Intelligent Process Automation Market Size 2025-2029

The intelligent process automation market size is forecast to increase by USD 17.18 billion at a CAGR of 16.4% between 2024 and 2029.

- Intelligent Process Automation (IPA) is experiencing significant growth, driven by the increasing demand for operational efficiency. This trend is being fueled by businesses seeking to streamline their processes and reduce costs. New solution launches are also contributing to market growth, as technology providers continue to innovate and offer advanced IPA capabilities. However, concerns over data privacy and security are challenges that must be addressed, as organizations adopt IPA solutions. IPA solutions encompass various technologies such as business process optimization, data analysis, machine learning, artificial intelligence, and digital workforce management. Implementing strong security measures and ensuring compliance with data protection regulations are crucial for market success. IPA is revolutionizing business operations by automating repetitive tasks, enhancing accuracy, and improving overall productivity. This market analysis report provides a comprehensive study of the key factors driving IPA market growth, new solution launches, and the challenges that must be addressed to ensure market success.

What will be the Size of the Intelligent Process Automation Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for automating manual tasks and improving business processes. These tools enable organizations to automate repetitive tasks, ensure data quality, enhance data security, and facilitate real-time data-driven decisions. IPA solutions play a crucial role in digital transformation by integrating with business intelligence, data visualization, and workflow automation systems. They help organizations achieve operational excellence by streamlining processes, ensuring compliance, and improving change management. IPA solutions also offer scalability, cloud deployment, and data governance capabilities, making them suitable for businesses of all sizes.

- Furthermore, IPA solutions provide risk mitigation and predictive analytics features, enabling organizations to identify potential threats and make informed decisions. Data sensitivity and data management are also addressed through advanced security measures and neural networks. Overall, the market is expected to continue growing as businesses seek to optimize their operations, enhance productivity, and gain a competitive edge In the digital economy.

How is this Intelligent Process Automation Industry segmented and which is the largest segment?

The intelligent process automation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- BFSI

- IT and telecom

- Healthcare

- Retail

- Others

- Component

- Services

- Solutions

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

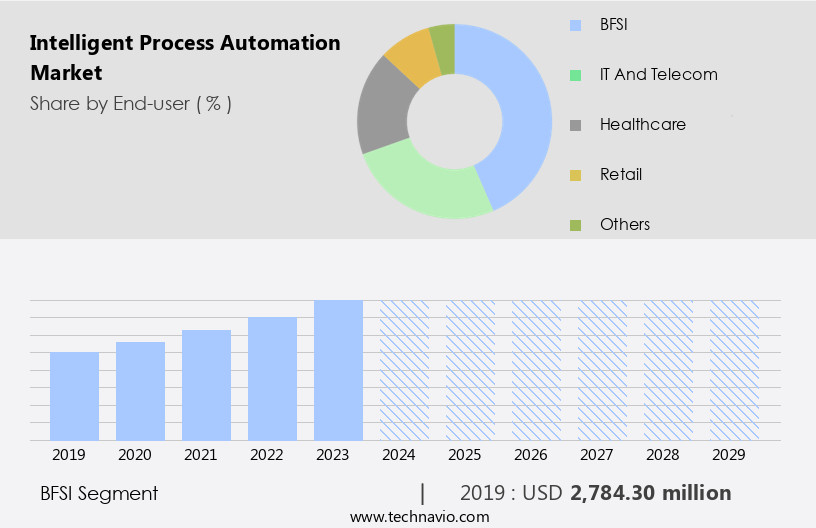

- The BFSI segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly In the banking, financial services, and insurance (BFSI) sector. Driven by the need to enhance operational efficiency and automate complex, labor-intensive processes such as underwriting, document processing, and financial transactions, BFSI institutions are increasingly adopting IPA solutions. These technologies, including Robotic Process Automation (RPA), Artificial Intelligence (AI), and Machine Learning (ML), enable the automation of repetitive tasks, minimize human error, and ensure real-time availability. IPA solutions also facilitate compliance with evolving regulations and enhance customer experience through faster and more efficient services. Additionally, IPA can be deployed on-premises or In the cloud, providing flexibility to enterprises.

IPA also offers cost efficiencies, improved performance, and enhanced security architecture through data validation, cybersecurity notifications, and troubleshooting capabilities. Industries such as life sciences, retail, IT and telecom, and manufacturing are also embracing IPA to streamline business processes and boost productivity. IPA's integration of natural language processing, cognitive learning, and computer vision further enhances its capabilities, enabling effective decision-making processes and automating complex workflows.

Get a glance at the market report of share of various segments Request Free Sample

The BFSI segment was valued at USD 2.78 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

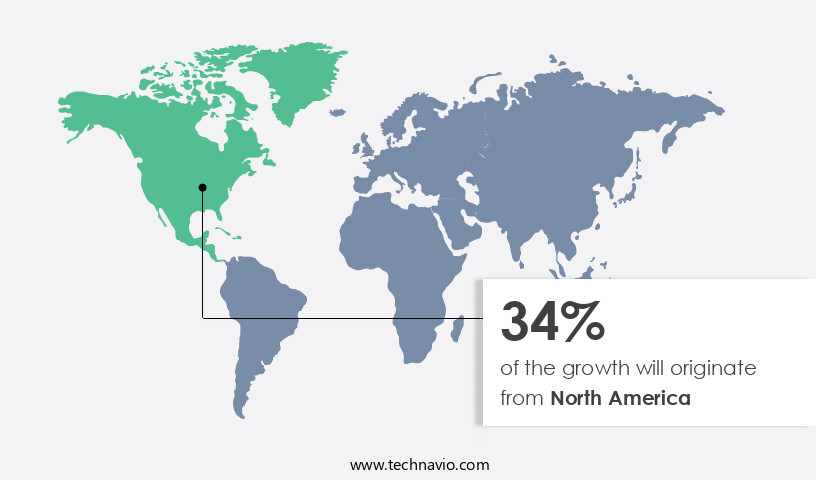

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth, driven by technological advancements and the early adoption of digital transformation solutions. Key industries, including banking, financial services, and insurance (BFSI), healthcare, retail, and IT and telecom, are leading the adoption of IPA. In the BFSI sector, automation solutions are extensively used for tasks such as claims processing, fraud detection, and compliance management, resulting in substantial cost savings and operational efficiency.

IPA solutions include Automation, Information Validation, Document Processing, and Cognitive Learning. They offer real-time availability, security notifications, and cybersecurity features to ensure data security. IPA also integrates with Cloud-Based, AI, and Machine Learning technologies to enhance performance and effectiveness. In healthcare, IPA is used for tasks like document sorting and data validation in telemedicine, while in manufacturing, it streamlines production processes and improves employee productivity. IPA solutions offer natural language processing and virtual agents for customer interaction, enabling businesses to provide superior customer experience. Despite the benefits, IPA implementation requires careful consideration of security architecture and maintenance. IPA solutions can be deployed on-premises or In the cloud, depending on business requirements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Intelligent Process Automation Industry?

- Increasing demand for operational efficiency is the key driver of the market. The market growth is fueled by the increasing need for operational efficiency among businesses across industries. IPA solutions, which incorporate AI, Machine Learning (ML), and Robotic Process Automation (RPA), enable organizations to automate intricate workflows and repetitive tasks. By streamlining processes, eliminating manual interventions, and optimizing resource usage, IPA technologies reduce costs, enhance productivity, and minimize human errors. This automation allows employees to focus on strategic decision-making and creative problem-solving, rather than being overwhelmed by routine tasks. IPA technologies integrate advanced capabilities like Natural Language Processing (NLP), Computer Vision, and Cognitive Learning to automate document processing, financial transactions, underwriting, data validation, and more.

- These solutions offer real-time availability, ensuring seamless customer interaction and digital transformation. Additionally, they provide security architecture, including cybersecurity notifications, support, and troubleshooting, to maintain data security and protect against ransomware attacks. IPA solutions cater to various sectors, including Life Sciences, Retail, IT and Telecom, Manufacturing, and others, offering cost efficiencies, improved performance, and effectiveness. They are available as hosted solutions and on-premises deployments, catering to diverse business requirements. With the integration of AI, ML, and RPA, IPA solutions enable enterprises to automate business functions and optimize workflow performance, making them indispensable for digital transformation initiatives.

What are the market trends shaping the Intelligent Process Automation Industry?

- New solution launches is the upcoming market trend. The market is experiencing significant growth due to the increasing demand for automation solutions that enhance operational efficiency. UiPath, a leading automation software provider, recently introduced new features to its Business Automation Platform, including the launch of UiPath Autopilot. This innovation integrates Generative AI (GenAI) to streamline automation processes, offering developers and testers natural language-driven capabilities for workflow creation and code generation, as well as automated test design and analysis. These updates aim to boost speed and efficiency, enabling businesses to optimize their operations and make informed decisions in real-time. With the integration of AI and machine learning algorithms, intelligent process automation is transforming various industries, including finance, retail, telecommunications, and life sciences, by automating financial transactions, document processing, data validation, and customer interaction.

- Enhanced security architecture, including cybersecurity notifications and support, ensures the protection of sensitive data and maintains a positive customer experience. This digital transformation not only improves employee productivity but also streamlines back-office operations, making businesses more competitive in today's market.

What challenges does the Intelligent Process Automation Industry face during its growth?

- Concerns over data privacy and security is a key challenge affecting the industry growth. The market solutions are transforming business operations by automating various tasks, including document processing, financial transactions, and information validation. These solutions offer significant cost efficiencies and operational efficiency improvements. However, as IPA systems handle sensitive data, ensuring strong security architecture is paramount. Data breaches and compliance with regulations such as GDPR pose significant challenges. The importance of security in IPA is underscored by high-profile incidents, such as the February 2024 ransomware attack on Change Healthcare, which disrupted healthcare services and underscored the need for comprehensive security measures. IPA solutions employ various technologies like computer vision, cognitive learning, natural language processing, and machine learning to enhance business functions' performance.

- They also offer real-time availability, customer interaction, and workflow automation. Despite these benefits, maintaining security remains a critical concern, with cybersecurity threats like ransomware posing a significant risk. Ensuring security notifications, maintenance, troubleshooting, and support are essential components of IPA solutions. IPA applications span various industries, including life sciences, retail, IT and telecom, manufacturing, and finance, among others. IPA solutions offer virtual agents for customer service, data extraction, document sorting, and underwriting, among other applications. Cloud-based and on-premises deployment options are available to cater to diverse business needs.

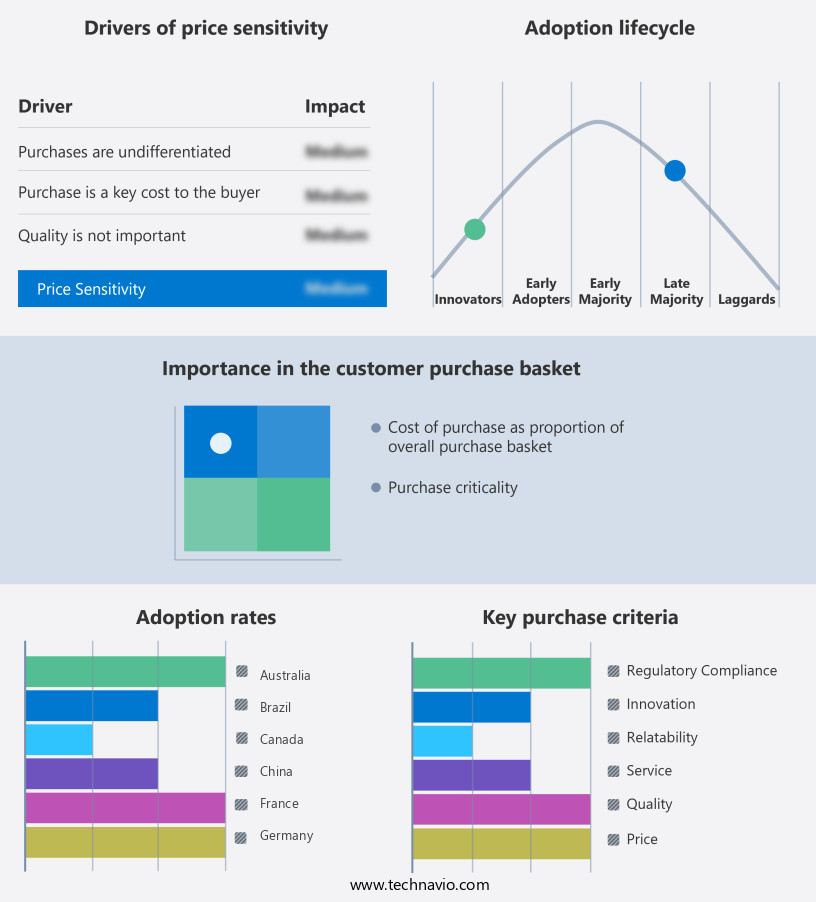

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AntWorks - The company offers intelligent process automation such as CMR+, the document processing platform that helps global enterprises streamline operations, extract insights, and easily make data-driven decisions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AntWorks

- Appian Corp.

- Automation Anywhere Inc.

- Blue Prism Ltd.

- Celonis SE

- Cognizant Technology Solutions Corp.

- Fortra LLC

- Genpact Ltd.

- HCL Technologies Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- NICE Ltd.

- Nintex Global Ltd.

- Pegasystems Inc.

- ThoughtSpot Inc.

- Tungsten Automation Corp.

- UiPath Inc.

- WorkFusion Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Intelligent process automation (IPA) is a technology-driven approach that leverages advanced algorithms, machine learning, and artificial intelligence (AI) to automate business processes. This automation goes beyond simple rule-based systems, enabling the identification and execution of complex patterns and decision-making processes. IPA is increasingly becoming a crucial component of digital transformation initiatives, particularly in industries such as IT and telecom, retail, finance, and life sciences. By automating repetitive tasks, IPA enhances operational efficiency, reduces costs, and improves customer experience. One of the primary applications of IPA is the automation of financial transactions. This includes information validation, document processing, and data entry.

Moreover, by automating these tasks, enterprises can ensure real-time availability, minimize errors, and enhance security. Another area where IPA is making a significant impact is in customer interaction. Virtual agents and chatbots, powered by natural language processing (NLP), the Internet of Things, and machine learning, are being used to provide personalized customer service, handle queries, and even troubleshoot issues. IPA is also being used to streamline back-office operations, particularly in industries such as manufacturing and telecommunications. This includes automating data extraction, document sorting, and workflow management. By automating these tasks, enterprises can improve employee productivity and focus on higher-value activities. IPA is not without its challenges, however.

Furthermore, security is a major concern, particularly with the rise of ransomware and other cyber threats. IPA solutions must be designed with strong security architecture, including cybersecurity notifications and support for security best practices. Another challenge is the maintenance and troubleshooting of IPA systems. Enterprises must have the right tools and expertise to ensure the ongoing effectiveness of their IPA solutions. This includes the ability to identify and address patterns of system performance issues and to implement updates and patches as needed. IPA is also being used to augment human decision-making processes, particularly in industries such as underwriting and risk assessment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.4% |

|

Market Growth 2025-2029 |

USD 17.18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.0 |

|

Key countries |

US, India, UK, Germany, Australia, China, Canada, France, Japan, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Intelligent Process Automation Market Research and Growth Report?

- CAGR of the Intelligent Process Automation industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the intelligent process automation market growth of industry companies

We can help! Our analysts can customize this intelligent process automation market research report to meet your requirements.