Cathode Materials Market Size 2024-2028

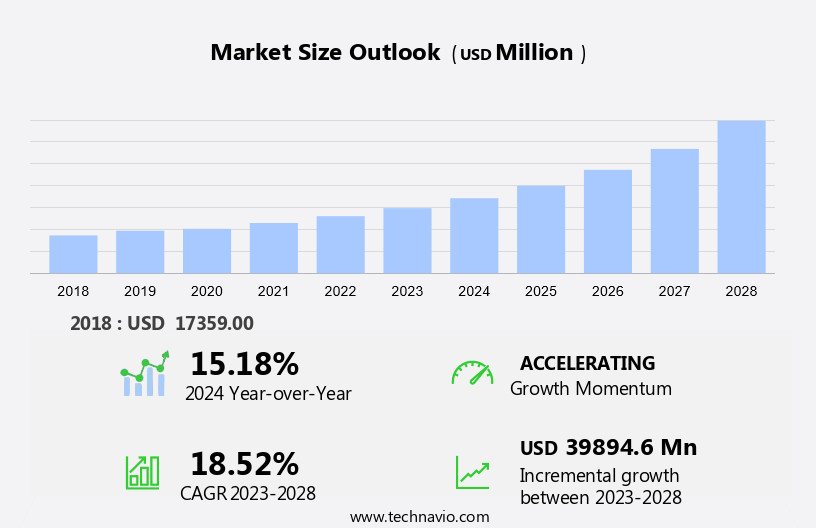

The cathode materials market size is forecast to increase by USD 39.89 billion at a CAGR of 18.52% between 2023 and 2028.

- Robust demand for lithium-ion batteries is the key driver of the cathode materials market, as these batteries are widely used in electric vehicles, renewable energy storage, and portable electronics. The upcoming trend is the increased application of cathode materials in consumer electronics. With the growing use of lithium-ion batteries in smartphones, laptops, and other portable devices, the demand for high-performance cathode materials is rising, driving innovations in material composition and production techniques.

- Additionally, research and development efforts are underway to explore alternative, cost-effective cathode materials, such as lithium iron phosphate and nickel manganese cobalt oxide. These trends and challenges are shaping the future of the market.

What will be the Size of the Cathode Materials Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for batteries in various applications, including electric vehicles, consumer electronics, and energy storage devices. This trend is driven by the global shift towards reducing greenhouse gas emissions and the need for cleaner energy sources. However, the market faces challenges related to the use of hazardous chemicals, such as acids and heavy metals, including mercury, in traditional energy storage devices like lead-acid batteries. In response, there is a growing focus on developing alternative cathode materials for energy storage, such as nickel, manganese, and lithium-based materials, including lithium-ion phosphate and lithium cobalt oxide.

- The demand for high power output batteries is also driving innovation in the market, with applications in data centers, UPS systems, and renewable energy storage. The transition to lithium-ion batteries, particularly those with advanced chemistries like lithium-ion phosphate and nickel-manganese-cobalt, is expected to continue shaping the market In the coming years.

How is this Cathode Materials Industry segmented and which is the largest segment?

The cathode materials industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Battery Type

- Lead-acid

- Lithium-ion

- Others

- Application

- Automotive

- Consumer electronics

- Power tools

- Others

- Material

- Lithium Iron Phosphate

- Lithium Cobalt Oxide

- Lithium Nickel

- Manganese Cobalt

- Lithium Manganese Oxide

- Lithium Nickel Cobalt Aluminium Oxide

- Lead Dioxide

- Other Materials

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Battery Type Insights

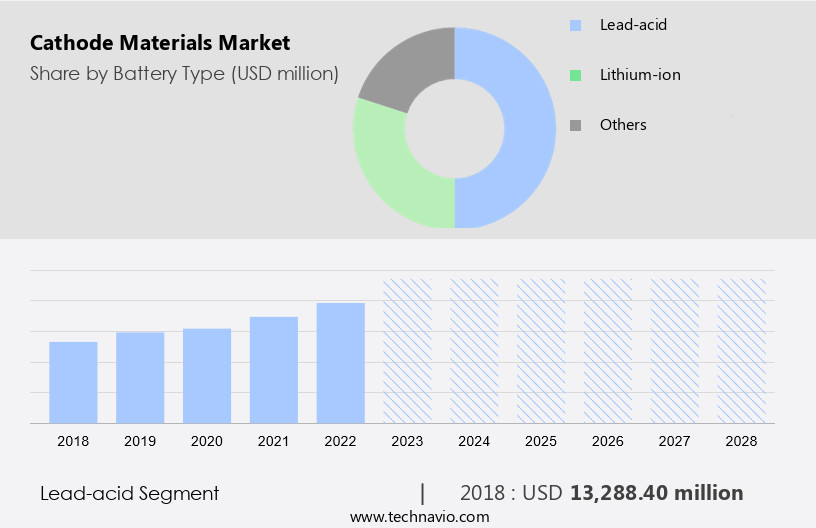

The lead-acid segment is estimated to witness significant growth during the forecast period. Lead-acid batteries, comprised of lead dioxide (PbO2) cathodes and sponge metallic lead (Pb) anodes, dominate The market. Used extensively in automotive, industrial, and energy storage applications, these batteries offer reliability and cost-effectiveness. In automobiles, they power start-stop systems, while in industry, they serve as uninterruptible power supplies (UPS) and grid energy storage systems. Despite the emergence of alternative technologies like lithium-ion batteries, lead-acid batteries retain a competitive edge due to their affordability, recyclability, and well-established manufacturing infrastructure. Innovations focus on enhancing their energy density, cycle life, and charge efficiency, ensuring their continued relevance In the energy sector. The global market for cathode materials in lead-acid batteries is expected to grow, driven by the increasing demand for energy storage devices.

Get a glance at the Cathode Materials Industry report of share of various segments Request Free Sample

The lead-acid segment was valued at USD 13.29 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

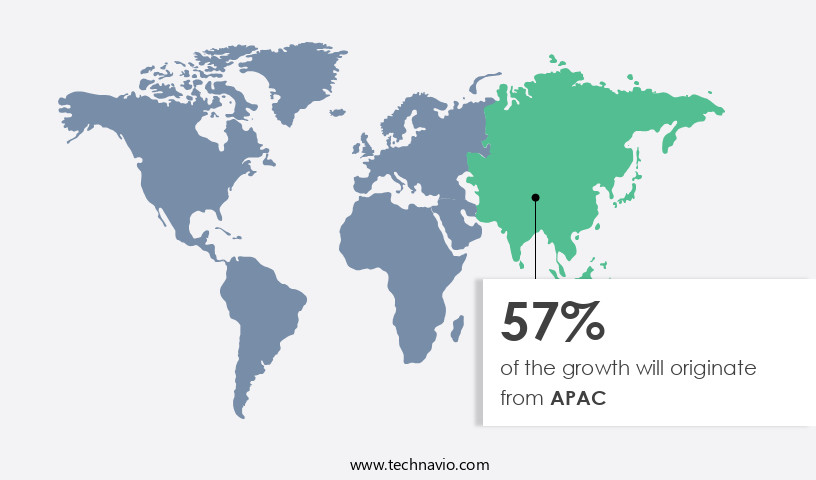

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region led The market in 2022, accounting for the largest market share. The region's dominance can be attributed to the EV industry's significant growth in APAC, particularly in China, where government incentives, regulations, and consumer demand for sustainable mobility have driven sales. Major battery manufacturers, such as BYD Co. Ltd and Panasonic Corporation, are based in APAC and require a consistent supply of cathode materials to meet the increasing demand for batteries In the region. The lithium-ion phosphate used In the production of positive electrodes is a key component of these batteries, making APAC a significant market for this material. The demand for cathode materials is expected to continue growing as the adoption of plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs) increases in APAC and other regions.

Market Dynamics

Our cathode materials market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cathode Materials Industry?

Robust demand for lithium-ion batteries is the key driver of the market.

- Lithium-ion batteries have witnessed significant growth in demand due to their application in various sectors, including consumer electronics and electric vehicles. These batteries power a multitude of portable devices such as smartphones, laptops, and televisions, driven by the expanding consumer electronics market and the increasing preference for energy-efficient and long-lasting batteries. In the transportation sector, lithium-ion batteries are essential for electric vehicles (EVs), plug-in hybrid vehicles (PHEVs), and hybrid electric vehicles (HEVs), as they provide high power output and enable zero-emission mobility. Beyond transportation, lithium-ion batteries are vital for energy storage applications, particularly in renewable energy integration and grid energy storage.

- With the growing adoption of renewable energy sources like solar and wind power, efficient energy storage solutions, such as lithium-ion batteries, are increasingly necessary to address intermittency and ensure energy reliability. The demand for these batteries is further fueled by the need for energy storage in data centers and uninterruptible power supply (UPS) systems, which require high power density and long cycle life. The production of lithium-ion batteries involves various materials, including lithium, nickel, manganese, cobalt, and mercury, as well as hazardous chemicals and acids. The use of these materials and the production process pose potential risks, including occupational diseases for battery workers and environmental pollution.

- As the market for lithium-ion batteries continues to expand, efforts are being made to develop safer and more sustainable alternatives, such as lithium iron phosphate and lithium cobalt oxide batteries, which have lower toxicity and improved safety features. In summary, the lithium-ion batteries market is driven by the growing demand for portable electronics, electric vehicles, and energy storage applications, particularly In the renewable energy sector. The market's growth is underpinned by the need for energy efficiency, mobility, and convenience, as well as the increasing adoption of renewable energy sources. However, the production process and the use of hazardous materials pose challenges, necessitating ongoing research and development to create safer and more sustainable alternatives.

What are the market trends shaping the Cathode Materials Industry?

Increased application in consumer electronics is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for batteries in various sectors. The proliferation of electric vehicles (EVs) and consumer electronics, such as laptops, televisions, and smartphones, is driving the need for energy storage devices with high power output. Lithium-ion batteries, which utilize cathode materials like lithium iron phosphate, lithium cobalt oxide, and nickel manganese cobalt (NMC), are popular choices for these applications due to their high energy density and excellent performance. In the automotive industry, the shift towards sustainable transportation and the reduction of greenhouse gas emissions is leading to an increase In the production of EVs and plug-in hybrid vehicles (PHEVs).

- This, in turn, is fueling the demand for cathode materials used in lithium-ion batteries, such as lithium, nickel, manganese, and cobalt. The energy sector is also witnessing a surge In the adoption of renewable energy storage solutions, such as wind and solar power, which require energy storage devices for efficient energy management. Data centers and uninterruptible power supply (UPS) systems are other significant consumers of energy storage devices, which rely on lead-acid batteries and lithium-ion batteries with lead dioxide or calcium lignosulfonate cathode materials. Despite the numerous benefits of cathode materials, the production and disposal of batteries can pose environmental and health risks.

- The use of hazardous chemicals, such as acids and heavy metals like mercury, lead, and cadmium, can lead to occupational diseases for battery workers. Therefore, efforts are being made to develop safer and more sustainable alternatives, such as lithium-ion phosphate batteries, which do not contain cobalt or nickel. In conclusion, the market is expected to continue its growth trajectory due to the increasing demand for batteries in various industries, including transportation, consumer electronics, and energy storage. However, the environmental and health concerns associated with the production and disposal of batteries necessitate the development of safer and more sustainable alternatives.

What challenges does the Cathode Materials Industry face during its growth?

High cost associated with raw materials is a key challenge affecting the industry growth.

- The market is driven by the increasing demand for batteries in various applications, including electric vehicles (EVs), consumer electronics, and energy storage devices. The transition towards renewable energy sources and the need for energy storage solutions for data centers, uninterruptible power supplies (UPS), and renewable energy storage have further boosted the market growth. However, the cost and availability of raw materials, such as cobalt, nickel, manganese, lithium, and mercury, used In the production of cathode materials pose significant challenges. These materials are essential components of batteries, including lead-acid batteries and lithium-ion batteries, which are widely used in plug-in hybrid electric vehicles (PHEVs), hybrid electric vehicles (HEVs), and various consumer electronics, such as laptops, televisions, and smartphones.

- The volatility In the prices of these materials, limited availability, and geopolitical risks can lead to supply chain disruptions and higher production costs. For instance, cobalt prices have historically been volatile due to its limited global supply and concentration of production in a few countries, leading to ethical concerns and potential health hazards for battery workers. Nickel prices are also subject to price volatility due to supply-demand dynamics, production disruptions, and policy changes in major nickel-producing countries. Moreover, the use of hazardous chemicals, such as acids and heavy metals, In the production of cathode materials can lead to environmental pollution and occupational diseases.

- Therefore, there is a growing emphasis on the development of eco-friendly and sustainable alternatives to traditional cathode materials. For example, lead-acid batteries use lead dioxide materials, while NMC lithium-ion batteries use lithium iron phosphate and lithium cobalt oxide as cathode materials. In conclusion, the market is experiencing significant growth due to the increasing demand for batteries in various applications. However, the cost and availability of raw materials, environmental concerns, and health hazards associated with the production of cathode materials pose significant challenges. Therefore, there is a need for continuous research and development efforts to address these challenges and ensure the sustainability and safety of cathode materials.

Exclusive Customer Landscape

The cathode materials market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cathode materials market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cathode materials market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Advanced Lithium Electrochemistry Cayman Co. Ltd. - The company specializes in providing high-performance cathode materials for the US market, including NMC variants such as NMC 111, NMC 532, and NMC 622. These advanced materials are essential components In the production of lithium-ion batteries, which power a wide range of applications from consumer electronics to electric vehicles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Lithium Electrochemistry Cayman Co. Ltd.

- ALTMIN

- Ascend Elements Inc.

- BASF SE

- Himadri Speciality Chemical Ltd.

- Hitachi Ltd.

- Malvern Panalytical Ltd.

- NEI Corp.

- Nichia Corp.

- Nippon Chemical Industrial Co. Ltd.

- NOVONIX Ltd.

- POSCO holdings Inc.

- Samsung SDI Co. Ltd.

- Sumitomo Metal Mining Co. Ltd.

- Targray Technology International Inc.

- TODA KOGYO CORP.

- Umicore SA

- Xiamen TOB New Energy Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, BASF launched a new line of high-performance nickel-rich cathode materials for electric vehicle batteries. These materials are designed to enhance energy density and improve the overall lifespan of batteries, addressing the growing demand for longer-range EVs.

-

In November 2024, LG Chem announced a strategic partnership with a leading Chinese battery manufacturer to jointly develop next-generation cathode materials. The collaboration focuses on utilizing sustainable raw materials to produce high-efficiency cathodes that contribute to reducing the environmental impact of battery production.

-

In October 2024, Umicore, a global leader in materials technology, acquired the cathode materials business of a South Korean firm, aiming to expand its capabilities in the EV battery supply chain. This acquisition will enhance Umicore's portfolio of sustainable cathode materials and solidify its position in the rapidly growing electric vehicle market.

-

In September 2024, Panasonic unveiled a new cathode material that combines nickel, manganese, and cobalt (NMC) to improve the energy density and stability of lithium-ion batteries. This innovation is expected to support the next generation of high-performance batteries for applications in both electric vehicles and renewable energy storage systems.

Research Analyst Overview

The market is a critical component of the energy storage industry, playing a pivotal role In the development and advancement of various applications, including electric vehicles (EVs), consumer electronics, and energy storage devices for renewable energy and data centers. This content explores the market dynamics and trends shaping the cathode materials landscape. Cathode materials are essential components of energy storage devices, responsible for the positive electrode that accepts and releases ions during the charging and discharging process. The choice of cathode material significantly influences the performance, cost, and safety of the energy storage system.

Two primary types of cathode materials dominate the market: lead-acid and lithium-ion. Lead-acid batteries, which have been in use for over a century, have a proven track record in providing reliable and affordable energy storage solutions. However, they are heavy, contain hazardous chemicals such as lead dioxide and sulfuric acid, and are associated with occupational diseases among battery workers. In contrast, lithium-ion batteries have gained significant attention due to their high power output, long cycle life, and ability to support various applications, including EVs, consumer electronics, and renewable energy storage. Lithium-ion batteries use various cathode materials, such as lithium iron phosphate, lithium cobalt oxide, and nickel manganese cobalt.

The chemistry type of cathode materials influences their properties and applications. For instance, lithium-ion phosphate cathodes offer excellent safety, thermal stability, and long cycle life, making them suitable for EVs and renewable energy storage. In contrast, lithium cobalt oxide cathodes provide high energy density, making them ideal for consumer electronics. The energy storage market is driven by the growing demand for clean energy and the need to reduce greenhouse gas emissions. The shift towards electrification of transportation and the increasing adoption of renewable energy sources have created significant opportunities for energy storage solutions. The market is also influenced by the advancements in battery technology, which aim to improve energy density, reduce costs, and enhance safety.

The market for energy storage devices is diverse, with applications ranging from data centers and uninterruptible power supplies (UPS) to plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs). The demand for energy storage in data centers and UPS systems is driven by the need for reliable power backup and the increasing adoption of cloud computing and big data. In the transportation sector, the growing popularity of EVs and the need for longer driving ranges are driving the demand for high-performance batteries. The market for energy storage devices is also influenced by the availability and cost of raw materials.

For instance, the price of lithium, cobalt, nickel, and manganese significantly impacts the cost of lithium-ion batteries. The market is also influenced by regulatory policies and environmental concerns, as some cathode materials, such as lead, contain hazardous chemicals and are associated with occupational diseases. In conclusion, the market is a dynamic and evolving industry, driven by the growing demand for energy storage solutions and the need to reduce greenhouse gas emissions. The choice of cathode material significantly influences the performance, cost, and safety of energy storage devices, making it a critical area of research and development. The market is influenced by various factors, including battery chemistry, raw material availability, and regulatory policies. As the market continues to grow, it is expected to bring significant advancements in battery technology and energy storage solutions.

|

Cathode Materials Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.52% |

|

Market growth 2024-2028 |

USD 39.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.18 |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cathode Materials Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of companies

We can help! Our analysts can customize this cathode materials market research report to meet your requirements. Get in touch