Coal Gasification Market Size 2024-2028

The coal gasification market size is forecast to increase by USD 14.01 billion at a CAGR of 16.25% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The rise in global energy demand, particularly in emerging economies, is a major factor fueling market growth. Additionally, the increase in global coal production, especially from countries like China, India, and Australia, is providing an abundant supply of raw material for coal gasification.

However, environmental concerns surrounding coal gasification, including carbon emissions and water usage, pose challenges to market growth. To mitigate these challenges, advancements in clean coal technology and carbon capture, utilization, and storage (CCUS) are being explored to make coal gasification a more sustainable and eco-friendly energy solution.Overall, the market is expected to witness steady growth in the coming years as it provides a viable solution to meet the increasing energy demands while addressing environmental concerns.

What will be the size of the Coal Gasification Market During the Forecast Period?

The market is witnessing significant growth due to the increasing demand for syngas, which is a key product of coal gasification. Syngas, a mixture of hydrogen, carbon monoxide, methane, and other gases, is used for power generation, fuel gas production, and the production of synthetic natural gas, ammonia, and fertilizers. Gasification technologies, including moving bed, fluidized bed, and entrained bed, are used for coal gasification. These technologies help reduce the environmental impact by minimizing the emission of sulfur dioxide, particulate matter, and other pollutants. Coal gasification also produces carbon dioxide and water vapour as by-products, which can be utilized for various applications such as enhanced oil recovery and carbon capture and storage.

The use of clean hydrogen and oxygen instead of air in the gasification process further reduces the emission of pollutants. Underground coal gasification is another emerging technology in the market, which offers several advantages such as lower capital and operating costs and the ability to gasify low-rank coals. However, the challenges associated with the safe and efficient operation of underground gasifiers remain a significant barrier to the widespread adoption of this technology. In summary, the market is expected to grow due to the increasing demand for clean energy, low-cost feedstocks, and the production of value-added products such as hydrogen, ammonia, and fertilizers.However, the environmental impact of coal gasification and the challenges associated with the safe and efficient operation of gasifiers remain key concerns.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Chemicals

- Fuels

- Power

- Type

- Moving bed

- Fluidized bed

- Entrained bed

- Molten bed

- Geography

- APAC

- China

- Middle East and Africa

- South Africa

- North America

- US

- Europe

- South America

- APAC

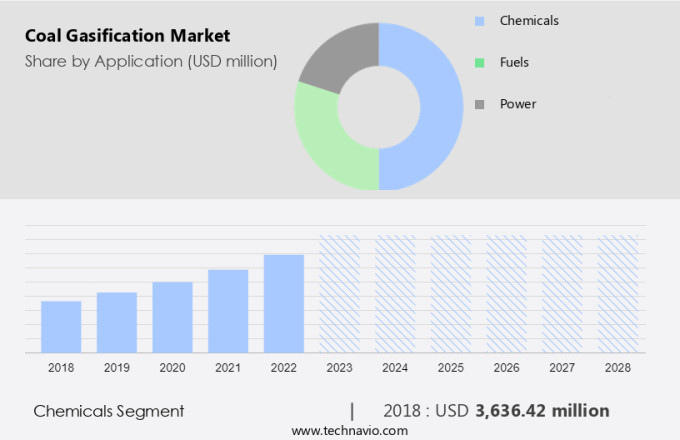

By Application Insights

The chemicals segment is estimated to witness significant growth during the forecast period. The market encompasses various gasification technologies, including fixed bed, fluidized bed, and entrained flow, for the production of Syngas, a mixture of CO, H2, CO2, and water vapor, from coal. This process is essential for the generation of clean hydrogen, electricity, and chemicals, such as methanol, ammonia, and urea. However, coal gasification also produces sulfur dioxide and particulate matter, which require proper treatment to minimize environmental impact. Underground Coal Gasification (UCG) is a promising alternative to conventional gasification, as it addresses water scarcity concerns by utilizing coal and water in the absence of air or oxygen. UCG also offers the potential for fuel gas production, synthetic natural gas, and the generation of chemicals like methanol, ammonia, and hydrogen.

Gasification technologies, such as Fluidized Bed Gasifiers, are employed in coal-to-methanol and coal-to-chemicals projects, which convert coal into valuable chemicals, reducing reliance on traditional fossil fuels. Coal reserves remain abundant, making them a viable and cost-effective feedstock for various industries, including electricity generation, steel production, and hydrogen generation. Carbon Monoxide, Hydrogen, Carbon Dioxide, and Methane are key components of Syngas, which can be utilized in various applications, such as power generation, ammonia production, and nitrogen manufacturing. The environmental impact of coal gasification is a critical concern, with the production of CO2 and the need for proper treatment of SO2 and particulate matter.

However, the potential for low-cost feedstocks and the generation of clean energy make coal gasification an attractive option for industries seeking sustainable and cost-effective solutions.

Get a glance at the market share of various segments Request Free Sample

The Chemicals segment accounted for USD 3.63 billion in 2018 and showed a gradual increase during the forecast period.

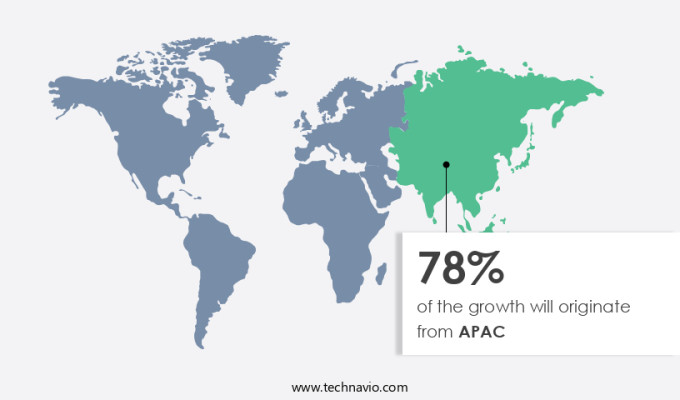

Regional Insights

APAC is estimated to contribute 78% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Coal gasification is an essential energy generation technology that converts coal into a cleaner fuel source through a process called gasification. This technique involves the partial oxidation of coal in an oxygen-deficient environment, resulting in the production of producer gas or syngas, which is devoid of tar and other impurities. The calorific value of this fuel gas is significantly higher than that of coal, making it a viable alternative for various applications, including household uses and industrial processes. In the industrial sector, coal gasification is extensively used in the production of electric motor systems, petrochemicals, and fertilizers. The petrochemicals sector, in particular, benefits from the use of coal as a feedstock for the synthesis of chemicals.

In contrast, biodegradable materials can also be gasified using the same technology, with coal acting as a supplementary feedstock to enhance the energy output. The resulting tar-free syngas can be further processed to produce Fuel Gas or Feedstock for various applications. Asian countries like China and India, which heavily rely on coal for energy generation, are increasingly adopting coal gasification to reduce emissions and meet their energy demands. China, as the world's largest coal producer since 1985, has shown significant interest in advanced carbon capture technologies, including gasification, to mitigate the environmental impact of coal usage while continuing to meet its energy requirements.

Researchers in China have even proposed a combination of coal and biomass energy to optimize energy production and minimize the carbon footprint.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rise in global energy demand is the key driver of the market. The International Energy Agency (IEA) reports a substantial growth in global energy demand over the past decade, driven by economic expansion and increasing demand for chemical products, particularly nitrogenous fertilizers and plastics. By 2040, global energy demand is projected to increase by over 25%, with a growing population expected to reach nine billion. The chemical industry's escalating demand for feedstocks, such as coal, has led to the exploration of alternative gasification technologies like fixed bed, fluidized bed, entrained flow, moving bed, and molten bed. These technologies produce Syngas, a mixture of Carbon Monoxide, Hydrogen, Carbon Dioxide, and Methane, from coal through the reaction of coal, water, and air or oxygen.

The resulting clean hydrogen and electricity generation offer potential for reducing greenhouse gas emissions and addressing water scarcity concerns. Furthermore, coal gasification is crucial for hydrogen generation, chemicals production, including Coal-to-methanol and Coal-to-chemicals projects, steel production, and Ammonia production. However, it's essential to consider the environmental impact, including sulfur dioxide and particulate matter emissions, and implement measures to minimize them. Fossil fuel-based gasification technologies continue to play a significant role in the energy sector, offering low-cost feedstocks for power generation and fuel gas production, contributing to clean energy solutions.

Market Trends

Rise in global coal production is the upcoming trend in the market. Coal gasification is a process that converts coal into Syngas (a mixture of CO, H2, CO2, and CH4) through the reaction of coal with steam, air or oxygen. This process reduces the environmental impact by decreasing sulfur dioxide and particulate matter emissions compared to traditional coal combustion. Various gasification technologies, including fixed bed, fluidized bed, and entrained flow, are used for coal gasification. These technologies are employed in electricity generation, hydrogen production, chemicals manufacturing, and steel production. Underground Coal Gasification (UCG) is a cleaner alternative to conventional coal mining and power generation. It produces Syngas, which can be used for electricity generation, hydrogen production, and the manufacture of chemicals such as methanol, ammonia, and urea.

Coal-to-methanol and coal-to-chemicals projects are gaining popularity due to the potential of coal as a low-cost feedstock. Water scarcity is a significant challenge in coal gasification, as it requires large amounts of water for steam generation. Fluidized bed gasifiers are more water-efficient than other types. Coal reserves in regions like Asia and Southern Africa are vast, making them prime locations for coal gasification projects. China, the US, Australia, India, and Russia are major coal producers, and the relaxation of coal import restrictions in China has stimulated global coal production. Gasification technologies produce clean hydrogen, which is a crucial component in the production of ammonia, fertilizers, and other chemicals.

The CO2 produced during coal gasification can be captured and utilized for various applications, including enhanced oil recovery and carbon capture and storage. The by-products of coal gasification, such as carbon monoxide and hydrogen, can be used as fuel gas or synthetic natural gas. The environmental impact of coal gasification is lower than that of traditional coal combustion due to the reduction of sulfur dioxide and particulate matter emissions. However, the production of Syngas from coal still generates significant amounts of CO2. The use of clean energy sources and carbon capture and storage technologies can help mitigate this environmental concern.

In conclusion, coal gasification is a promising technology for the conversion of coal into valuable products such as electricity, hydrogen, chemicals, and fuels. It offers environmental benefits by reducing sulfur dioxide and particulate matter emissions compared to traditional coal combustion. However, challenges such as water scarcity and carbon dioxide emissions must be addressed to make coal gasification a sustainable and environmentally friendly energy solution.

Market Challenge

Environment concerns for coal gasification is key challenge affecting the market growth. Coal gasification is a process that converts coal into syngas, a mixture of hydrogen, carbon monoxide, carbon dioxide, methane, water vapor, and other impurities. Gasification technologies, including fixed bed, fluidized bed, entrained flow, moving bed, and molten bed, are employed to achieve this conversion. However, the sulfur and nitrogen content in coal pose challenges in this process. Sulfur dioxide and other acid gases are produced due to high temperatures and low oxygen levels in the gasifier. These impurities must be removed using specialized equipment to prevent their release into the environment, as they contribute to particulate matter and have adverse impacts on clean energy generation.

Similarly, nitrogen results in the formation of ammonia and hydrogen cyanide. Coal reserves are abundant, making it a viable option for electricity generation, chemicals production, hydrogen generation, steel production, and fuel gas production. Coal-to-methanol and coal-to-chemicals projects, including urea production, utilize coal gasification. Despite its benefits, environmental impact is a concern, and efforts are underway to minimize carbon dioxide emissions and reduce the production of impurities like carbon monoxide and hydrogen. Coal gasification offers a low-cost feedstock for clean energy and industrial applications, but the environmental impact and the need for pollution control measures are crucial considerations.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Air Liquide SA - The company is committed to providing advanced coal gasification solutions through the implementation of our Rectisol syngas purification technology. This cutting-edge technology enables US to convert coal into synthesis gas (syngas) in an environmentally friendly and efficient manner.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Products and Chemicals Inc.

- Basin Electric Power Cooperative

- CASE GROUP

- Chiyoda Corp.

- Ergo Exergy Technologies Inc.

- Johnson Matthey Plc

- KBR Inc.

- Larsen and Toubro Ltd.

- McDermott International Ltd.

- Mitsubishi Heavy Industries Ltd.

- Regius Synfuels Ltd.

- Sasol Ltd.

- SEDIN Engineering Co. Ltd. CNCEC

- Siemens AG

- Swan Hills Synfuels LLP

- Synthesis Energy Systems Inc.

- thyssenkrupp AG

- Oil and Natural Gas Corp. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for syngas, a mixture of carbon monoxide, hydrogen, and other gases, for various applications. Gasification technologies, including fixed bed, fluidized bed, and entrained flow, are used to convert coal into syngas. Sulfur dioxide and particulate matter emissions are minimized through advanced gas cleaning technologies. Syngas is used for electricity generation, chemicals production, hydrogen generation, and steel production. Coal reserves are abundant, making it a cost-effective feedstock for these applications. However, water scarcity is a challenge in some regions, making the availability of water a critical factor in the selection of gasification technologies.

Fluidized bed gasifiers are popular due to their ability to handle a wide range of feedstocks and their lower environmental impact. Coal-to-methanol and coal-to-chemicals projects are gaining traction, with ammonia production and urea production being major applications. Carbon monoxide and hydrogen are separated from the syngas stream for use as fuel gas or for the production of clean hydrogen. Coal gasification also produces carbon dioxide, methane, water vapor, and nitrogen as by-products. The environmental impact of coal gasification is a concern, and efforts are being made to reduce emissions and improve efficiency. Synthetic natural gas and ammonia production are other emerging applications for coal gasification.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.25% |

|

Market growth 2024-2028 |

USD 14.01 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.75 |

|

Regional analysis |

APAC, Middle East and Africa, North America, Europe, and South America |

|

Performing market contribution |

APAC at 78% |

|

Key countries |

US, South Africa, China, Australia, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Air Liquide SA, Air Products and Chemicals Inc., Basin Electric Power Cooperative, CASE GROUP, Chiyoda Corp., Ergo Exergy Technologies Inc., Johnson Matthey Plc, KBR Inc., Larsen and Toubro Ltd., McDermott International Ltd., Mitsubishi Heavy Industries Ltd., Regius Synfuels Ltd., Sasol Ltd., SEDIN Engineering Co. Ltd. CNCEC, Siemens AG, Swan Hills Synfuels LLP, Synthesis Energy Systems Inc., thyssenkrupp AG, and Oil and Natural Gas Corp. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Middle East and Africa, North America, Europe, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch