China HVAC Equipment Market Size 2024-2028

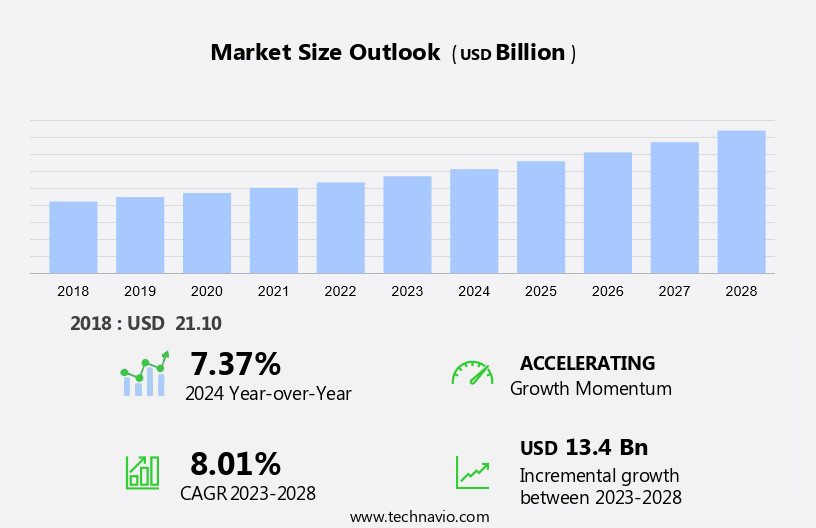

The China HVAC equipment market size is forecast to increase by USD 13.4 billion, at a CAGR of 8.01% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for centralized heating, ventilation, and air conditioning systems. This trend is being fueled by the country's rapid urbanization and infrastructure development, as well as the growing awareness of indoor air quality and energy efficiency. Furthermore, the advent of smart HVAC systems is transforming the market, offering enhanced comfort, convenience, and energy savings to consumers. Another trend is the advent of smart HVAC systems, which offer advanced features such as remote monitoring, automation, and energy management, making them increasingly popular among consumers. However, the market also faces challenges, including frequent failure issues with HVAC equipment due to the harsh climate and poor maintenance practices. Companies seeking to capitalize on the market opportunities must focus on providing reliable, high-quality products and services, while also addressing the challenges through innovative solutions and robust after-sales support.

- Additionally, partnerships and collaborations with local players can help international companies navigate the complex regulatory environment and build a strong market presence. Overall, the market presents significant growth potential, with opportunities for companies to differentiate themselves through technology, innovation, and customer service.

What will be the size of the China HVAC Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The market is witnessing significant advancements, driven by the integration of smart technologies and sustainable practices. Wireless communication and CFD modeling enable remote monitoring and optimization of HVAC systems, while smart building technology enhances energy efficiency and thermal comfort. Building envelope design focuses on reducing energy consumption, and machine learning algorithms facilitate predictive analytics for performance monitoring. Noise control and vibration reduction ensure occupant comfort, and refrigerant recovery systems promote carbon footprint reduction. Hybrid HVAC systems, including heat recovery units and variable speed drives, optimize energy usage and improve overall system efficiency.

- AI and energy modeling facilitate net zero energy buildings, and refrigerant leak detection systems ensure regulatory compliance. Predictive analytics and performance monitoring are essential for maintaining optimal HVAC system functionality and reducing maintenance costs.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Non-residential

- Residential

- Product

- Air conditioning equipment

- Heating equipment

- Ventilation equipment

- Geography

- APAC

- China

- APAC

By End-user Insights

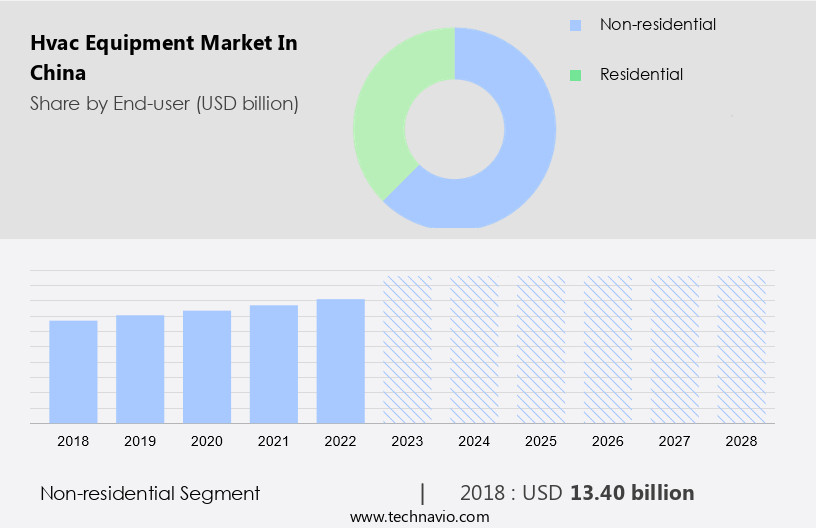

The non-residential segment is estimated to witness significant growth during the forecast period.

The non-residential HVAC market in China is witnessing significant growth, driven by the expansion of manufacturing facilities, commercial and industrial buildings, data centers, retail stores, healthcare institutions, and educational institutions. Compliance with energy efficiency regulations and the increasing need for sustainable and eco-friendly solutions are key factors influencing the market. The commercial segment dominates the HVAC equipment market, accounting for a substantial revenue share. Energy efficiency is a top priority for commercial entities, as HVAC and lighting systems consume a considerable portion of energy in commercial buildings. In response, HVAC equipment manufacturers in China are focusing on developing energy-efficient systems that adhere to both national and international regulations.

Split systems, heat pumps, and ducted systems are popular choices for commercial applications due to their energy efficiency and cost-effectiveness. The integration of IoT technology, data analytics, and smart HVAC systems is also gaining traction, enabling remote monitoring and optimization of energy consumption. Maintenance contracts and certification bodies play a crucial role in ensuring the safety and performance of HVAC systems. LEED certification and Ashrae standards are widely adopted in China, emphasizing the importance of energy efficiency and indoor air quality. Industrial HVAC systems, geothermal HVAC, and renewable energy integration are emerging trends in the market.

R-410a refrigerant and HSPF rating are essential considerations for heating systems. HVAC training, installation services, and ventilation systems are essential components of the HVAC value chain. Air filters, green building standards, and solar HVAC are other factors influencing the market dynamics. Cooling towers, HVAC design, and rooftop units are essential components of large-scale commercial and industrial HVAC systems. Safety standards and certification bodies play a crucial role in ensuring the safety and performance of HVAC systems. Demand response programs and building codes are regulatory initiatives aimed at reducing energy consumption and promoting energy efficiency. Data centers and hospitality sectors are significant consumers of HVAC equipment, requiring specialized solutions to maintain optimal temperature and humidity levels.

In conclusion, the market is evolving, with a focus on energy efficiency, sustainability, and regulatory compliance. The market is driven by the increasing construction activities in the non-residential sector and the need for cost-effective and energy-efficient solutions. HVAC equipment companies must adapt to these trends to remain competitive in the market.

The Non-residential segment was valued at USD 13.40 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the China HVAC Equipment Market drivers leading to the rise in adoption of the Industry?

- The centralized HVAC systems market is driven primarily by the rising demand for these systems due to their energy efficiency, cost-effectiveness, and ability to provide consistent temperature control in large buildings.

- Centralized HVAC systems are essential for both retail and commercial buildings in China, providing simultaneous cooling or heating to multiple rooms through a single base location. The systems draw in ambient air from each room using return-air ducts and filter it to remove impurities such as allergens, dust, pet dander, and pollen. The filtered air is then redistributed through separate ducts. Key components of centralized HVAC systems include air handler units (AHUs), air distribution ducts, and cooling towers for large-scale commercial applications.

- Commercial HVAC systems may also incorporate solar panels for energy efficiency and green building standards compliance. HVAC design and installation services are in high demand to ensure optimal system performance and energy savings. HVAC technicians are trained to install and maintain these complex systems, including packaged units and cooling towers. Air filters are a crucial aspect of HVAC maintenance, ensuring indoor air quality and occupant comfort.

What are the China HVAC Equipment Market trends shaping the Industry?

- The emergence of advanced HVAC systems represents a significant market trend. Smart HVAC technologies, which include energy efficiency, automation, and remote control, are increasingly popular solutions for both residential and commercial applications.

- Smart HVAC systems represent the future of heating, ventilation, and air conditioning (HVAC) engineering, offering users advanced control and energy savings. Unlike traditional systems, these intelligent technologies enable remote control via smartphones, tablets, or desktops. They provide more user-friendly and accessible options, allowing for more efficient temperature management and potential energy cost reductions of up to 13% per month. Additionally, smart HVAC systems incorporate sensors to prevent costly breakdowns. Compliance with safety and performance standards, such as those set by ASHRAE and certification bodies, is essential for these systems.

- Furthermore, smart HVAC systems can be integrated with renewable energy sources, making them an eco-friendly solution for buildings. In summary, smart HVAC systems offer enhanced control, energy savings, and compatibility with safety standards and renewable energy integration.

How does China HVAC Equipment Market face challenges during its growth?

- The growth of the HVAC industry is significantly impacted by the challenges posed by equipment failures. This issue, which is of great concern to industry professionals, necessitates continuous efforts to improve system reliability and maintenance practices.

- The market encompasses a range of heating and cooling systems for residential and non-residential applications. These systems incorporate advanced software, electrical, and mechanical components for optimal functionality. However, the complexity of modern HVAC units also increases the likelihood of component failure, potentially impacting system performance and energy efficiency. Common issues include worn-out or dirty filters, which can strain the system and raise energy costs. To mitigate these challenges, regular maintenance, such as energy audits and demand response programs, is essential.

- LEED certification and building codes prioritize energy efficiency, driving demand for high-SEER rating HVAC systems. Split systems and heat pumps are popular choices due to their energy savings and versatility. Data analytics plays a crucial role in optimizing HVAC performance and identifying potential issues before they escalate. Overall, addressing these concerns promptly is vital to ensure the longevity and efficiency of HVAC equipment.

Exclusive China HVAC Equipment Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Carrier Global Corp.

- Daikin Industries Ltd.

- Fujitsu Ltd.

- Gree Electric Appliances Inc. of Zhuhai

- GUANGDONG CHIGO AIR CONDITIONING CO. LTD.

- Guangzhou Seagull Kitchen And Bath Products Co. Ltd.

- Haier Smart Home Co. Ltd.

- Hitachi Ltd.

- Johnson Controls International Plc.

- Lennox International Inc.

- LG Corp.

- MIDEA Group Co. Ltd.

- Mitsubishi Electric Corp.

- Paloma Co. Ltd.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Shanghai Shenglin M and E Technology Co. Ltd.

- TCL Electronics Holdings Ltd.

- Toshiba Corp.

- Trane Technologies plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hvac Equipment Market In China

- In January 2023, Chinese HVAC giant, Midea Group, announced the launch of its new high-efficiency air conditioner series, the "Green HVAC," which utilizes R32 refrigerant and features an energy efficiency rating of up to 7.5 HSPF and 23.5 SEER (Midea Group press release). This innovative product line is expected to significantly reduce carbon emissions and contribute to China's commitment to reducing greenhouse gas emissions.

- In March 2024, Carrier China, a subsidiary of United Technologies Corporation, formed a strategic partnership with the Chinese e-commerce giant Alibaba, to enhance its online sales and distribution channels (Carrier China press release). This collaboration aims to expand Carrier China's reach and improve customer accessibility to its HVAC products and services.

- In May 2024, Haier, another major Chinese HVAC manufacturer, completed the acquisition of BlueStar, a leading commercial refrigeration equipment provider based in the United States (Haier press release). This acquisition is expected to strengthen Haier's presence in the global commercial refrigeration market and expand its product offerings.

- In July 2025, the Chinese government announced a new policy to encourage the adoption of energy-efficient HVAC systems in residential and commercial buildings, offering subsidies and tax incentives for their installation (China Ministry of Finance press release). This initiative is expected to boost the demand for HVAC equipment in China and contribute to the country's efforts to reduce energy consumption and carbon emissions.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and shifting market dynamics. HVAC engineering firms are at the forefront of this evolution, designing innovative solutions for various sectors, including ventilation systems, window units, and smart HVAC systems. These systems are integrated with cloud-based monitoring, safety standards, and Ashrae standards to optimize energy efficiency and performance. Heating systems are a significant focus, with certification bodies ensuring compliance with safety regulations and HSPF ratings. Renewable energy integration is also gaining momentum, with geothermal HVAC and solar HVAC systems becoming increasingly popular. In the industrial sector, HVAC systems are being integrated with IoT technology and data analytics for improved efficiency and maintenance.

The hospitality and office building sectors are adopting HVAC solutions to meet green building standards and enhance indoor air quality. HVAC training and maintenance contracts are essential for ensuring optimal performance and longevity of these systems. Air filters and data centers are other key applications, with a growing emphasis on energy efficiency and safety. The market for HVAC equipment in China is dynamic and ever-changing, with ongoing activities in HVAC design, installation services, and HVAC technician training. The integration of R-410a refrigerant and demand response systems is also shaping the market landscape. The future of HVAC in China is bright, with continued innovation and growth expected across various sectors.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled HVAC Equipment Market in China insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.01% |

|

Market growth 2024-2028 |

USD 13.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.37 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch