Cardless ATM Market Size 2024-2028

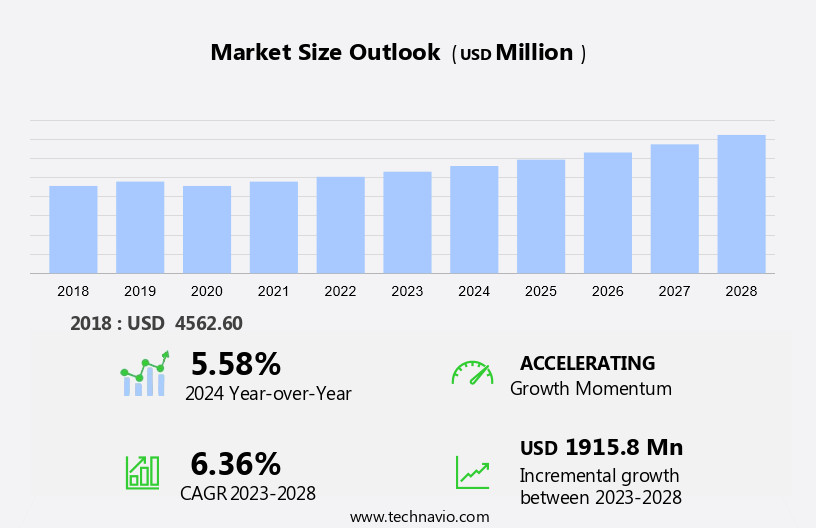

The cardless ATM market size is forecast to increase by USD 1.92 billion at a CAGR of 6.36% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key trends and factors. The increased penetration of smartphones and the emergence of biometric ATMs are major growth catalysts. Smartphones have become an integral part of our daily lives, and mobile banking applications enable users to perform various transactions, including cash withdrawals, without using traditional debit or credit cards. Biometric ATMs, which use fingerprint or facial recognition technology for authentication, offer enhanced security and convenience, making them increasingly popular. ATMs are no longer just physical machines for cash transactions; they have evolved into digital platforms offering various services through mobile apps. Additionally, regulations on contactless payment transactions are also fueling the market growth. However, challenges such as high implementation costs and security concerns related to biometric data remain. Despite these challenges, the market is expected to continue its upward trajectory, driven by the convenience and security benefits offered by cardless ATMs.

What will be the Size of the Cardless Atm Market During the Forecast Period?

- The market is witnessing significant growth as more financial institutions and tech companies adopt contactless technology for cash withdrawals and deposits. Transactions at Cardless ATMs can be initiated using biometrics, passcodes, or mobile apps. NFC technology and QR code scanning enable contactless transactions, enhancing user experience. ATM manufacturers, technology providers, and mobile app developers are collaborating to offer innovative solutions. Security is a major concern In the market, with geolocation services and fraud detection systems being implemented to ensure safety.

- Furthermore, interoperability between different banking apps and ATMs is also crucial for customer convenience. Leading players In the market include NCR Corporation, focusing on enhancing the user experience through advanced technology. Startups are also entering the market, bringing competition and innovation. Banks are integrating Cardless ATMs into their banking apps to offer teller services, cash deposits, and balance checks. Despite the benefits, challenges such as technical complexities and regulatory issues persist. However, the convenience and security offered by Cardless ATMs make them a preferred choice for customers. The market is expected to continue growing, offering opportunities for both established players and new entrants.

How is this Cardless Atm Industry segmented and which is the largest segment?

The cardless atm industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Offsite ATM

- Onsite ATM

- Others

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

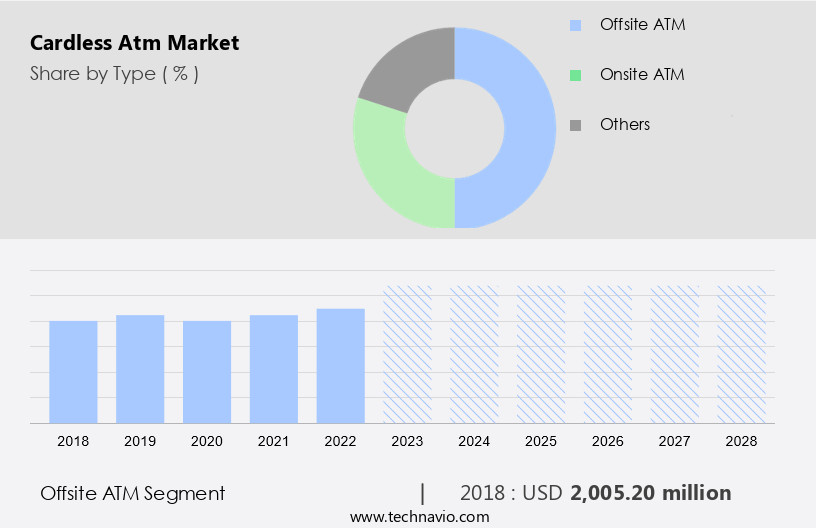

- The offsite atm segment is estimated to witness significant growth during the forecast period.

The market primarily consists of transactions conducted at offsite Automated Teller Machines (ATMs) that do not require the use of traditional plastic cards. Offsite ATMs, which account for the largest market share, are installed outside the premises of banks and are often situated in high-traffic areas such as transportation hubs, educational institutions, and marketplaces. Users can perform cash withdrawals and deposits, check balances, and initiate contactless transactions through mobile apps or biometric authentication methods, such as passcodes or fingerprint scanning. Technology providers, ATM manufacturers, mobile app developers, and IoT technologies collaborate to offer advanced features, including NFC, QR code scanning, and data analysis tools, to enhance the user experience.

Get a glance at the Cardless Atm Industry report of share of various segments Request Free Sample

The offsite ATM segment was valued at USD 2.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

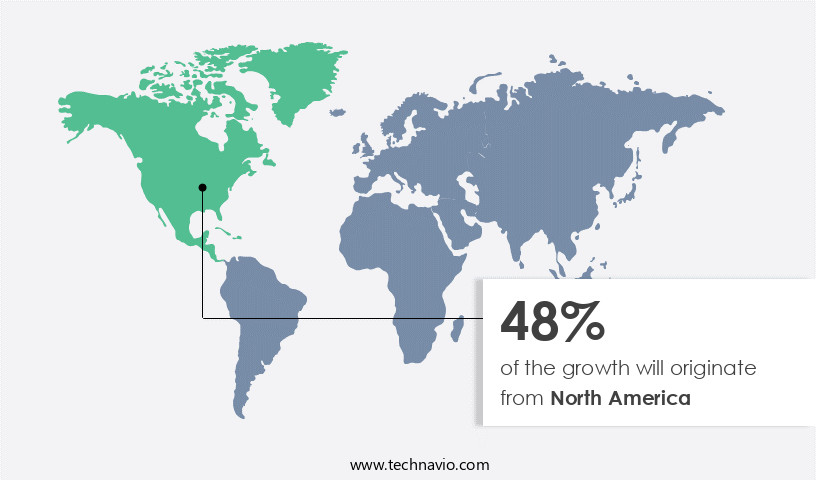

- North America is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is witnessing significant advancements as technology providers, ATM manufacturers, and mobile app developers collaborate to offer seamless transaction experiences. Biometrics, passcodes, and QR code scanning are becoming the new norm for cash withdrawals and deposits, replacing traditional card usage. This shift towards cardless transactions enhances user experience and reduces the risk of skimming and fraud. Startups and banking institutions are investing in NFC and contactless technologies to build interoperable systems, ensuring customers can access their balances and banking services through various channels. Security is a top priority, with data analysis tools and IT infrastructure safeguards to prevent data breaches and data security threats.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cardless Atm Industry?

Increased penetration of smartphones is the key driver of the market.

- The global market for Cardless ATM transactions is witnessing significant growth, driven by the increasing popularity of smart hardware such as NFC-enabled devices and QR codes. Companies like NEXGO and GUOXIN MICRO are leading this innovation with their advanced solutions. In India, for instance, the Unified Payments Interface (UPI) and various payment systems like Empays Payment and IMT Payment System have facilitated cashless transactions through smartphones. Major financial institutions such as Mastercard are also embracing contactless payment systems to enhance security and convenience. The integration of digital currency, Blockchain, Artificial Intelligence, IoT, and communication technologies like Azure Cognitive Services and facial recognition is further revolutionizing the ATM industry.

- Moreover, geolocation services and PINless transactions are also gaining traction, aiming to eliminate ATM fraud. Chinese smartphone manufacturers, including Xiaomi Corp., Guangdong Oppo Mobile Telecommunications Corp., Ltd, and OnePlus Technology Co., Ltd, are playing a crucial role in expanding the market by offering affordable smartphones, making digital transactions more accessible to a broader population.

What are the market trends shaping the Cardless Atm Industry?

Emergence of biometric ATM is the upcoming market trend.

- The market is witnessing significant growth due to the integration of advanced technologies such as NEXGO and GUOXIN MICRO's smart hardware. These innovations enable contactless payment methods like UPI, NFC-enabled smartphones, and QR codes for cashless transactions. Biometric technologies, including facial recognition, are increasingly being used in ATMs for multi-factor authentication. This technology uses single or multiple factors such as finger, iris, and face scanning for secure transactions. However, concerns over hygiene and potential ATM fraud persist, leading to the exploration of alternative authentication methods. For instance, Empays Payment and IMT Payment System are integrating Mastercard's contactless payment solutions to minimize physical contact.

- Furthermore, the adoption of digital currency, blockchain, artificial intelligence, IoT, and geolocation services is transforming the ATM landscape. Azure Cognitive Services, for example, offer facial recognition capabilities to enhance security, while NAB is testing ATMs with PINless transactions. These advancements aim to provide a seamless, secure, and hygienic banking experience for customers.

What challenges does the Cardless Atm Industry face during its growth?

Regulations on contactless payment transactions is a key challenge affecting the industry growth.

- Cardless ATMs, facilitated by smart hardware from companies like NEXGO and GUOXIN MICRO, enable contactless transactions using smartphones and NFC-enabled devices. However, there are limitations to these transactions, with most geographical regions imposing a daily maximum limit on cash withdrawals. For instance, HDFC Bank Ltd. Permits a maximum of approximately USD127 per day, while ICICI Bank Ltd. Allows up to USD254. These restrictions are imposed by central banks to prevent fraud, as cardless payment devices are susceptible to unauthorized access when ATMs are in close proximity. Additionally, contactless payment methods such as UPI, Empays Payment, and IMT Payment System, as well as digital currencies, are gaining popularity.

- In addition, Mastercard and other financial institutions are integrating advanced technologies like blockchain, artificial intelligence, IoT, facial recognition, and geolocation services through Azure Cognitive Services to enhance security and user experience. Despite these advancements, ensuring the security of cardless transactions remains a significant challenge.

Exclusive Customer Landscape

The cardless atm market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cardless atm market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cardless ATM market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Banco Santander SA

- Barclays Bank Plc

- Citigroup Inc.

- Commonwealth Bank of Australia

- Diebold Nixdorf Inc.

- Fifth Third Bancorp

- Fujitsu Ltd.

- GRGBanking

- HDFC Bank Ltd.

- HSBC Holdings Plc

- Hyosung Corp.

- ICICI Bank Ltd.

- JPMorgan Chase and Co.

- Kotak Mahindra Bank Ltd.

- NCR Voyix Corp.

- State Bank of India

- Turk Ekonomi Bank AS

- Wells Fargo and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is revolutionizing the way customers perform cash transactions without the need for traditional plastic cards. This innovative technology enables users to withdraw cash, make deposits, and check balances using biometrics, passcodes, or mobile apps. ATM manufacturers and technology providers collaborate to develop smart ATMs equipped with NFC, contactless transactions, QR code scanning, and IoT technologies. Mobile app developers play a crucial role in creating banking apps that facilitate cardless transactions, enhancing user experience. Security is a top priority In the market, with biometric authentication and data security measures ensuring fraud protection.

In addition, interoperability between various banking apps and ATMs is essential for seamless transactions. Competitors In the market include Huawei Cloud, OEMs, systems integrators, and technology companies. The market growth is driven by increasing mobile banking participation, improved IT infrastructure, and financing from various sources. End-users benefit from the convenience of cardless transactions, faster cash withdrawals, and reduced dependency on teller services. However, data breaches and data security concerns remain challenges for the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.36% |

|

Market growth 2024-2028 |

USD 1.92 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.58 |

|

Key countries |

US, China, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cardless Atm Market Research and Growth Report?

- CAGR of the Cardless Atm industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cardless ATM market growth of industry companies

We can help! Our analysts can customize this cardless ATM market research report to meet your requirements.