Food Trucks Market Size 2025-2029

The food trucks market size is forecast to increase by USD 2.27 billion at a CAGR of 8% between 2024 and 2029.

- The food truck market is experiencing significant growth due to the expanding popularity of street foods and the increasing demand for convenient and affordable eating options. As street foods gain increasing favor among consumers for their convenience and diverse culinary offerings, the demand for mobile food services rises accordingly. Moreover, the rapid urbanization observed globally provides a fertile ground for food truck businesses to thrive, catering to the bustling populations in urban areas and capitalizing on the growth of culinary tourism. However, the market faces challenges, including strict government regulations on the use of food trucks and ensuring food safety and quality. Adhering to these regulations is crucial for food truck operators to maintain customer trust and ensure the success of their businesses. Additionally, the use of technology, such as mobile ordering and contactless payment systems, is becoming increasingly important to meet the changing consumer preferences and expectations.

What will be the Size of the Food Trucks Market During the Forecast Period?

- The food truck market encompasses the operation of mobile food businesses, including vans, trailers, and food carts, that offer a diverse range of cuisines from quick service to gourmet offerings. This market caters to various food preferences, including vegan and meat-based options from barbeque food to snack and specialty beverages.

- Food trucks provide unique meal experiences, bridging the gap between traditional restaurant experiences and the convenience of fast food. Millennials have fueled the growth of this market due to their preference for unique food concepts and the desire for authentic, gourmet offerings. Commercial restaurant chains and food services have also embraced the food truck trend, integrating mobile food booths into their business models to expand their reach and cater to diverse customer preferences. The food truck market continues to evolve, offering innovative gastronomy experiences and unique food concepts that keep consumers engaged and satisfied.

How is this Food Trucks Industry segmented and which is the largest segment?

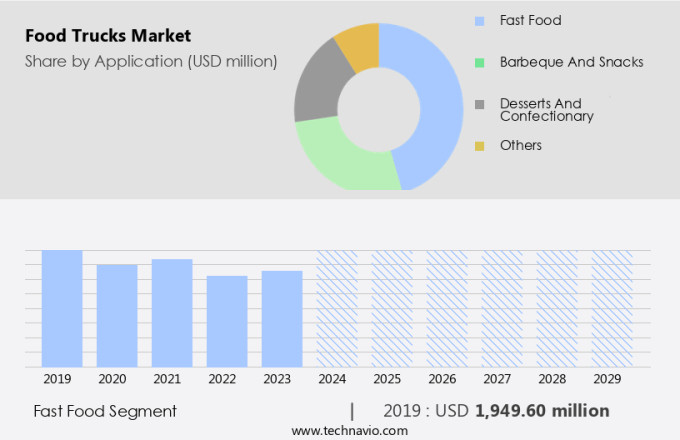

The food trucks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Fast food

- Barbeque and snacks

- Desserts and confectionary

- Others

- Type

- Medium-sized food trucks

- Small-sized food trucks

- Large-sized food trucks

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Spain

- North America

- Canada

- US

- APAC

- China

- India

- South America

- Brazil

- Middle East and Africa

- Europe

By Application Insights

- The fast food segment is estimated to witness significant growth during the forecast period.

The Food Truck Market is expected to expand significantly by 2024, with fast food being the largest application segment. Fast food offerings from food trucks include sandwiches, fries, noodles, and other quick-service items. The convenience and affordability of fast food have contributed to its increasing popularity, with approximately 40% of American adults and 70-80% of households consuming it daily, and around 45% of the Chinese population doing so at least once a week. Food trucks offer a variety of menus and unique food concepts, such as vegan, meat plant-based, bakery, and gourmet offerings. They can be found at tourism sites, commercial restaurants, and food festivals, as well as In the form of mobile vans, trailers, buses, and customized trucks. Electrically chargeable vans and stands or kiosks are also gaining popularity.

The Food Truck Market encompasses a wide range of offerings, including desserts, confectionary, specialty beverages, shaved ice, coffee, and barbeque food. The industry caters to diverse consumer preferences and is expected to continue growing due to the increasing demand for unique meal experiences and convenient food options.

Get a glance at the Food Trucks Industry report of share of various segments Request Free Sample

The fast food segment was valued at USD 1.95 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market experienced significant growth in 2024, accounting for a substantial share of the global market. Minimal capital investment and the rise of food festivals and street food events, fueled by increasing interest in international cuisine, have driven this trend. European cities host numerous street food festivals, providing a platform for food trucks to showcase unique food concepts and gourmet offerings. The working population's preference for quick, convenient meals and the ongoing trend of street food has further boosted demand. Food trucks offer a variety of options, from vegan and meat-based dishes to bakery goods, desserts, and specialty beverages.

These mobile food booths and carts provide a unique meal experience, bridging the gap between traditional restaurant experiences and gourmet offerings. Electrically chargeable vans and expandable boxes, buses, and vans have expanded the food truck industry's reach, allowing for greater flexibility and customization. The food services sector, including quick service restaurants, hotels, and commercial restaurants, has also adopted food trucks to cater to diverse customer preferences. The popularity of food trucks among millennials and the increasing demand for street food and beverages are key factors driving market growth.

Market Dynamics

Our food truck market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Food Trucks Industry?

Expanding popularity of street foods is the key driver of the market.

- The Food Truck Market In the US is experiencing significant growth due to the increasing popularity of gourmet street food served from customized trucks, vans, trailers, and buses. These mobile food establishments offer unique meal experiences, often featuring traditional local cuisine as well as international offerings. Consumers' preferences have shifted towards affordable yet tasty meals, making food trucks an attractive option. The variety of food offerings includes barbeque, snack food, desserts, confectionery, specialty beverages, and more.

- Food trucks also provide convenience, making them a popular choice for quick-service restaurants, hotels, and tourism industries. Electrically chargeable vans and expandable boxes enable food trucks to operate efficiently. The market encompasses a wide range of applications, from shaved ice and coffee stands to full-size vans and buses. Food festivals and street food events further fuel the market's expansion. Overall, the Food Truck Market is a dynamic and evolving sector within the restaurant industry, catering to the diverse tastes and preferences of consumers.

What are the market trends shaping the Food Trucks Industry?

Increasing demand for eating out is the upcoming market trend.

- Food trucks have revolutionized the food industry by providing quick and unique meal experiences through mobile vans, trailers, and customized trucks. These motorized vehicles offer various types of cuisine, including vegan, meat-based, bakery, and gourmet food trucks, providing an expansive range of options for consumers. The food offerings span from traditional fast food to specialty beverages, desserts, and international cuisine. Food trucks cater to the increasing demand for convenient and affordable dining options, especially among millennials. They provide a more personal and interactive dining experience compared to commercial restaurants and quick-service restaurants. The convenience of drive-through window stands or kiosks and electrically chargeable vans add to their appeal.

- Food festivals and street food events have further popularized food trucks, showcasing their diverse menus and unique food concepts. Food services such as shaved ice, coffee, and barbeque food are common offerings, but food trucks also provide less common and innovative options, such as Hanyi Machine's unique desserts and Ante Trailers' specialty beverages. The food truck market continues to expand, with the addition of buses and vans, as well as expandable boxes and customized trucks. The food cart and restaurant industry have been significantly impacted by the rise of food trucks, offering consumers more options and flexibility In their dining choices.

What challenges does the Food Trucks Industry face during its growth?

Strict government rules on the use of food trucks is a key challenge affecting the industry growth.

- The Food Truck Market encompasses a diverse range of mobile food businesses, including vans and trailers, that offer quick and convenient food solutions. These businesses serve various cuisines, from vegan and meat plant-based offerings to bakery items, barbeque food, snack food, and specialty beverages. Food trucks provide unique meal experiences, often featuring gourmet offerings and unique food concepts, which have gained popularity among millennials and tourists. However, operating a food truck business comes with challenges. Food trucks must comply with traffic laws and secure parking spaces, as gatherings near food trucks can lead to heavy losses for street food companies and create issues for nearby commercial restaurants and businesses.

- Additionally, food truck operators must navigate a complex landscape of licensing and health regulations, requiring permits from local health departments and adherence to safety standards. Food trucks have expanded beyond traditional offerings, with electrically chargeable vans, expandable boxes, buses, and vans, and customized trucks. The market includes mobile food booths, food carts, and gourmet food trucks, offering a range of services from shaved ice and coffee to desserts, confectionaries, and full-size vans. Food festivals and street food events showcase the international cuisine offered by food trucks, making them an integral part of the restaurant industry.

Exclusive Customer Landscape

The food trucks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food trucks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, food trucks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Bostonian Body Inc. - The company offers food and catering trucks as well as food truck equipment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bostonian Body Inc.

- Custom Concessions

- Food Trailers for Sale

- Food Truck Co.

- Foodtrucker Engineering LLP

- Futuristo Trailers

- M and R Specialty Trailers and Trucks

- MSM Catering Trucks Mfg.

- Prestige Food Trucks

- Roaming Hunger LLC

- United Food Truck LLC

- VS Special Design srl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The food trucks market encompasses a unique segment of the food industry, characterized by mobile food companies utilizing vans, trailers, and other motorized vehicles to offer quick and convenient meals to consumers. This market caters to various cuisines, including vegan, meat-based, bakery, and gourmet offerings, among others. They provide an alternative to traditional restaurant experiences, offering unique meal experiences that cater to the on-the-go lifestyle of modern consumers. These mobile food providers have gained popularity among millennials and tourists alike, as they offer a diverse range of food concepts that can be enjoyed at various events, food festivals, and street food markets.

Moreover, it comes in various sizes and configurations, from expandable boxes to customized trucks and buses. Some are equipped with electrically chargeable systems, enabling them to operate independently of external power sources. The versatility allows them to be used in various settings, from commercial restaurants and drive-through windows to stands or kiosks and even snack bars and coffee shops. The food truck market is driven by several factors, including the increasing demand for unique and convenient food options, the growing popularity of international cuisine, and the rising trend of food festivals and events. They also offer lower overhead costs compared to commercial restaurants, making them an attractive option for entrepreneurs looking to enter the food services industry.

Furthermore, it offers a range of menu items, from traditional barbeque food and snack food to specialty beverages, desserts, and confectionary. They also cater to various dietary needs, including vegan and gluten-free options. The market is highly competitive, with many players offering unique and innovative menu items to differentiate themselves from competitors. The food truck market is not limited to specific regions or industries. They can be found in various settings, from tourism destinations and hotels to schools and offices. It has become an integral part of the food services industry, offering consumers a convenient and affordable alternative to traditional restaurant experiences.

|

Food Trucks Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market Growth 2025-2029 |

USD 2.27 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, Germany, UK, Canada, China, Italy, France, Spain, Brazil, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Food Trucks Market Research and Growth Report?

- CAGR of the Food Trucks industry during the forecast period

- Detailed information on factors that will drive the Food Trucks market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the food trucks market growth of industry companies

We can help! Our analysts can customize this food trucks market research report to meet your requirements.