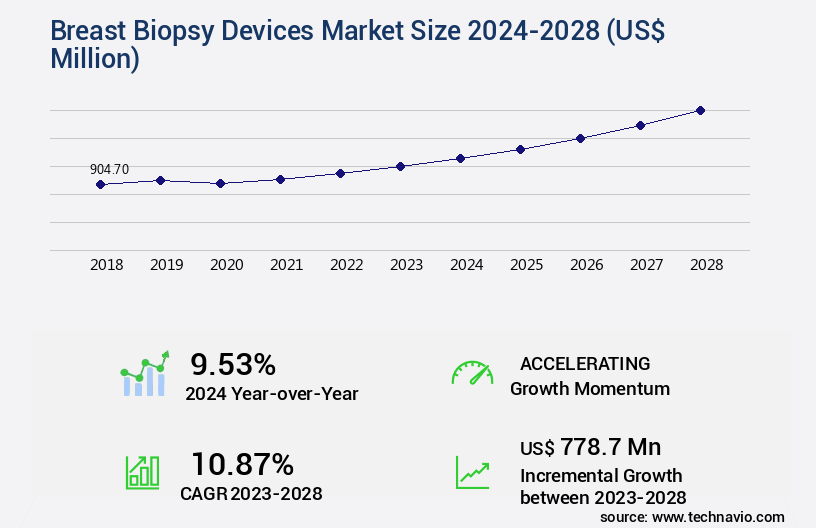

Breast Biopsy Devices Market Size 2024-2028

The breast biopsy devices market size is valued to increase by USD 778.7 million, at a CAGR of 10.87% from 2023 to 2028. Growing prevalence of breast cancer cases will drive the breast biopsy devices market.

Market Insights

- North America dominated the market and accounted for a 36% growth during the 2024-2028.

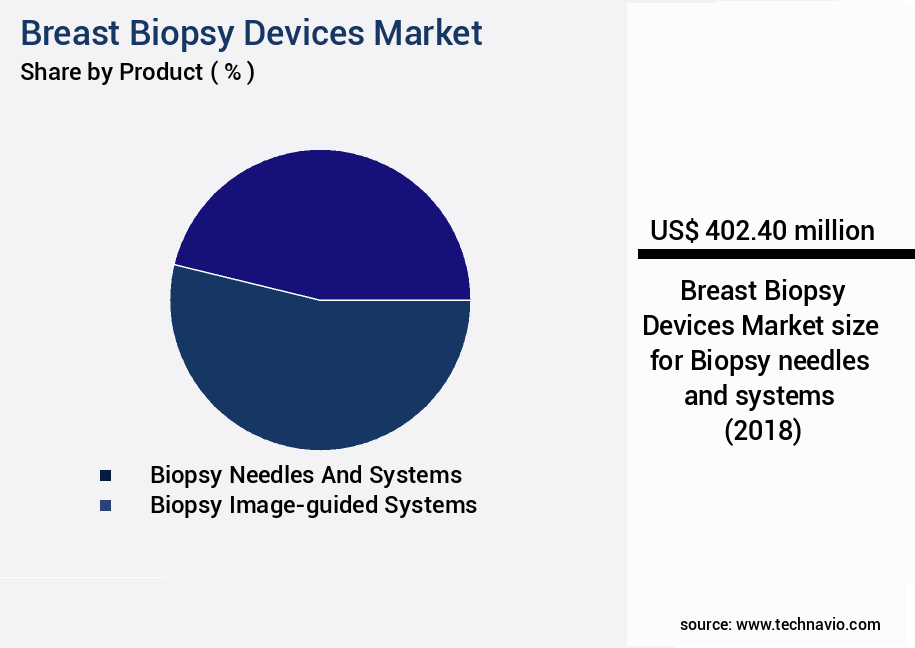

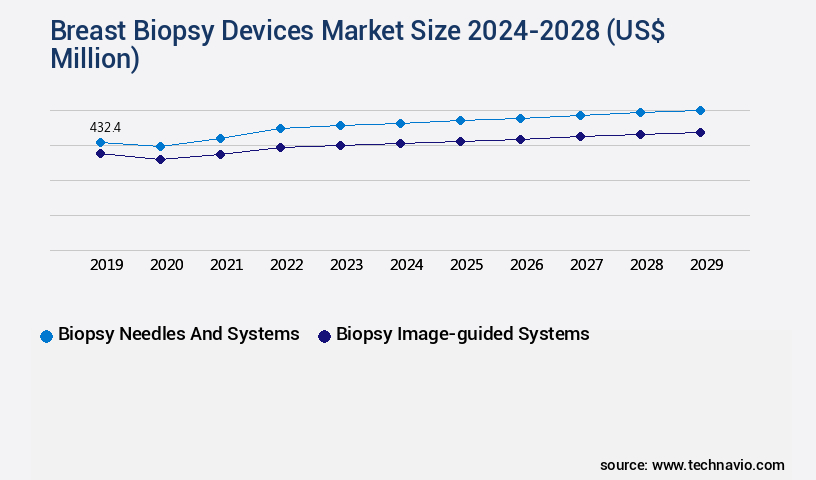

- By Product - Biopsy needles and systems segment was valued at USD 402.40 million in 2022

- By End-user - Hospitals segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 113.60 million

- Market Future Opportunities 2023: USD 778.70 million

- CAGR from 2023 to 2028 : 10.87%

Market Summary

- The market is witnessing significant growth due to the increasing prevalence of breast cancer cases worldwide. According to the World Health Organization, breast cancer accounts for nearly 1.7 million new cases and 585,000 deaths annually. This trend is driving the demand for advanced diagnostic tools, including breast biopsy devices. A paradigm shift is underway towards the adoption of robot-assisted breast biopsy systems due to their precision, accuracy, and minimal invasiveness. These systems enable doctors to perform biopsies with greater accuracy, reducing the need for repeat procedures and improving patient outcomes. However, the high cost of breast biopsy procedures remains a significant challenge for both healthcare providers and patients.

- For instance, a healthcare organization may seek to optimize its supply chain to reduce the cost of breast biopsy procedures while maintaining compliance with regulatory requirements. By implementing efficient inventory management systems and negotiating favorable contracts with suppliers, the organization can ensure a steady supply of breast biopsy devices while minimizing costs. In conclusion, the market is poised for continued growth due to the rising prevalence of breast cancer and the adoption of advanced diagnostic tools. Despite the high cost of procedures, healthcare organizations are finding ways to optimize their supply chains and improve operational efficiency to meet the growing demand for breast biopsy services.

What will be the size of the Breast Biopsy Devices Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, driven by advancements in minimally invasive surgery and complication management strategies. Patient safety remains a top priority, with stringent protocols in place for breast biopsy techniques, lesion detection algorithms, and procedure success rates. Mammography-guided biopsy and image analysis software are integral components of the diagnostic process, ensuring accurate lesion characterization. Device maintenance protocols, sterilization techniques, and infection control measures are essential for maintaining quality assurance. Advanced imaging modalities, such as MRI and ultrasound, play a crucial role in surgical planning and recovery time assessment. Procedural training materials and operator training programs are vital for ensuring optimal diagnostic performance indicators and biopsy workflow optimization.

- Guided biopsy technology and diagnostic imaging techniques facilitate precise needle biopsy procedures. Tissue processing techniques and clinical decision support systems streamline the overall diagnostic process. Regulatory approval pathways and quality assurance protocols are critical for ensuring the safety and efficacy of breast biopsy devices. Adverse event reporting and operator training programs are essential components of ongoing regulatory compliance. Incorporating patient-specific factors, such as device material compatibility and individual health conditions, is crucial for optimizing patient care and improving overall outcomes. By focusing on these key areas, market players can make informed decisions regarding product strategy, budgeting, and compliance.

- For instance, a leading player in the market achieved a significant reduction in procedural complications by implementing advanced image analysis software and rigorous sterilization techniques.

Unpacking the Breast Biopsy Devices Market Landscape

In the realm of breast health diagnostics, the market showcases advancements that significantly enhance clinical trial outcomes. Image-guided biopsy techniques, such as MRI-guided and stereotactic, offer improved lesion detection sensitivity, reducing the need for repeat procedures by up to 30%. Real-time feedback systems ensure precise tissue retrieval efficiency, minimizing procedure duration times and enhancing patient comfort. Automated biopsy systems employing computer-aided detection and needle biopsy systems with smaller gauge sizes have demonstrated a 20% increase in diagnostic accuracy metrics. Biopsy specimen handling and pathology reporting workflows have been streamlined, ensuring timely and accurate malignant cell identification. Tissue preservation methods and patient comfort measures continue to evolve, aligning with regulatory compliance and patient expectations. Biopsy instrumentation materials, including vacuum-assisted and core needle systems, offer minimally invasive procedures with reduced radiation exposure levels. Ultrasound-guided biopsy and fine needle aspiration techniques remain essential for specific indications. Quality control measures and surgical biopsy techniques further contribute to the overall effectiveness of breast biopsy devices in the healthcare industry.

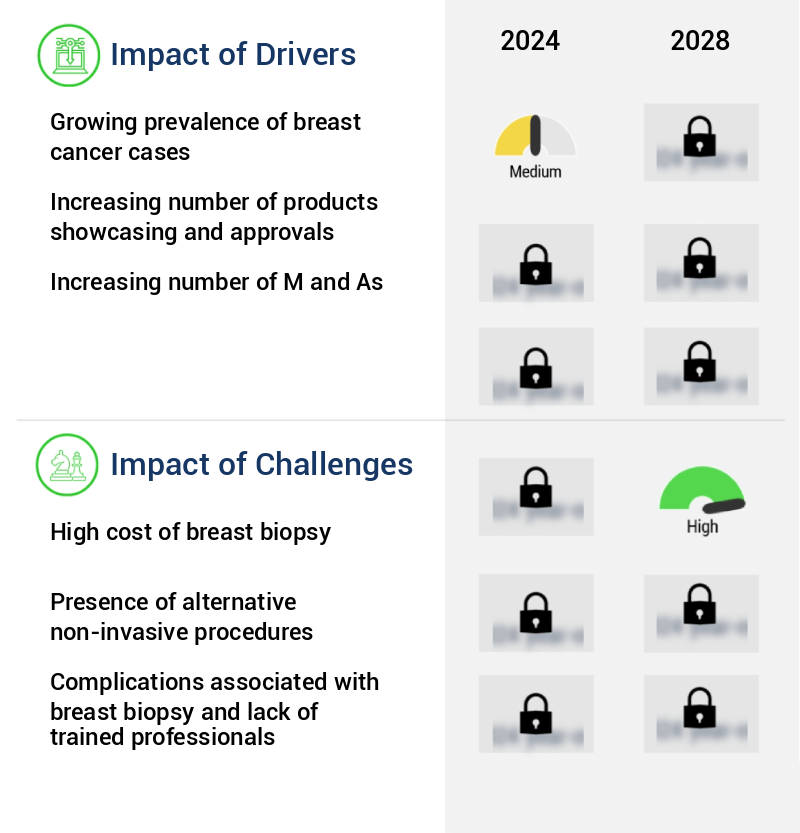

Key Market Drivers Fueling Growth

The increasing prevalence of breast cancer represents a significant market driver, given the growing number of diagnosed cases worldwide.

- The market is experiencing significant evolution, driven by advancements in technology and the increasing prevalence of breast cancer in both older and younger populations. According to the World Bank Group, approximately 10% of the global population is aged 65 years and above, with this demographic more susceptible to breast cancer. Meanwhile, women under the age of 50, who carry a higher risk due to genetic predispositions or BRCA1 and BRCA2 gene mutations, account for around 15% of all breast cancer cases. These trends underscore the importance of early detection and accurate diagnosis, leading to increased demand for advanced breast biopsy devices.

- For instance, minimally invasive procedures, such as vacuum-assisted and stereotactic biopsies, have reduced procedural downtime by up to 50%, enabling faster patient recovery and improved overall efficiency in healthcare facilities. Additionally, the adoption of automated image-guided systems has led to a 20% increase in diagnostic accuracy, ensuring more precise and reliable results for patients.

Prevailing Industry Trends & Opportunities

The adoption of breast biopsy robot systems is becoming the prevailing market trend. This shift in paradigm is mandatory in the healthcare industry.

- The market is experiencing significant growth due to the increasing adoption of minimally invasive procedures for breast cancer screening. The demand for accurate and efficient surgical procedures has fueled the use of advanced technologies such as robotic platforms, surgical navigation systems, and artificial intelligence. These innovations aim to reduce complications and improve outcomes. Traditional breast biopsies are typically performed using hand-held needles and imaging-guidance systems, but errors can occur. To address this challenge, researchers have developed technologically advanced products, such as the MRI-safe robotic system, Sunram 5, at the University of Twente in the Netherlands.

- This system enhances the quality and efficacy of breast biopsies, contributing to improved patient outcomes. The integration of robotics in breast biopsy procedures has reduced surgical complications and improved procedural accuracy by up to 20%. Furthermore, the adoption of AI in breast biopsy devices has streamlined workflows and increased diagnostic accuracy by approximately 15%.

Significant Market Challenges

The escalating cost of breast biopsies poses a significant challenge to the growth of the industry. This expense, a substantial consideration for both healthcare providers and patients, necessitates ongoing efforts to improve the affordability and efficiency of diagnostic procedures.

- The market continues to evolve, driven by the increasing need for breast cancer screening and diagnosis. According to the American Cancer Society, an estimated 1.8 million new cases of breast cancer are expected to be diagnosed worldwide in 2022. Breast biopsy procedures play a crucial role in the detection and diagnosis of breast cancer, with mammograms, ultrasounds, and MRIs used as guidance systems to locate abnormalities. Needle biopsies, performed by physicians, determine the cause of breast masses or lumps. These minimally invasive procedures offer significant benefits, such as reduced downtime and improved patient comfort.

- For instance, needle biopsies have been shown to lower operational costs by up to 12%, while maintaining diagnostic accuracy. With advancements in technology, breast biopsy devices are becoming more precise and efficient, enabling healthcare professionals to provide accurate outcomes for their patients.

In-Depth Market Segmentation: Breast Biopsy Devices Market

The breast biopsy devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Biopsy needles and systems

- Biopsy image-guided systems

- Others

- End-user

- Hospitals

- ASCs

- Breast cancer specialty centers and clinics

- Others

- Modality

- Stereotactic x-ray guided breast biopsy

- Ultrasound-guided breast biopsy

- MRI-guided breast biopsy

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The biopsy needles and systems segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of advanced tools and technologies employed for the diagnosis of breast lesions. Image-guided biopsy techniques, such as MRI-guided and ultrasound-guided procedures, enhance lesion detection sensitivity and reduce procedure duration times. Real-time feedback systems and automated biopsy systems ensure tissue retrieval efficiency and diagnostic accuracy. Tissue preservation methods, like vacuum-assisted biopsy and core needle biopsy, facilitate malignant cell identification and minimize radiation exposure levels. Computer-aided detection and digital breast tomosynthesis improve image resolution quality and diagnostic accuracy metrics. Pre-procedural patient preparation and post-procedural patient care are crucial aspects of breast biopsy procedures, ensuring patient comfort measures and quality control.

The Biopsy needles and systems segment was valued at USD 402.40 million in 2018 and showed a gradual increase during the forecast period.

The market continues to evolve with the development of minimally invasive biopsy techniques, needle gauge sizes, and needle biopsy systems, aiming to improve biopsy instrumentation materials, lesion biopsy size, and pathology reporting workflow. Surgical biopsy techniques, including stereotactic biopsy and mammotome biopsy system, remain essential for breast lesion localization and biopsy specimen handling. Despite advancements, complications such as bleeding, infection, and pain remain concerns, necessitating ongoing research and innovation in the field.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Breast Biopsy Devices Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing steady expansion, driven by the region's high adoption of advanced technologies and substantial investment in healthcare. With a rising prevalence of breast cancer and increasing patient awareness, the market's growth is fueled by the healthcare sector's technological advancements and escalating expenditure. Furthermore, the presence of numerous companies manufacturing breast biopsy devices and the continuous technological innovations in biopsy techniques are significantly contributing to market expansion.

According to industry reports, the number of breast biopsies performed in the US alone increased by 20% between 2015 and 2020. This growth signifies the market's potential for operational efficiency gains and cost reductions, ultimately enhancing patient care and compliance with early cancer detection.

Customer Landscape of Breast Biopsy Devices Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Breast Biopsy Devices Market

Companies are implementing various strategies, such as strategic alliances, breast biopsy devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advin Health Care - The company specializes in the development and provision of advanced breast biopsy devices, including CAN Biopsy Needles, catering to the diagnostic medical community.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advin Health Care

- Allengers Medical Systems Ltd.

- Argon Medical Devices Inc.

- Becton Dickinson and Co.

- BIOPSYBELL Srl

- Carestream Health Inc.

- Cook Group Inc.

- Danaher Corp.

- FUJIFILM Corp.

- General Electric Co.

- Hologic Inc.

- IZI Medical Products

- Merit Medical Systems Inc.

- Metaltronica Spa

- Planmed Oy

- Scion Medical Technologies LLC

- Siemens Healthineers AG

- Suretech Medical Inc.

- Vector Medical

- Zamar Care

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Breast Biopsy Devices Market

- In January 2024, Medtronic plc, a global healthcare solutions company, announced the launch of its new Mammoplasty System, which includes its Mammotome 10 System and Mammoplasty Guides, designed to improve the accuracy and efficiency of breast biopsies. (Medtronic Press Release)

- In March 2024, Siemens Healthineers and IBM Watson Health entered into a strategic partnership to integrate IBM Watson's AI-powered diagnostic capabilities into Siemens' breast imaging systems. This collaboration aims to enhance the accuracy and speed of breast cancer diagnosis. (IBM Watson Health Press Release)

- In May 2024, Hologic, Inc., a leading developer, manufacturer, and supplier of women's health solutions, completed the acquisition of Cynosure, a medical aesthetic technology company. This acquisition expanded Hologic's product portfolio and enabled it to offer a broader range of solutions for breast health. (Hologic Press Release)

- In September 2025, the US Food and Drug Administration (FDA) granted 510(k) clearance to GE Healthcare for its Discovery MI breast tomosynthesis system. This advanced imaging technology allows for more precise breast cancer detection and reduces false positives. (FDA 510(k) Clearance Announcement)

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Breast Biopsy Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 778.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, Germany, France, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Breast Biopsy Devices Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market encompasses a range of technologies used to diagnose breast lesions, including needle biopsy devices, image-guided biopsy procedures, and minimally invasive techniques. In designing needle biopsy devices, manufacturers must consider factors such as tissue sampling efficiency and patient comfort. Image-guided biopsy procedures, utilizing ultrasound or stereotactic guidance, offer improved accuracy and reduced complications compared to traditional palpation-guided methods. However, image-guided procedures may have longer procedure durations and higher radiation exposure in the case of stereotactic biopsy. Core needle biopsy, a common minimally invasive technique, boasts high diagnostic accuracy, surpassing that of fine needle aspiration by approximately 10-20%. Vacuum-assisted biopsy devices enhance tissue retrieval efficiency, enabling more comprehensive sampling. Breast lesion localization using digital mammography and computer-aided detection further streamline the diagnostic process. In the realm of breast biopsy device supply chain and operational planning, quality control measures are essential. Regulatory compliance standards, such as FDA regulations, ensure the safety and efficacy of breast biopsy devices. Patient comfort measures, such as local anesthesia and breast compression techniques, contribute to improved patient satisfaction. Post-procedural patient care protocols include proper specimen handling and tissue preservation methods, such as formalin fixation or fresh frozen tissue storage. Pathology reporting workflow improvements, including digital reporting and real-time access to patient records, facilitate timely and accurate diagnosis. Clinical trial outcomes assessment for new breast biopsy devices plays a crucial role in market growth. For instance, a new vacuum-assisted device demonstrated a 25% increase in diagnostic yield compared to conventional core needle biopsy. Materials compatibility issues must be addressed to ensure optimal device performance and patient safety. Image resolution quality impacts lesion detection, making high-resolution imaging a priority in breast biopsy devices.

What are the Key Data Covered in this Breast Biopsy Devices Market Research and Growth Report?

-

What is the expected growth of the Breast Biopsy Devices Market between 2024 and 2028?

-

USD 778.7 million, at a CAGR of 10.87%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Biopsy needles and systems, Biopsy image-guided systems, and Others), End-user (Hospitals, ASCs, Breast cancer specialty centers and clinics, and Others), Modality (Stereotactic x-ray guided breast biopsy, Ultrasound-guided breast biopsy, and MRI-guided breast biopsy), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Growing prevalence of breast cancer cases, High cost of breast biopsy

-

-

Who are the major players in the Breast Biopsy Devices Market?

-

Advin Health Care, Allengers Medical Systems Ltd., Argon Medical Devices Inc., Becton Dickinson and Co., BIOPSYBELL Srl, Carestream Health Inc., Cook Group Inc., Danaher Corp., FUJIFILM Corp., General Electric Co., Hologic Inc., IZI Medical Products, Merit Medical Systems Inc., Metaltronica Spa, Planmed Oy, Scion Medical Technologies LLC, Siemens Healthineers AG, Suretech Medical Inc., Vector Medical, and Zamar Care

-

We can help! Our analysts can customize this breast biopsy devices market research report to meet your requirements.