Europe Call Center Outsourcing Market Size 2025-2029

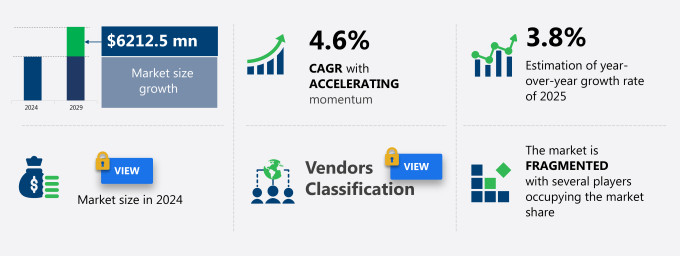

The Europe call center outsourcing market size is forecast to increase by USD 6.21 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of this business model by IT and telecom service providers. This trend is attributed to the cost savings and improved operational efficiency that call center outsourcing offers. Another key trend is the integration of voice bots and artificial intelligence (AI) in call center services, which enhances customer experience and reduces operational costs. Furthermore, there is a noticeable shift towards developing countries as preferred call center destinations due to their large talent pool and lower labor costs. These factors are expected to fuel market growth in the coming years.

What will be the Size of the Market During the Forecast Period?

- Call center outsourcing has become a significant trend in the business world, enabling companies to focus on their core competencies while external service providers handle support functions. The market encompasses various sectors, including email and chat support, voice services, and specialized expertise in areas such as government and defense, healthcare, IT and telecommunications, manufacturing, and more. The demand for call center services continues to grow, driven by the increasing importance of customer service and the need for multilingual support. Inbound call centers handle customer inquiries and support requests, while outbound call centers focus on telemarketing, order placements, and customer surveys.

- Furthermore, artificial intelligence and data analytics have revolutionized the call center industry, enabling the automation of routine tasks and providing specialized expertise for technical debugging. Omnichannel support is another key trend, allowing customers to interact with businesses through multiple channels, including voice, email, and chat. The market caters to diverse industries, each with unique requirements. For instance, government and defense organizations demand high security and language proficiency, while healthcare providers require expertise in medical terminology and compliance with regulations. In the IT and telecommunications sector, call centers play a crucial role in providing technical support and troubleshooting.

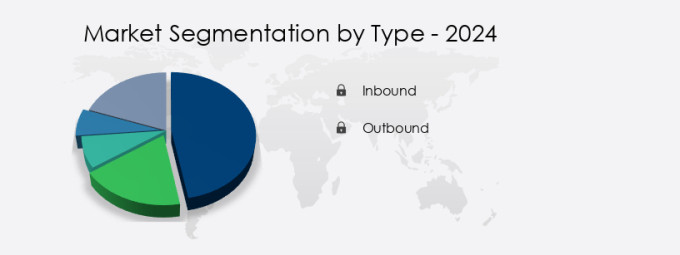

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Inbound

- Outbound

- End-user

- IT and telecom

- BFSI

- Healthcare

- Retail

- Others

- Geography

- Europe

- Germany

- UK

- France

- Europe

By Type Insights

- The inbound segment is estimated to witness significant growth during the forecast period.

Inbound call centers have gained significant importance in today's business landscape, with companies prioritizing exceptional customer service to enhance brand image. These centers focus on addressing customer concerns, answering queries, and handling complaints, often being the only point of contact for many customers. Providing polite, knowledgeable, and efficient support is crucial, as it boosts customer loyalty, improves service quality, increases operational efficiency, and offers cost-effective solutions.

Furthermore, the inbound call segment caters to various industries, including travel and e-commerce, and supports multilingual and omnichannel customer engagement through technical debugging, instant messaging platforms, AI-based chatbots, messaging apps, and social media. Organizations can leverage these services to provide seamless and timely assistance, ultimately contributing to a positive customer experience.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Call Center Outsourcing Market?

An increase in call center outsourcing by IT and telecom service providers is the key driver of the market.

- Telecom companies outsource customer support functions, including email and chat, to external service providers to focus on their core technical objectives. This strategy allows telecom companies to manage cost pressures, optimize investments, and gain access to specialized resources. Emerging technologies, such as Artificial Intelligence (AI) and Data analytics, play a significant role in enhancing the productivity of call center operations. AI-based chatbots and messaging apps facilitate instant customer support, while data analytics enables the prioritization of customer queries for faster resolutions. Omnichannel support, including voice, social media, video, and self-service options, caters to diverse customer preferences.

- Call centers offer multilingual support, technical debugging, and specialized expertise for various sectors, including government and defense, healthcare, IT and telecommunications, Manufacturing, Travel, E-commerce, and the SME/Startup market. Nearshore and onshore outsourcing models offer flexibility while ensuring data security and service quality. Cloud sourcing and knowledge bases enable efficient customer service and reduce communication barriers due to language proficiency, cultural differences, and employee turnover rates. AI solutions and cloud computer platforms further enhance customer experience and support functions.

What are the market trends shaping the Europe Call Center Outsourcing Market?

The emergence of voice bots in call center outsourcing services is the upcoming trend in the market.

- The market is witnessing significant growth due to the integration of advanced technologies such as artificial intelligence (AI) and data analytics. Email and chat support have become the preferred channels for customers seeking assistance, and voice support continues to play a crucial role in handling inquiries and support requests. Sectors like government and defense, healthcare, IT and telecommunications, manufacturing, travel, and e-commerce are major contributors to the market. AI-based chatbots and messaging apps are increasingly being used for instant customer support, with social media and self-service options also gaining popularity. Cloud sourcing and external service providers offer specialized expertise and efficiency, enabling companies to focus on their core functions.

- Furthermore, multilingual support and technical debugging are essential for catering to diverse customer bases and complex issues. Voice support and social media support are essential components of call centers, with video support and self-service options also gaining traction. Nearshore and onshore outsourcing models are popular among SMEs and startups, while IT and telecom companies rely on AI solutions and cloud computer platforms for advanced support functions. Data security and service quality are critical considerations for companies outsourcing their call center functions. Communication barriers, language differences, and cultural differences can pose challenges in call center outsourcing. Employee turnover rates and training requirements are also essential factors.

What challenges does Europe Call Center Outsourcing Market face during the growth?

Shifting focus on developing countries as call center destinations is a key challenge affecting the market growth.

- Call center outsourcing has become a popular business strategy for companies seeking to reduce costs and focus on their core functions. The market for call center services spans various industries, including email and chat support, voice services, and technical debugging, among others. Government and defense, healthcare, IT and telecommunications, manufacturing, and the travel and e-commerce sectors are significant consumers of call center services. Artificial intelligence and data analytics are transforming call center operations, with AI-based chatbots and messaging apps increasingly used for instant customer support. Multilingual support is essential for businesses catering to diverse customer bases, while self-service options and knowledge bases help reduce the volume of inquiries and support requests.

- Cloud sourcing and external service providers offer call center solutions to businesses, enabling them to choose from nearshore or onshore outsourcing options. Voice support, social media support, and video support are essential channels for customer engagement, while specialized expertise and automation are crucial for efficient and high-quality service. SMEs, startups, and IT and telecom companies are significant consumers of call center services, requiring 24/7 support for website issues and information technology queries. Data security and communication barriers, including language proficiency and cultural differences, are critical challenges in call center outsourcing. Employee turnover rates and training are ongoing concerns for call center organizations.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alorica Inc. - The company offers call center outsourcing solutions such as customer service, and technical support to third-party providers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alorica Inc.

- Atento SA

- Bertelsmann SE and Co. KGaA

- CIENCE Technologies

- Computer Generated Solutions Inc.

- Concentrix Corp.

- Conduent Inc.

- Foundever Group

- Helpware Inc.

- Hinduja Global Solutions Ltd.

- LLC Simply Contact International

- MCI LC

- StarTek Inc.

- Stroer SE and Co. KGaA

- Sutherland Global Services Inc.

- TDS Global Solutions

- Teleperformance SE

- TELUS Corp.

- Transcom Holding AB

- TTEC Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by the increasing demand for efficient and cost-effective customer support solutions. This sector caters to various industries, including email and chat support, voice services, government and defense, healthcare, IT and telecommunications, manufacturing, artificial intelligence, data analytics, and more. The market is characterized by several key dynamics. First, the trend towards automation and self-service options, such as AI-based chatbots, messaging apps, social media, and instant messaging platforms, is on the rise. These technologies enable faster response times, lower costs, and improved customer experiences.

However, they also present challenges, such as communication barriers, language differences, and cultural differences, which call center outsourcing providers must address to ensure effective service delivery. Another significant trend is the increasing importance of specialized expertise and multilingual support. As industries become more complex and globalized, businesses require call center outsourcing partners with deep domain knowledge and the ability to support multiple languages. This not only enhances the customer experience but also helps companies expand their reach and enter new markets. Moreover, the call center outsourcing market is witnessing a shift towards multichannel and omnichannel support. Customers expect seamless and consistent experiences across all touchpoints, from voice and email to social media and messaging apps.

Furthermore, providers that can offer a unified approach to customer service, leveraging data analytics and AI solutions, are well-positioned to meet these demands. Efficiency and data security are also critical factors in the call center outsourcing market. External service providers must ensure they can handle high volumes of inquiries, support requests, order placements, and telemarketing campaigns efficiently while maintaining the highest levels of data security. This requires strong infrastructure, advanced technologies, and rigorous compliance with industry standards. The market caters to various industries, including SMEs, startups, and large enterprises. For example, the IT and telecom sector relies heavily on call center outsourcing for technical debugging and customer support.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market Growth 2025-2029 |

USD 6.21 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

UK, Germany, France, The Netherlands, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch