Car-as-a-Service Market Size 2024-2028

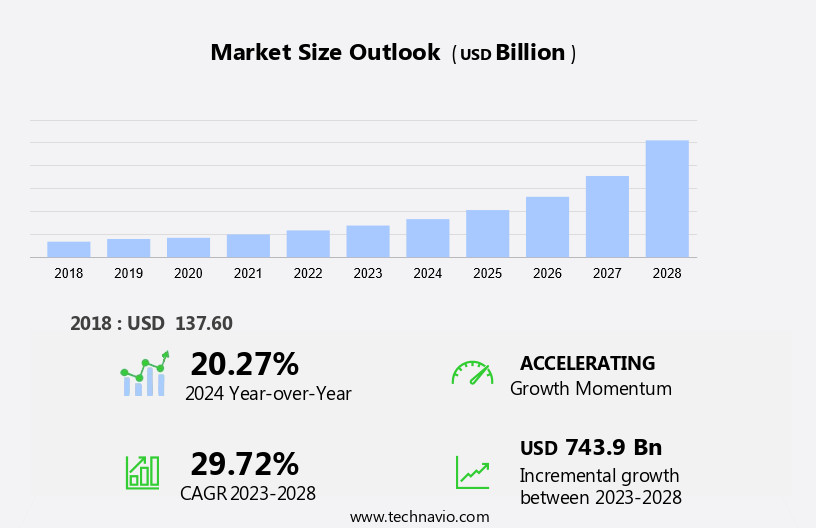

The car-as-a-service market size is forecast to increase by USD 743.9 billion at a CAGR of 29.72% between 2023 and 2028.

- The Car-as-a-Service (CaaS) market is experiencing significant growth, driven by the increasing popularity of subscription-based mobility solutions and the investment in autonomous taxi services. With the rise of single subscription packages for a wide range of vehicles, consumers are increasingly opting for flexible, on-demand transportation options, which is fueling market expansion. Furthermore, the availability of automotive financing solutions is making it easier for companies to invest in fleets and scale their operations, creating opportunities for new entrants and established players alike.

- However, challenges remain, including regulatory hurdles, technological complexities, and competition from traditional car ownership models. Companies seeking to capitalize on the CaaS market's potential must navigate these challenges effectively, focusing on innovation, regulatory compliance, and customer experience to differentiate themselves and succeed in this dynamic and evolving market.

What will be the Size of the Car-as-a-Service Market during the forecast period?

- The market encompasses autopilot functions, ride-sharing services such as taxis, and car subscription models. These services cater to the transportation needs of consumers, providing connectivity and convenience through ride-hailing apps and smartphones. Developing economies and smart device owners increasingly prefer these services over traditional car ownership. Ride-sharing services, including taxis, have revolutionized transportation by offering on-demand mobility solutions. Car subscription services offer a flexible alternative to car leasing, allowing customers to access vehicles without long-term commitments. Autonomous vehicles, like those developed by Volvo and General Motors, are poised to offer total autonomy and transform the transportation landscape further.

- Delivery needs are another area where cars-as-a-service models are gaining traction. Location-based services and technology play a crucial role in enhancing the user experience of these services. Consumers can easily request rides, track their drivers, and manage their subscriptions through these apps. In summary, the market is evolving rapidly, driven by consumer preferences for flexibility, convenience, and technology integration. Autonomous vehicles and delivery services are emerging trends that will shape the future of this market.

How is this Car-as-a-Service Industry segmented?

The car-as-a-service industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Corporate

- Private

- Type

- Ride hailing

- Car rental

- Car sharing

- Car subscription

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

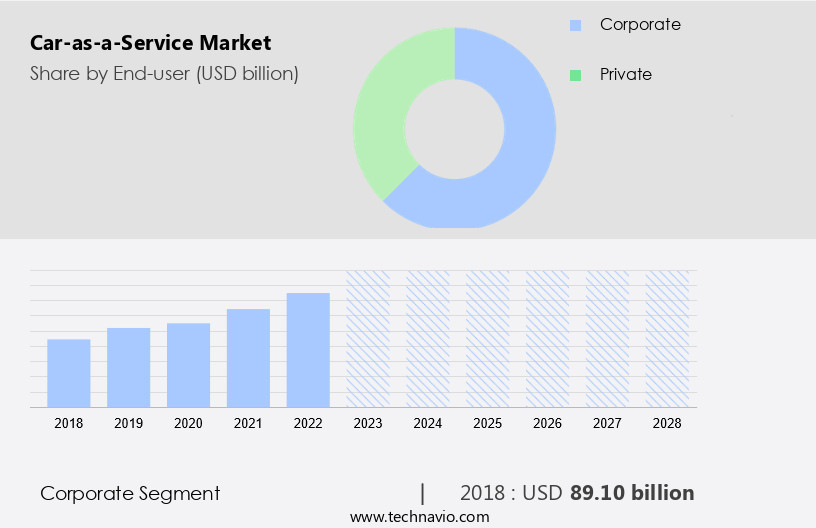

The corporate segment is estimated to witness significant growth during the forecast period.

The corporate sector represents a substantial segment in the global Car-as-a-Service (CaaS) market. Businesses increasingly opt for CaaS providers to address their transportation requirements more efficiently and cost-effectively. By partnering with CaaS companies, corporations can leverage the flexibility and convenience of on-demand transportation solutions while reducing expenses associated with vehicle ownership, upkeep, and administration. The corporate CaaS market is marked by intense competition, with numerous providers catering to the unique demands of businesses. Key market trends include the adoption of electric and autonomous vehicles to promote sustainability and efficiency, the integration of advanced technologies such as telematics and data analytics to enhance fleet utilization and cut costs, and the expansion of CaaS services to diverse industries and regions.

Furthermore, companies are exploring the use of CaaS for delivery needs, ride-sharing services, and even personal transportation for their employees. The integration of connectivity features, such as wireless car charging and ride-hailing apps, is also gaining popularity. Overall, the corporate CaaS market is poised for growth, driven by technological advancements, evolving consumer preferences, and the increasing adoption of driverless vehicles.

Get a glance at the market report of share of various segments Request Free Sample

The Corporate segment was valued at USD 89.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

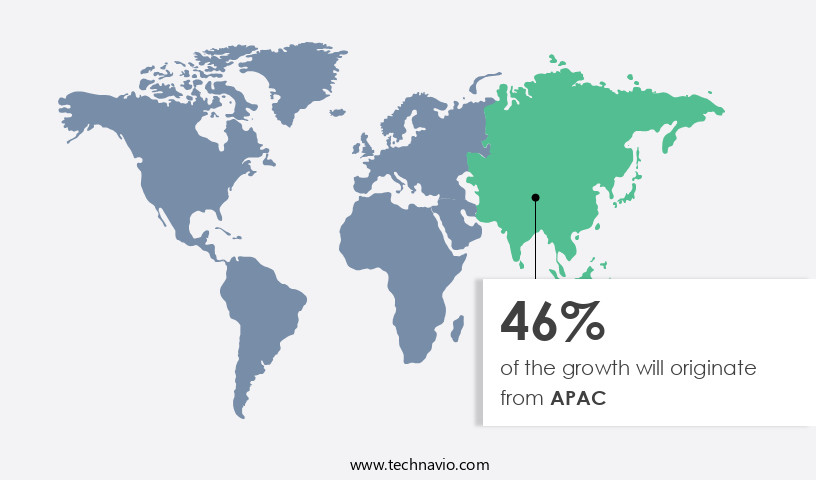

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the evolving landscape of transportation, the Cars-as-a-Service (CaaS) market is experiencing significant growth, particularly in Asia Pacific. China is a major contributor to this expansion, driven by government initiatives limiting new private vehicle registrations due to increasing urban congestion and pollution levels. With over half of China's population residing in urban areas, the difficulty in obtaining household registrations often hinders individuals from purchasing new cars. Instead, they opt for CaaS, which offers flexibility, convenience, and inexpensive transportation options. Millennials, insurance companies, and businesses are embracing CaaS, with preferences shifting towards ridesharing services, car leasing models, and driverless cars. The digital era has also influenced consumer behavior, with smartphone users summoning automobiles at their convenience.

Developing economies are following suit, recognizing the potential of CaaS in providing affordable and efficient transportation solutions. Automobile companies, such as General Motors and Volvo, are investing in advanced technologies, including CaaS and ride-sharing services, to cater to the changing market dynamics. The cost of ownership, including insurance and maintenance, is becoming a significant factor in consumer spending. As cities grapple with public transportation challenges, CaaS and ride-sharing services are becoming increasingly popular, offering total autonomy and on-demand services. The flexibility and convenience of CaaS are particularly appealing to individuals, including Globetrotters and urban commuters. The emergence of technologies like autopilot functions, wireless car charging, and ride-sharing apps have further enhanced the appeal of CaaS.

However, concerns regarding obsolescence and the impact on traditional car dealers and garages remain. In summary, the CaaS market is experiencing exponential growth, driven by government initiatives, consumer preferences, and technological advancements. The market's advantages, including flexibility, convenience, and cost savings, are making it an attractive alternative to traditional car ownership. However, challenges related to obsolescence and the impact on traditional industries must be addressed to ensure a smooth transition.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Car-as-a-Service Industry?

- Wide range of vehicles with single subscription packages is the key driver of the market.

- Car-as-a-Service (CaaS) allows users to access a fleet of vehicles by paying a subscription or rental fee for a specified duration. The fee encompasses expenses related to insurance, roadside assistance, and maintenance. Users have the flexibility to switch between various car models under a single plan. For instance, a user may opt for a sedan during weekdays and switch to an SUV or sports car for weekend excursions, all under the same subscription.

- Each plan comes with distinct terms and conditions, with some offering long-term rentals that enable users to change cars daily, weekly, or monthly. This model provides users with the convenience of having access to a diverse range of vehicles without the burden of ownership.

What are the market trends shaping the Car-as-a-Service Industry?

- Increasing investment in autonomous taxi is the upcoming market trend.

- Autonomous vehicles, enabled by Internet of Things technology, facilitate communication between cars, drivers, and infrastructure to enhance safety, efficiency, and commuting times. company investment in robo-taxis, or driverless taxis, is surging due to their potential cost savings for service providers. These taxis, offered by ride-hailing services, eliminate the need for human chauffeurs, making them an attractive investment for gaining a first-mover advantage. Furthermore, they are expected to manage traffic and provide seamless mobility, adding value to the transportation industry.

- The integration of autonomous taxis into the market is a significant development, and companies are capitalizing on this trend to stay competitive.

What challenges does the Car-as-a-Service Industry face during its growth?

- Availability of automotive financing is a key challenge affecting the industry growth.

- Automotive financing enables individuals to acquire a car for personal use through borrowed funds from financial institutions. The increasing demand for personal vehicles fuels the expansion of automotive financing services. In response to consumer preferences for digital solutions, automotive financial providers and dealers offer online financing platforms. This trend encourages more individuals to purchase new vehicles, thereby potentially limiting market growth during the forecast period.

- The automotive financing sector's market dynamics revolve around the growing demand for personal mobility and the increasing availability of digital financing solutions.

Exclusive Customer Landscape

The car-as-a-service market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the car-as-a-service market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, car-as-a-service market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - Volvo's car-as-a-service solution, Volvo On Demand, empowers customers with flexible, on-demand access to a fleet of vehicles, delivering convenience and mobility without the commitment of traditional car ownership. This innovative offering aligns with the company's commitment to providing premium experiences and advanced technology solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- ACE Rent A Car Reservations Inc.

- ANI Technologies Pvt. Ltd.

- Avis Budget Group Inc.

- Bayerische Motoren Werke AG

- Cabify Espana SL

- DiDi Global Inc.

- Enterprise Holdings Inc.

- Ford Motor Co.

- Hertz Global Holdings Inc.

- Hyundai Motor Co.

- LeasePlan Corp. NV

- Lyft Inc.

- Mercedes Benz Group AG

- Orix Corp.

- SIXT SE

- Stellantis NV

- Toyota Motor Corp.

- Uber Technologies Inc.

- Volkswagen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Car-as-a-Service (CaaS) market is experiencing significant growth as contractors and businesses increasingly embrace the convenience and flexibility offered by this innovative transportation solution. CaaS technology enables users to summon an automobile for their transportation needs on a regular basis, eliminating the need for car ownership and the associated costs. In developing economies, CaaS is particularly attractive due to its inexpensive nature and the ability to provide convenient transportation solutions for individuals and businesses. The integration of smartphone technology has further enhanced the user experience, allowing users to easily manage their car usage and even summon rider automobiles for specific tasks such as deliveries.

The advantages of CaaS extend beyond convenience and cost savings. The technology allows for the utilization of fleets of vehicles, reducing the need for businesses to invest in and maintain their own assets. Additionally, the use of autonomous vehicles and advanced technologies such as autopilot functions can lead to increased safety and efficiency. The preferences of millennials, who are more likely to prioritize convenience and connectivity over car ownership, have also contributed to the growing popularity of CaaS. The digital era has led to a shift in consumer spending habits, with more individuals opting for subscription services and on-demand offerings.

The automobile industry is responding to this trend with the development of car subscription services and partnerships with ride-sharing platforms. Conglomerates and automobile companies are recognizing the potential of CaaS and are investing in the technology to remain competitive. The use of CaaS technology is not limited to urban transportation. It is also being adopted for delivery needs and even for personal use by globetrotters and individuals who require transportation on a regular basis. Despite the numerous advantages, there are also challenges associated with CaaS. Regulations regarding driverless vehicles and the cost of insurance are major concerns.

Additionally, the obsolescence of traditional car leasing models and the impact on dealers and automobile garages are areas of ongoing discussion. In , the market is experiencing significant growth as businesses and individuals recognize the benefits of this innovative transportation solution. The integration of technology, the shift in consumer preferences, and the adoption of autonomous vehicles are driving the market forward. However, challenges related to regulations and the impact on traditional industries must be addressed to ensure the continued growth and success of CaaS.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 29.72% |

|

Market growth 2024-2028 |

USD 743.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.27 |

|

Key countries |

China, US, UK, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Car-as-a-Service Market Research and Growth Report?

- CAGR of the Car-as-a-Service industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the car-as-a-service market growth of industry companies

We can help! Our analysts can customize this car-as-a-service market research report to meet your requirements.