Cloud-Based Contact Center Market Size 2025-2029

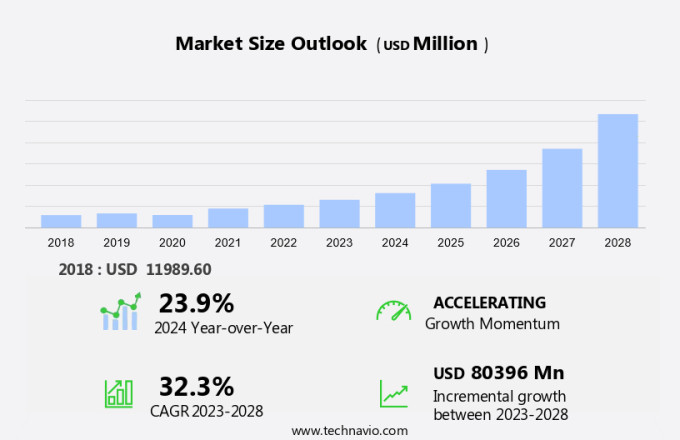

The cloud-based contact center market size is forecast to increase by USD 121.25 billion, at a CAGR of 36.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of cloud technologies and the integration of social, mobile, analytics, and cloud (SMAC) solutions. Businesses are recognizing the benefits of cloud-based contact centers, including cost savings, scalability, and flexibility. Moreover, the integration of SMAC technologies is enabling organizations to provide omnichannel customer engagement and improve customer experience. The adoption of cloud infrastructure and data center solutions ensures business continuity and scalability. However, the implementation of cloud-based contact centers is not without challenges.

- One major obstacle is the complexity of integrating these systems with legacy on-premises systems, which can require significant resources and time. Companies must carefully plan and execute their cloud migration strategies to overcome these challenges and capitalize on the opportunities presented by the market. Mobile apps and web services provide customers with convenient access to self-service options and live chat support.

What will be the Size of the Cloud-Based Contact Center Market during the forecast period?

- The market is experiencing significant growth as businesses increasingly adopt cloud migration for their customer service operations. Omnichannel customer service is a key trend, with contact center platforms integrating call center automation, voice biometrics, and virtual agents to enhance the customer experience. Edge computing and agile development are also shaping the market, enabling real-time data processing and faster deployment of new features. Cloud PBX solutions offer advanced communication capabilities, while knowledge management systems and agent training tools ensure efficient customer engagement. Disaster recovery plans and compliance monitoring are essential components of cloud-based contact centers, ensuring business continuity and regulatory compliance.

- Security audits and data encryption are critical for protecting sensitive customer information. Contact center analytics and customer feedback management provide valuable insights for improving customer engagement and satisfaction. Predictive routing and sentiment analysis help optimize call center workflows and personalize customer interactions. Hybrid cloud solutions offer flexibility and cost savings, while AI-powered chatbots and conversational marketing tools enhance digital customer service. Quality assurance and customer engagement platforms enable businesses to deliver exceptional customer experiences across multiple channels. Customer self-service portals and journey analytics provide valuable data for optimizing the customer journey.

How is this Cloud-Based Contact Center Industry segmented?

The cloud-based contact center industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solutions

- Services

- Deployment

- Public cloud

- Hybrid cloud

- Private cloud

- Sector

- Large enterprises

- Small and medium enterprises (SMEs)

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- South America

- Brazil

- Rest of World (ROW)

- North America

By Component Insights

The solutions segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing adoption of advanced technologies such as speech recognition, predictive analytics, and conversational AI. These technologies enable enhanced customer experiences, improved agent performance, and increased business efficiency. The financial services industry is a major contributor to this market, leveraging cloud-based contact center solutions for customer self-service, call routing, and real-time monitoring. Unified communications and remote work have become essential in today's business landscape, driving the demand for cloud-based contact center solutions. Customer journey mapping and analytics help companies gain valuable customer insights, leading to better customer engagement and satisfaction. Travel and hospitality industries, in particular, are focusing on enhancing the customer experience through personalized interactions and efficient call handling.

Disaster recovery and business continuity are critical considerations for large enterprises, making cloud-based contact center solutions an attractive option. Real-time monitoring, call recording, and quality management are essential features that ensure effective customer support and agent performance. Machine learning and artificial intelligence are revolutionizing the contact center landscape, enabling automated call queuing, workforce optimization, and sentiment analysis. Predictive analytics and customer insights help companies anticipate customer needs and tailor their interactions accordingly.

Virtual assistants and virtual contact centers offer cost-effective and efficient solutions for customer engagement and support. Call recording and voice analytics provide valuable data for continuous improvement and training purposes. Overall, the market is evolving to meet the demands of modern business needs, offering scalability, flexibility, and cost savings.

The Solutions segment was valued at USD 9.47 billion in 2019 and showed a gradual increase during the forecast period.

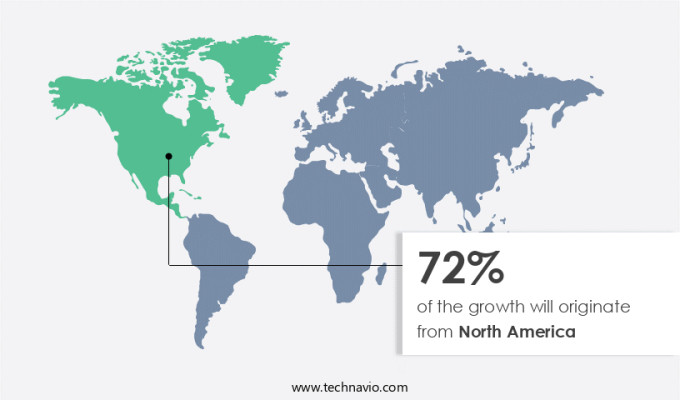

Regional Analysis

North America is estimated to contribute 75% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experienced significant growth in 2024, with the US being a major contributor. The increasing number of data centers, startups, and tech-savvy customers in the region are driving the adoption of advanced technologies, including speech recognition, predictive analytics, and unified communications, in cloud-based contact centers. Key players in the market, such as 8x8, Amazon, Avaya, and Cisco, are continually enhancing their offerings by integrating artificial intelligence, customer journey mapping, and machine learning. Furthermore, industries like travel and hospitality, retail, and healthcare are anticipated to increase the demand for cloud-based contact center services due to their need for business continuity, real-time monitoring, and disaster recovery capabilities.

The integration of virtual assistants, live chat, and sentiment analysis in cloud-based contact centers is also expected to improve customer engagement and satisfaction. Overall, the digital transformation of customer service is propelling the market forward, with large enterprises embracing this technology to optimize their workforce, manage agent performance, and gain valuable customer insights.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Cloud-Based Contact Center market drivers leading to the rise in the adoption of Industry?

- The increasing adoption of cloud-based contact center solutions serves as the primary growth driver for the market. The shift towards cloud computing is driving the growth of various business applications, with cloud-based contact centers being a notable trend. Cloud infrastructure provides enterprises with benefits such as scalability, reliability, and high resource availability, compelling them to adopt this technology for their customer support operations. By moving to the cloud, businesses eliminate the need for an on-premises IT team and reduce operational costs. To maximize cost savings, companies are increasingly adopting software-as-a-service (SaaS) solutions, including customer relationship management (CRM), sales management, human resource management (HRM), and financial management.

- In the contact center context, cloud-based solutions offer features like call queuing, workforce optimization, customer insights, business continuity, customer satisfaction, call recording, voice analytics, virtual assistants, and virtual contact centers.

What are the Cloud-Based Contact Center market trends shaping the Industry?

- The adoption of social, mobile, analytics, and cloud (SMAC) technologies is gaining significant traction in today's market. This trend is driven by the increasing demand for advanced technologies that enable businesses to become more agile, data-driven, and customer-centric. By integrating social media platforms, mobile devices, data analytics, and cloud computing, organizations can streamline operations, enhance customer engagement, and gain valuable insights to inform strategic decision-making. Contact centers have evolved from traditional single-channel operations to multichannel, multi-function units, managing inbound and outbound communications via calls, emails, online queries, and live chat.

- Machine learning algorithms help analyze unstructured data, providing actionable intelligence for enhancing customer experiences and optimizing business processes. By prioritizing customer feedback and delivering personalized interactions, businesses can foster stronger relationships and build brand loyalty. To stay competitive, organizations integrate advanced technologies such as sentiment analysis, digital transformation, cloud telephony, machine learning, and social media capabilities into their contact centers. These technologies enable real-time data processing, multichannel consistency, and improved customer engagement. By focusing on communication as a service, video enablement, virtual contact centers, and advanced analytics, businesses can gain valuable insights into customer behavior and preferences.

How does Cloud-Based Contact Center market faces challenges during its growth?

- The integration complexities with legacy systems represent a significant challenge that hinders industry growth, necessitating the need for proficient solutions to ensure seamless data exchange and compatibility between new and old technologies. The integration of cloud-based technologies in contact centers has gained significant traction, driven by the need for advanced features such as speech recognition, predictive analytics, and conversational AI. However, integrating cloud solutions with legacy systems poses a challenge for many organizations, particularly those in financial services and other industries with complex communication architectures. These legacy systems, which may include outdated hardware, proprietary software, and fragmented data structures, can hinder the seamless adoption of cloud-based contact center solutions. To effectively transition to a cloud-based contact center, it is crucial to ensure data continuity, operational efficiency, and minimal disruption to customer service processes.

- This requires a careful approach to integration, which can be complex when dealing with multiple communication channels, such as voice, email, chat, and social media, that are spread across disparate systems. Unified communications (UC) and customer self-service solutions have become essential components of cloud-based contact centers, enabling remote work and improving the overall customer journey mapping experience. Artificial intelligence (AI) and predictive analytics are also key technologies that can enhance customer service interactions and improve operational efficiency. While the benefits of cloud-based contact centers are clear, the integration of these solutions with legacy systems can be a complex process. Organizations must carefully plan and execute their transition to ensure a seamless and efficient adoption of cloud technologies. By focusing on data continuity, operational efficiency, and customer service processes, organizations can successfully make the transition to a cloud-based contact center and reap the rewards of advanced features and improved customer experiences.

Exclusive Customer Landscape

The cloud-based contact center market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cloud-based contact center market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cloud-based contact center market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3CLogic Inc. - This company specializes in cloud-based contact center solutions, featuring 3CLogic Total Cloud. An advanced, enterprise-level offering, it integrates AI-driven automation and omnichannel communication capabilities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3CLogic Inc.

- 8x8 Inc.

- Alvaria Inc.

- Amazon.com Inc.

- Ameyo Pvt Ltd.

- Avaya LLC

- Cisco Systems Inc.

- Enghouse Systems Ltd.

- Evolve IP LLC

- Five9 Inc.

- Genesys Telecommunications Laboratories Inc.

- NICE Ltd.

- Nubitel

- Redwood Technologies Group Ltd.

- RingCentral Inc.

- Serenova LLC

- Talkdesk Inc.

- Twilio Inc.

- Vocalcom Group

- Vonage Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cloud-Based Contact Center Market

- In February 2023, Amazon Web Services (AWS) introduced Amazon Connect Wisdom, an intelligent contact center service that leverages machine learning to help agents resolve customer queries more efficiently (AWS Press Release, 2023). This development signifies a significant technological advancement in the market, enhancing the capabilities of AI and automation in customer service.

- In May 2022, Microsoft Teams and Cisco Webex announced a partnership to integrate their contact center solutions, allowing businesses to use both collaboration and contact center functionalities within a single platform (Microsoft News Center, 2022; Cisco Press Release, 2022). This strategic collaboration represents a key development in the market, as it aims to streamline communication and customer service processes for businesses.

- In October 2021, Twilio acquired Zipwhip, a leading business texting platform, for approximately USD 850 million (Twilio Press Release, 2021). This acquisition marked a significant expansion for Twilio in the business messaging sector, broadening its offerings and strengthening its position in the market.

- In March 2020, Google Cloud launched Google Cloud Contact Center AI, an AI-driven contact center solution designed to improve customer interactions and automate repetitive tasks (Google Cloud Blog, 2020). This new product launch demonstrated Google's commitment to the market and showcased its focus on leveraging AI to enhance customer experiences.

- These developments highlight significant advancements in the market, including technological innovations, strategic partnerships, and acquisitions, all aimed at improving customer experiences and streamlining communication processes for businesses.

Research Analyst Overview

The market continues to evolve, driven by the ongoing digital transformation across various sectors. Large enterprises are increasingly adopting cloud solutions to enhance customer engagement and improve customer feedback mechanisms. Cloud telephony and live chat have become essential components of customer self-service, enabling seamless customer journeys. Machine learning (ML) and predictive analytics are revolutionizing call routing and agent performance, ensuring business continuity and real-time monitoring. Sentiment analysis plays a crucial role in understanding customer emotions and preferences, enabling proactive customer service and enhancing customer experience (CX). Unified communications (UC) and conversational AI are transforming customer interactions, making them more efficient and effective.

The remote work trend has accelerated the adoption of cloud-based contact centers, ensuring business continuity during disasters and other unforeseen circumstances. Customer journey mapping and quality management are essential for optimizing the customer lifecycle and ensuring customer satisfaction. Mobile apps and web services are expanding the reach of cloud-based contact centers, enabling customers to engage with businesses anytime, anywhere. The integration of ML and AI in call recording and voice analytics is providing valuable customer insights, enhancing agent performance, and improving overall CX. The travel and hospitality industry is a prime example of how cloud-based contact centers are transforming customer interactions.

By leveraging cloud infrastructure, these businesses can provide personalized and efficient customer service, ensuring customer satisfaction and loyalty. The future of cloud-based contact centers lies in their ability to provide real-time, data-driven insights and enhance customer engagement across various touchpoints. The Cloud-Based Contact Center Market is transforming customer interactions through innovative solutions like call center software and contact center platform offerings. Businesses are leveraging customer engagement platform tools and customer journey analytics to enhance service efficiency and satisfaction. AI-driven virtual agent and AI-powered chatbot technologies provide instant responses, improving operational workflows. The integration of customer engagement tools and customer self-service portal features empowers customers with faster resolutions. Organizations rely on knowledge management system frameworks to streamline support and ensure consistency. Additionally, a strong disaster recovery plan safeguards business continuity, ensuring uninterrupted services.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cloud-Based Contact Center Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 36.3% |

|

Market growth 2025-2029 |

USD 121.25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

26.8 |

|

Key countries |

US, China, Canada, Germany, UK, India, France, Brazil, Italy, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cloud-Based Contact Center Market Research and Growth Report?

- CAGR of the Cloud-Based Contact Center industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cloud-based contact center market growth of industry companies

We can help! Our analysts can customize this cloud-based contact center market research report to meet your requirements.