption of glucose from the bloodstream into cells for energy production. Diabetic patients, whose bodies either produce insufficient insulin or cannot effectively use it, require regular insulin injections to maintain glycemic control. The market is driven by several factors, including the aging population and the increasing prevalence of chronic diseases such as diabetes.

Moreover, the obesity epidemic also contributes to the market's growth, as obesity is a significant risk factor for diabetes and other chronic diseases. They come in various sizes and types, including conventional insulin pens. Conventional type consist of a needle, barrel, and plunger made of materials such as silicone or glass. Calibrations on the barrel indicate the units of insulin to be administered. Insulin pens, on the other hand, are disposable or reusable devices that integrate a needle and a cartridge containing insulin. The market is diverse, catering to various applications in hospitals, healthcare services, clinics, and home care settings.

Furthermore, in hospitals and clinics, these are used for the administration of insulin to patients during their hospital stay. The hospital segment is expected to grow due to the increasing number of hospital admissions for diabetes-related complications, such as cardiovascular diseases, which can lead to high mortality rates. In-home care settings, they are used by patients to self-administer insulin injections. The homecare application segment is also expected to grow due to the rising awareness of diabetes care and the increasing availability of home care services. The market is highly competitive, with various players offering different product offerings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 388 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Canada, Germany, China, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Insulin Syringes Market Research and Growth Report?

- CAGR of the Insulin Syringes industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the insulin syringes market growth of industry companies

We can help! Our analysts can customize this insulin syringes market research report to meet your requirements.