Software-Defined Networking (SDN) Market Size 2024-2028

The software-defined networking (SDN) market size is forecast to increase by USD 67.38 billion at a CAGR of 29.04% between 2023 and 2028. The market is experiencing remarkable growth due to several key drivers. First, the increasing adoption of cloud solutions by various industries, including banking, financial services, and insurance (BFSI), is fueling the demand for SDN technology. Second, the proliferation of the Internet of Things (IoT) and edge computing is creating complex network design challenges that SDN is well-positioned to address. Network policies and security configurations can be centrally managed and applied consistently across the organization, ensuring optimal application performance. The BFSI segment, in particular, stands to benefit from SDN's ability to improve network agility and security while reducing operational costs. This trend is expected to continue, making SDN an essential technology for businesses looking to streamline their IT infrastructure and enhance their customer experience. In summary, the SDN market is witnessing substantial growth due to the adoption of cloud solutions, the emergence of 5G technology, and the need for advanced security technologies.

Market Analysis

Software-Defined Networking (SDN) is a revolutionary network architecture that separates the control plane from the data plane, enabling network managers to centrally manage network resources and traffic flows in real-time. This approach offers numerous benefits, including increased network agility, improved network performance, and enhanced security. However, the adoption of SDN also presents certain challenges and emerging threats that require continuous monitoring and advanced security technologies. SDN architectures offer control functions that enable network administrators to make quick decisions and respond to disruptions, unauthorized access, malicious activities, and system failures.

Moreover, these functions include authentication mechanisms, encryption protocols, and continuous monitoring. However, the centralized controller used in SDN can be a potential target for targeted attacks, making security a top priority. The SDN market is witnessing significant growth due to the increasing demand for intelligent network architectures in the 5G ecosystem. The 5G ecosystem requires high network bandwidth, low latency, and network redundancy to support the massive data flows generated by IoT devices and other connected devices. SDN provides the flexibility and agility required to meet these demands and address reliability concerns. Despite the benefits, SDN adoption faces challenges related to network outages and collaboration between enterprises segment.

Network outages can lead to significant downtime and revenue loss, making network reliability a critical concern. Collaboration between enterprises is also essential to ensure seamless communication and data exchange in SDN environments. Advanced security technologies, such as machine learning and artificial intelligence, are being integrated into SDN to address emerging threats. These technologies enable real-time threat detection and response, ensuring the security and integrity of network resources. In conclusion, the SDN market is experiencing significant growth due to the increasing demand for agile networks and intelligent network architectures in the 5G ecosystem. While SDN offers numerous benefits, it also presents certain challenges related to security and network reliability. Continuous monitoring, advanced security technologies, and collaboration between enterprises are essential to ensure the successful adoption and implementation of SDN.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- BFSI

- Healthcare

- Retail

- Education

- Others

- Component

- Physical network infrastructure

- SDN applications

- Controller software

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- UK

- South America

- Middle East and Africa

- North America

By End-user Insights

The BFSI segment is estimated to witness significant growth during the forecast period. Software-Defined Networking (SDN) is a cutting-edge technology that offers significant benefits to secure networks in various industries, particularly in high-performance sectors like financial services. In the US market, the Banking, Finance, Services, and Insurance (BFSI) segment is poised for substantial growth in the SDN domain. This technology enables financial institutions to manage their networks more effectively, ensuring compliance and optimizing traffic flows. SDN's centralized management system offers enhanced security features, allowing financial organizations to implement and enforce strict safety rules. This centralized approach is crucial for safeguarding sensitive financial data, whether it's stored on-site or in the cloud. The advantages of SDN for financial institutions include streamlined provisioning and management, improved application performance, and reduced operational costs.

Moreover, the integration of SDN with Zero Trust security models further strengthens network security, especially in the context of the increasing number of Internet of Things (IoT) devices and ecosystems. Symantec, a leading cybersecurity company, highlights the importance of SDN in securing networks against advanced threats. The US market for SDN is expected to witness increased adoption as financial institutions recognize the potential of this technology to optimize their networks while maintaining the highest levels of security.

Get a glance at the market share of various segments Request Free Sample

The BFSI segment accounted for USD 2.94 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

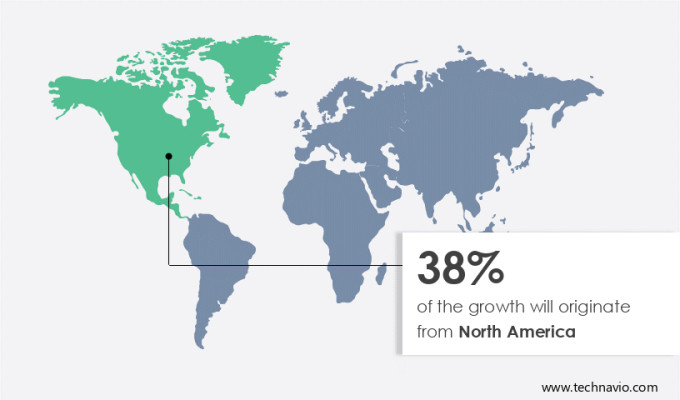

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is poised for expansion due to the escalating need for advanced network management in response to the increasing adoption of IoT technologies and the rollout of 5G networks. IoT devices generate massive amounts of data, necessitating high-capacity bandwidth. Enterprises are turning to SDN architectures to optimally utilize data center network resources. The proliferation of IoT investments and 5G deployment are anticipated to fuel the demand for SDN solutions in the region. Additionally, industries such as content and digital media, banking, financial services, and insurance (BFSI) require high connectivity with minimal latency, making SDN an indispensable tool for network management. The control functions of SDN architectures offer enhanced security features, including protection against targeted attacks, unauthorized access, and malicious activities, making them a preferred choice for organizations seeking to safeguard their network resources.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

High demand for cloud solutions adoption by enterprises is the key driver of the market. The market is experiencing significant growth due to enterprises' increasing adoption of cloud solutions. The primary reasons for this trend are the cost savings from reduced operational expenses and the flexibility to scale resources according to business needs. Hybrid cloud solutions, which combine the benefits of both private and public clouds, have gained popularity among enterprises. These solutions allow businesses to manage their applications and workloads efficiently by allocating resources from multiple clouds.

Moreover, the emergence of 5G technology and the 5G ecosystem is driving the demand for advanced security technologies in SDN. Encryption protocols and continuous monitoring are essential components of SDN security to counteract emerging threats. Intelligent network architectures are being adopted to optimize data flows and network bandwidth, ensuring low latency. As the use of cloud data centers continues to expand, it is crucial to implement strong security measures to protect sensitive data.

Market Trends

The rise of IoT and edge computing is the upcoming trend in the market. Software-defined networking (SDN) has gained significant traction in various industries due to the increasing need to manage and optimize network resources efficiently. With the proliferation of IoT and edge computing, applications such as connected cars, smart homes, and smart cities require low latency and high bandwidth. SDN's ability to control network infrastructure via software offers dynamic resource allocation, a centralized view of forwarding devices, and improved network management. This makes SDN an ideal solution for managing the complex network requirements of IoT applications.

Moreover, enterprises are expanding their operations globally to reach a larger customer base. SDN's centralized management and policy-driven approach enable businesses to implement network policies and security configurations consistently across multiple locations. This not only enhances application performance but also ensures data security. The BFSI segment, including banking and financial services, and the insurance industry, are expected to witness remarkable growth in SDN adoption. SDN's ability to provide real-time network visibility and control can help these industries comply with regulatory requirements and mitigate security threats. In conclusion, SDN's flexibility, scalability, and centralized management make it an essential technology for businesses looking to optimize their network resources and improve application performance. With the increasing adoption of IoT and the expansion of businesses across borders, the demand for SDN is expected to continue growing.

Market Challenge

Network design challenges in SDN technology is a key challenge affecting the market growth. Software-Defined Networking (SDN) has gained considerable attention in the business world due to its advantages, such as efficient resource utilization, compatibility with various forwarding devices, and cost savings. However, enterprises face challenges in adopting SDN, particularly with network design issues. These concerns encompass scalability, fault tolerance, flexibility, and elasticity. Scalability refers to a network's ability to manage unexpected or heavy traffic loads without compromising efficiency. In the event of heavy network usage, potential bottlenecks may occur between the centralized controller and forwarding devices, as a single controller may not be able to accommodate network expansion.

Network reliability is another significant concern for enterprises, as network outages and redundancy issues can lead to collaboration disruptions and a subpar user experience. Agile and responsive networks are essential to meet changing business requirements. SDN offers solutions to these challenges by enabling network administrators to centrally manage and control network traffic, ensuring reliable and efficient communication between devices and enhancing overall network performance.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Arista Networks Inc.: The company offers software-defined networking solutions such as Arista EOS network stack, and network data lake architecture, with the application of artificial intelligence and machine learning (AI/ML) to automation and security challenges.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AT and T Inc.

- Broadcom Inc.

- Ciena Corp.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Extreme Networks Inc.

- Hamburgnet eK

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- International Business Machines Corp.

- Juniper Networks Inc.

- Kyndryl Inc.

- Nokia Corp.

- NVIDIA Corp.

- Oracle Corp.

- Schweitzer Engineering Laboratories Inc.

- Telefonaktiebolaget LM Ericsson

- VMware Inc.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Software-Defined Networking (SDN) is a revolutionary network architecture that enables organizations to centrally manage and control their network functions, providing agility, reliability, and security. SDN separates the control plane from the data plane, allowing for dynamic and flexible network management. This technology addresses various challenges, including targeted attacks, system failures, and unauthorized access, through advanced security technologies such as authentication mechanisms, encryption protocols, and continuous monitoring. SDN is increasingly being adopted in diverse industries, including the BFSI segment, to create secure and high-performance networks for financial institutions. The 5G ecosystem and intelligent network architecture are driving the remarkable growth of SDN, enabling dynamic allocation of resources, optimization of traffic flows, and enhancement of security.

Enterprises are embracing SDN to meet changing business requirements, improve collaboration, and deliver a superior user experience. SDN for 5G networks offers low latency, network redundancy, and reliability, addressing concerns related to outages and network collapse. The increasing adoption of IoT devices and ecosystems brings interoperability challenges and security concerns. SDN solutions provide advanced encryption protocols, threat detection mechanisms, and proactive measures to address these challenges. Cloud environments and cloud-native architectures require elasticity, automation, and business agility. SDN infrastructure offers these capabilities, enabling businesses to respond to changing requirements and optimize application performance. Autonomous networks and service providers, including telecom operators, are leveraging SDN to deliver reliable networks and innovative services. The digital landscape is evolving, and SDN is a crucial component of the solution.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 29.04% |

|

Market Growth 2024-2028 |

USD 67.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

28.55 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 38% |

|

Key countries |

US, Australia, China, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arista Networks Inc., AT and T Inc., Broadcom Inc., Ciena Corp., Cisco Systems Inc., Dell Technologies Inc., Extreme Networks Inc., Hamburgnet eK, Hewlett Packard Enterprise Co., Huawei Technologies Co. Ltd., International Business Machines Corp., Juniper Networks Inc., Kyndryl Inc., Nokia Corp., NVIDIA Corp., Oracle Corp., Schweitzer Engineering Laboratories Inc., Telefonaktiebolaget LM Ericsson, VMware Inc., and Wipro Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch

_Market_size_abstract_2024_v1.jpg)

_Market_segments_abstract_2024_v2.jpg)