Brazil Dumplings Market Size 2025-2029

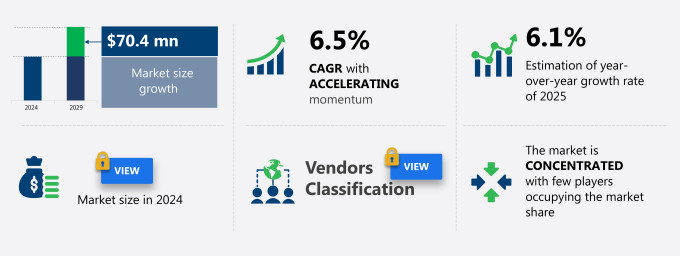

The Brazil dumplings market size is forecast to increase by USD 70.4 million at a CAGR of 6.5% between 2024 and 2029.

- The market is witnessing significant growth due to various factors. Urbanization and increasingly busy lifestyles have led to a rise in demand for convenient and ready-to-eat food options, with dumplings gaining popularity as a quick and delicious meal choice. These meals, such as those with succulent white meat chicken and savory gravy, provide a unique and adaptable dining solution for both lunch and dinner. Companies in the market are expanding their portfolios to cater to this demand, introducing new flavors and varieties to attract customers. However, concerns over product recalls continue to pose a challenge for companies, necessitating stringent quality control measures and adherence to food safety regulations. Overall, these trends and challenges present both opportunities and challenges for players in the North American dumplings market.

What will be the Size of the Market During the Forecast Period?

- The market, a significant segment of the global food industry, continues to captivate consumers with its rich cultural heritage and diverse offerings. Dumplings, a beloved staple in various cuisines, have evolved from a traditional dish to a global phenomenon, with innovations and adaptations that cater to diverse palates and dietary preferences. Steamed dumplings, a classic and timeless favorite, retain their popularity due to their delicate texture and savory flavors. Chinese cuisine, the birthplace of this delectable treat, has influenced the dumpling market significantly. However, the influence extends beyond borders, with Japanese, Korean, and other culinary traditions adding their unique twists to the dumpling repertoire.

- Vegetarian and vegan dumplings have gained traction in recent years, catering to the growing demand for plant-based alternatives. The fusion of dumpling dishes, such as veggie dumplings or jackfruit gyoza, has expanded the market's reach and attracted a broader consumer base. The dumpling business model has also evolved, with franchises and delivery services making these delectable treats more accessible than ever. Pre-cooked dumplings and frozen options have become staples in supermarkets and online stores, allowing consumers to enjoy the authentic taste of dumplings at home. Dumpling festivals and parties have become popular events, celebrating the cultural significance and communal nature of dumpling preparation and consumption.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Non-vegetarian filling

- Vegetarian filling

- Product Type

- Steamed

- Boiled

- Fried

- Baked

- Distribution Channel

- Offline

- Online

- Geography

- Brazil

By Type Insights

- The non-vegetarian filling segment is estimated to witness significant growth during the forecast period.

The market boasts a loyal customer base, particularly for meat-filled options. Pork, chicken, seafood, beef, and lamb are the preferred choices for fillings, catering to diverse taste preferences and dietary needs. One distinctive product in this sector is Hormel Compleats, which offers a range of microwavable meals featuring meat-based dumplings. With the convenience of instant food and the traditional appeal of Asian cuisines, the popularity of these meals continues to grow in the niche market.

Furthermore, for the adventurous palate, experimenting with various flavor combinations is a natural draw. Hormel Compleats' offerings provide a natural and satisfying dining experience, making them a go-to choice for consumers seeking a quick and delicious meal.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Brazil Dumplings Market?

Urbanization and busy lifestyles is the key driver of the market.

- The market has experienced significant growth due to the increasing popularity of ready-to-eat meals and unique flavor offerings. With the rise of casual dining restaurants, cafes, food carts, and food trucks, consumers have access to a wide range of dumpling options, including pan-fried and frozen varieties. The dumpling industry caters to both health-conscious consumers and those seeking convenient and quick food choices. The culinary experiences of dumplings hold cultural significance and have become a fashionable cuisine among urban populations. The food service sector, including supermarkets and online grocery shops, has responded to this trend by expanding its menu options and making dumplings more accessible.

- Asian cuisine, with its diverse flavors and textures, has gained popularity among working professionals and families. Food blogging and social media have played a significant role in shaping consumer behavior and increasing the market's reach. The adaptability of dumplings as a niche market has led to experiments with organic, natural, and preservative-free ingredients, attracting adventurous consumers. Brands and retail establishments have capitalized on this trend, offering various dumpling varieties and menu options. The dumpling craze has also influenced the retail sector, with the availability of meal kits and pop-up eateries catering to the convenience-driven consumer base. Food delivery services and cooking at home have become popular alternatives for those seeking a more personalized dining experience.

What are the market trends shaping the Brazil Dumplings Market?

Company portfolio expansion is the upcoming trend in the market.

- The market is experiencing a noteworthy development as companies broaden their portfolios to cater to evolving consumer preferences. Japchae, with plant-based beef, vegetables, and stir-fried glass noodles, and Green Chili, featuring a spicy plant-based filling. These new offerings come in microwaveable trays, offering greater convenience than the original pouch format. This strategic move follows the successful launch of plant-based dumplings by Bibigo in 2021. The market is witnessing a rise in demand for balanced, convenient, and health-conscious ready-to-eat meals.

- Asian cuisine, with its unique flavors and cultural significance, continues to be a popular choice among consumers. This trend is reflected in the growing number of Asian eateries, cafes, food carts, food trucks, and even supermarkets offering dumpling options. The dumpling industry encompasses various retail establishments, from casual dining restaurants to gourmet dining experiences, and food delivery services. The adaptability of dumplings as quick food choices, menu options for single-person homes, and the ease of preparation make them an attractive niche market. Food blogging and social media have further fueled the dumpling craze, with consumers increasingly experimenting with natural, organic, and preservative-free dumpling varieties.

What challenges does the Brazil Dumplings Market face during the growth?

Concerns of companies over product recalls is a key challenge affecting the market growth.

- The market continues to experience growth, driven by the increasing popularity of ready-to-eat meals and unique flavors. This trend is observed across various sectors, including casual dining restaurants, cafes, food carts, and even food trucks. The dumpling industry caters to diverse consumer behaviors, from health-conscious individuals seeking organic and natural options to adventurous foodies experimenting with fusion cuisines. The convenience offered by frozen dumplings and the availability of various menu options in Asian eateries has made them a staple in single-person households and urban areas. Globalization and immigration have played a significant role in introducing Asian culinary experiences to the US food culture, leading to a dumpling craze.

- However, the market faces challenges such as product recalls, which can negatively impact consumer trust and brand reputation. Despite these challenges, the dumpling market continues to attract investment from retail establishments, food service sector players, and online grocery shops. With the rise of food blogging and social media, consumers increasingly seek out attractive and unique dumpling varieties, textures, and flavors. This trend is expected to continue, driven by the adaptability of dumplings to various cultural significances and culinary traditions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ajinomoto Co. Inc. - The company offers dumplings such as pork and chicken Gyoza dumpling, seafood Gyoza dumpling, vegetable Gyoza dumpling and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Charoen Pokphand Foods PCL

- China In Box

- CJ CheilJedang Corp.

- General Mills Inc.

- Hormel Foods Corp.

- Makis Place

- Nestle SA

- Panda Restaurant Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The dumpling industry has experienced significant growth in recent years, fueled by the increasing popularity of ready-to-eat meals and unique flavors. This market caters to a diverse consumer base, including working professionals, families, and health-conscious individuals, who seek convenient and delicious food options. The dumpling industry encompasses various sectors, including restaurants, cafes, food carts, and retail establishments. A dumpling festival is the perfect setting to showcase a unique dumpling alternative, offering everything from dumpling vegetarian to innovative fusion creations that blend traditional Japanese cuisine and Korean cuisine. Dumpling appetizers and even dumpling desserts are becoming popular menu items, and for those looking to expand their culinary ventures, a dumpling franchise is an exciting business opportunity. A dumpling party, with its diverse dumpling fusion offerings, is an excellent way to celebrate the versatility and global appeal of this beloved dish.

Furthermore, the convenience and accessibility of dumplings have contributed to their popularity in the food service sector. Consumers' eating habits have shifted towards quick meal options, and the dumpling industry has adapted to meet this demand. Online grocery shops and food delivery services have made it easier for consumers to access dumplings, even from the comfort of their homes. Dumpling fillings offer endless possibilities, from classic meat and vegetable options to innovative and versatile ingredients, allowing for a wide range of flavors. Whether in dumpling retail or homemade dumplings, the convenience of using pre-made dumpling wrappers makes preparation easy. For an extra touch, dumpling dipping sauces can elevate the taste, especially when paired with crispy fried dumplings, which showcase the versatility and creativity that dumpling photography captures so beautifully. Social media and food blogging have played a significant role in promoting these trends and increasing the industry's visibility.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market Growth 2025-2029 |

USD 70.4 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

6.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Brazil

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch