Caravan And Motorhome Market Size 2025-2029

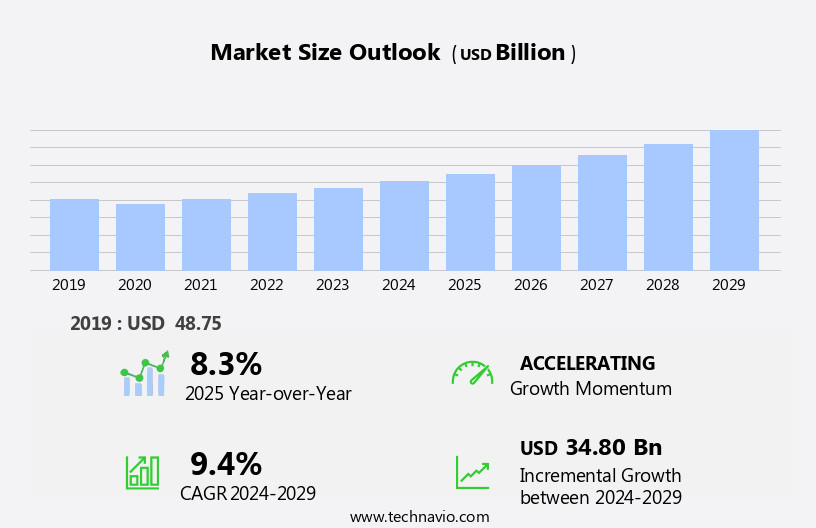

The caravan and motorhome market size is forecast to increase by USD 34.80 billion, at a CAGR of 9.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of recreational vehicles (RVs) by various consumer demographics. This trend is fueled by the versatility and convenience RVs offer, enabling travelers to explore new destinations while maintaining the comforts of home. Manufacturers are responding to this demand by expanding and upgrading their product lines, introducing innovative features and designs to cater to diverse consumer preferences. Another trend is the integration of advanced technologies, such as satellite technology for improved connectivity through satellite internet and GPS systems for navigation. However, the market faces challenges related to RV ownership. These obstacles include the high initial investment costs, ongoing maintenance expenses, and the need for adequate storage solutions.

- Addressing these challenges requires strategic planning and innovative solutions, such as financing options, affordable maintenance packages, and collaborations with storage providers. Companies that effectively navigate these challenges and continue to innovate will be well-positioned to capitalize on the market's growth potential.

What will be the Size of the Caravan And Motorhome Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping the industry's landscape. Maintenance services are a crucial aspect, ensuring the longevity of these recreational vehicles. Grey water tanks and black water tanks require regular upkeep, while hitching systems and towing vehicles undergo continuous advancements. Entertainment systems and safety features, such as carbon monoxide detectors and smoke detectors, are increasingly integrated, enhancing the living experience. Luxury motorhomes boast sophisticated plumbing systems, suspension systems, and waste management solutions, while travel trailers cater to budget-conscious consumers. Materials science innovations influence the market, with advancements in trailer brakes, solar panels, and fuel efficiency.

Lighting systems, electrical systems, and heating systems are also subject to ongoing improvements. RV communities and RV parks offer essential amenities, including water, electricity, and waste disposal facilities. Manufacturing processes and rental services continue to adapt, with a focus on weight limits, payload capacity, and turning radius. Cooking appliances, bathroom facilities, and interior design elements are continually refined. Pop-up campers, fifth-wheel trailers, and convertible campers cater to diverse consumer preferences. Exterior design, leveling systems, and propane tanks are essential components, with safety and functionality remaining top priorities. Air conditioning, first-aid kits, sleeping areas, and exterior design elements contribute to the overall comfort and enjoyment of these mobile living spaces.

The market is an ever-evolving industry, with continuous innovation and development shaping its future. From maintenance services and essential components to advanced technologies and design elements, the market's dynamism ensures a rich and diverse landscape for consumers and manufacturers alike.

How is this Caravan And Motorhome Industry segmented?

The caravan and motorhome industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Direct buyer

- Fleet owner

- Type

- Motorhome

- Caravan

- Product Type

- Medium-sized

- Compact

- Large-sized

- Price Range

- Mid-range

- Economy

- Luxury

- Application

- Recreational

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- The Netherlands

- UK

- APAC

- China

- South America

- Brazil

- Rest of World (ROW)

- North America

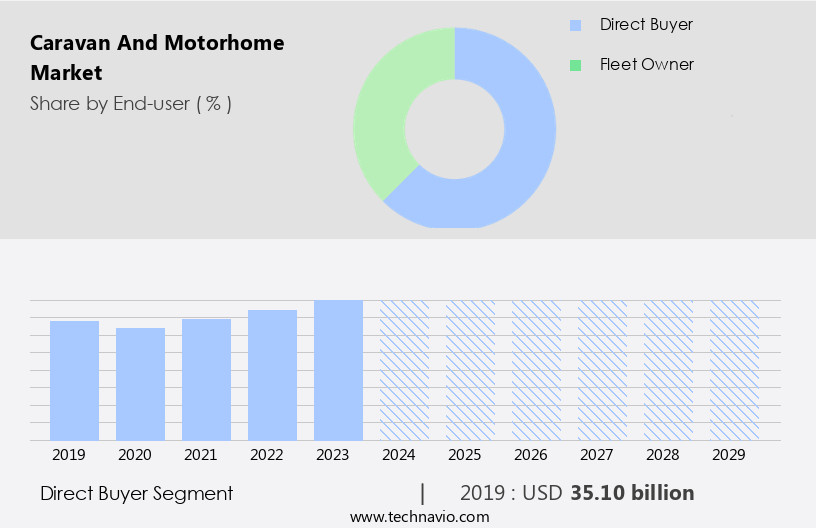

By End-user Insights

The direct buyer segment is estimated to witness significant growth during the forecast period.

In the market, direct buyers have gained significant traction as a prominent end-user segment in 2024. Unlike the conventional rental or leasing services, these buyers, often individuals or families, opt for purchasing their caravans and motorhomes directly from manufacturers or dealers. The increasing preference for individuality, convenience, and long-term ownership is fueling this trend. Direct buyers value the autonomy to customize their vehicles according to their travel needs. Solar panels, updated interiors, and advanced technology systems are some of the features that manufacturers are incorporating to cater to this demand. Moreover, the market continues to advance with innovations like entertainment systems, safety systems, luxury motorhomes, weight distribution hitches, waste disposal, suspension systems, and plumbing systems.

These enhancements add to the overall comfort and functionality of the vehicles. Additionally, materials science, trailer brakes, fuel efficiency, storage compartments, and exterior design are other essential aspects that are being prioritized to meet the evolving demands of the market. Direct buyers also consider essential safety features like carbon monoxide detectors, smoke detectors, and fire extinguishers. Furthermore, the market is witnessing the integration of advanced systems like navigation systems, GPS trackers, and leveling systems to ensure a seamless and enjoyable camping experience. Overall, the market is experiencing a surge in innovation and customization options to cater to the growing demand from direct buyers.

The Direct buyer segment was valued at USD 35.10 billion in 2019 and showed a gradual increase during the forecast period.

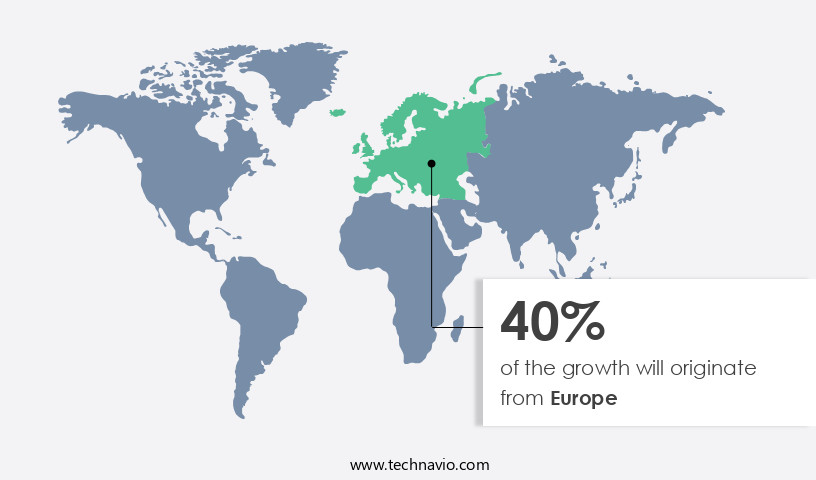

Regional Analysis

Europe is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market is experiencing significant growth due to the rising popularity of these vehicles in countries like the UK and Germany. With the UK being the second-largest producer of recreational vehicles (RVs) in Europe, the demand for caravans and motorhomes is increasing. These vehicles are not only used for camping but also as mobile offices, medical clinics, isolation units, and command centers. The market's expansion is further fueled by the influx of international tourists in Europe. Additionally, Europe's robust manufacturing capability for caravans and motorhomes contributes to the industry's growth. Caravan and motorhome maintenance services are essential for ensuring the longevity of these vehicles.

Grey water tanks and black water tanks require regular cleaning, while hitching systems and trailer brakes need periodic checks. Safety systems, including carbon monoxide detectors and smoke detectors, must be functioning correctly. Entertainment systems, lighting systems, and plumbing systems also require maintenance. Luxury motorhomes with advanced features such as solar panels, fuel efficiency, and waste management systems are gaining popularity. Weight distribution hitches and leveling systems ensure a stable and safe towing experience. Suspension systems and ground clearance are crucial for off-road adventures. Interior design, sleeping areas, and kitchen appliances are essential considerations for those purchasing caravans and motorhomes.

RV communities and RV parks offer convenient camping sites for travelers. Navigation systems and GPS trackers help travelers reach their destinations efficiently. The market's growth is also driven by the increasing demand for budget motorhomes and rental services. Manufacturing processes continue to evolve, with a focus on materials science, electrical systems, and fuel systems. Payload capacity and turning radius are essential factors for towing vehicles. In conclusion, the European market is growing due to the increasing popularity of these vehicles, the influx of international tourists, and Europe's robust manufacturing capability. Regular maintenance, advanced features, and convenience are key factors driving the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to the growing demand for flexible and adventurous travel solutions. These self-contained vehicles offer unparalleled freedom, enabling explorers to traverse diverse landscapes and cultures at their own pace. Caravan and motorhome models come in various sizes, from compact teardrop trailers to spacious Class A motorhomes. Features include slide-outs for added living space, solar panels for off-grid power, and advanced safety systems for peace of mind. Innovative technologies like smartphone integration and automated leveling systems enhance the user experience. The market also offers a wide range of accessories, from awnings and satellite dishes to bike racks and generators. With an emphasis on sustainability, some manufacturers incorporate eco-friendly materials and energy-efficient appliances. The market continues to evolve, catering to the unique needs of modern travelers seeking adventure, comfort, and self-sufficiency.

What are the key market drivers leading to the rise in the adoption of Caravan And Motorhome Industry?

- The rising preference for recreational vehicles (RVs) among various consumer demographics serves as the primary catalyst for market growth.

- The market is witnessing significant growth due to the increasing preference for self-contained, mobile living solutions. Consumers seek RVs equipped with modern amenities such as air conditioning, first-aid kits, and electrical systems for enhanced comfort. Exterior design is another essential factor influencing purchase decisions, with consumers favoring sleek and aerodynamic designs. RV shows provide an ideal platform for manufacturers to showcase their latest offerings, including truck campers, rental services, and innovative manufacturing processes. Safety features, including wheel chocks and GPS trackers, are becoming increasingly popular. Heating systems are essential for year-round usage, and repair services ensure the longevity of these investments.

- Payload capacity is a critical consideration for potential buyers, as is the turning radius for easy maneuverability. Manufacturers focus on delivering high-quality products with harmonious designs and efficient manufacturing processes to meet the evolving needs of diverse consumer demographics, from Baby Boomers to Millennials. The RV industry's growth is reflected in the increasing production capabilities and sales figures, with major players consistently expanding their offerings to cater to the market's demands.

What are the market trends shaping the Caravan And Motorhome Industry?

- Product line expansions and upgrades are currently mandated trends in the market. Professionals anticipate continued growth in this area as companies seek to meet evolving consumer demands and stay competitive.

- The market has experienced significant growth over the past decade, leading to an increase in manufacturing and repair facilities. This expansion is driven by the rising number of potential customers and the establishment of retail outlets in developing regions. As a result, original equipment manufacturers (OEMs) are investing in various areas to remain competitive. One such area is aftermarket services. Notable developments in the market include the introduction of new product lines. For instance, in August 2024, Holiday Rambler (Fleetwood RV) unveiled the latest Class A gas motorhome, named Eclipse. This motorhome boasts advanced features such as grey water tanks, hitching systems, entertainment systems, and safety systems.

- Additionally, there is a growing focus on luxury motorhomes, which come equipped with amenities like plumbing systems, suspension systems, and waste disposal. To cater to the diverse needs of customers, industry players are also investing in various safety systems, including carbon monoxide detectors and gas detectors. Furthermore, weight distribution hitches and surge brakes are becoming increasingly popular to ensure smooth towing. These advancements aim to provide a harmonious and immersive experience for travel trailer owners. In summary, the market is witnessing substantial growth, leading to increased competition and innovation. OEMs are expanding their product offerings to include aftermarket services and advanced features, such as grey water tanks, hitching systems, and safety systems, to cater to the evolving needs of consumers.

What challenges does the Caravan And Motorhome Industry face during its growth?

- The growth of the RV industry is significantly impacted by the challenges posed by the issues related to RV ownership. These challenges, which are a key concern for both manufacturers and consumers, must be addressed to ensure the continued expansion of this sector.

- The cost of owning a recreational vehicle (RV), such as a caravan or motorhome, encompasses more than just the initial purchase price. Factors like parking fees, insurance premiums, fuel consumption, and maintenance expenses are essential considerations. RVs are typically constructed using materials like wood and aluminum, which can deteriorate due to prolonged exposure to harsh weather conditions, leading to increased maintenance and repair costs. Additionally, the integration of extra amenities, such as lighting systems, solar panels, trailer brakes, cooking appliances, water pumps, bathroom facilities, and heating systems, can enhance the RV experience but also increase power consumption and fuel efficiency.

- Interior design elements, like weight limits and storage compartments, are also crucial considerations for RV owners. Special features, such as pop-up campers, fifth-wheel trailers, breakaway systems, and convertible campers, add to the overall cost. Maintaining a well-maintained RV requires a significant investment, making it essential for potential buyers to carefully weigh the costs and benefits before making a purchase.

Exclusive Customer Landscape

The caravan and motorhome market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the caravan and motorhome market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, caravan and motorhome market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bailey Caravans Ltd. - The company specializes in providing top-tier caravan and motorhome solutions, featuring innovative models such as Pegasus and Unicorn.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bailey Caravans Ltd.

- Caravan Conversion

- Dethleffs GmbH and Co. KG

- Eura Mobil GmbH

- Fleetwood RV

- Forest River Inc.

- Globecar Motorhomes UK and Ireland

- Hobby Caravan

- Hymer GmbH and Co. KG

- JCBLGroup

- KABE Group AB

- Knaus Tabbert AG

- LMC Caravan GmbH and Co. KG

- Possl Freizeit und Sport GmbH

- RAPIDO Motorhomes

- The Swift Group

- Thor Industries Inc.

- TRIGANO S.A.

- Triple E Canada Ltd.

- Winnebago Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Caravan And Motorhome Market

- In January 2024, Winnebago Industries, a leading manufacturer of recreational vehicles, announced the launch of its new electric motorhome, the eMotorHome, marking a significant step towards sustainable solutions in the market (Winnebago Industries Press Release).

- In March 2024, Thor Industries, another major player, formed a strategic partnership with Tesla to integrate Tesla's solar panels and Powerwall energy storage systems into their motorhomes, enhancing their off-grid capabilities (Thor Industries Press Release).

- In May 2025, The Recreational Vehicle Industry Association (RVIA) and the European Caravan Federation (CECV) signed a memorandum of understanding to collaborate on market development and regulatory initiatives, expanding the reach of both organizations in the market (RVIA Press Release).

- In the same month, Daimler Truck AG's subsidiary, Mercedes-Benz, completed the acquisition of the motorhome business of Erwin Hymer Group, a leading European manufacturer, strengthening its presence in the European market (Mercedes-Benz Press Release).

Research Analyst Overview

- The market exhibits dynamic sales volume, with brand reputation playing a pivotal role in consumer decision-making. Interior layout and storage solutions are key considerations for buyers, as they prioritize comfort and functionality. Sustainability initiatives and energy efficiency are increasingly important trends, shaping the market's future direction. Camping fees, warranty claims, and user experience influence customer satisfaction and loyalty. Weight distribution, user manuals, and safety features ensure safe operation. Import/export regulations, pricing strategies, and repair costs impact market accessibility. Chassis construction, fuel consumption, and dealer network shape the competitive landscape. Customer reviews, distribution channels, and environmental impact influence market perception. Insurance premiums, exterior finishes, maintenance schedules, rental rates, wastewater treatment, engine performance, and parts availability are crucial factors for potential buyers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Caravan And Motorhome Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.4% |

|

Market growth 2025-2029 |

USD 34.80 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.3 |

|

Key countries |

US, Germany, UK, France, Brazil, Italy, Canada, China, Spain, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Caravan And Motorhome Market Research and Growth Report?

- CAGR of the Caravan And Motorhome industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the caravan and motorhome market growth of industry companies

We can help! Our analysts can customize this caravan and motorhome market research report to meet your requirements.