Construction Fabrics Market Size 2024-2028

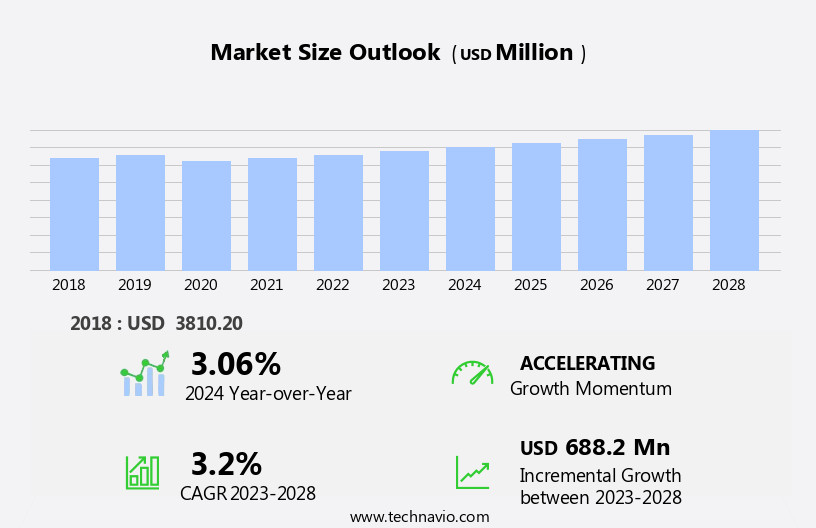

The construction fabrics market size is forecast to increase by USD 688.2 million at a CAGR of 3.2% between 2023 and 2028.

What will be the Size of the Construction Fabrics Market During the Forecast Period?

How is this Construction Fabrics Industry segmented and which is the largest segment?

The construction fabrics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Tensile architecture

- Awnings and canopies

- Facades

- Material

- Polyester

- PTFE

- ETFE

- Nylon

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

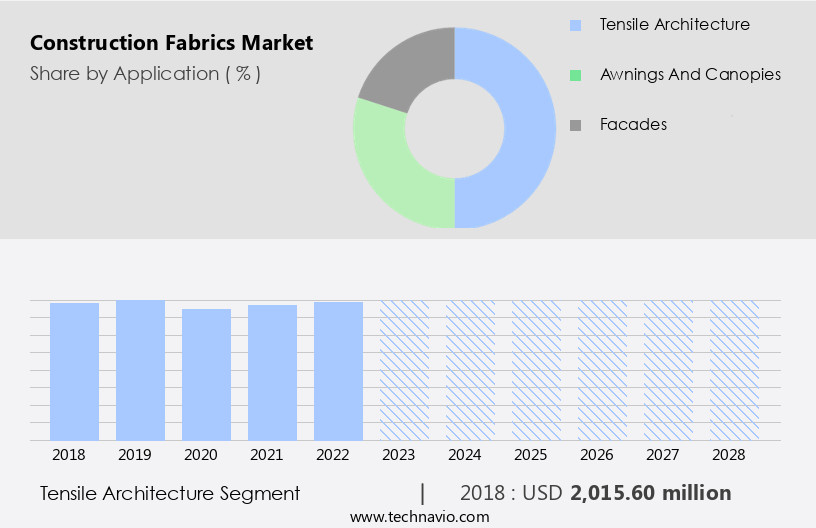

- The tensile architecture segment is estimated to witness significant growth during the forecast period.

Tensile architecture is a modern construction approach utilizing tension forces instead of compression. Known as "tension membrane architecture," "fabric architecture," or "lightweight tension structures," it employs materials such as coated polyester cloth (PVC) and glass cloth coated with Polytetrafluoroethylene (PTFE). Tensile structures' design relies on tension, enabling the creation of lightweight, durable, and adaptable buildings. This efficiency in material usage results in cost savings, fueling the growing demand for these structures. Tensile architecture offers numerous benefits, including energy efficiency, durability, flexibility, and virtually limitless designs. Architects and design engineers utilize these materials for awnings and canopies, facades, architectural membranes, and tensile surfaces.

Tensile structures can be found in various industries, including commercial and residential construction, real estate, transportation, and solar energy. The materials' high performance, lightness, chemical resistance, and self-cleaning qualities make them suitable for extreme weather conditions and various applications, such as thermal and acoustic insulation, structure protection, and sun protection.

Get a glance at the Construction Fabrics Industry report of share of various segments Request Free Sample

The Tensile architecture segment was valued at USD 2015.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

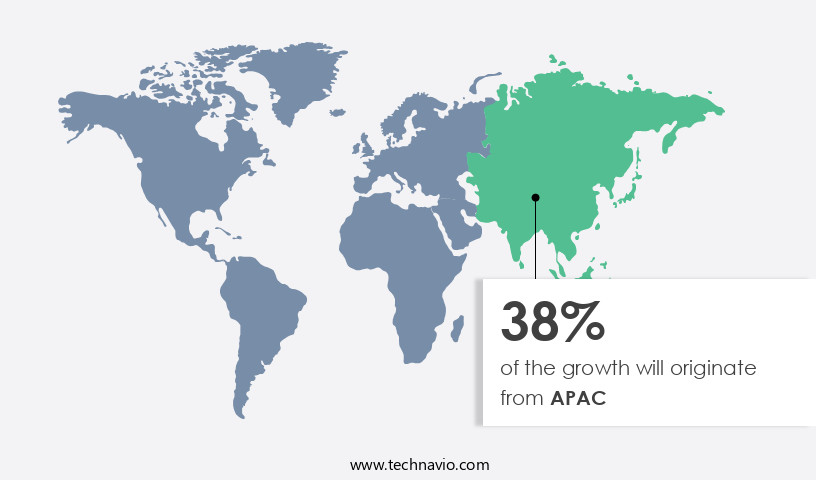

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to the increasing demand for canopies and awnings In the region. Factors such as the expansion of outdoor dining establishments, rising tourism activities, enhanced living standards, and heightened awareness of international brands are driving this trend. Furthermore, the growing internet penetration in APAC presents an opportunity for companies to adopt omnichannel sales strategies, contributing to the market's substantial growth. As people in countries like China focus on improving their residential and commercial properties' aesthetics, the market for construction fabrics is poised for continued expansion. Key product categories include Tensile Architecture, Facades, Architectural Membranes, and Awnings and Canopies.

These materials offer numerous benefits, such as durability, energy efficiency, and aesthetically superior designs, making them popular choices for designers, architects, and builders. High-performance materials like PVC, PTFE, ETFE, and structural fabrics are commonly used due to their flexibility, lightness, chemical resistance, and ability to withstand extreme weather conditions. Applications range from residential and commercial construction to public-private partnerships and various industries, including transportation and real estate. The market encompasses a wide array of products, from woven and non-woven fabrics to polyester, nylon, cotton, and silicon glass. Additionally, advancements in technology, such as 3D printing and thermal insulation, continue to expand the market's potential.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Construction Fabrics Industry?

Usage of ETFE in building and construction industry is the key driver of the market.

What are the market trends shaping the Construction Fabrics Industry?

Increasing demand for energy-efficient houses is the upcoming market trend.

What challenges does the Construction Fabrics Industry face during its growth?

Easy availability of inexpensive substitutes is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The construction fabrics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the construction fabrics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, construction fabrics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ADFIL NV - Construction fabrics serve as effective alternatives to steel reinforcement in various concrete applications. These fabrics can be integrated into ready-mix concrete without compromising its strength or durability. The use of construction fabrics offers several advantages, including improved workability, enhanced sustainability, and reduced construction time. These fabrics are engineered to withstand extreme temperatures, UV radiation, and other environmental stressors, ensuring long-term performance and reliability. The versatility of construction fabrics makes them a preferred choice for architects, engineers, and contractors seeking innovative and cost-effective solutions for reinforcing concrete structures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADFIL NV

- AGRU America Inc.

- BWF Offermann Waldenfels and Co. KG

- Compagnie de Saint Gobain

- DuPont de Nemours Inc.

- Fibertex Nonwovens AS

- Global Synthetics Pty Ltd.

- Solmax

- HUESKER Synthetic GmbH

- Machina TST

- NAUE GmbH and Co.KG

- Officine Maccaferri Spa

- Seaman Corp.

- Sefar AG

- Shri Raghavendra Textiles

- Sioen Industries NV

- SKAPS Industries Inc.

- TENAX Spa

- Terram Geosynthetics Pvt. Ltd.

- THRACE PLASTICS CO S.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Construction fabrics have emerged as a significant component in modern construction activities, offering a multitude of benefits for various applications. These fabrics, which include PVC, PTFE, ETFE, and other high-performance materials, are utilized in tensile architecture, awnings and canopies, facades, and architectural membranes. Construction fabrics are known for their durability, energy efficiency, and aesthetically superior qualities. Design engineers and architects increasingly prefer these materials due to their flexibility and virtually limitless designs. The fabrics can withstand tension forces, providing structural support in large spans, while also enduring extreme weather conditions. The use of construction fabrics in place of conventional glass panels offers several advantages.

For instance, these fabrics transmit light while providing sun protection, reducing energy consumption for heating and cooling. They also offer excellent weather resistance, shielding against moisture, heat, air, mechanical harm, and chemical harm. Tensile surfaces, such as canopies and roofs, made from architectural fabrics, have gained popularity due to their ability to create aesthetically pleasing architecture. These structures can be found in various sectors, including commercial buildings, retail stores, hotels, medical centers, warehouses, and garages. The integration of construction fabrics in modern construction projects is not limited to their structural role. They are also used for thermal insulation, acoustic insulation, and structure protection.

Furthermore, they serve as sun protection, wind protection, fire protection, and water protection systems. The residential construction industries and commercial construction industries have embraced the use of construction fabrics, leading to the growth of the polyester industry. The transportation industries also utilize these materials for various applications, such as geotextiles and green roofs. Advancements in technology, including 3D printing technology, have further expanded the potential of construction fabrics. These materials can now be used to create intricate designs and patterns, adding to their appeal and versatility. In conclusion, construction fabrics play a crucial role in modern construction activities, offering numerous benefits for various applications.

Their durability, flexibility, and ability to withstand extreme weather conditions make them an essential component in creating greener and eco-sustainable structures. The use of these fabrics in tensile architecture, awnings and canopies, facades, and architectural membranes is transforming the way we design and build structures, leading to energy conservation and cost savings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 688.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Key countries |

China, US, India, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Construction Fabrics Market Research and Growth Report?

- CAGR of the Construction Fabrics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the construction fabrics market growth of industry companies

We can help! Our analysts can customize this construction fabrics market research report to meet your requirements.