Public Cloud Services Market Size 2025-2029

The public cloud services market size is valued to increase USD 1707.7 billion, at a CAGR of 23.1% from 2024 to 2029. Increasing number of data center hyperscale and colocation providers will drive the public cloud services market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 59% growth during the forecast period.

- By Service - SaaS segment was valued at USD 256.20 billion in 2023

- By Type - SMEs segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 595.06 billion

- Market Future Opportunities: USD 1707.70 billion

- CAGR : 23.1%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and continually evolving landscape, driven by the increasing adoption of core technologies such as artificial intelligence, machine learning, and automation. This shift towards cloud-based solutions is fueled by the growing number of data center hyperscale and colocation providers, which offer scalable and flexible infrastructure to businesses. Additionally, strategic partnerships and collaborations among market participants continue to shape the competitive landscape, as they seek to expand their offerings and reach new customer segments. However, the market also faces challenges, including company lock-in and operational complexities, which can hinder adoption and create barriers to entry for smaller players.

- According to recent estimates, the market is expected to account for over 60% of total enterprise IT spending by 2023, underscoring its growing importance in the digital economy.

What will be the Size of the Public Cloud Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Public Cloud Services Market Segmented and what are the key trends of market segmentation?

The public cloud services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- SaaS

- IaaS

- PaaS

- Type

- SMEs

- Large enterprise

- End User

- BFSI

- IT & telecom

- Retail & consumer goods

- Manufacturing

- Energy & utilities

- Healthcare

- Media & entertainment

- Government & public sector

- Others

- Deployment Type

- Public Cloud

- Hybrid Cloud

- Application

- Storage & Backup

- Application Development & Testing

- Analytics & Big Data

- Business Applications

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

The saas segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with cloud storage services and resource monitoring witnessing a substantial uptake. Object storage systems have become increasingly popular due to their flexibility and scalability, while various storage tiers cater to diverse business needs. Virtual machines and cloud-native applications have gained traction, with compute instance types offering customizability and managed Kubernetes services ensuring seamless container orchestration. Disaster recovery solutions are essential for business continuity, while cloud security posture remains a top priority. Serverless function scaling and microservices architecture have revolutionized application development, with serverless computing enabling on-demand resource allocation. Data encryption methods are essential for securing sensitive information, and software-defined networking streamlines network management.

Data archiving strategies and cloud cost optimization are critical for efficient data management. Container orchestration tools like elastic block storage and hybrid cloud deployments facilitate seamless integration of on-premises and cloud infrastructure. High availability clusters and auto-scaling capabilities ensure uninterrupted service delivery. API gateway services, network virtualization, infrastructure as code, and load balancing algorithms are essential components of modern cloud architectures. DevOps automation tools and API management platforms streamline development and deployment processes. Cloud-based analytics provide valuable insights for data-driven decision-making. According to recent studies, the market has grown by 21.5% in the past year, and industry experts anticipate a further 25.3% expansion in the upcoming years.

These trends reflect the continuous evolution of the market and its applications across various sectors, offering businesses increased flexibility, scalability, and cost savings.

The SaaS segment was valued at USD 256.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 59% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Public Cloud Services Market Demand is Rising in North America Request Free Sample

Public cloud services, introduced over a decade ago, have seen significant growth in the US market due to the increasing adoption of cloud computing and rising data center investments. Major providers like AWS, Microsoft, Google, and Oracle, primarily based in the US, offer the public cloud model, which allows users to scale resources on demand, making it an attractive option for start-ups and small to medium enterprises. In this model, the cloud company manages, maintains, and develops the shared pool of computing resources across a network.

According to recent studies, over 70% of US enterprises have adopted cloud services, and the number is projected to reach 80% by 2025. Furthermore, the public cloud infrastructure market in the US is expected to reach USD150 billion by 2023, growing at a steady pace. These trends underscore the continuous evolution and increasing importance of the market in the US business landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, presenting businesses with numerous opportunities to manage their IT infrastructure more efficiently and cost-effectively. This market encompasses a range of services, including managing cloud infrastructure costs, implementing cloud security measures, ensuring high availability in cloud, migrating on-premises workloads to the cloud, optimizing cloud storage performance, automating cloud infrastructure provisioning, building resilient cloud applications, leveraging serverless functions effectively, implementing CI/CD pipelines in the cloud, monitoring cloud resource consumption, securing cloud-based APIs, designing scalable cloud architectures, managing cloud company relationships, adopting DevOps practices in the cloud, maintaining cloud compliance regulations, using cloud-based analytics dashboards, improving cloud application performance, reducing cloud operational expenses, deploying containerized microservices, and implementing disaster recovery solutions in the cloud.

One notable trend in this market is the increasing focus on cost optimization. According to market intelligence, more than 60% of organizations cite cost savings as a primary reason for migrating to the cloud. Furthermore, the industrial sector accounts for a significantly larger share of public cloud services adoption compared to the academic sector, with over 75% of Fortune 500 companies already utilizing cloud services. As businesses increasingly rely on public cloud services, ensuring security, availability, and performance becomes paramount. In this context, the market offers various solutions, such as implementing cloud security measures, optimizing cloud storage performance, automating infrastructure provisioning, and designing scalable cloud architectures.

By adopting these strategies, businesses can not only reduce their operational expenses but also improve their overall cloud experience. In conclusion, the market offers businesses a multitude of benefits, including cost savings, increased efficiency, and improved security and performance. By focusing on areas such as managing cloud infrastructure costs, implementing cloud security measures, ensuring high availability in cloud, migrating on-premises workloads to the cloud, optimizing cloud storage performance, automating cloud infrastructure provisioning, building resilient cloud applications, leveraging serverless functions effectively, implementing CI/CD pipelines in the cloud, monitoring cloud resource consumption, securing cloud-based APIs, designing scalable cloud architectures, managing cloud company relationships, adopting DevOps practices in the cloud, maintaining cloud compliance regulations, using cloud-based analytics dashboards, improving cloud application performance, reducing cloud operational expenses, deploying containerized microservices, and implementing disaster recovery solutions in the cloud, businesses can maximize their potential in this dynamic and ever-growing market.

What are the key market drivers leading to the rise in the adoption of Public Cloud Services Industry?

- The proliferation of hyperscale and colocation data center providers significantly drives market growth.

- The market experiences ongoing expansion due to the continuous efforts of hyperscale and colocation providers to expand their data center capacities. Over the past few years, these companies have invested approximately USD200 billion in capacity expansion and new data center construction. This growth in the number of hyperscalers is expected to positively influence the market. In addition to purchasing branded servers from companies like Cisco and Dell Technologies, hyperscalers are increasingly adopting white box servers during their hardware refresh cycles.

- For instance, Alibaba has opted for white box servers instead of branded companies. The shift towards white box servers signifies a trend towards customization and cost efficiency, contributing to the evolving landscape of the market.

What are the market trends shaping the Public Cloud Services Industry?

- Strategic partnerships and collaborations have emerged as the prevailing market trend among market participants.

- In the dynamic global public cloud market, competition among companies is fierce, leading to an increasing number of strategic partnerships and collaborations. These alliances are formed with infrastructure providers, software providers, technology providers, and platform providers to facilitate product development, geographical expansion, and access to technological expertise. By engaging in these collaborations, companies can explore new opportunities for product and service offerings in various sectors, including IT and telecom, BFSI, retail, healthcare, manufacturing, media and entertainment, and government organizations.

- For instance, SAP and Salesforce have formed numerous partnerships to expand their offerings and reach new customer bases. These collaborations enable companies to generate revenue through software sales and strengthen their market presence.

What challenges does the Public Cloud Services Industry face during its growth?

- company lock-in and operational complexities pose significant challenges to the industry's growth, limiting business flexibility and increasing operational costs. These issues can hinder innovation and competitiveness, making it essential for organizations to carefully evaluate their technology choices and consider strategies for mitigating these risks.

- company lock-in is a significant concern for businesses adopting public cloud services. This phenomenon arises when a company becomes dependent on a specific cloud company, making it challenging to transition to another provider. According to recent studies, over 80% of enterprise workloads will be in the cloud by 2025, highlighting the growing reliance on cloud services. However, this transition comes with risks. For instance, when applications are built using a specific cloud platform and its associated tools, switching companies becomes a complex process. Furthermore, data stored in the cloud can create additional challenges. A report suggests that 53% of organizations experience company lock-in due to data stored in the cloud.

- This situation can hinder innovation and competition, limiting the potential benefits of cloud adoption. To mitigate these risks, businesses must consider multi-cloud strategies, enabling them to use multiple cloud providers and maintain flexibility. This approach can help ensure business continuity and reduce the risks associated with company lock-in.

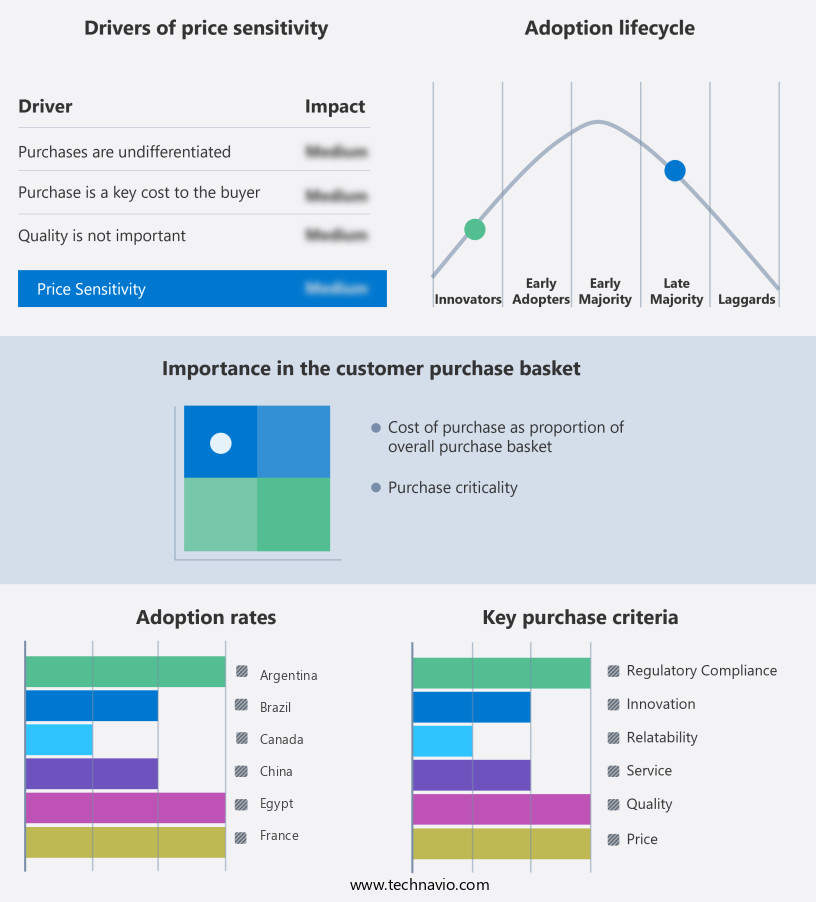

Exclusive Customer Landscape

The public cloud services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the public cloud services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Public Cloud Services Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, public cloud services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adobe Inc. - The company specializes in providing public cloud services, with a focus on Adobe Experience Manager. This solution enables businesses to manage and deliver digital experiences at scale, enhancing customer engagement and optimizing marketing efforts. The company's innovative approach to cloud services sets it apart in the market, offering versatility and flexibility to meet diverse business needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Alibaba Group Holding Ltd.

- Alphabet Inc.

- Amazon.com Inc.

- AT and T Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Microsoft Corp.

- Oracle Corp.

- Rackspace Technology Inc.

- Salesforce Inc.

- SAP SE

- ServiceNow Inc.

- Tencent Holdings Ltd.

- Verizon Communications Inc.

- VMware Inc.

- Workday Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Public Cloud Services Market

- In January 2024, Amazon Web Services (AWS) announced the launch of its new serverless database, Amazon DynamoDB Global Tables, allowing customers to replicate data globally with single-digit millisecond latency (AWS Press Release). In March 2024, Microsoft and Google signed a multi-year partnership to expand their respective public cloud offerings, with Microsoft Azure becoming the preferred cloud provider for Google's advertising business (Reuters). In April 2025, IBM secured a significant investment of USD2 billion from South Korea's National Pension Service to expand its public cloud presence in the Asian market (Bloomberg). In May 2025, Oracle Corporation announced the acquisition of NetSuite, a leading provider of cloud business software, for approximately USD9.3 billion (Oracle Press Release). These developments demonstrate the ongoing competition and innovation in the market, with companies expanding their offerings, forming strategic partnerships, and making significant investments to capture market share.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Public Cloud Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.1% |

|

Market growth 2025-2029 |

USD 1707.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.3 |

|

Key countries |

US, Canada, Germany, China, UK, France, India, Italy, Japan, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and ever-evolving landscape of business technology, two distinct yet interconnected domains continue to gain significant traction: cloud storage services and cloud resource monitoring. Cloud storage services, a crucial component of the cloud computing ecosystem, offer businesses flexible, scalable, and cost-effective solutions for managing and storing data. Object storage systems, a popular choice within cloud storage services, provide unstructured data storage and enable seamless integration with various applications. Meanwhile, cloud resource monitoring plays a vital role in ensuring optimal performance, reliability, and security of cloud-based infrastructure. Virtual machines, cloud-native applications, and managed Kubernetes services all benefit from real-time monitoring and analysis.

- Disaster recovery solutions and cloud security posture management are essential aspects of cloud resource monitoring, safeguarding against potential threats and ensuring business continuity. As businesses adopt more advanced technologies such as serverless function scaling, microservices architecture, and serverless computing, the demand for elastic block storage and high availability clusters increases. These solutions cater to the auto-scaling capabilities required by these modern architectures. Moreover, container orchestration, API gateway services, network virtualization, and infrastructure as code have emerged as essential tools for managing and optimizing cloud resources. Load balancing algorithms and DevOps automation tools further enhance the efficiency and reliability of cloud deployments.

- Data encryption methods, data archiving strategies, and cloud cost optimization are critical considerations for businesses looking to maximize the value of their cloud investments. Software-defined networking and API management platforms are essential components of the cloud infrastructure that enable businesses to maintain control and security while leveraging the flexibility and scalability of the cloud. In conclusion, the market continues to evolve, with cloud storage services and cloud resource monitoring playing pivotal roles in driving innovation and growth. Businesses can harness the power of these technologies to improve operational efficiency, enhance security, and achieve greater flexibility in their IT infrastructure.

What are the Key Data Covered in this Public Cloud Services Market Research and Growth Report?

-

What is the expected growth of the Public Cloud Services Market between 2025 and 2029?

-

USD 1707.7 billion, at a CAGR of 23.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Service (SaaS, IaaS, and PaaS), Type (SMEs and Large enterprise), Geography (North America, Europe, APAC, South America, and Middle East and Africa), End User (BFSI, IT & telecom, Retail & consumer goods, Manufacturing, Energy & utilities, Healthcare, Media & entertainment, Government & public sector, and Others), Deployment Type (Public Cloud and Hybrid Cloud), and Application (Storage & Backup, Application Development & Testing, Analytics & Big Data, and Business Applications)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing number of data center hyperscale and colocation providers, Vendor lock-in and operational complexities

-

-

Who are the major players in the Public Cloud Services Market?

-

Key Companies Adobe Inc., Alibaba Group Holding Ltd., Alphabet Inc., Amazon.com Inc., AT and T Inc., Cisco Systems Inc., Dell Technologies Inc., Fujitsu Ltd., Hewlett Packard Enterprise Co., International Business Machines Corp., Microsoft Corp., Oracle Corp., Rackspace Technology Inc., Salesforce Inc., SAP SE, ServiceNow Inc., Tencent Holdings Ltd., Verizon Communications Inc., VMware Inc., and Workday Inc.

-

Market Research Insights

- The market continues to expand, with cloud infrastructure spending projected to reach USD1.3 trillion by 2025, representing a 17% compound annual growth rate (CAGR) from 2020. Cloud data warehousing and cloud-based machine learning are among the fastest-growing segments, with a CAGR of 22% and 21%, respectively. Cloud security audit and compliance standards play a crucial role in this market, as businesses increasingly adopt hybrid cloud strategies to optimize resource utilization and cost savings. Cloud infrastructure cost remains a key consideration, with cloud automation frameworks and efficient resource allocation essential for managing these expenses. Cloud performance metrics, including serverless application design and network traffic management, are also critical for ensuring high availability and reliability.

- Cloud resource utilization and cloud networking design are essential components of any effective cloud strategy, with container image security and cloud application security becoming increasingly important as organizations adopt cloud-native development and microservices deployment. Cloud monitoring tools and cloud resource allocation are vital for maintaining optimal performance and ensuring business continuity. Cloud platform migration and data center migration are ongoing challenges for many organizations, requiring careful planning and execution. Cloud service availability and data lake implementation are also key considerations, as businesses seek to maximize the benefits of their cloud investments while minimizing risks.

- Ultimately, the market is characterized by continuous innovation and evolution, with new technologies and best practices emerging regularly to address the evolving needs of businesses.

We can help! Our analysts can customize this public cloud services market research report to meet your requirements.