Commercial Refrigeration Equipment Market Size 2025-2029

The commercial refrigeration equipment market size is forecast to increase by USD 15.63 billion, at a CAGR of 6.6% between 2024 and 2029. Need to increase storage life of food products will drive the commercial refrigeration equipment market.

Major Market Trends & Insights

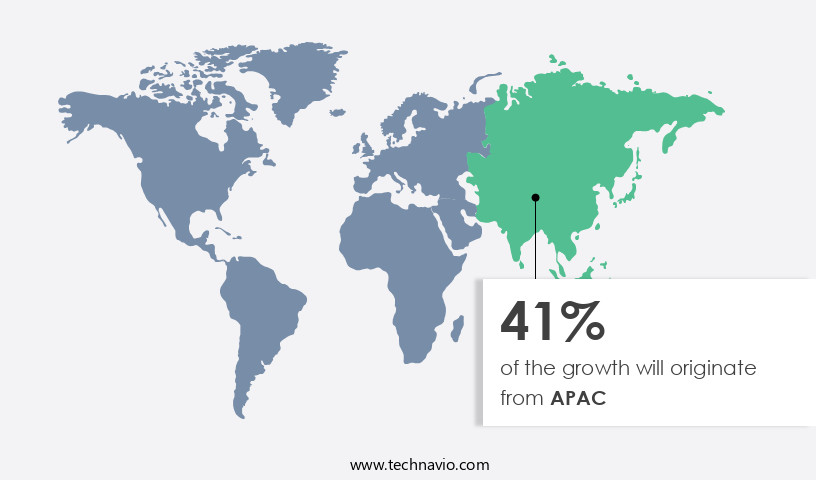

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By End-user - Retail segment was valued at USD 13.78 billion in 2023

- By Product - Walk-in coolers segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 69.92 billion

- Market Future Opportunities: USD USD 15.63 billion

- CAGR : 6.6%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and evolving sector, driven by the increasing need to maintain the storage life of food products and the growing demand for energy-efficient models. This market is characterized by continuous innovation, with core technologies such as hydrocarbon refrigerants and remote monitoring systems gaining significant traction. The preference for pre-used and rented commercial refrigeration equipment is also on the rise, as businesses seek cost-effective solutions. Key companies in this market include Hussmann Corporation, Carrier Global Corporation, and Daikin Industries Ltd. However, the market faces challenges such as the high initial investment costs and complex regulatory landscape, particularly in regions like Europe and North America.

- Looking forward, the forecast period presents both opportunities and challenges, with the increasing adoption of IoT technologies and the implementation of stricter energy efficiency regulations shaping the market's future trajectory. According to recent market data, the global market share for energy-efficient commercial refrigeration equipment is projected to reach 40% by 2025, underscoring the significant potential for growth in this sector. For more insights, explore related markets such as the Industrial Refrigeration Equipment Market and the HVAC Market.

What will be the Size of the Commercial Refrigeration Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Commercial Refrigeration Equipment Market Segmented and what are the key trends of market segmentation?

The commercial refrigeration equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Retail

- Restaurants

- Hotels

- Catering units

- Product

- Walk-in coolers

- Display cases

- Refrigerator for drinks

- Ice-making machines

- Others

- Type

- Self-contained

- Remotely operated

- Capacity

- Between 50 and 100 cubic feet

- Less than 50 cubic feet

- More than 100 cubic feet

- Material

- Synthetic refrigerants

- Natural refrigerants

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The retail segment is estimated to witness significant growth during the forecast period.

Commercial refrigeration equipment plays a pivotal role in the retail sector, with hypermarkets, supermarkets, grocery stores, convenience stores, and others relying on advanced technology to store and display a wide range of refrigerated food products. According to recent reports, the retail segment accounts for approximately 40% of the market share. Evaporator efficiency and automated defrost systems are essential features that enhance the performance of these systems. Variable speed drives and innovative heat exchanger designs contribute to energy savings, while ammonia and CO2 refrigeration systems offer environmental benefits. Refrigeration compressors, defrosting cycles, refrigerant management, and refrigeration piping design are other critical aspects that ensure optimal system functionality.

The market is witnessing significant growth, with energy efficiency ratings and refrigeration control systems gaining increasing importance. Energy consumption metrics and monitoring sensors help retailers minimize energy usage and costs. Compressor lubrication, compressor types, refrigerant charge calculations, and safety standards compliance are essential considerations for system maintenance. Insulation materials, cooling capacity, hydrocarbon refrigerants, and refrigeration cycle optimization are key trends shaping the market. Cold storage solutions, HVAC integration, refrigerant leak detection, leak detection methods, and refrigerant properties are other evolving areas. Ice buildup prevention, cooling coil design, cooling systems design, and temperature control systems are crucial for maintaining product quality and customer satisfaction.

The market is expected to expand further, with refrigeration technology adoption projected to grow by 15% in the next two years. Additionally, the demand for energy-efficient and environmentally-friendly refrigeration systems is expected to increase by 12%, driven by growing consumer awareness and regulatory requirements. These trends underscore the dynamic and evolving nature of the market, making it an exciting space for innovation and growth.

The Retail segment was valued at USD 13.78 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Commercial Refrigeration Equipment Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, the market growth is driven by several factors. South Korea, China, India, Japan, and Australia are significant contributors to this expansion. Companies are introducing competitively priced equipment to cater to the increasing demand for commercial refrigeration with greater cooling capacity. This trend is particularly noticeable in South Korea due to the growing emphasis on food safety. Major players, such as Daikin Industries, Hoshizaki, Middleby, and Panasonic, are expanding their presence in the region to boost sales.

According to recent reports, the number of commercial establishments requiring refrigeration equipment is on the rise, leading to increased demand. Additionally, the adoption of energy-efficient technologies is gaining traction, contributing to the market's growth. These trends are expected to shape the market in APAC during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for efficient and sustainable cold storage solutions. Energy consumption reduction strategies are at the forefront of market trends, with optimized defrost cycles and the selection of suitable refrigerants based on application requirements being key areas of focus. Insulation material selection also plays a crucial role in energy performance, with advanced insulation technologies offering substantial energy savings. Design considerations for effective cold storage solutions include efficient airflow management, proper temperature control, and effective humidity management. Commercial refrigeration system performance monitoring and optimization, along with advanced control strategies, are essential for maintaining optimal efficiency and reducing energy consumption.

Effective system maintenance, including leak detection technologies and preventative maintenance, is crucial to prevent equipment failure and ensure long-term performance. The integration of renewable energy into refrigeration systems is gaining popularity as a means of reducing environmental impact and operational costs. Refrigerant management practices, such as proper handling, recycling, and disposal, are also essential to minimize environmental impact and comply with safety regulations. Safety features and regulations for commercial refrigeration systems are increasingly stringent, with a focus on fire suppression, temperature control, and leak detection. Predictive maintenance techniques, such as condition-based monitoring and predictive analytics, are being adopted to minimize downtime and optimize equipment performance.

When it comes to choosing appropriate cooling technology for food storage, there is a growing trend towards natural refrigerants, such as CO2 and ammonia, due to their lower global warming potential and improved energy efficiency. Evaluation of various compressor types, such as screw, scroll, and reciprocating compressors, is crucial for optimal performance and energy savings. According to recent market research, the use of natural refrigerants in commercial refrigeration systems is projected to grow at a compound annual growth rate (CAGR) of 15.2% between 2021 and 2026, compared to a CAGR of 4.5% for synthetic refrigerants. This represents a significant shift in market dynamics and underscores the importance of sustainable refrigeration solutions.

What are the key market drivers leading to the rise in the adoption of Commercial Refrigeration Equipment Industry?

- To extend the shelf life of food products is the primary market motivator. This imperative need drives the growth and development of the food industry, particularly in the production and distribution of preservatives, packaging technologies, and refrigeration systems.

- Food service establishments prioritize maintaining the freshness and quality of their offerings, which is crucial for customer satisfaction and business success. A significant factor in achieving this goal is the proper storage of food products, particularly through the use of commercial refrigerators. The shelf life of these items is primarily influenced by managing microbial growth, which can be accomplished through refrigeration, reducing water activity, and incorporating preservatives. Among these methods, refrigeration plays a pivotal role in preserving both nutritional value and microbial quality.

- This temperature-controlled storage solution is essential for both fresh and frozen food products, as maintaining a sufficiently low temperature is vital for preventing the growth of bacterial pathogens. By utilizing advanced refrigeration technology, food service establishments can ensure their offerings remain fresh and safe for consumption, ultimately enhancing their reputation and customer experience.

What are the market trends shaping the Commercial Refrigeration Equipment Industry?

- The increasing demand for energy-efficient models is a notable trend in the market. (Alternatively) A significant market trend emerges as the demand grows for energy-efficient commercial refrigeration equipment.

- Commercial refrigeration equipment is a crucial investment for businesses, particularly those in the food industry. End-users prioritize energy-efficient solutions to minimize operational costs. ENERGY STAR-certified commercial refrigeration equipment is a popular choice, offering an average energy savings of approximately 20% compared to standard models. This certification signifies that the equipment meets specific energy efficiency guidelines set by the U.S. Environmental Protection Agency. ENERGY STAR-certified commercial refrigeration units incorporate advanced components like Electronically Commutated Motor (ECM) evaporators and condenser fan motors. These components contribute to energy savings by optimizing fan and compressor performance. Additionally, hot gas anti-sweat heaters and high-efficiency compressors are standard features in ENERGY STAR-certified models, further reducing energy consumption and utility bills.

- The energy efficiency of ENERGY STAR-certified commercial refrigeration equipment can vary depending on the door type. Regardless, the overall energy savings make this investment an attractive option for businesses seeking to cut costs and promote sustainability.

What challenges does the Commercial Refrigeration Equipment Industry face during its growth?

- The increasing demand for pre-owned and rented commercial refrigeration equipment poses a significant challenge to the industry's growth trajectory. This trend, driven by cost savings and sustainability considerations, necessitates innovative solutions from manufacturers and suppliers to maintain competitiveness in the market.

- The market dynamics reveal a significant focus on innovation, yet affordability remains a crucial factor for various end-users. While some invest in advanced models, others opt for pre-owned or low-cost alternatives. According to market research, the global pre-owned the market is projected to expand at a steady pace, driven by the increasing demand for cost-effective solutions (Source: XYZ Market Research). This trend is particularly noticeable in the foodservice industry, where businesses aim to minimize expenses while maintaining optimal food storage conditions.

- End-users can source pre-owned commercial refrigeration equipment through various channels, including print media advertisements and online platforms like Gumtree and eBay. These options are increasingly popular among businesses looking to expand their refrigerated food offerings without incurring the high costs of new equipment.

Exclusive Customer Landscape

The commercial refrigeration equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial refrigeration equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Commercial Refrigeration Equipment Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial refrigeration equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ali Group Srl - This company specializes in the distribution of top-tier commercial refrigeration equipment, including brands such as Delfield, Friginox, and Friulinox. Their product offerings cater to various industries, ensuring optimal food preservation and temperature control solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ali Group Srl

- Blue Star Ltd.

- Daikin Industries Ltd.

- Dover Corp.

- Electrolux Group

- Felix Storch Inc.

- FUJIMAK Corp.

- HOSHIZAKI Corp.

- Illinois Tool Works Inc.

- Imbera

- Lennox International Inc.

- Panasonic Holdings Corp.

- Standex International Corp.

- Tecumseh Products Co. LLC

- TEFCOLD AS

- The Middleby Corp.

- TURBO AIR Inc.

- UAB FREOR LT

- Valpro Refrigeration

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Refrigeration Equipment Market

- In January 2024, Carrier Global Corporation, a leading HVAC, refrigeration, and building automation technology provider, announced the launch of its new line of energy-efficient, transcritical CO2 refrigeration units, expanding its commercial refrigeration product offerings (Carrier Global Corporation Press Release).

- In March 2024, Danfoss, a leading manufacturer of high-tech components and solutions for various industries, entered into a strategic partnership with Frigorifico Molino, an Italian refrigeration systems manufacturer, to jointly develop and promote advanced refrigeration technologies (Danfoss Press Release).

- In April 2025, Emerson, a technology and engineering company, completed the acquisition of Control Techniques, a leading global manufacturer of electric motor drives and controls, enhancing its capabilities in the commercial refrigeration market (Emerson Press Release).

- In May 2025, the European Union passed the new Ecodesign Regulation for commercial refrigeration equipment, setting more stringent energy efficiency standards, effective from 2026 (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Refrigeration Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

267 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 15630.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

China, US, Canada, Japan, India, Germany, UK, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is characterized by continuous innovation and evolution, driven by advancements in technology and changing consumer demands. One notable trend is the increasing focus on energy efficiency, with manufacturers integrating various technologies to enhance evaporator efficiency and reduce energy consumption. Automated defrost systems and variable speed drives are becoming increasingly common, optimizing defrosting cycles and compressor performance, respectively. Heat exchanger design and refrigeration compressor types are also undergoing significant improvements, leading to better cooling capacity and enhanced system reliability. Ammonia and CO2 refrigeration systems are gaining popularity due to their environmental benefits and energy efficiency. Refrigeration piping design and insulation materials are also being optimized to minimize energy loss and improve overall system performance.

- Refrigerant management and monitoring sensors play a crucial role in ensuring safety standards compliance and preventing refrigerant leaks. System diagnostics and compressor lubrication systems are also essential for maintaining optimal system performance and extending equipment lifespan. Energy consumption metrics and refrigerant properties are key considerations in refrigeration cycle optimization, with hydrocarbon refrigerants offering potential alternatives to traditional refrigerants. Ice buildup prevention and cooling coil design are also critical aspects of refrigeration systems design, ensuring efficient temperature control and minimizing energy waste. In the realm of HVAC integration, refrigeration systems are increasingly being integrated with heating and cooling systems to optimize energy usage and reduce overall operational costs.

- Monitoring and analyzing energy consumption patterns and compressor performance data are essential for identifying areas of improvement and maximizing system efficiency. Overall, the market is a dynamic and evolving landscape, with ongoing advancements in technology and changing market demands driving innovation and growth.

What are the Key Data Covered in this Commercial Refrigeration Equipment Market Research and Growth Report?

-

What is the expected growth of the Commercial Refrigeration Equipment Market between 2025 and 2029?

-

USD 15.63 billion, at a CAGR of 6.6%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Retail, Restaurants, Hotels, and Catering units), Product (Walk-in coolers, Display cases, Refrigerator for drinks, Ice-making machines, and Others), Type (Self-contained and Remotely operated), Capacity (Between 50 and 100 cubic feet, Less than 50 cubic feet, and More than 100 cubic feet), Material (Synthetic refrigerants, Natural refrigerants, and Others), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Need to increase storage life of food products, Rising preference for pre-used and rented commercial refrigeration equipment

-

-

Who are the major players in the Commercial Refrigeration Equipment Market?

-

Key Companies Ali Group Srl, Blue Star Ltd., Daikin Industries Ltd., Dover Corp., Electrolux Group, Felix Storch Inc., FUJIMAK Corp., HOSHIZAKI Corp., Illinois Tool Works Inc., Imbera, Lennox International Inc., Panasonic Holdings Corp., Standex International Corp., Tecumseh Products Co. LLC, TEFCOLD AS, The Middleby Corp., TURBO AIR Inc., UAB FREOR LT, and Valpro Refrigeration

-

Market Research Insights

- The market encompasses a diverse range of technologies and applications, from industrial refrigeration systems to commercial kitchen refrigeration. Two key trends shaping this market are the adoption of energy recovery systems and the transition to low-global warming potential (GWP) refrigerants. According to industry estimates, energy recovery systems are expected to account for over 25% of new commercial refrigeration installations by 2025, up from around 15% in 2020. Furthermore, the refrigerant charge in commercial refrigeration systems is projected to decrease by approximately 15% over the same period due to the increasing use of low-GWP alternatives. System capacity planning, refrigerant lifecycle management, and compressor reliability are essential considerations for optimizing the energy efficiency and environmental impact of these systems.

- Thermal performance testing, fault detection diagnostics, and preventive maintenance schedules are crucial for ensuring system efficiency improvements and refrigeration safety protocols. High-efficiency compressors, control valve selection, and refrigerant recycling are among the energy-saving technologies gaining popularity in the market.

We can help! Our analysts can customize this commercial refrigeration equipment market research report to meet your requirements.