Boiler Control Market Size 2024-2028

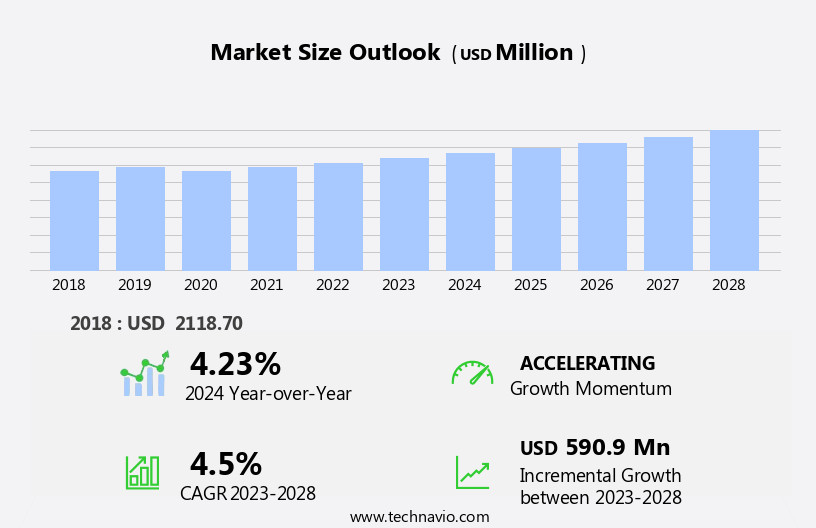

The boiler control market size is forecast to increase by USD 590.9 million at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the integration of advanced technologies such as artificial intelligence, analytics, sensors, and cloud computing. The use of microprocessors and IoT in boiler control systems enables optimization of boiler processes and improved energy efficiency. The trend toward alternative fuels, including biogas and biofuels, is driving the demand for multi-fuel boilers.

- However, integrating new technologies with existing boilers presents challenges, requiring careful planning and consideration. The adoption of digital technologies, such as glass displays and data analytics, is becoming increasingly important for monitoring and managing boiler performance in real-time. Additionally, the integration of renewable energy sources, such as solar and wind, into microgrids is creating opportunities for the industrial boiler market.

- Overall, the market is expected to grow steadily due to these trends and the increasing focus on greenhouse gas reduction and renewable energy.

What will be the Size of the Boiler Control Market During the Forecast Period?

- The market encompasses technologically advanced systems used in power generation and industrial heating applications. This market is driven by the increasing automation of power plants and the need for real-time monitoring and compliance with stringent laws. Internet of Things (IoT) and data analytics are key trends shaping the market, enabling remote monitoring and predictive maintenance of boiler control systems.

- Collaborations between industry players and research facilities foster technological developments in areas such as distributed control systems, cloud computing, and feedback mechanisms. Hydraulic and pneumatic systems are being gradually replaced by programmable logic controllers, microprocessors, and digital components. Boiler control systems are utilized extensively in various industries, including chemical, food processing, and pharmaceutical, to ensure efficient and safe operations.

- Overall, the market is experiencing significant growth due to the increasing demand for energy efficiency, reliability, and regulatory compliance.

How is this Boiler Control Industry segmented and which is the largest segment?

The boiler control industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Water tube

- Fire tube

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Type Insights

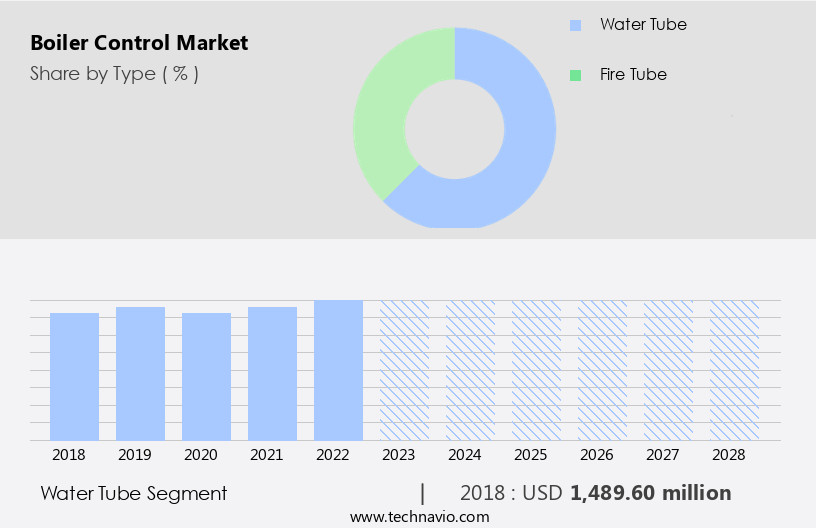

- The water tube segment is estimated to witness significant growth during the forecast period.

The water tube boiler market encompasses technologically advanced systems used for generating steam with high pressure and temperature. In power generation, boilers are widely adopted due to their ability to achieve higher operating pressures compared to fire tube boilers. Comprised of components such as burner, boiler shell, mud drum or mud ring, safety valve, furnace, strainer, feed check valve, sight glass, and steam stop valve, water tube boilers are utilized in various industries. Stringent laws mandating reduced greenhouse gas emissions have driven the adoption of more efficient boiler systems. Technological developments, including automation, real-time monitoring through the Internet of Things (IoT), and collaborations between industry leaders, have further enhanced the performance and efficiency of water tube boilers.

Applications extend to industries like power plants, chemical, food processing, and pharmaceutical, as well as residential markets, including electric, solar, biogas-powered home boilers. Integration with building management solutions, microgrids, and decentralized energy systems also offers significant potential. Key components include feedback mechanisms, analog components, programmable logic controllers, distributed control systems, cloud computing, artificial intelligence, and combi boiler and residential boiler markets. Water tube boilers are essential for industries seeking to minimize carbon emission levels and adopt renewable energy.

Get a glance at the Boiler Control Industry report of share of various segments Request Free Sample

The Water tube segment was valued at USD 1.49 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

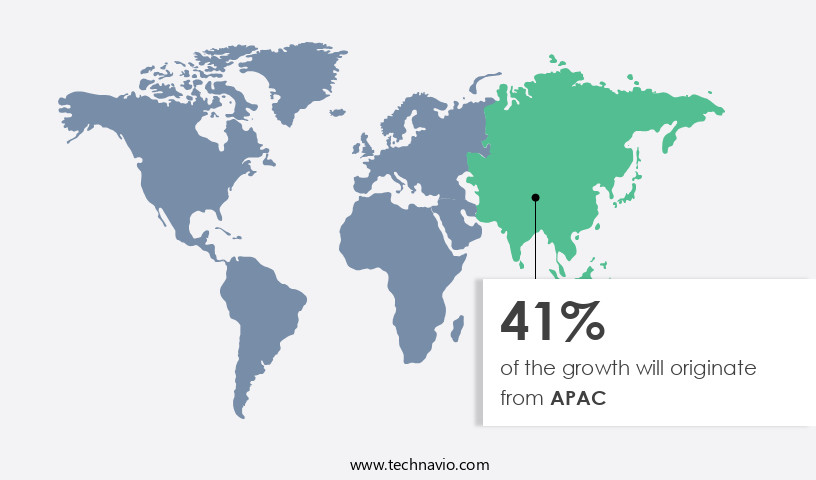

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is poised for substantial expansion over the forecast period. Key contributors to this growth include China, Japan, India, Vietnam, South Korea, Malaysia, and Australia. These countries' industrialization and increasing investments in sectors such as oil and gas, power, water and wastewater treatment, food and beverage, automotive, and others, are primary growth drivers. Furthermore, urbanization, electrification, and a focus on energy optimization are additional factors fueling market growth. Technological advancements, including automation, real-time monitoring, and the Internet of Things (IoT), are transforming industrial heating control systems. Collaborations and technological developments in combi boiler, residential boiler, and industrial boiler markets are also contributing to market expansion.

The integration of cloud computing, artificial intelligence, and distributed control systems further enhances efficiency and reduces greenhouse gas emissions. The markets growth is also influenced by the adoption of renewable energy sources, such as solar, biomass, and building management solutions, including microgrids and decentralized energy systems. Compliance with stringent environmental regulations, particularly regarding carbon emission levels, is another significant factor driving market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Boiler Control Industry?

Integration of burner management system (BMS) for optimization of boiler process is the key driver of the market.

- Boiler control systems play a pivotal role in optimizing the combustion process in power generation and industrial heating applications. The efficiency of the combustion process significantly influences the overall performance of power plants and industrial processes. Moreover, stringent environmental regulations necessitate the need for advanced boiler control systems to minimize greenhouse gas emissions and air pollution. Technological advancements, such as automation, the Internet of Things (IoT), and distributed control systems, are transforming the market. Real-time monitoring and feedback mechanisms are essential components of these systems, enabling efficient and effective control of industrial boilers. Programmable logic controllers and high-voltage immersed electrodes are common hardware used In these systems.

- Collaborations between industry leaders and technological developments in artificial intelligence and cloud computing are driving innovation In the market. The market caters to various industries, including power generation, chemical, food processing, and pharmaceutical, among others. Combi boilers, electric, solar, and biogas-powered home boilers are also part of the residential boiler market. BMS (Building Management Solutions) are an integral part of boiler control systems, ensuring safe start-up, flame monitoring, emission control, and industrial burner control. The increasing focus on reducing carbon emission levels and the adoption of renewable energy sources, such as solar power and biomass, are expected to further fuel the growth of the market.

What are the market trends shaping the Boiler Control Industry?

Rising trend of multi-fuel boilers is the upcoming market trend.

- The market is experiencing significant growth due to the increasing adoption of automation in power plants and industrial heating applications. Stringent environmental laws have driven the need for technologically advanced boiler control systems that enable real-time monitoring and optimization of fuel usage. The Internet of Things (IoT) is playing a pivotal role In the development of these systems, with collaborations between industry leaders and technological innovations in areas such as feedback mechanisms, programmable logic controllers, and distributed control systems. Fuel flexibility is a new trend In the market, with an increasing number of power generation and process industries opting for multi-fuel operations.

- This trend is driven by the availability and affordability of locally produced renewable biomass and recycled fuels, which are much less expensive than traditional fuels. National government policies that reward efforts to reduce environmental impact are also encouraging the use of these fuels, with incentives such as carbon credits and higher electricity purchase rates for renewable energy. Boiler control systems are becoming increasingly complex, with the integration of cloud computing, artificial intelligence, and building management solutions. Hydraulic and pneumatic systems are being replaced by digital hardware such as high-voltage immersed electrodes and advanced feedback mechanisms. The combi boiler market and residential boiler market are also witnessing significant growth, with the adoption of electric, solar, and biogas-powered home boilers.

- The market is expected to continue growing as industries and consumers seek to reduce greenhouse gas emissions and improve energy efficiency.

What challenges does the Boiler Control Industry face during its growth?

Concerns related to integration of new technologies with existing boilers is a key challenge affecting the industry growth.

- The market is experiencing significant technological advancements due to the increasing demand for automation and real-time monitoring in power generation and various industries. With stringent laws focusing on reducing greenhouse gas emissions, there is a growing emphasis on the use of renewable energy sources and energy-efficient technologies. Industrial heating control systems are transitioning from hydraulic and pneumatic systems to distributed control systems and programmable logic controllers. Technological developments such as the Internet of Things, cloud computing, artificial intelligence, and feedback mechanisms are being integrated into boiler control systems to optimize performance and reduce energy consumption. Collaborations between industry leaders and technological innovators are driving the market forward.

- The chemical, food processing, and pharmaceutical industries are major consumers of boiler control systems, while the combi boiler market and residential boiler market are expanding with the adoption of electric, solar, and biogas-powered home boilers. Building management solutions, microgrids, and decentralized energy systems are also gaining popularity. High-voltage immersed electrode boilers and water tube boilers continue to dominate the market, but hardware advancements such as air pollution control systems and carbon emission level monitors are becoming essential components.

Exclusive Customer Landscape

The boiler control market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the boiler control market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, boiler control market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The ControlMaster solution from the company delivers a clear and comprehensive presentation of process status through advanced TFT technology, offering full-color displays for enhanced operational visibility In the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Acuity

- Babcock and Wilcox Enterprises Inc.

- Burnham LLC

- Eaton Corp. Plc

- Emerson Electric Co.

- Federal Corp.

- Forbes Marshall Pvt. Ltd.

- HBX Control Systems Inc.

- Honeywell International Inc.

- Legrand SA

- MicroMod Automation and Controls LLC

- Parker Boiler Co.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Spirax Group

- Sprecher + Schuh

- SPX Technologies Inc.

- The Cleaver Brooks Co. Inc.

- The Fulton Companies

- VirtualExpo Group

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses advanced technologies and systems designed to optimize the performance and efficiency of power generation processes in various industries. Automation plays a pivotal role in this sector, enabling real-time monitoring and response to changing conditions in power plants. Stringent laws and regulations have driven the demand for technologically advanced boiler control systems. These systems facilitate the reduction of greenhouse gas emissions, a critical concern for environmental sustainability. The integration of the Internet of Things (IoT) has been instrumental in enhancing the capabilities of boiler control systems. Industrial heating control applications represent a significant segment of the market.

Hydraulic and pneumatic systems, along with feedback mechanisms and analog components, have traditionally been used for boiler control. However, the trend is shifting towards programmable logic controllers (PLCs) and distributed control systems (DCS). Cloud computing and artificial intelligence (AI) are two technological developments that have gained traction In the market. Cloud computing offers remote access and data storage capabilities, while AI enables predictive maintenance and optimization of boiler performance. The market caters to various industries, including chemical, food processing, and pharmaceutical. Boiler control systems are essential for ensuring consistent temperature and pressure conditions In these industries. Boiler control systems are also employed in power generation applications, where they help optimize energy efficiency and reduce emissions.

Collaborations between industry players and technology providers have led to significant advancements in boiler control technology. For instance, the integration of wearable devices and solar-powered boilers is a promising development In the residential boiler market. Similarly, the use of high-voltage immersed electrodes in water tube boilers is a technological advancement that enhances efficiency and reduces air pollution. The market is witnessing the emergence of microgrids and decentralized energy systems. These systems enable the integration of renewable energy sources, such as solar and biomass, into the power generation process. This trend is expected to continue as the world moves towards a more sustainable energy future.

Carbon emission levels are a critical concern for the market. Technological advancements in boiler control systems are helping to reduce these levels by optimizing energy efficiency and improving combustion processes. The use of sensors and monitoring systems is also enabling real-time detection and mitigation of emissions. In conclusion, the market is a dynamic and evolving sector that is driven by the need for efficient, sustainable, and technologically advanced power generation processes. The integration of IoT, cloud computing, AI, and renewable energy sources is transforming the market and offering new opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 590.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Boiler Control Market Research and Growth Report?

- CAGR of the Boiler Control industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the boiler control market growth of industry companies

We can help! Our analysts can customize this boiler control market research report to meet your requirements.