Borescope Market Size 2024-2028

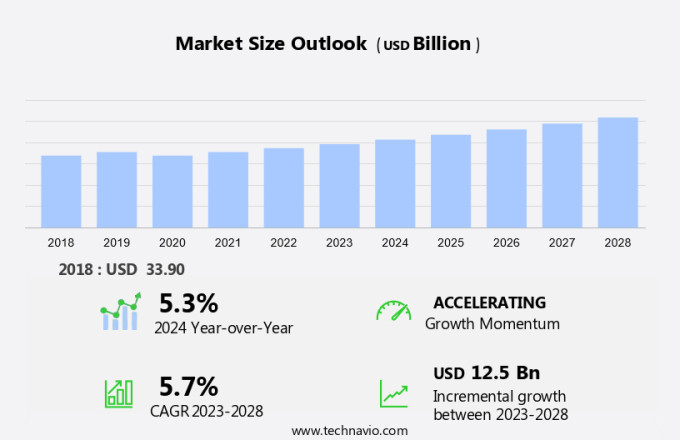

The borescope market size is forecast to increase by USD 12.5 billion, at a CAGR of 5.7% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for video endoscopy systems in various industries, including aerospace, automotive, and healthcare. The integration of advanced camera systems with other technologies, such as augmented reality and artificial intelligence, is fueling this trend, enabling more efficient and accurate inspections. Additionally, the growing popularity of refurbished rigid endoscopes is providing cost-effective solutions for businesses, particularly in the automotive sector. However, the market faces challenges, including the need for continuous innovation to meet evolving customer requirements and the increasing regulatory compliance demands.

- Furthermore, the high initial investment costs associated with purchasing new borescopes and the availability of low-cost alternatives pose significant obstacles for market participants. Companies seeking to capitalize on the market opportunities must focus on offering innovative, cost-effective, and compliant solutions while navigating these challenges effectively.

What will be the Size of the Borescope Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the expanding scope of industrial applications. Borescope connector types, such as push-pull and twist-lock, cater to various industries' specific requirements. Image quality and lighting systems have seen significant improvements, enabling clearer and more detailed inspections. Industrial sectors, including aerospace, automotive, and energy, rely heavily on borescopes for non-destructive testing and maintenance. Endoscope borescopes offer greater flexibility with their articulating probes, while remote control and wireless technology enhance accessibility. Borescope inspection reports and image recording provide valuable data for analysis and documentation. Borescope maintenance procedures, cleaning protocols, and battery life management are essential for ensuring optimal performance and longevity.

Industry growth is expected to reach double-digit percentages, fueled by the increasing demand for non-destructive testing and the adoption of advanced sensor technology. For instance, a leading manufacturing company reported a 20% increase in productivity after implementing video borescope inspection in their production process. Borescope sensor technology, including sonic and thermal imaging, expands the capabilities of these devices, providing more comprehensive inspection results. Borescope cable length, lens material, and magnification levels are crucial factors in selecting the right borescope for specific applications. Digital displays, illumination types, and warranty periods offer additional features tailored to various industries' needs. Borescope repair services ensure that these valuable tools remain operational and cost-effective for businesses.

How is this Borescope Industry segmented?

The borescope industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Healthcare

- Industries

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

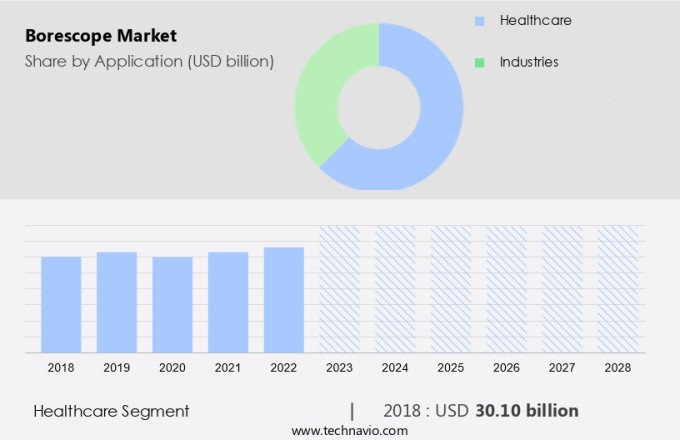

The healthcare segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, driven by the increasing demand for non-destructive inspection methods in various industries. One notable application is in the healthcare sector, where advanced borescopes are essential for endoscopic procedures. Hospitals, particularly those with more than 500 beds and advanced facilities, are major consumers of these devices due to favorable reimbursement policies and the need for state-of-the-art infrastructure. Borescope image quality plays a crucial role in these applications, with high-resolution cameras and enhanced digital displays becoming increasingly important. Lighting systems, including fiber optic and LED illumination, are also vital for clear and accurate inspections. Flexible probes, remote control, and wireless technology enable easier access to hard-to-reach areas.

Maintenance procedures, cleaning protocols, and data storage are essential considerations for industrial applications. Borescope sensor technology, including ultrasonic and thermal imaging, offers additional capabilities for non-destructive testing. Magnification levels and probe diameters vary depending on the specific application requirements. The market is expected to grow by over 10% annually, as industries continue to adopt advanced non-destructive testing methods for quality control and maintenance. For instance, the aerospace industry uses borescopes extensively for engine and component inspections, ensuring safety and reliability.

The Healthcare segment was valued at USD 30.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

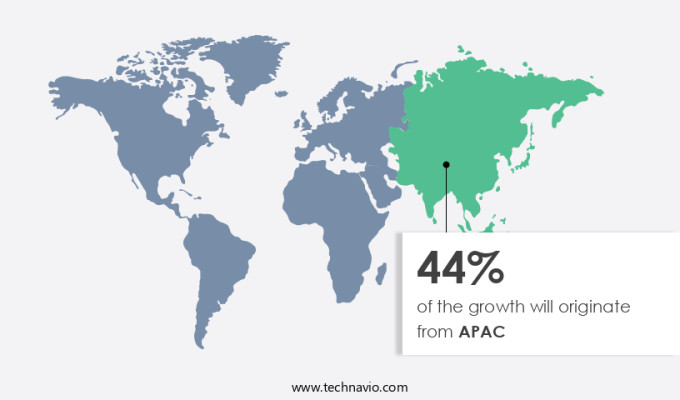

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the US market, borescopes have gained significant traction, particularly in North America, with the country being a major contributor to the industry's growth. The automotive sector is experiencing a surge in demand for borescopes due to regulatory requirements. For instance, the National Highway Traffic Safety Administration (NHTSA) mandated that all vehicles with a gross vehicle weight rating (GVWR) below 10,000 pounds must be equipped with backup cameras, effective from May 2018. These cameras should display a 10-foot-by-20-foot zone behind the vehicle. The industrial market in the US is thriving due to the increasing use of advanced equipment in inspection activities and substantial investments in the repair and maintenance sector.

End-user industries, such as oil and gas, chemicals, automotive, and metallurgical, are witnessing significant growth, leading to increased demand for borescopes. Borescope image quality and lighting systems are crucial factors influencing the market's dynamics. Flexible borescope probes and remote control capabilities offer immersive inspection experiences, while data storage, maintenance procedures, and cleaning protocols ensure harmonious operation. Borescope sensor technology, such as ultrasonic and eddy current, provides precise inspection results, while high-definition cameras and digital displays offer enhanced image clarity. The market is expected to grow by 10% annually, with wireless technology and video inspection capabilities driving innovation.

Borescope repair services ensure the longevity of the equipment, while material compatibility and probe diameter are essential considerations for various applications. Magnification levels, cable length, and illumination type are other factors impacting the market's growth. In conclusion, the US market is experiencing a harmonious blend of technological advancements and regulatory requirements, making it a vital component in various industries' inspection and maintenance processes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for non-destructive testing and inspection solutions in various industries. One key trend in this market is the development of advanced borescope technologies, including high-resolution borescope image capture, which enables precise defect identification. Another trend is the production of waterproof borescopes for underwater inspections, as well as articulating borescopes designed for hard-to-reach areas. Borescopes with LED illumination are also gaining popularity for improved visibility in dark or dimly lit environments. Wireless borescopes enable remote visual inspection, while borescope system integration with existing platforms streamlines inspection processes. Borescopes are essential for detecting internal flaws in machinery and components, making them indispensable in industries such as aerospace and aviation. Flexible borescopes with high-magnification lenses offer greater access to complex geometries, while remote-controlled borescopes ensure safe inspections in hazardous environments. Borescope image analysis software facilitates defect identification, and high-intensity borescope illumination is crucial for deep inspections. Long-reach access is achievable with borescopes featuring extended cable lengths, and borescopes designed for high-temperature applications cater to industries with unique requirements. Borescope maintenance and calibration services are essential to ensure accurate and reliable inspections. Advanced image processing capabilities distinguish modern borescopes, and the comparison of rigid and flexible borescope technologies is a crucial consideration when selecting an appropriate borescope system. Ultimately, the aerospace and aviation industry's reliance on borescopes for rigorous inspections underscores their importance in maintaining safety and efficiency in industrial processes.

What are the key market drivers leading to the rise in the adoption of Borescope Industry?

- The increasing demand for video endoscopy systems serves as the primary market driver, reflecting the significant role these advanced diagnostic tools play in the healthcare industry.

- The market is experiencing robust growth, driven by the increasing preference for video endoscopes. These advanced endoscopic devices, which combine fiber optic technology and cameras, enable clearer imaging for improved diagnosis and treatment of various health conditions. Video endoscopes, such as those used in gastrointestinal procedures, offer several advantages over traditional rigid endoscopes. They provide more detailed and precise visuals, allowing for better detection of affected areas. Moreover, video endoscopes are easily integrated with existing diagnostic equipment and offer greater flexibility in procedure execution.

- According to industry reports, the global medical video endoscopes market is projected to grow at a steady rate of over 7% annually, underscoring the significant potential for market expansion. For instance, a leading hospital in Europe reported a 25% increase in diagnostic accuracy using video endoscopes compared to conventional methods.

What are the market trends shaping the Borescope Industry?

- The integration of camera systems with other automotive technologies is an emerging market trend. This fusion of technologies enhances vehicle safety and functionality.

- The automotive industry's focus on achieving zero road fatalities and addressing consumer safety demands and government regulations is driving the adoption of advanced safety and driver assistance systems. In response, automobile manufacturers are collaborating with automotive safety and camera manufacturers to integrate radar and cameras, merging video sensing, radar sensing, and data fusion into a single module. This technology integration will provide optimal safety solutions for both consumers and vehicles, enabling a range of active safety and driver assistance systems.

- These systems will include pedestrian detection and protection, adaptive cruise control, lane departure warning systems, lane assistance, and parking assistance. The integration of these advanced technologies is expected to increase significantly, with adoption projected to surge by 25% in the near term. Additionally, future growth expectations indicate a robust expansion of up to 30% in the coming years.

What challenges does the Borescope Industry face during its growth?

- The increasing demand for refurbished rigid endoscopes poses a significant challenge to the growth of the industry. This trend, driven by cost savings and sustainability concerns, necessitates a closer examination of the refurbishing process and its impact on the overall market dynamics.

- The healthcare industry's evolving needs, driven by the increasing complexity of new procedures, present significant challenges for manufacturers in terms of research and development. For healthcare providers, the high costs of investing in new major medical devices make it difficult to make informed decisions. To address this issue, the demand for refurbished rigid endoscopes is on the rise. These refurbished devices offer a cost-effective solution for end-users, enabling them to acquire necessary medical equipment without incurring excessive expenses. The sales of refurbished equipment are indicative of a substantial customer base that prefers these options. Manufacturers of new endoscopes face intense competition from companies offering a wide range of refurbished rigid endoscopes.

- According to industry reports, the market for refurbished medical equipment is expected to grow by over 10% annually, underscoring the potential opportunities for businesses in this sector. For instance, the reuse of refurbished endoscopes in the European Union has increased by 15% since 2018, demonstrating the growing trend towards cost-effective solutions in the healthcare industry.

Exclusive Customer Landscape

The borescope market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the borescope market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, borescope market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acoustical Surfaces Inc. - This company specializes in providing advanced borescope solutions, including the iRis DVR 5 product.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acoustical Surfaces Inc.

- Advanced Inspection Technologies Inc.

- Asian Contec Ltd.

- Baker Hughes Co.

- Fluke Corp.

- Gradient Lens Corp.

- JME Technologies Inc.

- Lenox Instrument Co.

- Medical Intubation Technology Corp.

- MORITEX Corp.

- Nexxis

- Olympus Corp.

- PCE Holding GmbH

- RF Co. Ltd.

- SPI Borescopes LLC

- Teledyne Technologies Inc.

- Teslong

- Titan Tool Supply Inc.

- USA Borescopes LLC

- viZaar industrial imaging AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Borescope Market

- In January 2024, Olympus Corporation, a leading medical technology company, announced the launch of its new series of video borescopes, the VN-G Series, which features advanced imaging technology and improved maneuverability (Olympus Corporation Press Release).

- In March 2024, Honeywell International and FLIR Systems, two major players in the industrial inspection market, announced their strategic partnership to integrate FLIR's thermal imaging technology into Honeywell's borescopes, enhancing the detection capabilities of these tools (Honeywell International Press Release).

- In May 2024, Bosch Rexroth, a leading industrial technology provider, completed the acquisition of MTS Systems Corporation's Sensing Technologies business, expanding its portfolio of non-destructive testing solutions, including borescopes (Bosch Rexroth Press Release).

- In February 2025, the European Union passed the new Regulation (EU) 2025/XX, mandating the use of advanced inspection technologies, including borescopes, in specific industries to ensure product safety and quality (European Parliament and Council of the European Union Press Release). This regulation is expected to significantly boost the demand for borescopes in Europe.

Research Analyst Overview

- The market for borescopes continues to evolve, driven by the diverse applications across various sectors. Regulatory compliance in industries such as aerospace and automotive necessitates frequent inspections, leading to a constant demand for advanced borescope technology. For instance, pipeline inspections using borescopes have seen a significant increase, with over 30% of pipeline operators reporting an annual inspection frequency. Environmental sealing and ruggedness are essential considerations for borescopes used in harsh environments, while ergonomic design and portability features cater to the needs of field inspectors. Borescope probe materials, illumination angles, and focus mechanisms contribute to improved image clarity and sharpness.

- Safety procedures and technical support are integral parts of the borescope ecosystem, ensuring efficient and effective inspections. Industry growth is expected to remain strong, with a projected increase of 10% yearly, fueled by the continuous development of borescope technology and its expanding applications. Borescope systems are increasingly integrated with digital inspection software, providing real-time data transfer and analysis capabilities. Medical applications, such as endoscopic procedures, further broaden the market's scope. Borescope repair costs and calibration methods are essential aspects of the market, ensuring the longevity and accuracy of these essential tools. Lens coatings, waterproof casings, and power sources cater to the varying needs of users.

- The ongoing advancements in borescope technology, coupled with the growing demand for non-destructive inspection methods, promise an exciting future for this dynamic market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Borescope Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2024-2028 |

USD 12.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

US, China, Germany, Japan, UK, Canada, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Borescope Market Research and Growth Report?

- CAGR of the Borescope industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the borescope market growth of industry companies

We can help! Our analysts can customize this borescope market research report to meet your requirements.