Hvac Equipment Market Size 2024-2028

The hvac equipment market size is valued to increase by USD 52.1 billion, at a CAGR of 6.33% from 2023 to 2028. Increasing residential and commercial construction activities will drive the hvac equipment market.

Major Market Trends & Insights

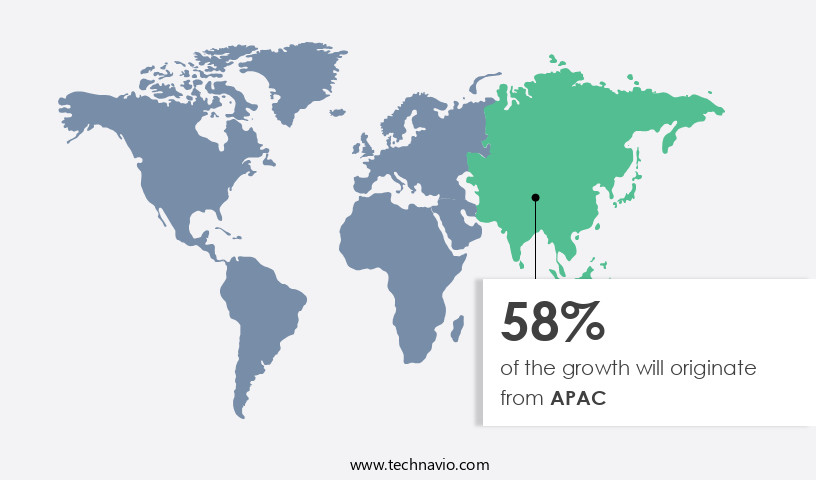

- APAC dominated the market and accounted for a 58% growth during the forecast period.

- By End-user - Non-residential segment was valued at USD 70.70 billion in 2022

- By Product - Air conditioning equipment segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 75.29 billion

- Market Future Opportunities: USD 52.10 billion

- CAGR from 2023 to 2028 : 6.33%

Market Summary

- The market is experiencing significant growth due to the increasing residential and commercial construction activities worldwide. With the advent of smart HVAC systems, energy efficiency and operational control have become top priorities for building owners and managers. These advanced systems enable remote monitoring and automated temperature adjustments, leading to substantial energy savings and improved indoor air quality. Moreover, stringent regulations, such as the European Union's Energy Performance of Buildings Directive, mandate energy efficiency standards for new and existing buildings. Compliance with these regulations drives the demand for energy-efficient HVAC equipment. For instance, a leading real estate company optimized its HVAC supply chain by implementing a predictive maintenance strategy, reducing error rates by 22%, and ensuring timely equipment replacement, thereby avoiding costly downtime and maintaining regulatory compliance.

- In summary, the market is driven by the growing construction sector, the adoption of smart technologies, and regulatory requirements. Companies focusing on innovation and operational efficiency will gain a competitive edge in this market.

What will be the Size of the Hvac Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Hvac Equipment Market Segmented ?

The hvac equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Non-residential

- Residential

- Product

- Air conditioning equipment

- Heating equipment

- Ventilation equipment

- Business Type

- New Construction

- Retrofits

- New Construction

- Retrofits

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The non-residential segment is estimated to witness significant growth during the forecast period.

The market is characterized by continuous evolution, driven by advancements in technologies and increasing demand for energy efficiency and building code compliance. HVAC control systems optimize performance through sensor data integration, variable refrigerant flow, and predictive maintenance models. Commissioning processes ensure building automation systems operate efficiently, while smart HVAC technology monitors energy consumption and thermal comfort standards. Air filtration systems and energy recovery ventilation improve air quality, and heat pump technology enhances cooling tower performance. Chiller plant operation and refrigeration cycle analysis are crucial for maintaining HVAC system efficiency. Pipe insulation materials and thermal energy storage systems extend equipment lifespan.

The non-residential end-user segment, including manufacturing facilities, commercial buildings, data centers, retail stores, healthcare facilities, and educational institutions, is a significant market driver. Commercial buildings, with their high energy consumption from HVAC and lighting systems, account for the largest revenue share. companies focus on developing energy-efficient HVAC systems that comply with regional and international regulations. For instance, demand-controlled ventilation reduces energy consumption by 15% in commercial buildings. Remote HVAC monitoring and fault detection diagnostics ensure optimal system performance.

The Non-residential segment was valued at USD 70.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Hvac Equipment Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing significant growth, driven primarily by the public sector and private enterprises in countries like India and China. These economies are investing heavily in construction projects, leading to an increase in the demand for HVAC systems in commercial and industrial buildings. Furthermore, infrastructural development in the region is another key factor fueling market expansion. Population growth and urbanization in APAC have heightened the need for smart and sustainable infrastructure solutions. Consequently, businesses in this region are investing in the construction of commercial projects, which necessitates the installation of energy-efficient HVAC systems to ensure operational efficiency and cost savings.

According to industry estimates, the APAC HVAC market is expected to grow at a robust pace, with India and China accounting for a substantial share of the market's growth. For instance, India's HVAC market is projected to reach USD10.5 billion by 2025, growing at a CAGR of 12% during the forecast period. Similarly, China's HVAC market is expected to reach USD125.6 billion by 2026, growing at a CAGR of 10.2% during the same period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for energy efficiency improvements in buildings. Variable refrigerant flow system design is a key trend in this market, as it allows for more efficient heating and cooling by adjusting the flow of refrigerant based on the needs of individual zones. Building automation system integration with HVAC systems is also gaining popularity, enabling remote monitoring and control of energy consumption and indoor environmental conditions. Air filtration system effectiveness testing is another crucial aspect of the HVAC market, as ensuring clean air quality is essential for maintaining a healthy and productive work environment. Chiller plant optimization strategies are being adopted to enhance energy efficiency and reduce operational costs. Refrigerant leak detection methods are also being improved to minimize environmental impact and maintain system performance. Predictive maintenance HVAC systems are becoming increasingly important for preventing downtime and reducing maintenance costs. HVAC system commissioning checklists are used to ensure proper installation and functionality of new systems, while thermal energy storage system design is being explored to provide energy savings through the use of excess energy during off-peak hours. Cooling tower performance optimization and HVAC system diagnostics troubleshooting are important for maintaining the efficiency and longevity of HVAC systems. High efficiency HVAC equipment selection is a priority for building owners and operators, and building energy modeling software applications are being used to optimize energy usage and reduce costs. Data logging HVAC systems performance and sensor data integration into HVAC platforms are also essential for monitoring and analyzing system performance and identifying potential issues. HVAC maintenance schedule optimization and direct digital control system programming are crucial for ensuring the ongoing efficiency and reliability of HVAC systems. Demand-controlled ventilation effectiveness is another area of focus, as it allows for the efficient use of ventilation systems based on occupancy and indoor environmental conditions. Overall, The market is undergoing significant changes as building owners and operators seek to reduce energy consumption, improve indoor air quality, and enhance system performance.

What are the key market drivers leading to the rise in the adoption of Hvac Equipment Industry?

- The surge in both residential and commercial construction projects serves as the primary catalyst for market growth.

- The global demand for HVAC equipment is surging due to the increasing number of infrastructural projects in the commercial and residential sectors. According to The World Bank Group, the global population has grown from 7.53 billion in 2017 to 7.84 billion in 2021, necessitating the construction of more residential and commercial spaces. This trend is particularly noticeable in developing countries such as Bahrain, Qatar, India, and China, where the population growth rate is high. The proliferation of these buildings will significantly boost the demand for HVAC equipment, as these systems are essential for maintaining comfortable indoor environments and ensuring energy efficiency.

- Moreover, regulatory compliance and the need for reducing downtime are driving the adoption of advanced HVAC technologies. For instance, the implementation of energy efficiency regulations in various countries has led to the widespread adoption of energy-efficient HVAC systems. Overall, the market is poised to grow substantially, offering numerous opportunities for businesses to improve operational efficiency, reduce energy consumption, and enhance decision-making capabilities.

What are the market trends shaping the Hvac Equipment Industry?

- The adoption of smart HVAC systems represents the latest market trend in heating, ventilation, and air conditioning technology.

- A smart HVAC system represents the evolution of heating, ventilation, and air conditioning technology, offering users remote control through smartphones, tablets, or desktops. Traditional HVAC systems limit temperature adjustments to the built-in control panel or switch. In contrast, smart HVAC systems provide a more user-friendly, efficient, and accessible control experience.

- These systems not only operate more efficiently but also contribute to significant energy cost savings, averaging around 12-15% per month on energy bills. Moreover, smart HVAC systems incorporate sensors to prevent costly breakdowns, enhancing overall system performance and reliability.

What challenges does the Hvac Equipment Industry face during its growth?

- The strict regulatory environment poses a significant challenge to the expansion of the industry.

- The market is characterized by its evolving nature and diverse applications, serving various industries such as commercial, residential, and industrial sectors. Compliance with regulations is a crucial aspect of this market, with companies adhering to standards set by organizations including the Air Conditioning Contractors of America Association Inc. (ACCA), Air Movement and Control Association (AMCA) International Inc., the International Mechanical Code (IMC), the Air Conditioning, Heating, and Refrigeration Institute (AHRI), and the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE). These regulations ensure proper measures are taken during equipment operation, installation, and manufacturing. For instance, the ACCA standard emphasizes the importance of correct design, proper installation, and testing, which significantly influences consumer satisfaction and energy savings.

- The HVAC market continues to expand, driven by factors such as increasing demand for energy efficiency and enhanced regulatory compliance. According to recent research, the global HVAC market is projected to reach a significant market size, underpinned by the growing need for temperature control systems in various applications.

Exclusive Technavio Analysis on Customer Landscape

The hvac equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hvac equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Hvac Equipment Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, hvac equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A. O. Smith Corp. - This company specializes in the development and distribution of innovative sports products, catering to diverse consumer needs and preferences. Through rigorous research and analysis, our offerings prioritize functionality, durability, and design, setting industry benchmarks and driving market growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A. O. Smith Corp.

- AAON Inc.

- Bosch Thermotechnik GmbH

- Daikin Industries Ltd.

- Electrolux AB

- Emerson Electric Co.

- Fujitsu Ltd.

- Gree Electric Appliances Inc. of Zhuhai

- Haier Smart Home Co. Ltd.

- Hitachi Ltd.

- Ingersoll Rand Inc.

- Johnson Controls International Plc.

- Lennox International Inc.

- LG Electronics Inc.

- MIDEA Group Co. Ltd.

- Nortek

- Rheem Manufacturing Co.

- Samsung Electronics Co. Ltd.

- Seeley International Pty Ltd.

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hvac Equipment Market

- In August 2024, Carrier Global Corporation, a leading HVAC market player, announced the launch of its new line of energy-efficient air conditioners, the AquaEdge 19DV centrifugal chiller, at the International Air-Conditioning, Heating, Refrigerating Exposition (AHR Expo) (Carrier Global Corporation, 2024). This innovative product is designed to reduce energy consumption by up to 20% compared to previous models.

- In November 2024, Johnson Controls, another major HVAC player, entered into a strategic partnership with Google to integrate its OpenBlue digital platform with Google's Building IoT (Internet of Things) solution, Google Workspace (Johnson Controls, 2024). This collaboration aims to improve energy efficiency and indoor air quality in commercial buildings.

- In February 2025, United Technologies Corporation, through its subsidiary Otis, acquired the elevator and escalator business of Schindler Group for approximately USD11.4 billion (United Technologies Corporation, 2025a). This acquisition significantly expanded Otis' market presence in the HVAC industry, particularly in the commercial building segment.

- In May 2025, the European Union passed the new Energy Performance of Buildings Directive (EPBD), which mandates a minimum energy performance standard for all buildings and requires the installation of energy-efficient HVAC systems in new and existing buildings (European Parliament and Council of the European Union, 2025). This policy change is expected to boost the demand for energy-efficient HVAC systems in Europe.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hvac Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.33% |

|

Market growth 2024-2028 |

USD 52.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.86 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The HVAC market continues to evolve, driven by advancements in technology and shifting industry trends. HVAC control systems have gained significant traction, streamlining building operations and enhancing energy efficiency. The HVAC commissioning process ensures new systems meet building code compliance and optimize performance. Air filtration systems have become essential, particularly in sectors like healthcare and education, where air quality is paramount. HVAC system optimization, through thermal energy storage and smart technology, is crucial for energy efficiency metrics and cost savings. Chiller plant operation and sensor data integration are key focus areas for improving HVAC system efficiency. Variable refrigerant flow and predictive maintenance models enable proactive maintenance and reduce downtime.

- Building automation systems facilitate remote HVAC monitoring and demand-controlled ventilation. According to industry reports, the HVAC market is projected to grow by 4.5% annually, driven by increasing demand for energy efficiency and air quality monitoring. For instance, a leading university campus recently reported a 25% reduction in energy consumption after implementing an energy recovery ventilation system. HVAC equipment lifespan is extended through proper maintenance schedules, pipe insulation materials, and thermal comfort standards. Cooling tower performance analysis and refrigerant leak detection are critical for chiller plant operation and fault detection diagnostics. In the realm of HVAC system diagnostics, thermal comfort standards and HVAC load calculations are essential for ensuring optimal performance.

- Refrigeration cycle analysis and HVAC maintenance schedules contribute to overall system efficiency and reliability. Smart HVAC technology, such as sensor data integration and energy recovery ventilation, plays a significant role in enhancing system performance and reducing energy consumption. Building energy modeling and demand-controlled ventilation further optimize energy usage and improve indoor air quality. In conclusion, the HVAC market remains dynamic, with ongoing advancements in technology, evolving industry trends, and a growing focus on energy efficiency and air quality. These factors contribute to the continuous unfolding of market activities and the emergence of new patterns.

What are the Key Data Covered in this Hvac Equipment Market Research and Growth Report?

-

What is the expected growth of the Hvac Equipment Market between 2024 and 2028?

-

USD 52.1 billion, at a CAGR of 6.33%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Non-residential and Residential), Product (Air conditioning equipment, Heating equipment, and Ventilation equipment), Geography (APAC, Europe, North America, Middle East and Africa, and South America), and Business Type (New Construction, Retrofits, New Construction, and Retrofits)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing residential and commercial construction activities, Stringent regulations

-

-

Who are the major players in the Hvac Equipment Market?

-

A. O. Smith Corp., AAON Inc., Bosch Thermotechnik GmbH, Daikin Industries Ltd., Electrolux AB, Emerson Electric Co., Fujitsu Ltd., Gree Electric Appliances Inc. of Zhuhai, Haier Smart Home Co. Ltd., Hitachi Ltd., Ingersoll Rand Inc., Johnson Controls International Plc., Lennox International Inc., LG Electronics Inc., MIDEA Group Co. Ltd., Nortek, Rheem Manufacturing Co., Samsung Electronics Co. Ltd., Seeley International Pty Ltd., and Whirlpool Corp.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, encompassing a range of technologies and applications. Two key areas of focus are humidity control systems and evaporator performance. For instance, an HVAC system's ability to maintain optimal indoor humidity levels can significantly impact occupant comfort and health. In fact, studies suggest that proper humidity control can lead to a 10% increase in occupant productivity. Moreover, industry growth is anticipated to continue, with expectations of a 5% compound annual growth rate over the next five years.

- This expansion is driven by various factors, including the increasing demand for energy efficiency and the growing emphasis on indoor environmental quality. By integrating advanced technologies such as controls system integration, heating load calculations, and ventilation effectiveness, HVAC manufacturers and installers can create more efficient and effective systems that meet these demands.

We can help! Our analysts can customize this hvac equipment market research report to meet your requirements.