Calibration Services Market Size 2024-2028

The calibration services market size is forecast to increase by USD 1.79 billion at a CAGR of 5.54% between 2023 and 2028.

- The market is driven by stringent regulations mandating product safety, quality, and compliance, ensuring accurate measurement and consistent performance in various industries. Companies continue to introduce new calibration solutions, enhancing the market's competitive landscape and offering customers advanced technologies. However, the shortage of skilled calibration professionals poses a significant challenge for market growth. Companies must invest in training and development programs or outsource calibration services to address this issue and maintain operational efficiency. Adhering to regulatory requirements and staying updated with technological advancements will be crucial for market participants to capitalize on opportunities and navigate challenges effectively.

What will be the Size of the Calibration Services Market during the forecast period?

- The calibration market continues to evolve, driven by the constant need for measurement accuracy across various sectors. Calibration processes are integral to ensuring the reliability and performance of instruments, with calibration engineers and technicians utilizing advanced calibration equipment to maintain precision and adhere to industry standards. Calibration history is a critical component of calibration workflows, with calibration reports detailing the results of each calibration event. Calibration turnaround time is a significant factor in the calibration industry, with calibration management software streamlining the process and enabling real-time tracking. Calibration accreditation is essential for calibration providers, ensuring the credibility and trustworthiness of calibration services.

- Calibration intervals are determined based on equipment usage and environmental conditions, with calibration control ensuring compliance with regulations and maintaining traceability standards. Calibration on-site is increasingly popular, reducing downtime and enabling remote calibration verification. Calibration innovations continue to emerge, with calibration management solutions offering advanced data management capabilities and calibration training programs equipping specialists with the latest techniques and best practices. Calibration costs are a key consideration, with calibration outsourcing an effective strategy for optimizing resources and improving efficiency. The calibration market is characterized by ongoing calibration trends, including the increasing importance of measurement accuracy, calibration precision, and calibration compliance. Calibration strategies are continually evolving, with calibration providers adapting to meet the changing needs of their clients and the industry as a whole.

How is this Calibration Services Industry segmented?

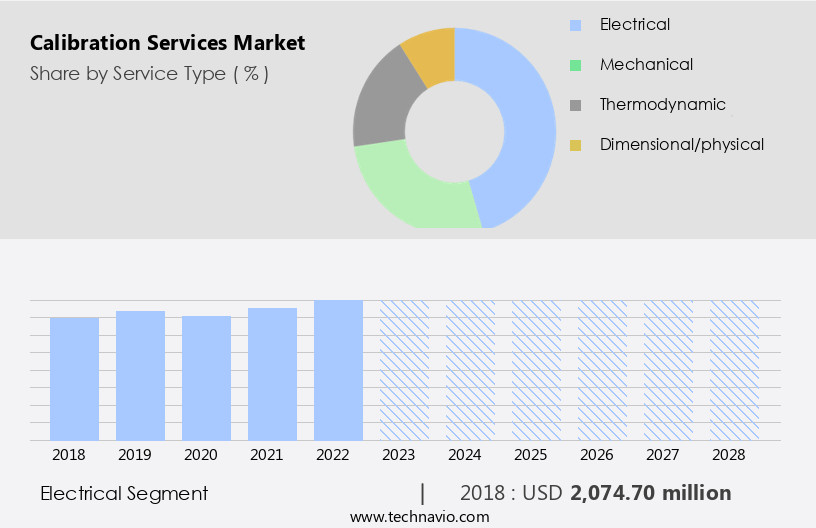

The calibration services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Service Type

- Electrical

- Mechanical

- Thermodynamic

- Dimensional/physical

- Service

- Third party vendors

- In-house laboratories

- OEMs

- Technology Specificity

- Manual Calibration

- Automated Calibration

- End-User

- Manufacturing

- Automotive

- Aerospace

- Healthcare

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Type Insights

The electrical segment is estimated to witness significant growth during the forecast period.

Electrical calibration is an essential process in ensuring the accuracy and reliability of various measuring instruments and devices, particularly those used for electrical measurements. This process involves adjusting and verifying the performance of electrical testing equipment such as multimeters, oscilloscopes, power supplies, and signal generators. The primary objective of electrical calibration is to maintain the precision of these devices within specified tolerances, enabling them to deliver accurate readings and measurements. The calibration process typically entails comparing the device under test against a reference standard of known accuracy. Any discrepancies are corrected to ensure the instrument's output aligns with the standard.

Electrical calibration plays a crucial role in various industries, including manufacturing, healthcare, aerospace, telecommunications, and automotive, where precise electrical measurements are vital for quality control, safety, and regulatory compliance. Calibration trends include the increasing adoption of advanced calibration techniques, such as remote calibration and automated calibration systems. Calibration providers offer training and certification programs for calibration specialists, ensuring a skilled workforce capable of managing complex calibration workflows. Calibration management software facilitates the streamlining of calibration processes, enhancing efficiency and reducing turnaround time. Calibration uncertainty, a critical aspect of calibration, is continuously addressed through the development of more precise calibration standards.

Calibration documentation and reporting have become increasingly important, ensuring traceability and compliance with regulatory requirements. Calibration intervals, control, and verification are essential components of a robust calibration strategy, ensuring the ongoing reliability and accuracy of measuring instruments. Calibration innovations include the integration of artificial intelligence and machine learning algorithms into calibration processes, enabling predictive maintenance and real-time calibration adjustments. Calibration market growth is driven by the increasing demand for precise measurements and the need for regulatory compliance across various industries. Calibration laboratories and services providers offer a range of calibration solutions tailored to specific industry requirements, ensuring measurement accuracy and cost-effectiveness.

The Electrical segment was valued at USD 2.07 billion in 2018 and showed a gradual increase during the forecast period.

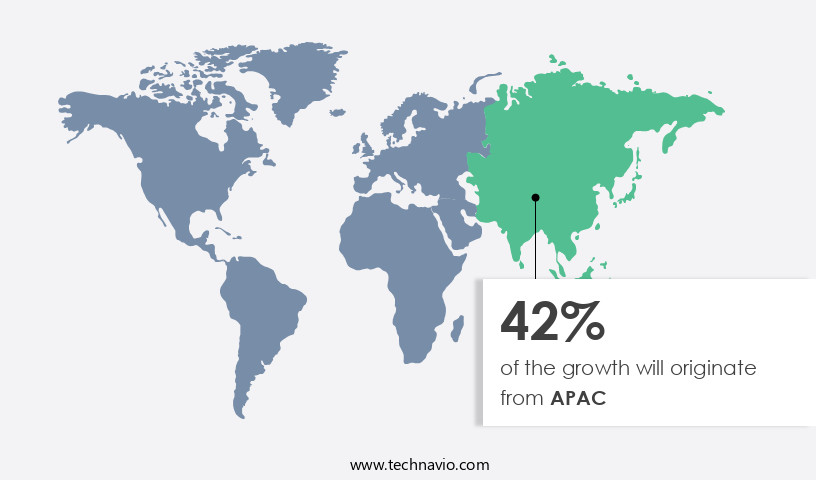

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia-Pacific (APAC) region. Industrial and technological advancements are key drivers of this expansion, with countries such as China, India, Japan, and South Korea leading the way. In China, the manufacturing sector's increasing demand for precise and reliable calibration solutions is fueling market growth. As the world's largest manufacturing hub, China's industries, including automotive and electronics, rely on calibration to ensure quality and efficiency. For instance, China's industrial production grew by 4.3% in 2023, according to the National Bureau of Statistics, highlighting the sector's continued strength. The calibration lifecycle is a critical aspect of this market, with calibration trends focusing on reducing turnaround time and increasing accuracy.

Calibration certificates, documentation, and standards are essential components of the calibration process, ensuring traceability and compliance. Calibration providers offer various solutions, including on-site services, calibration management software, and calibration training for specialists. Calibration processes involve calibration engineers, technicians, and telecom equipment, with calibration workflows optimized for efficiency and reliability. Calibration innovations include remote calibration, calibration management systems, and calibration testing techniques. Calibration accreditation and calibration reliability are essential for maintaining quality and trust in the calibration industry. Calibration market size and cost are significant factors, with calibration services providers offering various pricing models. Calibration compliance regulations and traceability standards ensure measurement accuracy and consistency.

Calibration strategies include outsourcing, with calibration laboratories providing specialized expertise and equipment. In conclusion, the market is a dynamic and evolving industry, with the APAC region at the forefront of growth. Calibration processes, trends, and solutions continue to advance, ensuring measurement accuracy and reliability for various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Calibration Services market thrives with calibration services for manufacturing and electrical calibration for precision. Calibration services market trends highlight on-site calibration for efficiency and third-party calibration services. Calibration for aerospace industry and mechanical calibration for automotive drive demand, per calibration services market forecast. Thermodynamic calibration for healthcare leverages calibration with IoT integration, while calibration for quality assurance ensures compliance. Calibration services for energy sector and dimensional calibration for defense enhance accuracy. Calibration for regulatory compliance, advanced calibration technologies, and calibration services supply chain optimize performance. Calibration for industrial automation, calibration for global industries, calibration for equipment reliability, calibration for B2B markets, and calibration for predictive maintenance fuel growth through 2028.

What are the key market drivers leading to the rise in the adoption of Calibration Services Industry?

- Strict regulations governing product safety, quality, and compliance are the primary driver in the market, as companies prioritize adherence to these regulations to ensure consumer trust and business success. Regulatory compliance is a key driver in the global calibration services market, as it ensures that measurement instruments and equipment meet industry-specific standards and legal requirements. In highly regulated sectors such as healthcare, medical devices and diagnostic equipment must be routinely calibrated to guarantee accuracy and protect patient safety.

- For instance, the U.S. Food and Drug Administration (FDA) mandates calibration of medical devices to uphold their reliability and performance. Similarly, the aerospace industry is governed by the Federal Aviation Administration (FAA), which enforces strict calibration protocols for avionics and flight instruments to ensure safety and efficiency. The automotive sector follows ISO standards that require precise calibration of testing and production tools to meet environmental and safety benchmarks. In manufacturing, compliance with quality systems like ISO 9001 demands regular calibration to maintain product quality and customer satisfaction. The growing pressure to meet these regulatory standards is fueling demand for calibration services, as businesses must ensure their equipment remains compliant to avoid penalties and operational disruptions. As global regulatory scrutiny intensifies, the need for accurate and dependable calibration services will continue to drive market growth throughout forecast year.

What are the market trends shaping the Calibration Services Industry?

- The release of new calibration solutions is a current market trend among companies. This development signifies a significant advancement in ensuring product accuracy and reliability.

- The introduction of advanced calibration solutions by vendors is a key trend propelling the growth of the global calibration services market. Manufacturers are increasingly launching innovative technologies tailored to the evolving demands of various industries. For example, in October 2023, Keysight Technologies unveiled its Phased Array Antenna Control and Calibration solution an over-the-air (OTA) system designed for satellite communication developers working with active electronically scanned arrays. This solution enables rapid testing and early design validation for modern satellite systems, optimizing gain, phase response, and beam-steering accuracy through proprietary calibration algorithms and an intuitive software interface.

- Similarly, in March 2023, Beamex enhanced its HART-enabled MC6 Advanced Field Calibrator with firmware version 4.40, enabling partial calibration of air-operated valves essential components in process industries. This update allows users to power valve controllers, generate input signals, and read digital outputs using a single device, streamlining operations and integrating directly with Beamex's Calibration Management Software.Such continuous product innovations are expected to drive market expansion as industries seek efficient, integrated, and high-performance calibration solutions.

What challenges does the Calibration Services Industry face during its growth?

- The scarcity of proficient calibration specialists poses a significant challenge to the expansion of the industry. The shortage of skilled professionals poses a major challenge in the global calibration services market. As calibration technology becomes more advanced and sophisticated, the demand for highly skilled technicians who can operate and maintain complex equipment increases. For instance, in the aerospace industry, accurate calibration of avionics and instrumentation requires specialized knowledge and training, making it difficult to find qualified professionals who meet these stringent requirements.

- Similarly, the healthcare sector needs calibration experts for medical devices, where precision is critical for patient safety, yet the shortage of skilled personnel can lead to delays and increased costs. In emerging markets like India and China, rapid industrialization has heightened the need for skilled calibration professionals, but the supply of adequately trained technicians has not kept pace. This shortage can hinder the ability of companies to perform regular calibrations, affecting product quality and compliance with regulatory standards. Additionally, as technology continues to evolve, existing professionals must continually upgrade their skills, which can be a challenge in a rapidly changing field. Addressing this issue requires investments in education and training programs to develop a new generation of calibration experts and to enhance the skills of current professionals. Thus, a shortage of skilled calibration professionals can pose a major challenge to the growth of the global calibration services market during the forecast period.

Exclusive Customer Landscape

The calibration services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the calibration services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, calibration services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in providing precision calibration services, including ABB's ART FLOW facilities and other advanced technologies. Our offerings ensure accurate measurement and optimization of flowmeter performance, enhancing operational efficiency and reducing downtime. By utilizing state-of-the-art equipment and adhering to industry standards, we deliver reliable and consistent calibration solutions to clients across various industries. Our team of experienced professionals is dedicated to maintaining the highest level of calibration accuracy and ensuring customer satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Agilent Technologies

- Bruel & Kjaer

- Danaher Corporation

- Endress+Hauser

- Fluke Corporation

- General Electric

- Honeywell International

- Keysight Technologies

- Mettler Toledo

- Mitutoyo Corporation

- National Instruments

- Omega Engineering

- PerkinElmer

- Rockwell Automation

- Siemens AG

- Spectris PLC

- Trescal

- Transcat

- WIKA Alexander Wiegand SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Calibration Services Market

- In February 2024, Hexagon AB, a leading global provider of measurement and sensor solutions, announced the launch of its new calibration service offering for industrial metrology equipment, aiming to enhance the accuracy and reliability of manufacturing processes for its clients (Hexagon AB Press Release, 2024).

- In May 2025, Sensirion AG, a Swiss sensor manufacturer, entered into a strategic partnership with Calibre Laboratories, a renowned calibration services provider, to offer integrated sensor calibration solutions, expanding their combined service offerings and addressing the growing demand for precise sensor calibration in various industries (Sensirion AG Press Release, 2025).

- In October 2024, National Instruments Corporation, a technology company specializing in automated test and automated measurement systems, completed the acquisition of Calnex Solutions, a UK-based calibration and test solutions provider, to strengthen its position in the market and broaden its product portfolio (National Instruments Corporation Press Release, 2024).

- In January 2025, the European Union published new regulations on the market surveillance of measuring instruments, which include stricter requirements for calibration and verification of measuring instruments, providing an opportunity for calibration services providers to expand their offerings and ensure compliance for their clients (European Union Regulation, 2025).

Research Analyst Overview

The market is witnessing significant advancements, driven by the adoption of calibration subscription models and calibration software solutions. Calibration process automation, enabled by UKAS and A2LA accreditation, is becoming increasingly popular for enhancing efficiency and ensuring accuracy. Calibration remote control and monitoring are gaining traction, allowing businesses to access calibration services on-demand and reduce downtime. Calibration predictive maintenance, fueled by machine learning and big data analysis, offers a competitive advantage by identifying potential issues before they escalate. Calibration data acquisition and analysis, facilitated by IoT and cloud technologies, enable real-time calibration reporting and analytics.

Calibration field services and mobile solutions cater to businesses requiring on-site calibration services. Calibration business models continue to evolve, incorporating artificial intelligence and subscription-based pricing to deliver value to customers. Calibration data acquisition, analysis, and reporting are essential components of maintaining NIST traceability and ensuring regulatory compliance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Calibration Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.54% |

|

Market growth 2024-2028 |

USD 1786.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.36 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Calibration Services Market Research and Growth Report?

- CAGR of the Calibration Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the calibration services market growth of industry companies

We can help! Our analysts can customize this calibration services market research report to meet your requirements.