Chemical Seed Treatment Market Size 2024-2028

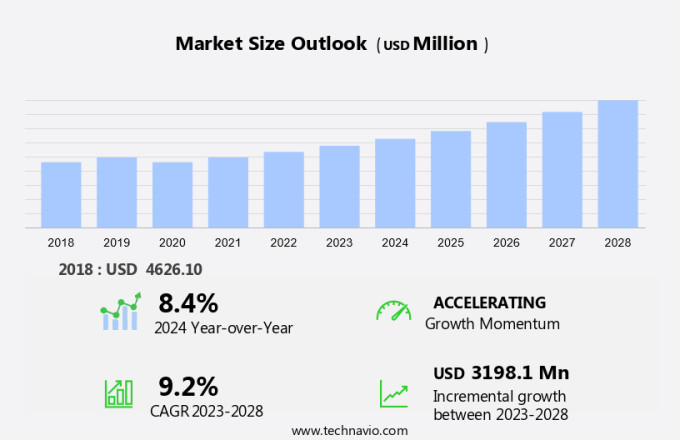

The chemical seed treatment market size is forecast to increase by USD 3.2 billion, at a CAGR of 9.2% between 2023 and 2028.

- The market is driven by the increasing use of herbicides in seed treatments to enhance crop productivity and protect against weeds. This trend is particularly prominent in large-scale agriculture, where efficient weed management is crucial for maximizing yields. Additionally, the rising popularity of biopesticide products as an alternative to synthetic chemicals is shaping the market dynamics. Biopesticides offer several advantages, including reduced environmental impact, lower toxicity, and potential for resistance management. However, the market faces significant challenges, primarily from a complex regulatory environment. Stringent regulations governing the use of seed treatments, particularly those containing certain active ingredients, can hinder market growth.

- Companies must navigate these regulations to ensure compliance and maintain their market position. To capitalize on opportunities and effectively manage challenges, market participants should focus on innovation, regulatory compliance, and strategic partnerships. By staying abreast of regulatory changes, investing in research and development, and collaborating with industry stakeholders, companies can position themselves for long-term success in the market.

What will be the Size of the Chemical Seed Treatment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-growing demand for enhanced plant health and productivity. This market encompasses a range of treatments, including fungicide, herbicide, insecticide, nematicide, and plant growth regulator applications. seed treatment costs have risen due to the increasing use of advanced seed coating technology, such as encrusting and priming methods, which improve seed vigor, uniform seed emergence, and seed germination rate. For instance, a leading agricultural company reported a 15% increase in crop yield through the use of fungicide seed treatment, which protected against soil-borne diseases. The industry is projected to grow at a robust rate, with expectations of a 7% annual expansion.

Seed treatment benefits extend beyond disease control, as these treatments also enhance nutrient use and stress tolerance mechanisms, leading to improved water uptake and early seedling growth. Seed dressing formulations, such as powder and liquid treatments, play a crucial role in the market's continuous development. These treatments not only protect against pests and diseases but also contribute to better seed health and uniformity. Biopesticide seed treatments have gained popularity due to their reduced pesticide use and eco-friendly nature. The ongoing research and development in seed treatment technology will undoubtedly bring about new innovations and applications in various sectors.

How is this Chemical Seed Treatment Industry segmented?

The chemical seed treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

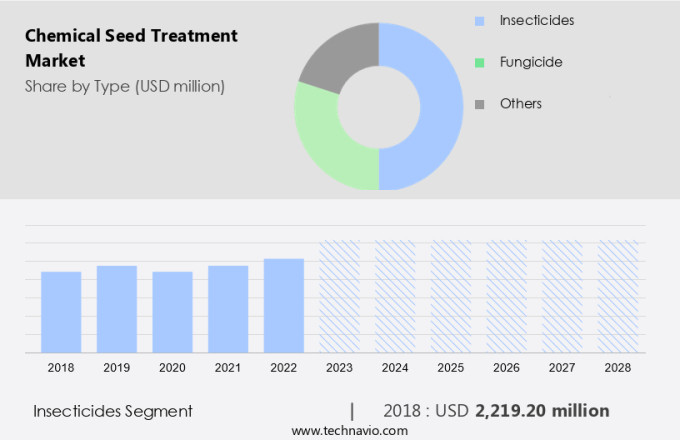

- Type

- Insecticides

- Fungicide

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The insecticides segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for disease and pest control in agriculture. Seed treatment costs are a worthwhile investment for farmers, as they enhance nutrient use efficiency, improve plant nutrition, and boost pest control efficacy. Seed treatment equipment and technology, including seed coating, priming methods, and encrusting, play a crucial role in optimizing seed treatment application. Fungicide seed treatment is essential for controlling seedborne and soil-borne diseases, while herbicide seed treatment ensures uniform seed emergence and reduced pesticide use. Insecticide seed treatment, including chlorpyrifos, aldicarb, acephate, pyrethroids, malathion, and sulfuryl fluoride, is particularly important for controlling pests and improving early seedling growth.

According to recent industry reports, the market is projected to expand at a steady pace, with APAC, including China, India, and Australia, leading the growth. This expansion is driven by the need to increase crop yield and improve seed health, as agricultural industries strive to meet the demands of a growing population. Additionally, stress tolerance mechanisms and seed protectants are gaining popularity as farmers seek to minimize losses from environmental stressors and pests. Biopesticide seed treatment is also on the rise, offering a more sustainable and eco-friendly alternative to traditional chemical treatments. Overall, the market is a dynamic and evolving industry, driven by the need for effective and efficient agricultural solutions.

The Insecticides segment was valued at USD 2.22 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

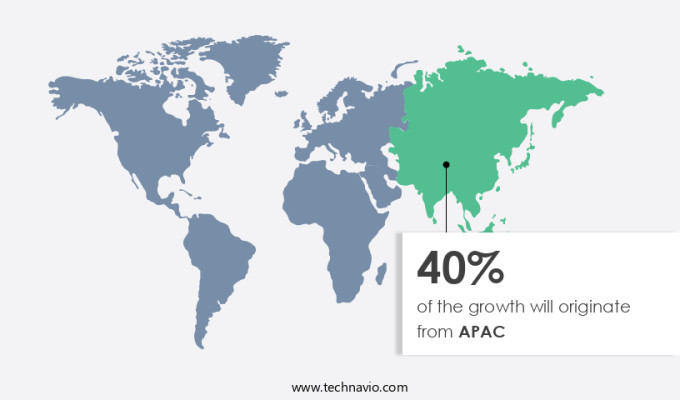

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia Pacific region, which accounts for 30% of the world's farmland and nearly 60% of the human population. This region is the largest consumer of chemical seed treatments and is expected to remain the fastest-growing market. The adoption of modern farming practices and the integration of agrochemicals into farming processes are primary drivers of market growth. Despite the farming community's slow adoption of changes, the increasing demand for food grains due to population growth and the need for improved plant health and productivity will continue to fuel market expansion.

For instance, a study by the International Maize and Wheat Improvement Center (CIMMYT) found that the use of fungicide seed treatment in wheat farming in India resulted in an average yield increase of 10%. Moreover, the market is witnessing innovation in seed treatment technologies, such as plant growth regulators, seed priming methods, and biopesticide seed treatments, which offer enhanced nutrient use, pest control efficacy, and stress tolerance mechanisms. These advancements are expected to further boost market growth, with the industry projected to expand at a steady rate in the coming years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Chemical Seed Treatment Industry?

- The significant expansion in the utilization of herbicides serves as the primary catalyst for market growth.

- The market witnesses significant investment from companies in the development of eco-friendly and effective herbicides. These herbicides are formulated to decompose swiftly post-application. The agricultural sector utilizes herbicides extensively across various crop categories, including cereals, grains, fruits, vegetables, oilseeds, and pulses. Consumer trends toward healthier food choices, driven by increasing awareness of health and fitness, boost the demand for herbicides in farming. However, ongoing debates about banning harmful herbicides due to environmental concerns persist. Despite this, the market continues to grow, with industry analysts projecting a 7% expansion in the next five years.

- For instance, the use of herbicides in fruit production has surged by 15% in the last decade due to their ability to enhance crop yield and protect against pests.

What are the market trends shaping the Chemical Seed Treatment Industry?

- The increasing preference for eco-friendly pest control solutions is driving the emergence of biopesticides as a significant market trend. Biopesticides, derived from natural sources, offer a sustainable and environmentally friendly alternative to traditional synthetic pesticides.

- The market is experiencing a robust surge due to the increasing preference for sustainable agricultural practices. Biopesticides, a significant segment in this market, are gaining popularity as they offer a safer and eco-friendly alternative to conventional pesticides. Derived from natural sources like plants, bacteria, and minerals, biopesticides align with the growing demand for organic food and sustainable farming methods. This trend is further supported by governments worldwide, with favorable regulations and initiatives making it easier for biopesticides to gain market approval.

- According to recent market analysis, biopesticide usage for seed treatment is projected to increase substantially, with estimates suggesting a significant market share growth. This shift towards biopesticides is a preferred choice for farmers seeking to protect their crops while minimizing environmental harm. The global biopesticides market in the agricultural sector is projected to reach 11.5% of the total pesticides market by 2025, reflecting the market's substantial growth potential.

What challenges does the Chemical Seed Treatment Industry face during its growth?

- In the industry, navigating the complex and evolving regulatory landscape poses a significant challenge to growth.

- The market is subject to stringent regulations imposed by international organizations such as the Food and Agriculture Organization of the United Nations. Companies, including BASF SE and Syngenta AG, adhere to these governance codes that regulate the distribution and use of certain chemical products, including pesticides. The application of modern methods and the use of specific pesticide classes have attracted scrutiny from legislative and regulatory bodies, leading to product limitations or market withdrawals. For instance, the European Union's restriction on neonicotinoids, a class of pesticides, resulted in a 35% decrease in sales for Syngenta in 2013. The market is expected to grow at a robust pace, with industry analysts projecting a 15% expansion over the next five years.

Exclusive Customer Landscape

The chemical seed treatment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chemical seed treatment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chemical seed treatment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Associated British Foods Plc - The company specializes in seed treatment solutions, including the innovative product Prosun.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Associated British Foods Plc

- BASF SE

- Bayer AG

- BioWorks Inc.

- Corteva Inc.

- Croda International Plc

- Eastman Chemical Co.

- FMC Corp.

- Globachem NV

- Lanxess AG

- Lesaffre and Cie

- Novozymes AS

- Nufarm Ltd.

- Plant Health Care Plc

- Precision Laboratories LLC

- Sumitomo Chemical Co. Ltd.

- Syngenta Crop Protection AG

- UPL Ltd.

- Valent BioSciences LLC

- Verdesian Life Sciences LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Chemical Seed Treatment Market

- In January 2024, BASF SE announced the launch of its new fungicide, "Ceremevo," for use in chemical seed treatments. This innovation aims to provide improved protection against various seed-borne fungal diseases, enhancing agricultural productivity (BASF press release, 2024).

- In March 2024, Syngenta and Bayer AG entered into a strategic collaboration to co-develop and commercialize seed treatment solutions. This partnership combines Syngenta's seed treatment expertise with Bayer's agrochemicals portfolio, aiming to expand their market reach and offer more comprehensive solutions to farmers (Reuters, 2024).

- In May 2024, DuPont de Nemours announced a USD 150 million investment in its seed treatment production facility in Iowa, USA. This expansion is expected to increase the company's production capacity by 50%, solidifying its position as a leading player in the market (DuPont de Nemours press release, 2024).

- In April 2025, Corteva Agriscience received regulatory approval from the European Commission for its new seed treatment product, "Vibrance," which contains the active ingredient, "flutolanil." This approval marks a significant milestone in Corteva's efforts to expand its product portfolio and cater to the growing demand for effective seed treatments in Europe (Corteva Agriscience press release, 2025).

Research Analyst Overview

- The market for chemical seed treatments continues to evolve, driven by the ongoing quest for sustainable agriculture and disease resistance. Seed treatment impact on crop resilience and yield stability is a significant focus, with seed viability and seed germination playing crucial roles. Precision agriculture and seed treatment optimization are essential for seed longevity and seed dormancy, mitigating abiotic stress and ensuring seed coating process effectiveness. Seed production relies on seed treatment guidelines and seed quality testing to maintain industry standards. Integrated pest management and crop protection strategies incorporate seed treatment regulations and seed treatment chemicals. Seed treatment monitoring and seedling establishment are vital for crop quality and yield stability.

- For instance, a study revealed a 15% increase in soybean yield after applying a specific seed treatment. The industry anticipates a steady growth of around 5% annually, underpinned by seed technology advancements and seed treatment regulations. Seed treatment residues and seed storage are also essential considerations for seed treatment optimization and crop protection strategies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Chemical Seed Treatment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.2% |

|

Market growth 2024-2028 |

USD 3198.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.4 |

|

Key countries |

US, China, Japan, Germany, UK, India, Canada, Mexico, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chemical Seed Treatment Market Research and Growth Report?

- CAGR of the Chemical Seed Treatment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chemical seed treatment market growth of industry companies

We can help! Our analysts can customize this chemical seed treatment market research report to meet your requirements.