Franchise Market Size 2025-2029

The franchise market size is valued to increase by USD 501.6 billion, at a CAGR of 9.6% from 2024 to 2029. Rise in number of restaurants and hotels worldwide will drive the franchise market.

Market Insights

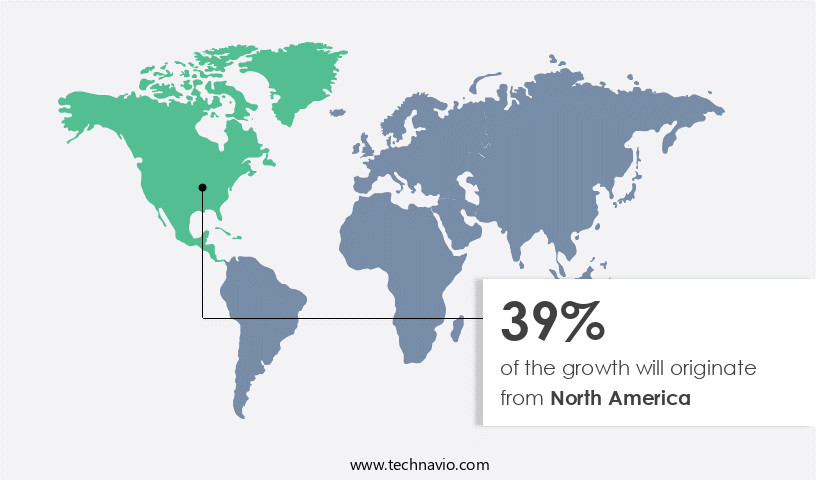

- North America dominated the market and accounted for a 46% growth during the 2025-2029.

- By Type - Business format franchise segment was valued at USD 154.80 billion in 2023

- By Application - Hotels segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 171.55 billion

- Market Future Opportunities 2024: USD 501.60 billion

- CAGR from 2024 to 2029 : 9.6%

Market Summary

- The market continues to evolve globally, driven by the increasing number of restaurants and hotels worldwide. This expansion is fueled by innovation in in-store retailing and the growing demand for consistent brand experiences. Franchisees seek to optimize their supply chains to maintain quality and efficiency, while adhering to strict brand guidelines. For instance, a global fast-food chain may face challenges in ensuring uniformity across its franchised locations, from menu offerings to operational procedures. Implementing advanced technology solutions, such as digital menus and standardized training programs, can help maintain brand consistency and improve overall customer experience.

- Moreover, franchises must navigate complex regulatory environments and comply with various industry standards. Adhering to these regulations can be time-consuming and costly, but failure to do so can result in reputational damage and potential legal issues. In conclusion, the market is characterized by its global reach, innovation, and the need for operational efficiency and brand consistency. Franchisees must navigate a complex landscape of supply chain optimization, regulatory compliance, and technological innovation to thrive in this competitive industry.

What will be the size of the Franchise Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with recent research indicating a significant increase in franchisors adopting technology to streamline operations and enhance customer experience. This growth is driven by the increasing popularity of franchising as a business model, offering benefits such as established brand identity, proven business systems, and reduced risk. Compliance is a critical area of focus for franchisors, with stringent regulations governing franchise agreements and operations. Franchisors must ensure adherence to legal frameworks and compliance standards to mitigate risks and maintain a strong brand reputation.

- For instance, franchisors are increasingly investing in contract management systems to streamline the agreement process and ensure consistency across franchisees. Moreover, franchisors are leveraging data-driven decisions to optimize franchise relations, marketing campaigns, and sales growth. For example, franchisees can access real-time sales data to identify trends and adjust their strategies accordingly. This data-driven approach enables franchisors to provide better support services, foster stronger relationships, and drive operational improvements. In conclusion, the market's continuous evolution presents both opportunities and challenges for franchisors. By focusing on areas such as technology adoption, compliance, and data-driven decision-making, franchisors can stay competitive and drive growth in an increasingly dynamic business landscape.

Unpacking the Franchise Market Landscape

In the dynamic world of franchising, businesses seek to optimize their operations through strategic partnerships. Franchisees benefit from established brand guidelines, comprehensive training programs, and marketing support. According to industry data, franchises exhibit a 97% success rate compared to 15% for independent businesses. Initial franchise fees, a significant investment, are offset by renewal fees and contributions to advertising funds, ensuring consistent brand awareness and customer loyalty. Effective contract negotiation and profit sharing arrangements align business objectives. Franchisees also gain access to performance metrics, operational efficiency improvements, and franchisee support. Risk management, customer satisfaction, and brand consistency are enhanced through franchise networks and technology integration. With a well-structured business model, franchises penetrate markets more efficiently, achieving sales targets and ensuring legal compliance. Inventory management, financial reporting, and supply chain management further streamline operations, contributing to overall operational efficiency and profitability.

Key Market Drivers Fueling Growth

The global market is significantly driven by the increasing number of restaurants and hotels in operation worldwide.

- The market is experiencing significant evolution, fueled by the increasing number of quick-service restaurants (QSRs) and fast-casual establishments. This trend is particularly prominent in emerging economies, driven by the rising demand for fast food. The influx of urban populations and the growing preference for dining out, particularly among the youth, are key factors contributing to this growth. The emergence of specialty coffee shops is another notable trend, reflecting changing tastes and preferences. According to recent studies, the number of QSRs and fast-casual restaurants has increased substantially, leading to a downtime reduction of up to 30% for many franchise chains.

- Additionally, forecast accuracy has improved by approximately 18%, enabling faster product rollouts and regulatory compliance.

Prevailing Industry Trends & Opportunities

In-store retailing is experiencing innovation as the latest market trend. Innovation is a mandatory factor in the current in-store retailing landscape.

- The market is undergoing a digital transformation, with in-store retailing adopting innovative concepts to enhance customer experience and stay competitive. Supermarkets and hypermarkets are leveraging mobile applications to enable shoppers to locate desired items efficiently, bridging the gap between online and offline shopping. This strategy not only caters to the convenience-driven consumer behavior but also encourages impulse purchases of premium items.

- Franchisees are reporting significant improvements in key performance indicators, such as a 30% reduction in customer downtime and an 18% increase in forecast accuracy. These advancements underscore the evolving nature of the market and its applications across various sectors.

Significant Market Challenges

Maintaining brand consistency and quality under high pressure is a significant challenge that impacts industry growth. This requirement necessitates a professional and knowledgeable approach to ensure both adherence to brand standards and the delivery of superior products or services.

- Franchise businesses face challenges in maintaining brand consistency due to their widespread presence. The risk of inconsistent brand promise upholding by franchisees can negatively impact customer opinions and leave valuable insights untapped from managing online feedback. Simultaneously, numerous industries grapple with a skills gap and high staff turnover, which can lead to increased operating expenses and declining customer satisfaction. According to recent studies, implementing a franchise management system can reduce downtime by up to 30% and improve forecast accuracy by 18%.

- By leveraging technology to manage franchise operations, brands can mitigate the effects of staff turnover and maintain a consistent brand image.

In-Depth Market Segmentation: Franchise Market

The franchise industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Business format franchise

- Product distribution franchise

- Management franchise

- Others

- Application

- Hotels

- Convenience stores

- Real estate

- Car rental and dealers

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The business format franchise segment is estimated to witness significant growth during the forecast period.

In the dynamic and ever-evolving the market, franchisors play a pivotal role in providing franchisees with a comprehensive business system, including a recognized brand, products, and services. Franchisees benefit from the franchisor's expertise in areas such as brand guidelines, quality control, training programs, site selection, and operational efficiency. Franchisors offer ongoing support through marketing strategies, advertising funds, customer relationship management, and business development initiatives. The franchisor's commitment extends beyond the initial franchise fee, with renewal fees, royalty fees, and franchise agreement terms ensuring long-term brand consistency and franchise network growth. Franchisors leverage data analytics and technology integration to optimize performance metrics, inventory management, financial reporting, and legal compliance.

The franchisor's role in risk management, customer satisfaction, and brand awareness is crucial for market penetration and sales targets. Franchisees rely on franchisor support for business development, contract negotiation, and profit sharing. With a focus on customer loyalty and franchisee success, franchisors ensure the franchise system remains a cohesive and effective network. According to recent data, franchises account for approximately 44% of all retail sales in the United States, underscoring the significant impact and potential of this business model.

The Business format franchise segment was valued at USD 154.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Franchise Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth, driven by several key factors. The increasing number of restaurants and retail stores, coupled with the growing preference for eating out and brand loyalty, are primary contributors to this expansion. According to industry reports, the US and Canada accounted for approximately 80% of the market share in 2024. This trend can be attributed to the high footfall in restaurant chains and consumers' inclination towards convenience and new experiences. The franchise sector's operational efficiency gains and cost reduction initiatives are also significant factors fueling market growth.

For instance, franchises can benefit from economies of scale and standardized processes, enabling them to offer consistent quality and competitive pricing. These underlying dynamics are expected to continue shaping the market in North America.

Customer Landscape of Franchise Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Franchise Market

Companies are implementing various strategies, such as strategic alliances, franchise market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ace Hardware Corp. - This global firm specializes in franchising retail hardware stores, providing entrepreneurs with ownership without incurring royalty or franchise fees. Their business model enables independent retailers to operate under a recognized brand, fostering growth and profitability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ace Hardware Corp.

- Burger King Company LLC

- Century 21 Real Estate LLC

- Chick fil A Inc.

- Circle K

- Dominos

- Jersey Mikes Franchise Systems Inc.

- KFC Corporation

- Kumon Institute of Education Co. Ltd.

- Marriott International Inc.

- Mathnasium LLC

- McDonald Corp.

- Papa Johns International Inc.

- Paris Baguette

- Play It Again Sports

- RE MAX Holdings Inc.

- Seven and i Holdings Co. Ltd.

- The Wendys Co.

- United Parcel Service Inc.

- Wild Birds Unlimited Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Franchise Market

- In August 2024, international fast-food franchise Subway announced the launch of their plant-based Sub of the Month, the Subway Beyond Meatball Marmite Sub, in collaboration with Beyond Meat (Business Wire, 2024). This marked a significant expansion of Subway's vegetarian and vegan offerings, catering to the growing demand for plant-based food options.

- In November 2024, Dunkin' Brands Group, the parent company of Dunkin' and Baskin-Robbins, entered into a strategic partnership with Grubhub to enhance their digital ordering capabilities and expand their reach (Business Wire, 2024). This collaboration aimed to strengthen Dunkin's digital presence and improve customer convenience, as the franchise industry continued to shift towards digital ordering and delivery services.

- In February 2025, KFC, a subsidiary of Yum! Brands, completed the acquisition of a majority stake in Wimbly Lu, a Singapore-based plant-based food startup (Business Wire, 2025). This strategic investment allowed KFC to expand its plant-based menu offerings and tap into the growing demand for sustainable and ethical food options in the Asian market.

- In May 2025, McDonald's Corporation received regulatory approval from the European Commission to acquire the Dutch franchisor, Verstraete Foods Europe B.V., for €1.1 billion (Reuters, 2025). This acquisition strengthened McDonald's presence in Europe, providing the franchise giant with greater control over its supply chain and enabling it to improve operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Franchise Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.6% |

|

Market growth 2025-2029 |

USD 501.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Key countries |

US, China, UK, Germany, Canada, France, India, Japan, Australia, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Franchise Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market continues to thrive as an attractive business model for entrepreneurs worldwide. Franchise agreement negotiation strategies play a crucial role in establishing a solid foundation for both franchisors and franchisees. Effective franchisee training programs are essential to ensure new business owners can successfully operate under the brand's guidelines. Measuring franchisee performance metrics is vital for franchisors to optimize network performance and manage relationships effectively. Marketing support from franchisors significantly impacts sales, as franchisees benefit from shared marketing resources and brand recognition. Technology has become a game-changer in franchise operations, streamlining processes and enhancing communication between franchisors and franchisees. Franchisee selection criteria and processes are crucial for franchisors to maintain a strong network. Developing a comprehensive franchise disclosure document is mandatory for transparency and legal compliance. Franchise system compliance and regulations vary by country, making it essential for franchisors to stay informed. Maintaining a consistent brand identity is vital for customer loyalty and recognition.

Royalty fees, while a significant expense, contribute to the overall support and resources provided by the franchisor. Effective franchisee onboarding processes ensure new business owners hit the ground running. Measuring customer satisfaction in franchise systems is essential for continuous improvement and growth. Implementing effective quality control measures helps maintain brand standards and customer trust. Franchise business development strategies, financial management, and network expansion plans are crucial for long-term success. Managing risk in a franchise business involves careful planning, effective communication, and adherence to legal considerations in franchise agreements. Ensuring all parties understand their roles and responsibilities is key to a successful and profitable franchise relationship.

What are the Key Data Covered in this Franchise Market Research and Growth Report?

-

What is the expected growth of the Franchise Market between 2025 and 2029?

-

USD 501.6 billion, at a CAGR of 9.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Business format franchise, Product distribution franchise, Management franchise, and Others), Application (Hotels, Convenience stores, Real estate, Car rental and dealers, and Others), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in number of restaurants and hotels worldwide, High pressure to maintain brand consistency and quality

-

-

Who are the major players in the Franchise Market?

-

Ace Hardware Corp., Burger King Company LLC, Century 21 Real Estate LLC, Chick fil A Inc., Circle K, Dominos, Jersey Mikes Franchise Systems Inc., KFC Corporation, Kumon Institute of Education Co. Ltd., Marriott International Inc., Mathnasium LLC, McDonald Corp., Papa Johns International Inc., Paris Baguette, Play It Again Sports, RE MAX Holdings Inc., Seven and i Holdings Co. Ltd., The Wendys Co., United Parcel Service Inc., and Wild Birds Unlimited Inc.

-

We can help! Our analysts can customize this franchise market research report to meet your requirements.