Cloud Security Market In The Retail Sector Size 2024-2028

The cloud security market in the retail sector size is forecast to increase by USD 6.86 billion at a CAGR of 16.83% between 2023 and 2028. In the retail sector, cloud security has emerged as a critical concern due to the rise in e-commerce activities and the increasing adoption of cloud-based point-of-sale (POS) systems. Hackers pose a significant threat to retail businesses, making multi-layered protections essential. Cloud security solutions and architectures are evolving to address these challenges, with quantum-safe encryption gaining traction as the next frontier in data security. The solution segment is witnessing significant growth as retailers seek strong security measures to safeguard customer data and maintain regulatory compliance. The complex regulatory landscape adds another layer of complexity, necessitating a comprehensive approach to cloud security. Retailers must prioritize encryption, access control, and threat detection to mitigate risks and ensure the secure adoption of cloud technologies.

The retail sector's digital transformation initiatives have led to an increased adoption of cloud computing, with Security Software becoming a crucial component. Amidst the economic recession, CIOs are under pressure to optimize IT budgets while ensuring strong Cloud Security. The retail industry's reliance on IT and telecommunications for digital strategies has made Cloud Security a priority. The integration of 5G technology in healthcare and life sciences enables strong hybrid and multi-cloud configurations, facilitating the seamless operation of the Internet of Medical Things (IoMT) for improved patient care. Cloud architectures, such as Software-as-a-Service (SaaS), are increasingly being adopted to streamline operations and enhance customer experience. However, these advancements come with the risk of cyber threats.

Furthermore, IT Budget Growth and Cloud Security Despite the economic downturn, IT budgets for Cloud Security are expected to grow. Retail enterprises recognize the importance of securing their digital assets in the cloud. Security measures, including DevSecOps and automated security testing, are essential to mitigate risks. A Growing Concern Cyber threats, such as shell scripts and zero-trust security models, pose significant risks to retailers in the cloud environment. Hackers target sensitive customer data, financial information, and intellectual property. Retailers must invest in advanced security solutions to protect their digital assets. Cloud Security Solutions: AI and ML Artificial Intelligence (AI) and Machine Learning (ML) are transforming Cloud Security.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Solution

- Cloud IAM

- Cloud e-mail security

- Cloud IDS/IPS

- Cloud DLP

- End-user

- Large enterprises

- SMEs

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Solution Insights

The cloud IAM segment is estimated to witness significant growth during the forecast period. The Cloud Identity and Access Management (IAM) segment is a significant component of the expanding market. Retail businesses have undergone substantial changes by implementing cloud computing technology to enhance security, streamline processes, and deliver a seamless customer experience. Cloud IAM in retail is crucial for managing and controlling access to digital assets, applications, and data residing in the cloud. It grants authorized access to employees, customers, or partners while safeguarding sensitive information from unauthorized users. The adoption of cloud IAM strengthens the security posture of retail organizations, ensuring data privacy and compliance with industry regulations.

Get a glance at the market share of various segments Request Free Sample

The cloud IAM segment was valued at USD 1.22 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

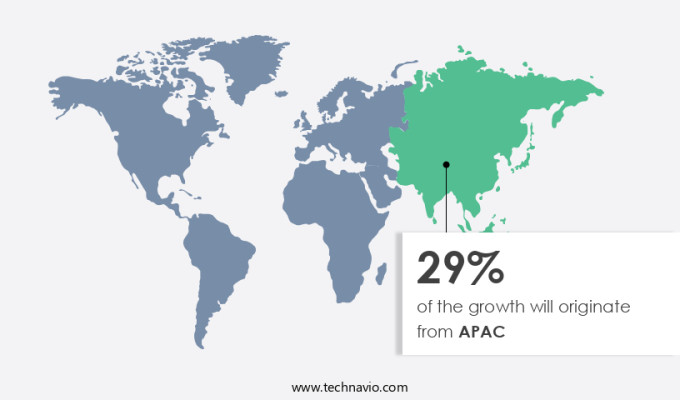

APAC is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American retail sector holds the largest market share in the global cloud security market for the retail industry. This leadership position is attributed to several factors, making North America an ideal location for cloud security solutions. The region boasts a strong IT and telecommunications infrastructure, a well-established cybersecurity ecosystem, and a high adoption rate of cloud technology. Additionally, the presence of numerous online and offline retail giants necessitates top-notch security measures. The growing preference for online shopping among tech-savvy consumers in North America further increases the demand for cloud security services. According to recent studies, the IT infrastructure in North America is mature, and the region is home to several digital transformation initiatives by enterprises. Cloud security is a crucial aspect of these initiatives, as businesses aim to protect their valuable data and maintain customer trust.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rise in E-commerce activities is the key driver of the market. In the retail industry, digital strategies have become essential for businesses to thrive in today's market. The shift towards e-commerce has led to an increased dependence on cloud infrastructure and applications for managing customer data, processing payments, and running online stores. However, this reliance on cloud technology also brings about the risk of cyber threats, making cloud security a top priority. Security measures, such as artificial intelligence (AI) and machine learning (ML), have emerged as effective solutions to mitigate these risks. Zero-trust security models are gaining popularity due to their ability to provide multi-factor authentication and continuous monitoring of user activity.

Furthermore, retailers must invest in these advanced security solutions to safeguard sensitive customer information, transaction data, and intellectual property from potential breaches. The market is poised for significant growth due to these factors. According to recent studies, the market is expected to expand positively during the forecast period. Cyber threats continue to evolve, making it crucial for retailers to stay updated with the latest security trends and technologies to protect their digital assets. By implementing strong security strategies, retailers can build customer trust and ensure the success of their online businesses.

Market Trends

Increased adoption of cloud-based point of sale (POS) systems is the upcoming trend in the market. The retail sector is experiencing a shift towards cloud-based Point of Sale (POS) systems, as evidenced by the increasing popularity of these solutions. This transition from traditional on-premises systems is driven by several factors, including the need for greater operational flexibility. Cloud-based POS systems offer scalability, allowing retailers to adjust their operations according to seasonal demands. Additionally, these systems enable remote management, enhancing operational efficiency by allowing retailers to manage their operations from any location with an internet connection. Cloud security services are a crucial aspect of cloud-based POS systems, ensuring the protection of sensitive customer and financial data.

Furthermore, these services employ advanced security protocols, such as encryption, access control, and authentication mechanisms, to safeguard data. Large enterprises and IT and telecom companies in the US are increasingly adopting cloud security services for their retail operations. Both private and hybrid cloud models are popular choices for retailers seeking cloud security solutions. Private clouds offer greater control and customization, while hybrid clouds provide the flexibility to combine both on-premises and cloud-based infrastructure. Security analytics plays a vital role in cloud security, providing real-time threat detection and response capabilities. By implementing strongsecurity measures, retailers can mitigate risks and ensure the integrity of their cloud-based POS systems.

Market Challenge

The complex regulatory landscape is a key challenge affecting market growth. In the retail sector's cloud security market, safeguarding customer data privacy and compliance are paramount concerns. Retailers handle vast amounts of sensitive information, including payment and personal data, necessitating a rise in security measures. Compliance with stringent regulations, such as the GDPR and CCPA, adds complexity to cloud security efforts. These regulations impose rigorous standards for data handling, storage, and protection.

Furthermore, as a global retailer, navigating the intricacies of various regional and international compliance frameworks is essential. Each framework presents unique challenges, requiring multi-layered protections, including quantum-safe encryption, to ensure data security. Solution segments, such as Identity and Access Management (IAM), Security Information and Event Management (SIEM), and Firewalls, are crucial in implementing these protections. Hackers pose a constant threat to retailers, making it necessary to stay updated on the latest security trends and technologies to maintain a strong defense.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AccuKnox Inc. - The company offers cloud security in the retail sector such as AccuKnox, a cloud security platform that helps protect data and applications from a variety of threats.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akamai Technologies Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Ascend Technologies LLC

- Banyan Data Services

- Caveonix Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- CrowdStrike Holdings Inc.

- Data Theorem Inc.

- Dell Technologies Inc.

- Ermetic Ltd.

- F5 Inc.

- Fidelis Cybersecurity Inc.

- FireMon LLC

- Forcepoint LLC

- Fortinet Inc.

- Fortra LLC

- Lookout Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing adoption of cloud computing and digital transformation initiatives by enterprises. With the economic recession leading to IT budget growth being a priority, CIOs are turning to cloud security solutions to protect their businesses from cyber threats. The market is segmented into the solution segment and the services segment. Cloud security software, including security analytics, automated security testing, IAM policies, and DevSecOps practices, are essential for securing cloud environments. IOT devices and those made by IOT device makers also require rise security measures. Cloud architectures, such as IaaS, SAAS, and managed services, offer multi-layered protections through encryption, security analytics, and zero-trust security models.

Furthermore, the services segment includes private, hybrid, and managed security services. The retail sector's digital transformation initiatives have led to an increase in remote work, making cloud security more crucial than ever. IT and telecommunications, energy and utilities, healthcare, and large enterprises are investing in cloud security services to protect their sensitive data. Hackers continue to pose a significant threat, and cybersecurity measures such as artificial intelligence (AI) and machine learning (ML) are being integrated into cloud security solutions to provide advanced threat detection and response capabilities. Cloud security services are essential for enterprises looking to implement digital strategies and stay competitive in today's market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.83% |

|

Market Growth 2024-2028 |

USD 6.86 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.01 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 29% |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AccuKnox Inc., Akamai Technologies Inc., Alphabet Inc., Amazon.com Inc., Ascend Technologies LLC, Banyan Data Services, Caveonix Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., CrowdStrike Holdings Inc., Data Theorem Inc., Dell Technologies Inc., Ermetic Ltd., F5 Inc., Fidelis Cybersecurity Inc., FireMon LLC, Forcepoint LLC, Fortinet Inc., Fortra LLC, and Lookout Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch