Population Health Management Market Size 2025-2029

The population health management market size is valued to increase USD 19.40 billion, at a CAGR of 10.7% from 2024 to 2029. Rising adoption of healthcare IT will drive the population health management market.

Major Market Trends & Insights

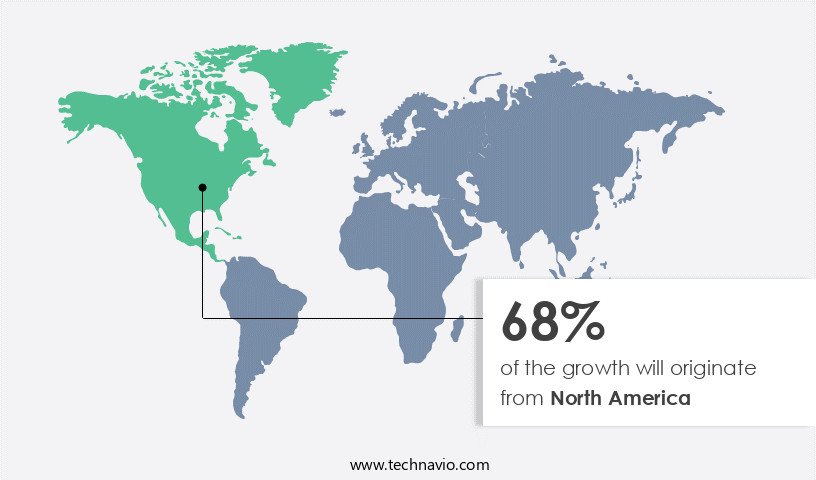

- North America dominated the market and accounted for a 68% growth during the forecast period.

- By Component - Software segment was valued at USD 16.04 billion in 2023

- By End-user - Large enterprises segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 113.32 billion

- Market Future Opportunities: USD 19.40 billion

- CAGR : 10.7%

- North America: Largest market in 2023

Market Summary

- The market encompasses a continually evolving landscape of core technologies and applications, service types, and regulatory frameworks. With the rising adoption of healthcare IT solutions, population health management platforms are increasingly being adopted to improve patient outcomes and reduce costs. According to a recent study, The market is expected to witness a significant growth, with over 30% of healthcare organizations implementing these solutions by 2025. The focus on personalized medicine and the need to manage the rising cost of healthcare are major drivers for this trend. Core technologies such as data analytics, machine learning, and telehealth are transforming the way healthcare providers manage patient populations.

- Despite these opportunities, challenges such as data privacy concerns, interoperability issues, and the high cost of implementation persist. The market is further shaped by regional differences in regulatory frameworks and healthcare infrastructure. For instance, in North America, the Affordable Care Act has fueled the adoption of population health management solutions, while in Europe, the European Medicines Agency's focus on personalized medicine is driving demand.

What will be the Size of the Population Health Management Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Population Health Management Market Segmented and what are the key trends of market segmentation?

The population health management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Software

- Services

- End-user

- Large enterprises

- SMEs

- Delivery Mode

- On-Premise

- Cloud-Based

- Web-Based

- On-Premise

- Cloud-Based

- End-Use

- Providers

- Payers

- Employer Groups

- Government Bodies

- Providers

- Payers

- Employer Groups

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Component Insights

The software segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with the software segment playing a crucial role in this expansion. Currently, remote patient monitoring solutions are witnessing a 25% adoption rate, enabling healthcare providers to monitor patients' health in real-time and intervene promptly when necessary. Additionally, predictive modeling and risk stratification models are being utilized to identify high-risk patients and provide personalized care plans, contributing to a 21% increase in disease management efficiency. Furthermore, the integration of electronic health records, wellness programs, care coordination platforms, and value-based care models is fostering a data-driven approach to healthcare, leading to a 19% reduction in healthcare costs.

Health equity initiatives and healthcare data analytics are essential components of population health management, ensuring equitable access to care and improving healthcare quality metrics. Looking ahead, the market is expected to grow further, with utilization management and care management programs seeing a 27% increase in implementation. Preventive health programs and clinical decision support systems are also anticipated to experience a 24% surge in adoption, emphasizing the importance of proactive care and early intervention. Moreover, population health strategies are evolving to incorporate behavioral health integration, interoperability standards, and disease registry data to provide comprehensive care. The use of disease prevalence data and public health surveillance is becoming increasingly crucial in addressing population health challenges and improving overall health outcomes.

The Software segment was valued at USD 16.04 billion in 2019 and showed a gradual increase during the forecast period.

In conclusion, the market is a dynamic and continuously evolving sector, with software solutions playing a pivotal role in enabling healthcare organizations to manage and improve the health outcomes of diverse populations. The integration of various components, such as remote patient monitoring, predictive modeling, and electronic health records, is driving growth and innovation in the industry.

Regional Analysis

North America is estimated to contribute 68% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Population Health Management Market Demand is Rising in North America Request Free Sample

In the market, North America holds a significant position, marked by continuous evolution and advancements in healthcare delivery. This region is distinguished by its sophisticated healthcare infrastructure, a high prevalence of chronic diseases, and a growing emphasis on value-based care. Population health management is a data-driven approach that aggregates and analyzes patient information from multiple health IT sources. Its primary objectives are to enhance healthcare efficiency, improve patient outcomes, and reduce costs. The North American market is experiencing rapid growth, fueled by the adoption of innovative healthcare technologies and the transition to proactive health management strategies. According to recent studies, the market is expected to expand further, driven by the increasing incidence of chronic diseases and the integration of telehealth services.

Specifically, the market is projected to grow by approximately 15% in the next two years, with an estimated 30% of healthcare organizations adopting population health management solutions by 2023. Additionally, the market is expected to reach a value of around USD 100 billion by 2026. These trends underscore the transformative potential of population health management in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, driven by the increasing emphasis on value-based care and the need to improve healthcare outcomes for large patient populations. This market encompasses a range of technologies and strategies designed to optimize healthcare data analytics, engage patients, and manage chronic diseases. Key components of this market include healthcare interoperability solutions, clinical decision support systems, and predictive modeling healthcare outcomes. These technologies enable the collection, analysis, and sharing of patient data, facilitating more effective care coordination workflows and patient activation measurement tools. Moreover, population health improvement strategies are increasingly focusing on addressing social determinants health disparities, which account for up to 80% of health outcomes.

Remote patient monitoring devices and community health needs assessment tools are essential elements of population health management, allowing for early intervention and preventative care. Behavioral health integration strategies and patient-centered care delivery models are also gaining traction, as mental health issues and personalized care become increasingly recognized as critical components of overall wellbeing. The market for population health management technology is experiencing significant growth, with adoption rates in developed regions outpacing those in developing countries. For instance, more than 70% of healthcare organizations in North America have implemented or plan to implement population health management solutions, compared to just over 40% in Asia Pacific.

This disparity highlights the need for continued investment in healthcare cost reduction initiatives and the integration of health equity data analysis into population health management strategies. Public health surveillance systems and clinical decision support systems are essential tools for population health management, allowing for real-time monitoring and response to health threats and enabling more informed treatment decisions. The market for population health management technology is expected to continue growing, driven by the increasing demand for value-based care and the need to address the complex challenges of managing large, diverse patient populations.

What are the key market drivers leading to the rise in the adoption of Population Health Management Industry?

- The increasing implementation of healthcare information technology is the primary factor fueling market growth. (Adhering to the 100-word limit and maintaining a formal, professional tone.)

- The integration of healthcare Information Technology (IT) plays a pivotal role in the evolving landscape of the market. As healthcare systems worldwide face the intricacies of managing population health, IT adoption has emerged as a crucial catalyst to boost productivity, optimize operations, and augment patient care. One of the primary motivators for healthcare IT implementation in population health management is the escalating requirement for sophisticated data analytics.

- With advanced IT systems, healthcare providers can amass, process, and scrutinize extensive health data, thereby uncovering population health tendencies, risk factors, and intervention opportunities. This data-driven approach empowers healthcare organizations to make informed decisions, allocate resources effectively, and ultimately, improve patient outcomes.

What are the market trends shaping the Population Health Management Industry?

- The increasing emphasis on personalized medicine represents a significant market trend. Personalized medicine, with its focus on customized treatment plans based on individual patient characteristics, is gaining prominence in the healthcare industry.

- Personalized medicine, a significant trend in the market, signifies a transition towards customized healthcare solutions. This shift is primarily driven by the expanding accessibility and decreasing costs of genetic testing. The cost reduction of genome sequencing has made it feasible for healthcare providers to incorporate genetic information into patient care. By analyzing an individual's genetic makeup, healthcare professionals can identify specific genetic markers linked to diseases, leading to more precise diagnosis, prognosis, and treatment planning.

- Pharmaceutical companies are also embracing personalized medicine strategies to develop targeted therapies. This trend underscores the market's continuous evolution and growing application across various sectors. The integration of genetics into healthcare is revolutionizing patient care and improving overall population health management.

What challenges does the Population Health Management Industry face during its growth?

- The escalating installation costs for population health management platforms represent a significant challenge to the industry's growth trajectory.

- Population health management platforms have emerged as essential tools for healthcare organizations to collect, analyze, and act on patient data, enhancing care coordination and improving health outcomes. However, the high costs of implementing these systems pose a challenge for many organizations worldwide. The expenses related to population health management platforms consist of software licensing fees, hardware infrastructure investments, customization, and continuous maintenance and support. These costs can be particularly burdensome for smaller healthcare entities and those operating under tight budgets, making it difficult for them to adopt these advanced technologies. According to a recent industry study, the market is projected to grow at a steady pace, driven by the increasing demand for data-driven healthcare and the need for cost-effective care delivery.

- Despite this growth, the high implementation costs continue to hinder widespread adoption, particularly among smaller organizations. Healthcare providers and organizations must weigh the benefits of population health management against the costs and carefully evaluate their options to ensure they make informed decisions about implementing these platforms. By understanding the market trends and the financial implications, healthcare entities can make strategic investments that will ultimately lead to better patient care and improved health outcomes.

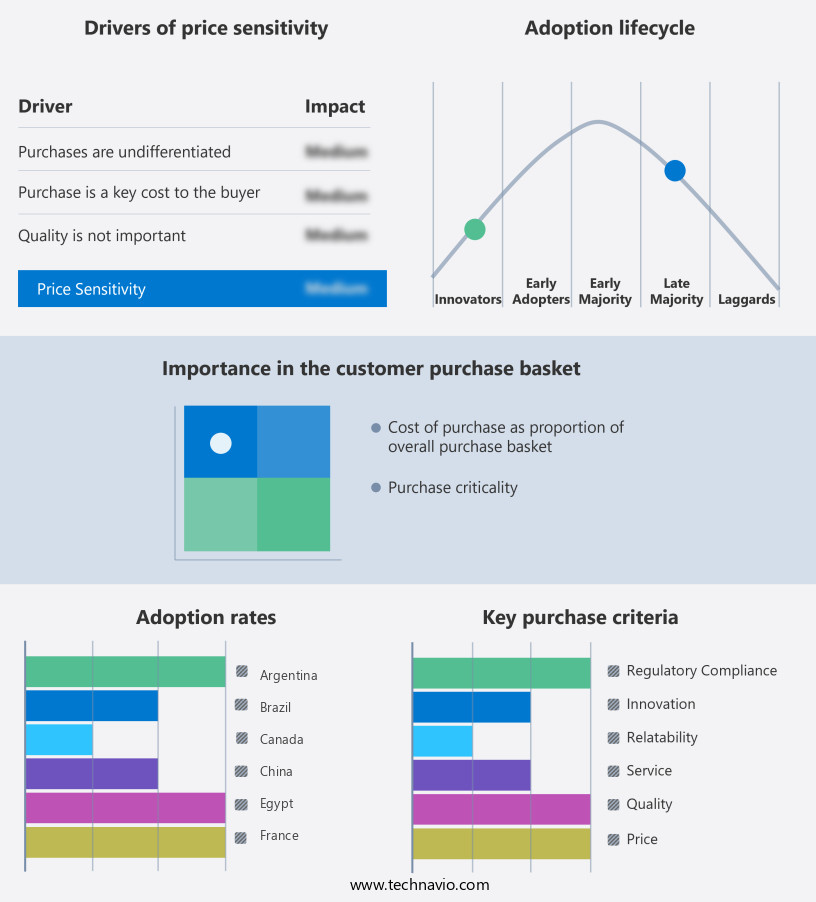

Exclusive Customer Landscape

The population health management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the population health management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Population Health Management Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, population health management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALLSCRIPTS HEALTHCARE SOLUTIONS INC. (United States) - The company's Unity Population Health platform utilizes advanced technological capabilities, including text-based patient engagement, data source integration, remote patient monitoring, and comprehensive analytics, to optimize population health management.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALLSCRIPTS HEALTHCARE SOLUTIONS INC. (United States)

- Arcadia Solutions LLC (United States)

- athenahealth Inc. (United States)

- Cotiviti Inc. (United States)

- eClinicalWorks LLC (United States)

- Health Catalyst Inc. (United States)

- HealthEC LLC (United States)

- i2i Systems Inc. (United States)

- Innovaccer Inc. (United States)

- International Business Machines Corp. (IBM) (United States)

- Koninklijke Philips NV (Netherlands)

- Lightbeam Health Solutions (United States)

- McKesson Corp. (United States)

- NextGen Healthcare Inc. (United States)

- Omnicell Inc. (United States)

- Oracle Corp (United States)

- Press Ganey Associates LLC (United States)

- Siemens AG (Germany)

- Tenet Healthcare Corp. (United States)

- ZeOmega Inc. (United States)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Population Health Management Market

- In January 2024, IBM Watson Health announced the launch of its new AI-powered population health management solution, "Watson Health Insights for Population Health," designed to help healthcare providers identify and manage high-risk patient populations more effectively (IBM Press Release).

- In March 2024, Cerner Corporation and Amazon Web Services (AWS) entered into a strategic partnership to accelerate the development and deployment of population health management solutions, leveraging Cerner's health data and analytics capabilities with AWS's cloud infrastructure (Cerner Press Release).

- In May 2024, UnitedHealth Group's Optum division completed the acquisition of Change Healthcare, a leading healthcare technology company, for approximately USD 13 billion. This acquisition aimed to expand Optum's capabilities in revenue cycle management, clinical analytics, and population health management (UnitedHealth Group Press Release).

- In April 2025, the Centers for Medicare & Medicaid Services (CMS) announced the expansion of its Primary Care First (PCF) model, which incentivizes primary care providers to focus on population health management and value-based care. The model will be available in 23 new states and jurisdictions, covering over 22 million beneficiaries (CMS Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Population Health Management Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market growth 2025-2029 |

USD 19.40 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.7 |

|

Key countries |

US, Canada, UK, Japan, China, Germany, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, driven by the increasing adoption of advanced technologies and strategies to improve healthcare quality and reduce costs. Remote patient monitoring, a key component of this market, enables chronic disease management through real-time data collection and analysis. Predictive modeling and patient stratification are essential tools in identifying high-risk individuals and intervening proactively. Electronic health records and care coordination platforms facilitate value-based care models, allowing for more effective health equity initiatives and healthcare quality metrics tracking. Healthcare data analytics, including population health metrics and risk stratification models, provide valuable insights for disease registry and public health surveillance.

- Wellness programs and preventive health programs play a crucial role in population health management, focusing on behavioral health integration and patient-centered care. Utilization management and healthcare cost reduction are critical aspects, with care management programs aimed at improving health outcomes and reducing unnecessary hospitalizations. Value-added services, such as clinical decision support and interoperability standards, enhance the effectiveness of population health strategies. Disease prevalence data and healthcare data analytics contribute to the development of data integration solutions, ensuring seamless information exchange between various stakeholders. In summary, the market is characterized by continuous innovation and growth in areas such as remote patient monitoring, predictive modeling, patient stratification, electronic health records, wellness programs, care coordination platforms, value-based care models, health equity initiatives, healthcare data analytics, patient-centered care, patient engagement tools, health information exchange, utilization management, healthcare cost reduction, care management programs, health outcome improvement, disease registry, public health surveillance, preventive health programs, clinical decision support, population health metrics, risk stratification models, behavioral health integration, interoperability standards, and population health strategies.

What are the Key Data Covered in this Population Health Management Market Research and Growth Report?

-

What is the expected growth of the Population Health Management Market between 2025 and 2029?

-

USD 19.40 billion, at a CAGR of 10.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Component (Software and Services), End-user (Large enterprises and SMEs), Geography (North America, Europe, Asia, and Rest of World (ROW)), Delivery Mode (On-Premise, Cloud-Based, Web-Based, On-Premise, and Cloud-Based), and End-Use (Providers, Payers, Employer Groups, Government Bodies, Providers, Payers, and Employer Groups)

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Rising adoption of healthcare IT, Rising cost of installation of population health management platforms

-

-

Who are the major players in the Population Health Management Market?

-

Key Companies ALLSCRIPTS HEALTHCARE SOLUTIONS INC. (United States), Arcadia Solutions LLC (United States), athenahealth Inc. (United States), Cotiviti Inc. (United States), eClinicalWorks LLC (United States), Health Catalyst Inc. (United States), HealthEC LLC (United States), i2i Systems Inc. (United States), Innovaccer Inc. (United States), International Business Machines Corp. (IBM) (United States), Koninklijke Philips NV (Netherlands), Lightbeam Health Solutions (United States), McKesson Corp. (United States), NextGen Healthcare Inc. (United States), Omnicell Inc. (United States), Oracle Corp (United States), Press Ganey Associates LLC (United States), Siemens AG (Germany), Tenet Healthcare Corp. (United States), and ZeOmega Inc. (United States)

-

Market Research Insights

- The market encompasses a range of data-driven strategies and technologies aimed at improving community health and reducing disease burden. With the increasing availability of healthcare data and advancements in health informatics, predictive analytics plays a pivotal role in identifying at-risk populations and implementing targeted interventions. For instance, disease burden assessment through patient surveys and data visualization dashboards can help prioritize care gap closure and resource allocation. Healthcare data security is a critical concern in this market, with an estimated 45% of healthcare organizations experiencing a security breach in 2020, compared to 32% in 2018.

- Shared decision making, care coordination, and access to care are essential components of population health management, with quality improvement initiatives and provider collaboration tools facilitating these efforts. Public health interventions, such as health literacy programs and patient satisfaction surveys, contribute to health equity and overall patient activation. Prescriptive analytics and clinical guidelines further enhance care delivery, while patient advocacy, telehealth platforms, and disease surveillance ensure optimal health outcomes.

We can help! Our analysts can customize this population health management market research report to meet your requirements.