Non-Destructive Testing (NDT) Equipment Market Size 2025-2029

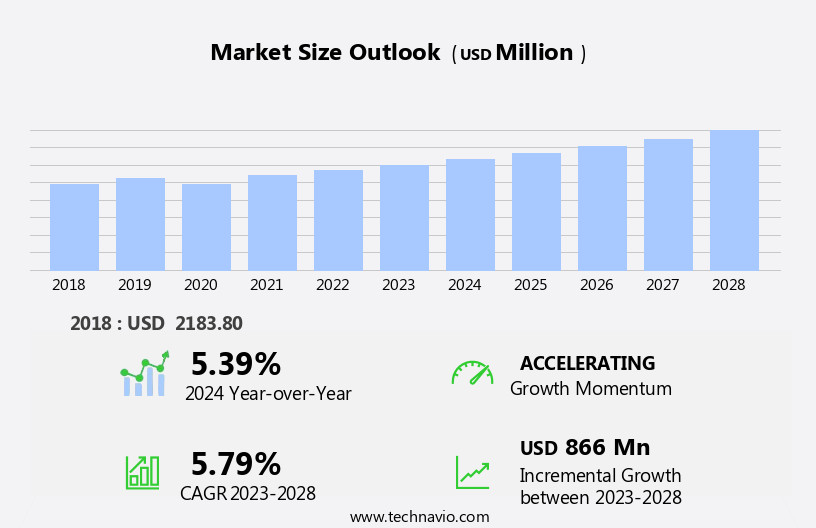

The non-destructive testing (NDT) equipment market size is forecast to increase by USD 950.5 million at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rise in oil and gas and power generation projects. This sector's expansion creates a substantial demand for advanced NDT technologies, particularly ultrasonic testing equipment. Another key trend shaping the market is the increasing availability of pre-used NDT equipment. In the power generation sector, there is a growing emphasis on safety and reliability, leading to increased adoption of NDT technologies for asset management and maintenance. This trend offers cost-effective solutions for companies seeking to invest in NDT technology without the high upfront costs associated with new equipment. However, the market faces challenges as well. One significant obstacle is the stringent regulations governing the use of NDT equipment in various industries.

- Additionally, the market's competitive landscape is becoming increasingly crowded, with numerous players vying for market share. Companies must differentiate themselves through innovation, quality, and customer service to remain competitive. To capitalize on the market's opportunities and navigate these challenges effectively, companies should focus on continuous improvement, regulatory compliance, and customer satisfaction. Ensuring compliance with these regulations can be time-consuming and costly, requiring substantial resources and expertise. This trend is further fueled by the rise in crude oil prices, which is expected to drive investments in conventional oil and gas basins.

What will be the Size of the Non-Destructive Testing (NDT) Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market encompasses a range of solutions designed to ensure compliance assurance and risk mitigation in various industries. Consulting services play a crucial role in optimizing NDT processes, while software upgrades and automated NDT systems facilitate efficiency improvements and cost reduction. Global markets demand supply chain management solutions to streamline the procurement of NDT probes, engineering services, equipment rentals, and maintenance contracts. The market is experiencing significant growth, driven primarily by the increasing number of oil and gas and power generation projects worldwide.

- Industry regulations mandate stringent safety standards, necessitating continuous process optimization and repair services. Overall, the NDT market is dynamic, with a focus on innovation and cost savings. Handheld and portable NDT equipment enable inspection personnel to conduct tests in remote locations, reducing downtime. Safety procedures and material science advancements drive the adoption of emerging technologies, such as phased array ultrasonic testing and eddy current testing.

How is this Non-Destructive Testing (NDT) Equipment Industry segmented?

The non-destructive testing (NDT) equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Oil and gas

- Power generation

- Aerospace and defense

- Automotive and transportation

- Others

- Product Type

- Ultrasonic testing equipment

- Radiography testing equipment

- Visual testing equipment

- Others

- Product

- Portable equipment

- Stationary equipment

- Software solutions

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

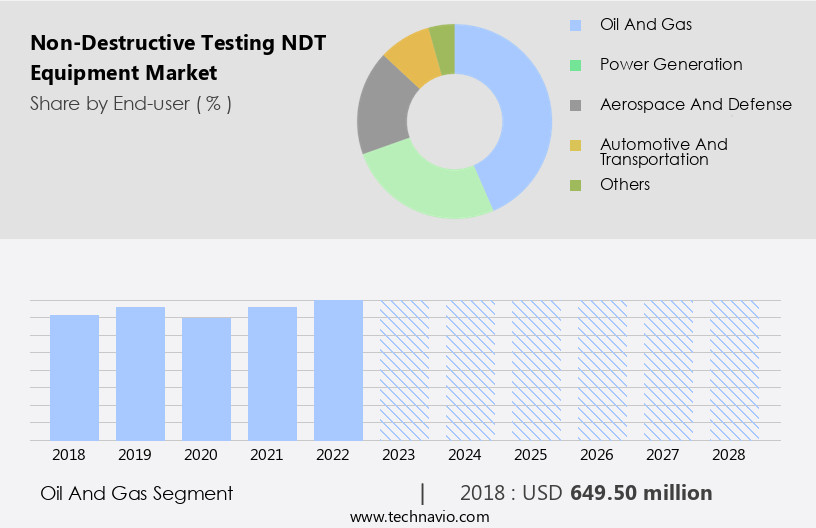

By End-user Insights

The oil and gas segment is estimated to witness significant growth during the forecast period. Non-Destructive Testing (NDT) equipment plays a crucial role in ensuring the integrity and safety of various industries, particularly in energy applications such as oil and gas. In this sector, pipelines are a vital means of transporting oil and gas, making NDT essential for detecting defects, including corrosion and cracks. These issues can lead to severe consequences if left unchecked, such as pipeline leaks or ruptures. NDT techniques, including digital radiography, magnetic particle testing, and ultrasonic testing, are employed to identify and classify defects. Data analysis software and machine learning algorithms enable real-time radiography and predictive modeling, enhancing the efficiency and accuracy of inspections.

NDT software, including report generation software and data visualization tools, streamline the inspection process and facilitate informed decision-making. In the oil and gas sector, NDT is vital for pipeline inspection, with guided wave testing and crack detection techniques used to assess the structural integrity of pipelines. Leak testing and welding inspection are other essential applications. Neutron radiography and X-ray fluorescence are used for material characterization and corrosion detection. NDT is also used in non-energy applications, such as automotive and aerospace, for ensuring safety and quality. The NDT market is dynamic and evolving, driven by advancements in technology and the increasing demand for safety and efficiency in various industries.

NDT techniques, including digital radiography, magnetic particle testing, and ultrasonic testing, are essential for detecting defects and maintaining the integrity of critical infrastructure. Data analysis software, machine learning, and remote inspection technologies are transforming NDT, enabling real-time monitoring and predictive modeling. Regulatory compliance, training, and calibration services are crucial for maintaining the effectiveness of NDT equipment and techniques. A key trend in the market is the rising demand for ultrasonic testing equipment due to its versatility and ability to detect defects in various materials.

The Oil and gas segment was valued at USD 689.20 million in 2019 and showed a gradual increase during the forecast period.

NDT equipment is also integral to quality control and safety standards in manufacturing applications, aerospace, automotive, and construction industries. Remote inspection using sensor technology, such as electromagnetic acoustic transducers and acoustic emission testing, is increasingly popular for non-contact, real-time monitoring. Structural health monitoring using industrial computed tomography and dimensional inspection ensures the integrity of critical infrastructure. Big data and data analytics are transforming NDT, enabling advanced image processing and signal processing techniques. Training courses and calibration services ensure the continued effectiveness of NDT equipment and techniques. Regulatory compliance and asset integrity management are crucial aspects of NDT, ensuring safety and reliability.

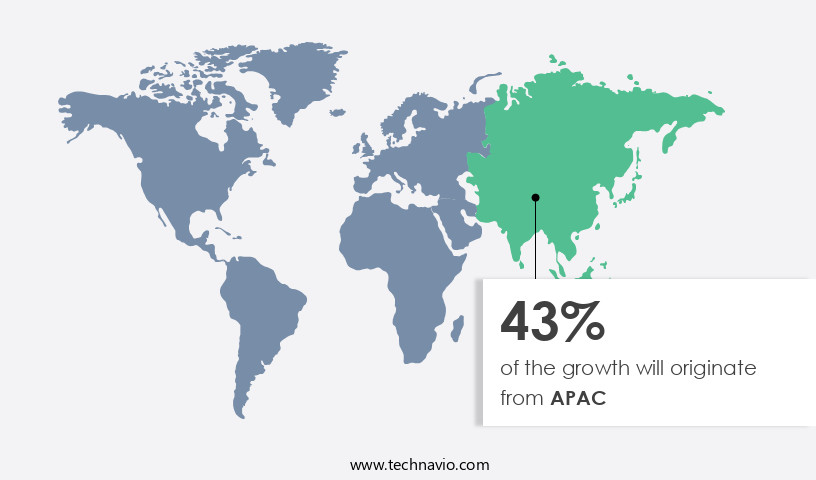

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven primarily by the robust presence of the oil and gas and aerospace industries in the region. The US, as a global leader in petroleum and natural gas production, continues to invest heavily in the upstream sector, including shale basins. The rise in crude oil prices is further fueling investments in conventional oil and gas basins, leading to increased demand for NDT equipment. In the aerospace sector, the focus on ensuring safety and quality control is driving the adoption of advanced NDT technologies such as digital radiography, time-of-flight diffraction, and phased array ultrasonic testing.

Energy applications are a major segment of the NDT market, with remote inspection and structural health monitoring being key areas of focus. Big data and data analytics play a crucial role in NDT, enabling real-time radiography, predictive modeling, and defect classification. Advanced sensor technology, including electromagnetic acoustic transducers and acoustic emission testing, are also gaining popularity for their ability to detect flaws in real-time. Manufacturing applications, including leak testing, welding inspection, and dimensional inspection, are other significant segments of the NDT market. Quality assurance and regulatory compliance are key considerations for manufacturers, and NDT equipment plays a critical role in ensuring product safety and reliability.

Training courses and calibration services are essential for maintaining the effectiveness of NDT equipment and ensuring accurate results. In the construction industry, NDT is increasingly being used for pipeline inspection, asset integrity management, and corrosion detection. Industrial computed tomography and x-ray fluorescence are particularly useful for material characterization and identifying defects in materials used in construction applications. Machine learning and artificial intelligence are also being integrated into NDT software to improve data analysis and automate processes such as automated ultrasonic testing and automated visual inspection. The NDT Equipment Market in North America is witnessing significant growth, driven by the strong presence of the oil and gas and aerospace industries in the region.

Advanced technologies such as digital radiography, time-of-flight diffraction, and machine learning are transforming the industry, enabling real-time flaw detection, predictive modeling, and automated processes. The focus on safety, quality control, and regulatory compliance is driving the adoption of NDT equipment across various industries, including manufacturing, construction, and energy. The integration of NDT technologies with AI and machine learning algorithms is expected to further enhance the capabilities of NDT solutions, improving overall operational efficiency and safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Non-Destructive Testing (NDT) Equipment market drivers leading to the rise in the adoption of Industry?

- The rise in oil, gas, and power generation projects serves as the primary catalyst for market growth. Non-Destructive Testing (NDT) plays a crucial role in the oil and gas industry for ensuring equipment integrity, petroleum refining safety, and petroleum extraction operation safety. Ultrasonic and eddy current NDT equipment are essential for meticulous inspection of welds and metals to detect flaws and corrosion, preventing hazardous chemicals and fluids from escaping. NDT solutions are indispensable in various oil and gas applications, including upstream, midstream, and downstream sectors. Ultrasonic testing is used for inspecting welds and materials in the upstream sector to maintain the integrity of equipment used in petroleum extraction. Eddy current testing is employed to detect corrosion under insulation in the midstream sector, ensuring pipeline and transportation safety.

- In the downstream sector, NDT techniques such as X-ray fluorescence, computed tomography (CT), and acoustic emission testing are used for defect classification and structural health monitoring. Sensor technology, real-time radiography, microfocus X-ray, and artificial intelligence (AI) are advanced NDT technologies used to enhance inspection efficiency and accuracy. Training courses and calibration services are also essential for maintaining the effectiveness of NDT equipment and ensuring that inspectors are proficient in using the latest NDT techniques. Leak testing and welding inspection are critical applications of NDT in the oil and gas industry. NDT solutions enable the detection of even the smallest defects, ensuring the safe and efficient operation of oil and gas facilities.

What are the Non-Destructive Testing (NDT) Equipment market trends shaping the Industry?

- The increasing demand for ultrasonic testing equipment represents a significant market trend. This technology is increasingly being adopted for various industries due to its non-destructive inspection capabilities and high precision. Non-Destructive Testing (NDT) equipment is essential for ensuring asset integrity and regulatory compliance in various industries. Ultrasonic testing, a widely used NDT method, has gained prominence over radiography or computed tomography due to its advantages. Ultrasound technology employs high-frequency sound waves to detect defects, offering benefits such as accurate measurement of defect height, superior planar flaw detection, radiation-free operation, and no generation of waste material or use of chemicals.

- This acceptance of ultrasonic testing as a viable alternative to radiography is a significant market trend. Other NDT techniques, such as guided wave testing for pipeline inspection, crack detection, material characterization through industrial computed tomography, dimensional inspection via visual inspection, dye penetrant testing, hardness testing, infrared thermography, and electromagnetic acoustic transducers, cater to diverse industry requirements. These methods contribute to the growth and versatility of the NDT market. Data acquisition systems play a crucial role in NDT, enabling efficient and accurate data collection and analysis. The ongoing development of advanced NDT technologies and the increasing focus on asset integrity management drive market expansion.

How does Non-Destructive Testing (NDT) Equipment market face challenges during its growth?

- The increasing prevalence of pre-owned NDT (Non-Destructive Testing) equipment in the market poses a significant challenge to the industry's growth trajectory. This trend, driven by the affordability and accessibility of second-hand equipment, necessitates continuous innovation and differentiation strategies among manufacturers and providers to remain competitive. The market is witnessing significant attention from market participants, with a focus on enhancing the capabilities of existing NDT solutions. However, not all end-users can afford to invest in the latest NDT equipment due to budget constraints. Instead, they opt for pre-owned NDT equipment, which is cost-effective and available through various sources such as NDT Supply.Com Inc., R-CON NDT, Test Equipment Distributors, and JWJ NDT. These platforms offer a wide range of pre-owned NDT equipment, including automated ultrasonic testing systems, radiographic testing equipment, eddy current testing systems, and more. The trend toward pre-owned NDT equipment may hinder the sales growth of new units.

- End-users prefer this option due to the significant cost savings it offers. However, these pre-owned units may not have the latest features and advanced capabilities of new NDT equipment. Moreover, they may require additional maintenance and calibration efforts. To cater to the evolving needs of end-users, market participants are integrating advanced technologies such as NDT software, machine learning, data visualization, and predictive modeling into their offerings. These technologies enable automated ultrasonic testing, corrosion detection, and automated visual inspection, among other applications. Furthermore, cloud computing is gaining popularity in the NDT industry, enabling end-users to access real-time data and analysis from anywhere.

Exclusive Customer Landscape

The non-destructive testing (ndt) equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the non-destructive testing (ndt) equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, non-destructive testing (NDT) equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acuren Corp. - The company specializes in Non-Destructive Testing (NDT) Equipment and delivers advanced testing services powered by state-of-the-art technologies, such as 3D modeling, high-precision ultrasonics, corrosion mapping, and cathodic protection (CP) measurement systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuren Corp.

- Ashtead technology

- Carl Zeiss AG

- Cygnus Instruments Ltd.

- Eddyfi Technologies

- FPrimeC Solutions Inc.

- FUJIFILM Holdings Corp.

- General Electric Co.

- HELMUT FISCHER GMBH

- Illinois Tool Works Inc.

- Labquip NDT Ltd.

- Mistras Group Inc.

- MME Group

- Nikon Corp.

- Olympus Corp.

- Roper Technologies Inc.

- Sonatest Ltd

- TWI Ltd.

- YXLON International GmbH

- Zetec Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Non-Destructive Testing (NDT) Equipment Market

- In January 2024, Olympus Corporation, a leading manufacturer of NDT equipment, launched its new PharmaBright series of digital radiography systems, designed specifically for the pharmaceutical industry to ensure product quality and compliance with regulatory standards (Olympus Corporation Press Release).

- In March 2024, Siemens AG and Mistras Group, Inc., two major players in NDT, announced a strategic partnership to expand their service offerings, combining Siemens' advanced technology with Mistras' extensive expertise in NDT services and data analytics (Siemens AG Press Release).

- In May 2024, Eddyfi Technologies, a leading provider of advanced NDT technologies, completed a USD 50 million Series C funding round, led by Caisse de dépôt et placement du Québec, to accelerate the development and commercialization of its innovative technologies and expand its global presence (Eddyfi Technologies Press Release).

- In April 2025, the European Union passed the new European Regulation on the Market Surveillance of Products (Regulation 2019/1020), which includes provisions for increased scrutiny of NDT equipment, aiming to enhance product safety and consumer protection (European Commission Press Release).

Research Analyst Overview

The market continues to evolve, driven by the increasing demand for efficient, accurate, and cost-effective methods for flaw detection and quality control across various sectors. This dynamic market encompasses a range of technologies, including pipeline inspection, data acquisition systems, testing standards, guided wave testing, crack detection, material characterization, industrial computed tomography, regulatory compliance, dimensional inspection, visual inspection, dye penetrant testing, asset integrity management, infrared thermography, hardness testing, electromagnetic acoustic transducers, and more. Energy applications, particularly in the oil and gas industry, have been a significant driver of growth in the NDT market. Remote inspection and big data analysis have become essential for ensuring safety and optimizing operations in these sectors.

Digital radiography, time-of-flight diffraction, and other advanced NDT techniques are increasingly being adopted to enhance the capabilities of traditional methods. In the manufacturing sector, NDT plays a crucial role in ensuring product quality and safety. Ultrasonic testing, eddy current testing, and automated ultrasonic testing are widely used for defect classification and predictive modeling. Neutron radiography and automated visual inspection are essential for aerospace applications, while X-ray fluorescence and microfocus X-ray are critical for material characterization. The ongoing development of sensor technology, data analysis software, and machine learning algorithms is transforming the NDT landscape. Real-time radiography, signal processing, image processing, and cloud computing are enabling more efficient and accurate data analysis.

Training courses and calibration services are also essential for ensuring the effective implementation and maintenance of NDT technologies. Regulatory compliance remains a critical factor in the NDT market, with stringent safety standards driving the adoption of advanced testing methods. Leak testing, welding inspection, and structural health monitoring are essential for ensuring the integrity of critical infrastructure. Infrared thermography and corrosion detection are vital for maintaining asset health and preventing costly downtime. The NDT equipment market is characterized by continuous innovation and evolution, driven by the need for efficient, accurate, and cost-effective methods for flaw detection and quality control across various sectors.

The integration of advanced technologies, such as digital radiography, machine learning, and cloud computing, is transforming the market and enabling new applications in energy, manufacturing, and infrastructure. The NDT equipment market is witnessing a shift towards pre-owned equipment due to cost considerations. However, market participants are responding by integrating advanced technologies into their offerings to provide end-users with more value and capabilities. This dynamic market environment requires a deep understanding of the latest trends and technologies to stay competitive. Regulatory organizations, including the American Society of Mechanical Engineers (ASME) and the American Petroleum Institute (API), have approved codes that permit the substitution of radiography testing with ultrasonic testing in specific applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Non-Destructive Testing (NDT) Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 950.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, Germany, UK, India, Canada, Japan, France, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Non-Destructive Testing (NDT) Equipment Market Research and Growth Report?

- CAGR of the Non-Destructive Testing (NDT) Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the non-destructive testing (ndt) equipment market growth of industry companies

We can help! Our analysts can customize this non-destructive testing (ndt) equipment market research report to meet your requirements.