Carbon Credit Trading Platform Market Size 2024-2028

The carbon credit trading platform market size is forecast to increase by USD 313.8 billion at a CAGR of 27.77% between 2023 and 2028. The carbon credit trading market is experiencing significant growth due to increasing international sustainability initiatives and stricter environmental rules. As enterprises strive to reduce their carbon footprints and comply with emission regulations, the demand for emission reduction projects and carbon credits is on the rise. Market stability is a key trend, as more businesses recognize the long-term benefits of carbon credit trading. However, a lack of awareness and understanding of the process hinders widespread adoption. Greenhouse gas emissions continue to be a major concern for governments and organizations alike, making the carbon credit trading platform an essential tool for achieving emission reduction targets.

The global focus on climate change and the adoption of renewable energy sources have led enterprises to prioritize emission reduction targets and environmental responsibility. Carbon credits have emerged as a financial tool to facilitate these efforts, enabling businesses to offset their carbon footprints by investing in emission reduction projects. Carbon capture technologies are gaining traction as essential components of the global transition towards a low-carbon economy. The increasing awareness of the environmental impact of greenhouse gas emissions has driven enterprises to seek sustainable practices and adhere to international sustainability initiatives.

Moreover, net zero goals have become a corporate mindset, with many organizations committing to reducing their carbon emissions in line with environmental regulations. Carbon credits provide a means for businesses to achieve these targets by investing in projects that reduce or remove greenhouse gas emissions from the atmosphere. The market is witnessing significant growth as more enterprises recognize the importance of carbon footprint reduction in their business strategies. Carbon credits offer a flexible and cost-effective solution for organizations to meet their emission reduction targets while supporting sustainable projects. The economic transition towards a low-carbon economy necessitates the adoption of carbon credits as a financial instrument.

Further, renewable energy sources, such as wind and solar power, are increasingly becoming the preferred choice for power generation, reducing the demand for fossil fuels and, consequently, carbon emissions. Carbon credits serve as a crucial financial mechanism in the context of environmental regulations. As governments worldwide implement stricter emission norms, businesses are turning to carbon credits to offset their carbon footprints and ensure compliance with these rules. Sustainability is a key concern for businesses, and carbon credits offer a tangible way to demonstrate environmental responsibility. By investing in emission reduction projects, organizations can reduce their carbon footprints and contribute to global efforts to mitigate climate change.

In conclusion, the market is expected to continue its growth trajectory, driven by the increasing demand for carbon credits from enterprises. The market's expansion is further fueled by the growing awareness of the importance of cybersecurity in the context of carbon credit trading platforms. In conclusion, the market plays a vital role in facilitating the transition towards a low-carbon economy by enabling enterprises to offset their carbon footprints and invest in emission reduction projects. As the global focus on climate change and sustainability intensifies, the demand for carbon credits and carbon credit trading platforms is expected to continue growing.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Voluntary carbon market

- Regulated carbon market

- Service Type

- Cap and trade

- Baseline and credit

- Geography

- Europe

- Germany

- UK

- Italy

- APAC

- China

- North America

- US

- South America

- Middle East and Africa

- Europe

By Type Insights

The voluntary carbon market segment is estimated to witness significant growth during the forecast period. In The market, the voluntary segment held the largest share in 2022. This segment's popularity is on the rise as businesses increasingly commit to net zero goals and renewable energy adoption in response to climate change concerns. Voluntary carbon credits enable companies to offset their carbon emissions by investing in projects that reduce or remove greenhouse gas (GHG) emissions. These initiatives not only contribute to the fight against climate change but also bring about additional benefits, such as pollution reduction, improved public health, job creation, and biodiversity preservation. By purchasing carbon credits, businesses demonstrate their commitment to environmental sustainability and support innovative climate change solutions that might not otherwise receive funding.

Get a glance at the market share of various segments Request Free Sample

The voluntary carbon market segment was valued at USD 33.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

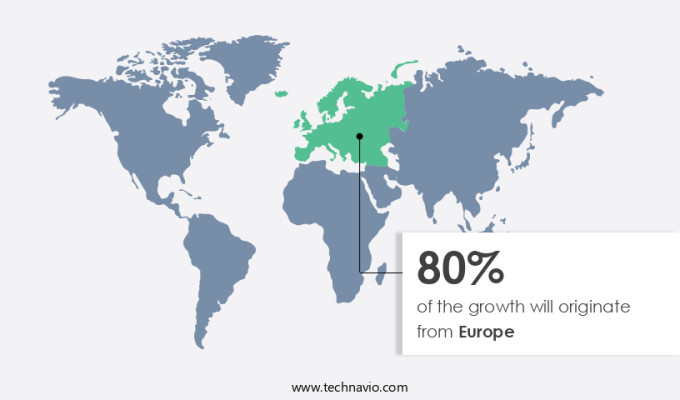

Europe is estimated to contribute 80% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Carbon credit trading platforms have gained significant attention from sustainability-focused investors in Europe due to the region's strong commitment to renewable energy projects and stringent regulations. The European Union (EU) has implemented policies to reduce emissions and improve air quality, making it a major contributor to the global carbon credit market. The European Environment Agency (EEA) plays a crucial role in evaluating and developing strategies to enhance air quality in the EU. Countries like the UK, Germany, and France are projected to have high pollution levels during the forecast period due to urbanization. Blockchain technology, smart contracts, artificial intelligence (AI), and advanced analytics are transforming the carbon credit trading landscape.

Further, these technologies streamline transactions, ensure transparency, and enhance the efficiency of the market. The voluntary carbon market and regulated carbon market, including cap and trade systems, are utilizing these technologies to meet their sustainability goals. The market is expected to grow steadfastly, with Europe remaining a key player. Blockchain technology, smart contracts, and AI are revolutionizing the market by providing transparency, security, and efficiency. The UK, Germany, and France, with their significant pollution levels, are expected to contribute significantly to the market's growth. According to market research, The market is expected to expand at a steady pace, with Europe leading the charge.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing adoption of policies on carbon emissions is the key driver of the market. In the global business landscape, the regulatory landscape regarding carbon emissions is evolving, leading to a significant increase in the demand for carbon credit trading platforms. For instance, in the US, the Clean Air Act's Section 111 empowers the Environmental Protection Agency (EPA) to regulate greenhouse gas emissions from power plants.

Further, this regulation allows the EPA to set standards for carbon emissions from power plants. Similar regulations are in place in Europe and several Chinese cities and provinces through the cap-and-trade policy, also known as emissions trading. Under this policy, organizations or companies responsible for greenhouse gas emissions must acquire allowances for each ton they emit during a designated period. The energy, industrials, petrochemical, and aviation sectors are significant contributors to carbon emissions and are, therefore, key players in the carbon credit trading market.

Market Trends

The growing adoption of carbon credit trading platform across various industries is the upcoming trend in the market. Carbon credit trading platforms have gained increasing popularity among various industries in the US, as organizations recognize the importance of addressing their carbon emissions and contributing to renewable energy solutions. Previously, large corporations in sectors like energy, manufacturing, and transportation predominantly utilized these platforms. However, the scope has broadened to include retail, real estate, construction, and IT services, among others. The growing concern for environmental sustainability and the need to reduce carbon footprints have driven this expansion. By implementing carbon credit trading platforms, companies can accurately measure their CO2 emissions, establish reduction targets, and track their progress towards sustainability goals.

Similarly, regulatory bodies and governments worldwide are imposing stricter environmental regulations and reporting requirements to ensure environmental improvements or prevent damage. As a result, organizations are increasingly turning to carbon credit trading to remain compliant and demonstrate their commitment to reducing their carbon impact. Carbon credits, derived from CO2 offsets, serve as a crucial component of these platforms, allowing organizations to trade and exchange these credits to offset their own emissions. This market, which facilitates the buying and selling of these credits, is expected to grow significantly due to the increasing demand for carbon neutrality and sustainability. In summary, carbon credit trading platforms have become an essential tool for businesses in the US and beyond, enabling them to accurately assess their carbon emissions, set reduction targets, and contribute to renewable energy initiatives while staying compliant with regulatory requirements.

Market Challenge

The lack of awareness in adopting low-carbon emission infrastructure is a key challenge affecting the market growth. The global market for carbon credit trading platforms is witnessing significant growth due to the increasing focus on reducing greenhouse gas emissions and the implementation of international sustainability initiatives. Enterprises are recognizing the importance of measuring and reducing their carbon footprints to comply with environmental rules and regulations. Carbon credit trading platforms facilitate the buying and selling of emission reduction projects, providing market stability and incentivizing emission reductions.

However, a lack of awareness and understanding among businesses about the benefits and processes of carbon credit trading may hinder market growth. The rapid proliferation of electronic devices, while driving technological advancements, also poses a challenge due to the resulting e-waste and its contribution to pollution. It is crucial for manufacturers to provide clear guidelines on product disposal to mitigate these issues.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Air Carbon: The company offers a carbon credit trading platform that involves an objective assessment of the authenticity and verification of documents.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anew Climate LLC

- BetaCarbon Pty Ltd

- Carbon Credit Capital LLC

- Carbon Trade Exchange

- Carbonex Ltd.

- Carbonplace

- Climate Impact X PTE LTD.

- Climatetrade

- ClimeCo LLC

- Deutsche Borse AG

- Finyear

- Flow Carbon Inc.

- Moss Earth

- Nasdaq Inc.

- Pathzero Pty Ltd.

- Planetly

- South Pole

- Toucan Protocol

- Xpansiv

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing focus on climate change and the adoption of renewable energy. Net zero goals and economic transition are driving the demand for innovative tools such as carbon credits, which enable enterprises to offset their carbon emissions and demonstrate environmental responsibility. The industrial segment, including utilities and power companies, is a major consumer of carbon credits. Carbon capture technologies and renewable energy projects are key sources of carbon credits. However, the market faces challenges such as fraudulent activities and cybersecurity concerns. The regulatory landscape plays a crucial role in market stability, with both voluntary and regulated carbon markets, including cap and trade systems, providing opportunities for emission reduction projects.

Consequently, compliance markets, such as those driven by international sustainability initiatives, are a significant contributor to the market's growth. The use of blockchain technology, smart contracts, and artificial intelligence in carbon trading platforms enhances market regularity, uniformity, and transparency. Sustainability-focused investors are increasingly interested in carbon credits as a financial tool for meeting emission reduction targets and reducing their carbon footprint. The aviation, industrials, energy, petrochemical sectors are major consumers of carbon credits. Carbon trade exchanges and ecosecurities provide a platform for selling and trading carbon credits. The regulatory landscape continues to evolve, with new environmental rules and awareness driving the demand for carbon credits and carbon offsets. The market is expected to grow further as enterprises adopt sustainable practices and transition to a low-carbon economy.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 27.77% |

|

Market growth 2024-2028 |

USD 313.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

22.76 |

|

Regional analysis |

Europe, APAC, North America, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 80% |

|

Key countries |

Germany, UK, Italy, China, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Air Carbon, Anew Climate LLC, BetaCarbon Pty Ltd, Carbon Credit Capital LLC, Carbon Trade Exchange, Carbonex Ltd., Carbonplace, Climate Impact X PTE LTD., Climatetrade, ClimeCo LLC, Deutsche Borse AG, Finyear, Flow Carbon Inc., Moss Earth, Nasdaq Inc., Pathzero Pty Ltd., Planetly, South Pole, Toucan Protocol, and Xpansiv |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch