Business Process Automation Market Size 2025-2029

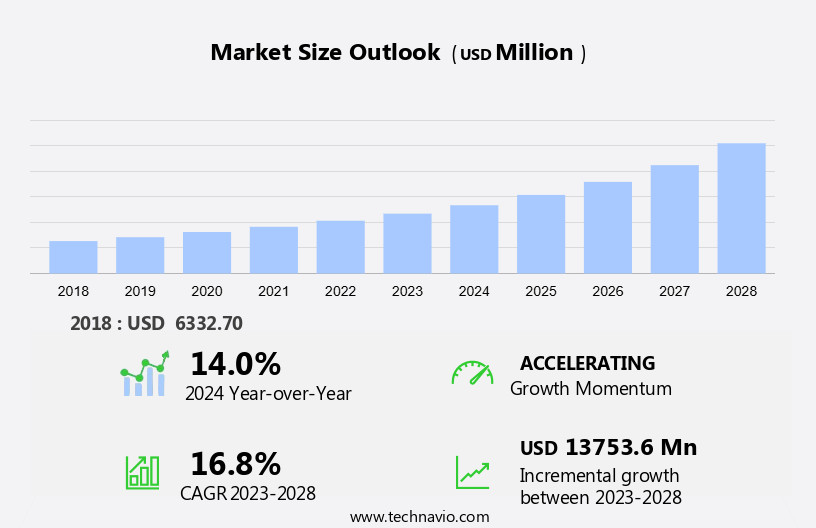

The business process automation market size is forecast to increase by USD 17.68 billion, at a CAGR of 18.4% between 2024 and 2029.

- The Business Process Automation (BPA) market is witnessing significant growth due to the increasing emphasis on operational efficiency and productivity. Companies are increasingly adopting automation solutions to streamline their business processes and reduce manual work, thereby improving overall productivity and competitiveness. Another key trend driving the market is the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies in business process automation. These advanced technologies enable intelligent process automation, allowing businesses to automate complex tasks and gain valuable insights from their data. However, the high cost of business process automation services remains a significant challenge for many organizations.

- The implementation and maintenance of automation solutions can be costly, particularly for small and medium-sized enterprises. This cost barrier may limit the adoption of automation technologies, particularly in industries with tight budgets or low-margin business models. Despite this challenge, the potential benefits of business process automation, including increased efficiency, improved accuracy, and enhanced customer experience, make it an attractive investment for companies seeking to gain a competitive edge in their markets.

What will be the Size of the Business Process Automation Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-growing demand for productivity enhancement and cost reduction. Process management software, data analytics, and automation tools are increasingly being adopted to optimize workflows, redesign business processes, and improve overall efficiency. The integration of artificial intelligence (AI) and machine learning (ML) technologies further enhances automation capabilities, enabling more accurate data analysis and error reduction. Businesses are embracing automation as part of their digital transformation initiatives, focusing on customer experience improvement and innovation enablement. Automation governance, financial management, and compliance management are also critical components of a comprehensive automation strategy. Process analysis and modeling are essential for identifying areas ripe for automation and optimizing existing workflows.

No-code development platforms and automation frameworks streamline implementation and enable faster time-to-value. Automation monitoring, security management, and risk management are crucial for ensuring compliance and maintaining business agility. Automation adoption rates continue to soar as businesses recognize the potential for significant efficiency gains and cost savings. Automation training and best practices are becoming increasingly important to ensure successful implementation and ongoing optimization. The automation roadmap is an ongoing journey, with continuous process improvement initiatives and the adoption of new technologies shaping the market landscape. Automation maturity models provide a framework for measuring progress and identifying opportunities for further optimization. Ultimately, automation is a key enabler for businesses seeking to remain competitive and adapt to changing market dynamics.

How is this Business Process Automation Industry segmented?

The business process automation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Large enterprises

- SMEs

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

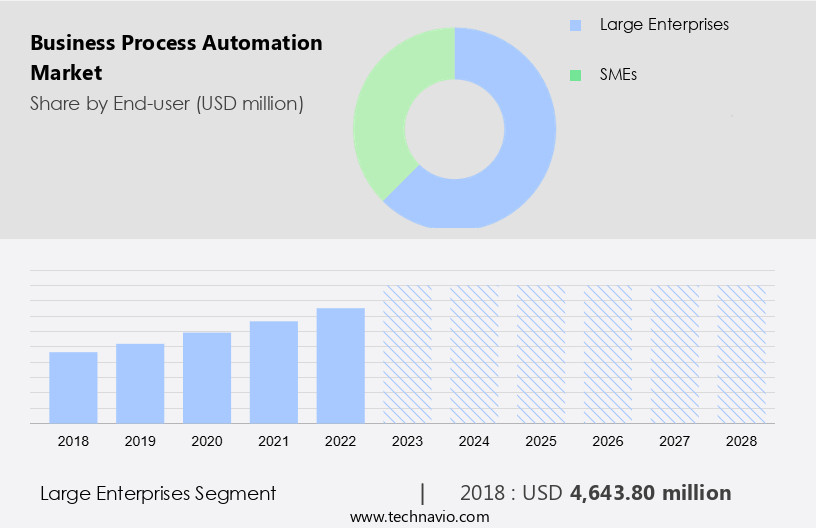

The large enterprises segment is estimated to witness significant growth during the forecast period.

In the market, the IT and Telecom segment is poised for significant growth between 2023 and 2024. This segment's operational efficiency and cost reduction are key drivers, with automation enabling organizations to streamline workflows, minimize manual intervention, and improve service delivery. Advanced technologies like artificial intelligence, machine learning, and robotic process automation will be leveraged to increase automation and intelligence in business processes. The demand for faster, more reliable communication networks and IT services necessitates automation adoption. To remain competitive and meet customer needs, organizations in this segment will prioritize automation strategies. Data analytics plays a crucial role in process optimization and redesign, while process mapping ensures a clear understanding of workflows.

Automation training equips employees with the necessary skills, and workflow management systems facilitate seamless integration with various tools. Automation monitoring, security management, and compliance management ensure business continuity and regulatory adherence. Business intelligence and automation ROI provide valuable insights for process improvement initiatives. Cloud computing and no-code development platforms enable quick implementation and efficiency gains. Automation frameworks, governance, and best practices ensure risk management and innovation enablement. Overall, the market is evolving to deliver significant benefits in terms of productivity enhancement, cost reduction, and digital transformation.

The Large enterprises segment was valued at USD 5.19 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

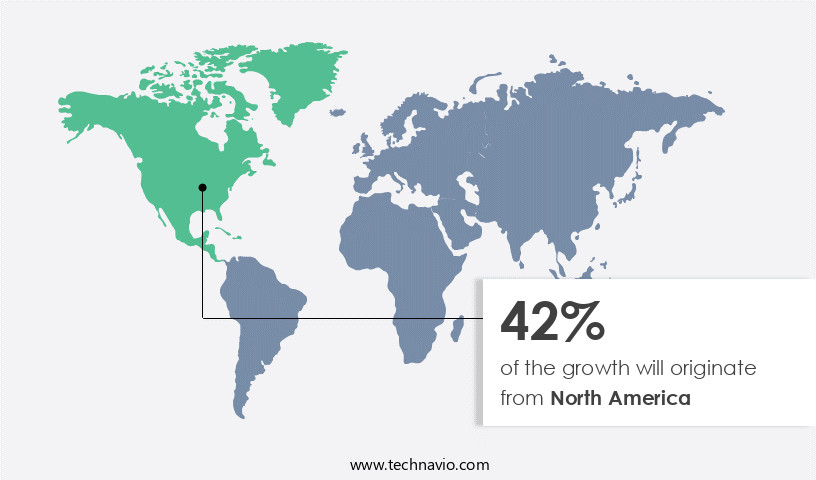

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Business process automation continues to gain momentum as companies seek to enhance productivity, optimize processes, and reduce errors. In Europe, Germany, France, and the UK are leading markets for automation, with various industries, including banking and financial services, adopting the technology to address fraud concerns and streamline rule-based processes. The UK's National Health Service (NHS) is an exemplary user of Robotic Process Automation (RPA), provided by UiPath, delivering substantial cost savings. The European market is poised to significantly contribute to The market's growth during the forecast period. Artificial intelligence (AI) and machine learning (ML) are integral to modern automation solutions, enabling process discovery, analysis, and optimization.

Workflow automation and integration platforms facilitate seamless data exchange and process coordination, while automation monitoring, security management, and compliance management ensure robust governance. Cloud computing and no-code development platforms offer flexibility and ease of implementation, enabling businesses to automate processes quickly and cost-effectively. Automation training and best practices ensure a smooth transition and optimal adoption rate. Automation roadmaps and maturity models provide a clear path to innovation enablement and risk management. Digital transformation and customer experience improvement are key drivers of automation adoption, with cost reduction and financial management being essential benefits. Employee satisfaction and business agility are additional advantages, making automation a valuable investment for organizations.

Automation consultants and low-code development platforms further support businesses in their automation journey.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Business Process Automation Industry?

- The increasing prioritization of operational efficiency and productivity in business process automation solutions serves as the primary market driver.

- The market is experiencing significant growth due to the increasing need for efficiency and productivity among organizations. Across industries such as finance, telecommunications, and automotive, businesses are recognizing the value of automating repetitive tasks. Workflow management systems, which include artificial intelligence (AI) and machine learning (ML), are at the forefront of this trend. These technologies enable the automation of complex workflows and the integration of various systems and applications. Automation monitoring, security management, and compliance management are essential components of a successful automation strategy. Business intelligence (BI) and automation ROI are key performance indicators that organizations use to measure the success of their automation initiatives.

- For instance, in the manufacturing sector, business process automation can automate inventory management processes, reducing errors and providing real-time visibility of stock levels. This leads to better inventory control and improved operational efficiency. Overall, the adoption of automation solutions is helping businesses streamline operations, reduce costs, and enhance productivity.

What are the market trends shaping the Business Process Automation Industry?

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is becoming a significant trend in business process automation. These advanced technologies are essential for enhancing efficiency, improving accuracy, and driving innovation in various industries.

- Business process automation is experiencing significant advancements with the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies in the cloud. These technologies offer organizations the ability to automate complex decision-making processes, enhance efficiency gains, and ensure compliance assurance. AI algorithms analyze vast amounts of data, identify patterns, and make intelligent decisions or recommendations, enabling automation of tasks that previously required human intervention or expert judgment. For instance, in the insurance sector, AI algorithms can automatically approve or reject insurance claims based on predefined rules and historical data, thereby reducing the time and effort of human agents.

- No-code development platforms facilitate the implementation of these advanced technologies, making process improvement initiatives more accessible and cost-effective for businesses. The automation maturity model plays a crucial role in enabling innovation and best practices in business process automation. Automation consultants offer expertise and guidance in implementing automation strategies, risk management, and process discovery. By adhering to automation best practices, organizations can maximize the benefits of automation while minimizing potential risks. In conclusion, the integration of AI and ML technologies in business process automation is revolutionizing operations and optimizing processes, offering substantial efficiency gains and compliance assurance.

- The use of no-code development platforms, process discovery, and automation consultants are essential components of successful automation initiatives.

What challenges does the Business Process Automation Industry face during its growth?

- The escalating costs of business process automation services pose a significant challenge and hinder the industry's growth trajectory.

- Business process automation is a critical component of digital transformation, offering numerous benefits such as error reduction, cost savings, and improved customer experience. However, the high cost of automation services has been a significant barrier for many organizations, particularly small and medium-sized enterprises (SMEs). The initial investment required for infrastructure and software can be substantial, involving the purchase of automation licenses, hardware investments, and IT professional services for setup and maintenance. To address this challenge, low-code development platforms have emerged as a cost-effective solution. These platforms enable users to build applications and automate processes using a graphical interface, reducing the need for extensive coding knowledge.

- Moreover, business process modeling tools help organizations analyze their existing processes and identify areas for automation, ensuring a harmonious and immersive implementation. Error reduction and cost savings are essential aspects of automation, but so is automation governance and financial management. Automation frameworks provide a structured approach to managing and monitoring automation initiatives, ensuring compliance and maintaining control over business processes. Additionally, employee satisfaction is a crucial factor in the success of automation projects. By automating repetitive tasks, businesses can free up their employees' time to focus on more strategic and creative work, leading to increased job satisfaction.

- In conclusion, the benefits of business process automation far outweigh the initial investment, but the high cost remains a challenge for some organizations. Low-code development platforms and process modeling tools offer cost-effective solutions, while automation frameworks ensure governance and financial management. By focusing on these aspects, businesses can successfully implement automation initiatives and reap the rewards of improved efficiency, error reduction, and enhanced customer experience. Recent research suggests that automation is a key driver of digital transformation, and its adoption is expected to continue growing in the coming years.

Exclusive Customer Landscape

The business process automation market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the business process automation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, business process automation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AgilePoint Inc. - The company specializes in business process automation, delivering innovative solutions through the use of Appian Platform for process automation and process mining. By leveraging these advanced technologies, organizations can streamline operations, enhance efficiency, and improve overall productivity. The Appian Platform enables the creation and execution of automated workflows, while process mining offers insights into existing processes, enabling optimization and continuous improvement. This approach empowers businesses to adapt to evolving market conditions and customer needs, ensuring a competitive edge.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AgilePoint Inc.

- Appian Corp.

- Automation Anywhere Inc.

- Bizagi Group Ltd.

- BONITASOFT SA

- BP Logix Inc.

- CMW Lab Inc.

- Compulink Management Center Inc.

- Genpact Ltd.

- International Business Machines Corp.

- Kissflow Inc.

- Kofax Inc.

- Microsoft Corp.

- Nintex Global Ltd.

- Oracle Corp.

- Pegasystems Inc.

- SAP SE

- ServiceNow Inc.

- SS and C Technologies Holdings Inc.

- UiPath Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Business Process Automation Market

- In January 2024, UiPath, a leading Business Process Automation (BPA) company, announced the launch of its new AI Center of Excellence (CoE) in Germany. This CoE is aimed at helping European enterprises accelerate their digital transformation journeys by providing expertise in AI and automation technologies (UiPath Press Release).

- In March 2024, Blue Prism, another major BPA player, announced a strategic partnership with Microsoft to integrate Blue Prism's robotic process automation (RPA) platform with Microsoft Power Automate. This collaboration aimed to offer a more comprehensive automation solution to customers (Microsoft News Center).

- In May 2024, Automation Anywhere, a prominent BPA company, secured a strategic investment of USD550 million from Blackstone Growth, a growth equity investment firm. This investment was intended to fuel Automation Anywhere's continued growth and innovation in the RPA market (Automation Anywhere Press Release).

- In February 2025, IBM announced the acquisition of WDG Automation, a leading European RPA and Intelligent Automation (IA) provider. This acquisition aimed to strengthen IBM's automation capabilities and expand its presence in the European market (IBM Press Release).

Research Analyst Overview

- The market is experiencing significant growth and innovation, driven by the integration of various technologies such as process simulation, intelligent automation (IA), and automation security. IA, in particular, is revolutionizing business operations by enabling the automation of complex tasks using machine learning and artificial intelligence. Automation sustainability is also gaining traction as companies seek to reduce their carbon footprint and ensure compliance with environmental regulations. Process intelligence and business rules management are key components of automation, providing valuable insights for continuous process improvement and decision making. Automation impact assessments and audits are essential for ensuring compliance with automation governance frameworks and maintaining automation ethics.

- Workflow engines and process orchestration tools facilitate the automation of business processes, while process monitoring tools and analytics dashboards enable real-time visibility into process performance. Lean process automation and cognitive automation are also emerging trends, focusing on streamlining processes and enhancing human-machine collaboration. Virtual assistants and process mining are transforming knowledge management and process documentation, making it easier for businesses to access and leverage data for process standardization and certification. Change management and automation compliance are critical for successful implementation and maintenance of automation solutions. Automation future trends include the integration of automation with agile methodologies, digital workforce management, and the use of advanced technologies such as robotics process automation and process control systems.

- Rule engines and decision management systems are also becoming increasingly important for optimizing business processes and enhancing operational efficiency.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Business Process Automation Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.4% |

|

Market growth 2025-2029 |

USD 17676.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.2 |

|

Key countries |

US, Canada, UK, Germany, India, Japan, France, China, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Business Process Automation Market Research and Growth Report?

- CAGR of the Business Process Automation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the business process automation market growth of industry companies

We can help! Our analysts can customize this business process automation market research report to meet your requirements.