Cloud Based Workload Scheduling Software Market Size 2024-2028

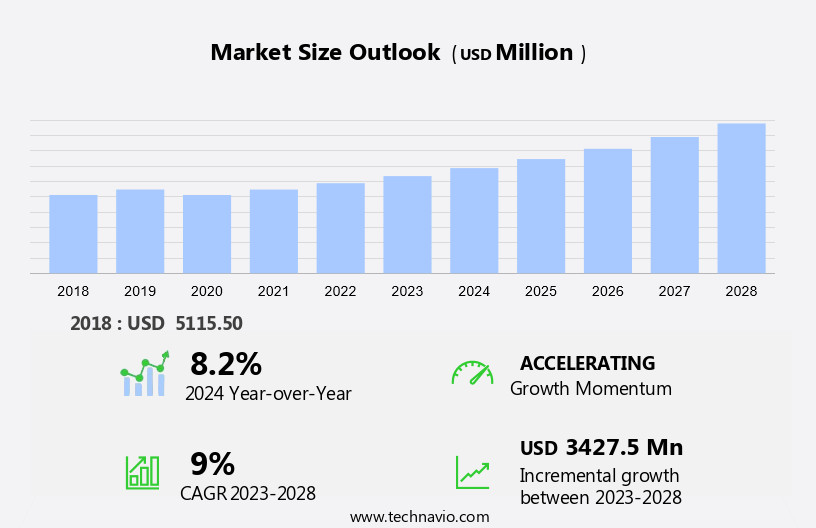

The cloud based workload scheduling software market size is forecast to increase by USD 3.43 billion at a CAGR of 9% between 2023 and 2028.

- In today's business landscape, the adoption of cloud-based workload scheduling software is on the rise, driven by the need for workforce diversity management and the increasing preference for cloud solutions among organizations. Open-source applications offer cost-effective options, catering to various application niches. Geographic expansions and the requirement to manage diverse cloud environments, including private and public clouds, are also fueling market growth. Furthermore, the increasing utilization of big data, machine learning, and artificial intelligence technologies is creating a need for sophisticated scheduling software capable of handling intricate workloads. However, challenges such as interoperability issues, regulatory compliance, and import-export analysis remain key concerns for multi-national enterprises. The market is expected to continue its expansion, as businesses seek to optimize their operations in the dynamic and complex world of cloud computing.

What will be the Size of the Cloud Based Workload Scheduling Software Market During the Forecast Period?

- The market is witnessing significant growth due to enterprises' increasing adoption of cloud-based services. Cloud computing has become crucial to IT infrastructure management, enabling businesses to scale resources, optimize system performance, and automate processes. Cloud-based workload scheduling software solutions enable organizations to manage and automate the distribution of computing resources, ensuring optimal usage and cost savings. These software solutions are essential for businesses implementing DevOps practices and agile methodologies, as they help streamline IT infrastructure management and facilitate faster deployment of applications.

- New developments in cloud-based workload scheduling software are focused on providing customizable services, workload optimization, and cloud cost optimization. Open source software and cloud infrastructure automation are gaining popularity due to their flexibility and cost-effectiveness. Cloud security is a critical concern for businesses adopting cloud-based services, and workload scheduling software companies are responding by integrating advanced cybersecurity solutions into their offerings. Compliance management software and data privacy regulations are also driving the need for secure cloud-based services. Workload analysis is a key feature of cloud-based workload scheduling software, enabling businesses to gain insights into system performance and identify bottlenecks. Hybrid cloud management is becoming increasingly important as businesses adopt a multi-cloud strategy. Cloud services, including cloud-based software development and data analytics, are essential components of this strategy, providing businesses with the tools they need to innovate and compete in today's digital economy.

How is this Cloud Based Workload Scheduling Software Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Public

- Hybrid

- Private

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Type Insights

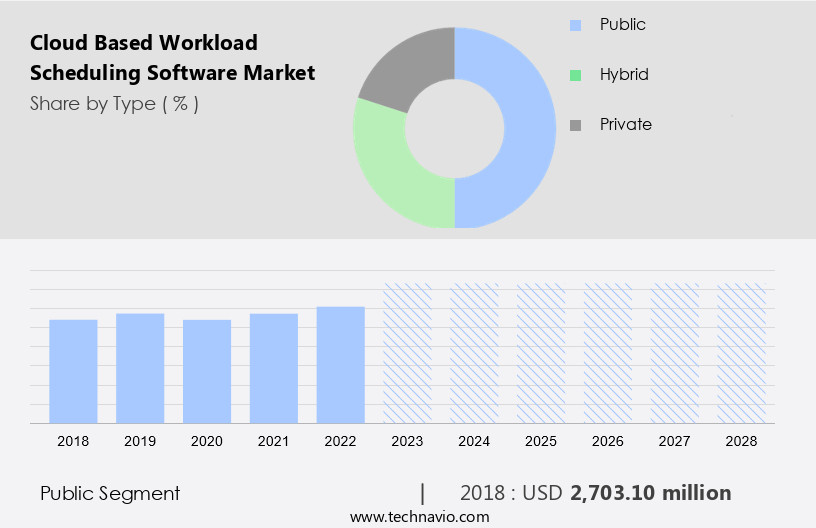

- The public segment is estimated to witness significant growth during the forecast period.

Cloud-based workload scheduling software allows businesses to manage and automate the deployment of applications in diverse cloud environments, including private and public clouds. This solution caters to various application niches and is increasingly adopted by startups and geographic expansions due to its flexibility and cost-effectiveness. The software enables import and export analysis, ensuring efficient utilization of resources and adherence to regulations. Workload scheduling software is essential for multi-national enterprises to optimize their IT infrastructure and meet the demands of their users. Cloud providers offer tools and services to help manage cloud applications, such as data storage, security, and monitoring.

Open-source software options are also available for businesses seeking cost savings and customization. The public cloud model provides businesses with access to virtual resources, including virtual computers, programs, and storage, which can be accessed remotely. Free public cloud services exist, as well as subscription and on-demand payment models, such as pay-per-use. The benefits of public cloud include cost savings through reduced investment in on-premise IT resources and scalability to meet workload and user demands, resulting in reduced resource wastage.

Get a glance at the market report of share of various segments Request Free Sample

The Public segment was valued at USD 2.7 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

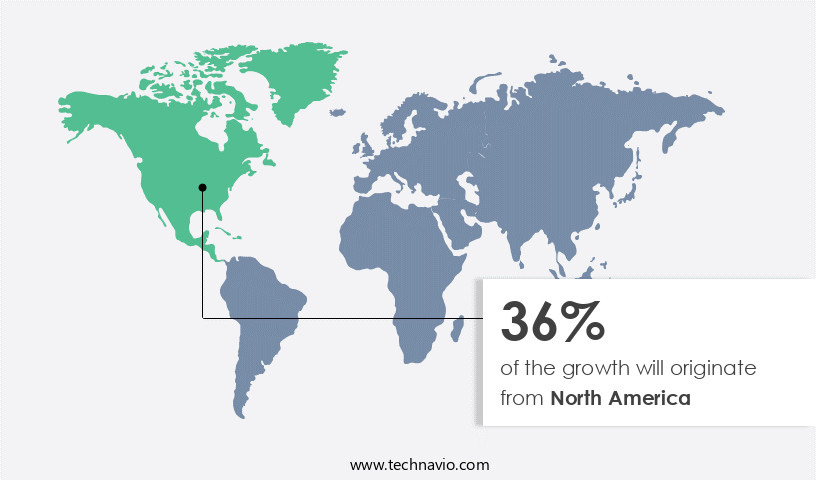

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In North America, the market is thriving due to the region's extensive digital transformation and the widespread adoption of cloud computing technologies. Businesses across various sectors in the US and Canada are turning to cloud-based solutions to streamline workload management, improve operational efficiency, and minimize labor-intensive tasks. The dominance of major cloud service providers is driving cloud adoption, thereby fueling the demand for advanced scheduling software. Cloud-based workload scheduling solutions offer scalability, low maintenance, and security features, making them an attractive option for organizations seeking to optimize their IT operations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cloud Based Workload Scheduling Software Industry?

Need for workforce diversity management is the key driver of the market.

- In today's business landscape, enterprises are constantly seeking ways to optimize their IT environments and gain a competitive edge. One area of focus is workload scheduling in virtualized environments, where the need for efficient management of updates, maintenance, and system performance is paramount. Cloud-based workload scheduling software has emerged as a popular solution for managing workloads across multiple platforms. This software enables the automation and orchestration of workloads, ensuring that they are executed on time and in an optimal manner. It also allows for easy scaling of resources to meet changing demands, making it an essential tool for businesses looking to stay agile and responsive.

- The adoption of cloud-based workload scheduling software is on the rise, as enterprises recognize the benefits it brings to their IT environments. By automating repetitive tasks and providing real-time insights into workload performance, this software enables IT teams to focus on more strategic initiatives. Moreover, cloud-based workload scheduling software offers the flexibility to manage workloads from anywhere, making it an ideal solution for businesses with distributed teams or those looking to adopt a remote work model. With its ability to streamline IT operations, improve system performance, and provide a competitive edge, cloud-based workload scheduling software is a must-have for enterprises looking to succeed in today's dynamic business environment.their diverse workforce effectively and achieve success in implementing their strategies.

What are the market trends shaping the Cloud Based Workload Scheduling Software Industry?

Increase in adoption of cloud-based workload scheduling software in organizations is the upcoming market trend.

- In today's corporate world, optimizing value chain operations is a top priority for businesses to stay competitive. Cloud-based workload scheduling software has emerged as a valuable solution for organizations of all sizes to manage their workloads efficiently. By utilizing this software, businesses can effectively plan and manage security, performance, and configuration management in the cloud. The adoption of cloud-based services for workload scheduling offers several benefits, including improved employee efficiency and productivity.

- With cloud-based scheduling, projects are executed accurately, reducing the time spent on manual scheduling and allowing employees to focus on other tasks. Moreover, cloud-based workload scheduling software enables strict compliance with trade regulations and operational costs, making it an essential tool for businesses. Technological innovations in this field have led to sophisticated scheduling capabilities, open-source solutions, and hybrid cloud options, further expanding the market's potential growth during the forecast period.

What challenges does the Cloud Based Workload Scheduling Software Industry face during its growth?

Availability of open-source applications is a key challenge affecting the industry growth.

- In today's business landscape, cloud technology has become a game-changer for workload scheduling, leading to the increasing popularity of cloud-based platforms and solution suites. Cloud deployment offers numerous benefits, including cost savings and streamlined processes, making it an attractive option for organizations of all sizes. Many developers offer free or open-source cloud-based workload scheduling software, which can adversely impact the sales of paid solutions.

- These offerings are popular among small businesses and those with limited budgets. While these solutions may have certain restrictions, they provide essential features for workload scheduling and management. However, it is essential to consider the specific needs of your organization before opting for a free or open-source solution.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Broadcom Inc.

- Cisco Systems Inc.

- Citrix Systems Inc.

- Cloudify Platform Ltd.

- Dell Technologies Inc.

- Dillon Kane Group

- HelpSystems LLC

- Hitachi Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- NetApp Inc.

- Pure Storage Inc.

- Qubole Inc.

- Rocket Software Inc.

- Sage Group Plc

- SAP SE

- ServiceNow Inc.

- Stonebranch Inc.

- Turbonomic Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing adoption of cloud-based services among corporates. This technological innovation enables businesses to optimize their value chain by automating workload scheduling in diverse cloud environments. The software offers analytical abilities to help enterprises streamline processes, improve employee efficiency, and ensure strict compliances with trade regulations. Cloud-based workload scheduling solutions cater to various application niches, including import export analysis, data processing, and machine learning. They provide seamless integration with multiple platforms, enabling businesses to scale their operations with minimal manual intervention. The market is witnessing geographic expansions as more and more businesses adopt cloud computing technologies for their digital operations.

Moreover, the affordability of cloud-based solutions, coupled with their low maintenance requirements, makes them an attractive option for businesses of all sizes. Sophisticated scheduling capabilities, interoperability, and scalability are some of the essential features of the software. They offer automatic updates and maintenance, ensuring system performance and a competitive edge in the dynamic business environment. The software supports both private and public cloud deployments and caters to the scheduling needs of various IT environments. The software is essential for managing workloads in virtualized environments and ensures efficient resource utilization, reducing operational costs. Security features are a crucial aspect of the software, ensuring data protection and confidentiality.

Furthermore, the software supports dynamic business environments and offers remote work arrangements, enabling teams to collaborate effectively. Cloud technology's ability to process big data in real-time and its scalability makes it an ideal solution for businesses looking to gain a competitive edge in their respective industries. The market is expected to grow further as more businesses adopt cloud-based solutions for their operational needs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2024-2028 |

USD 3.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.2 |

|

Key countries |

US, China, UK, Canada, Japan, Germany, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.