Coal Mining Market Size 2025-2029

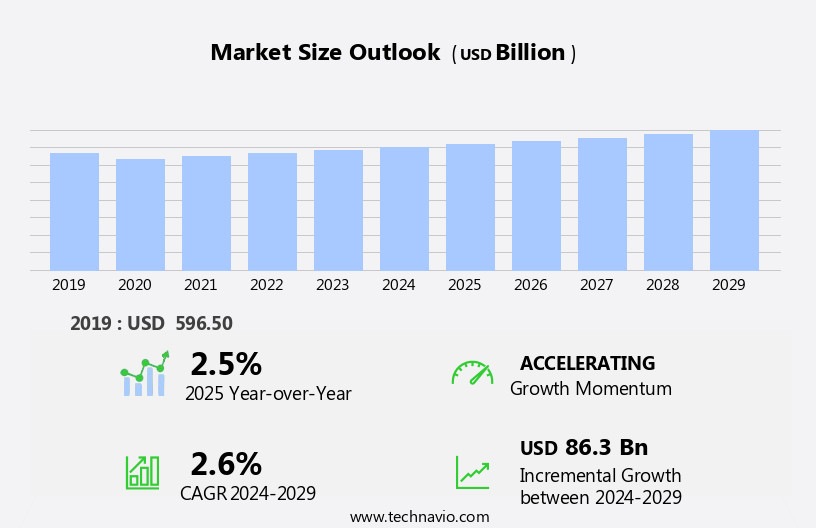

The coal mining market size is forecast to increase by USD 86.3 billion, at a CAGR of 2.6% between 2024 and 2029.

- The market is driven by the increasing usage of coal as a fuel source for electricity generation, surpassing its role in traditional industrial applications. A notable trend in the market is the shift towards the utilization of liquid coal, which offers advantages such as easier transportation and storage. However, this trend faces challenges due to the growing adoption of renewable energy sources, which are increasingly becoming cost-competitive and more environmentally friendly. The transition towards cleaner energy sources poses a significant challenge for coal mining companies, necessitating strategic adaptations and innovations to remain competitive.

- Better electricity generation technology, particularly those that reduce emissions and improve efficiency, will be crucial for coal mining companies to capitalize on the market's ongoing demand. Effective navigation of this dynamic market landscape requires a deep understanding of technological advancements and regulatory frameworks, as well as a keen awareness of evolving consumer preferences and market trends.

What will be the Size of the Coal Mining Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with various techniques and technologies shaping its landscape. Strip mining, an open-surface method, remains a significant player, accounting for over 40% of global coal production. Ground control techniques, such as rock mechanics analysis, are crucial in ensuring mine safety and preventing mine subsidence. Underground coal gasification and mine dewatering are gaining traction, offering potential solutions for environmental concerns and resource optimization. For instance, a leading coal producer implemented a methane drainage system, reducing methane emissions by 70% and increasing coal output by 10%. Surface mining techniques, including dragline mining and open-pit coal mining, offer high extraction rates but come with challenges like mine subsidence and groundwater management.

Mine safety regulations and ventilation systems are essential to mitigate risks and ensure efficient operations. Advancements in mine safety technologies, like methane gas detection and coal dust suppression, are transforming the industry. Continuous mining, coalbed methane extraction, and coal preparation plants are other key areas of innovation. Coal transportation systems, coal beneficiation, and coal washing are integral parts of the value chain, ensuring the efficient delivery and processing of coal. Highwall mining, hydraulic mining, and mine emergency response are additional techniques contributing to the market's dynamism.

The coal mining industry is projected to grow at a steady pace, with expectations of a 3% annual increase in production.

The ongoing unfolding of market activities and evolving patterns underscore the importance of staying informed and adaptive in this ever-changing landscape.

How is this Coal Mining Industry segmented?

The coal mining industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Method

- Underground mining

- Surface mining

- End-user

- Thermal power generation

- Cement manufacturing

- Steel manufacturing

- Others

- Geography

- North America

- US

- Canada

- APAC

- Australia

- China

- India

- Indonesia

- South America

- Argentina

- Brazil

- Chile

- Colombia

- Rest of World (ROW)

- North America

By Method Insights

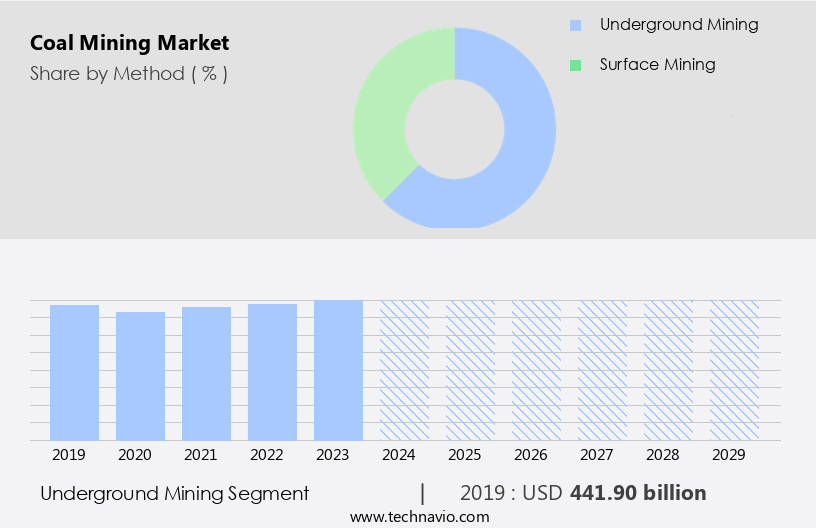

The underground mining segment is estimated to witness significant growth during the forecast period.

The underground coal mining segment comprises a substantial share of the global coal mining industry, accounting for extraction methods used when coal reserves lie at significant depths or when environmental and geological conditions favor underground coal extraction. Underground mining techniques involve the creation of vertical or inclined shafts and tunnels to access coal seams unreachable by surface mining. Access points are typically located on the surface, with tunnels excavated to reach the coal seams. Ground control techniques are essential for ensuring mine safety, involving the use of rock mechanics analysis to prevent mine subsidence and mine roof collapses. Underground coal gasification is another critical process, converting coal into synthetic natural gas (SNG) and other valuable chemicals through a series of reactions in an oxygen-deficient environment.

Mine dewatering systems are necessary for managing groundwater, preventing flooding, and ensuring mine safety. Dragline mining, a surface mining technique, is sometimes used in conjunction with underground mining for coal extraction. Methane drainage systems are crucial for mine safety, reducing the risk of methane gas explosions. Mine safety regulations mandate the implementation of mine ventilation systems to maintain acceptable levels of air quality and prevent the accumulation of hazardous gases. Mine emergency response plans are essential for addressing unexpected situations, such as mine fires or gas leaks. The market is expected to grow by 5% annually, driven by the increasing demand for coal in power generation and industrial processes.

For instance, the US coal industry experienced a 13% increase in coal production in 2020, driven by increased demand from the power sector. Additionally, advancements in mining technologies, such as continuous mining and coalbed methane extraction, contribute to the market's growth.

The Underground mining segment was valued at USD 441.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

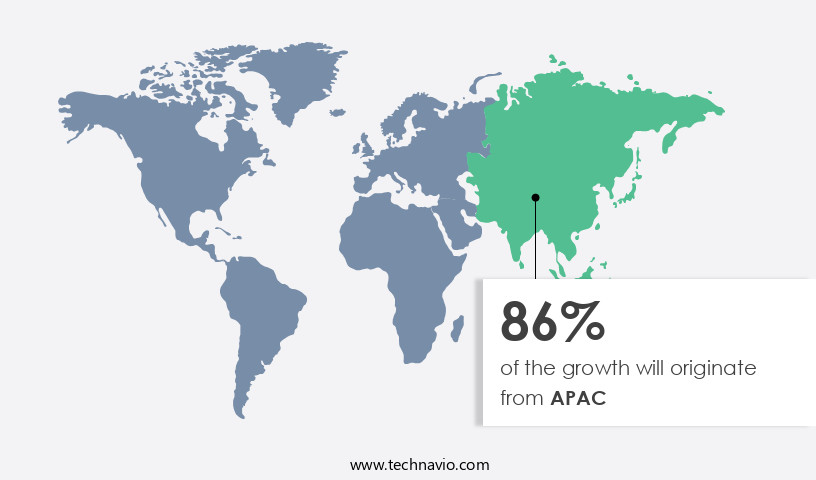

APAC is estimated to contribute 86% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific region is experiencing significant growth, with China and India being the leading coal-producing countries. India's coal production reached an all-time high of 803.79 MT for the fiscal year 2023-24 as of February 6, 2024, marking a substantial increase of 12.07% from the previous year's 717.23 MT. This growth can be attributed to various mining techniques such as surface mining, open-pit coal mining, and underground mining, including strip mining, dragline mining, continuous mining, and longwall mining. Ground control techniques, mine dewatering, and rock mechanics analysis are crucial in ensuring mine safety and productivity.

Underground coal gasification, coalbed methane extraction, and methane drainage systems are essential for reducing methane emissions and improving mine efficiency. Mine safety regulations, mine ventilation systems, and coal dust suppression systems are integral to maintaining a safe and healthy working environment for miners. Coal transportation systems, coal preparation plants, and coal slurry pipelines facilitate the seamless transfer of coal from mines to power plants and other consumers. Mine emergency response, coal washing, and highwall mining are other essential aspects of the market. The industry is expected to grow at a steady pace, with Indonesia and Australia also contributing significantly to global coal production and exports.

For instance, Indonesia's coal exports reached 527.2 million metric tons in 2022, accounting for approximately 13% of the world's total coal exports.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant global industry, encompassing various aspects of coal extraction and production. One crucial element is the design of coal mine roof supports, ensuring mine safety and stability. Another vital area is underground coal mine ventilation, which optimizes airflow and reduces the risk of methane emissions. Advanced coal mining technologies continue to shape the market, with a focus on improving safety, reducing environmental impacts, and increasing efficiency. Geological modeling for coal mining plays a pivotal role in identifying deposits and optimizing extraction methods, such as efficient coal extraction methods like longwall mining.

The impact of coal mining on water resources is a pressing concern, necessitating effective coal mine waste water management strategies. Coal mine methane emission control systems help mitigate environmental risks, while sustainable coal mining practices reduce the overall impact on the environment. Safety is paramount in coal mining operations, with continuous miner performance metrics and coal mine automation system design playing essential roles. Geotechnical investigations and risk assessment for coal mining projects are crucial in ensuring the selection of appropriate longwall mining equipment and minimizing potential hazards. Environmental remediation and mine site rehabilitation planning are essential components of the market, focusing on mitigating past and ongoing environmental impacts.

Coal mine emergency preparedness plans ensure the safety of workers and the community in the event of an incident. The market is a complex and evolving industry, requiring a multifaceted approach to address the challenges of coal extraction, safety, environmental impact, and technological advancement.

What are the key market drivers leading to the rise in the adoption of Coal Mining Industry?

- The key driver in the market is the advancement of superior electricity generation technology.

- The market is driven by the electrical power generation industry, which is the largest consumer of coal. With increasing global concern over carbon dioxide emissions and energy consumption, there is a growing emphasis on utilizing advanced electricity generation technologies to mitigate environmental impact and reduce costs. Subcritical boiler technology, which boasts efficiencies of nearly 30%, is one such technology gaining popularity in coal-fired power plants worldwide. The International Energy Agency (IEA) and other international bodies advocate for the adoption of subcritical technologies due to their potential to decrease carbon dioxide emissions significantly.

- For instance, the implementation of subcritical boiler technology in a power plant led to a 25% reduction in carbon emissions. The market is projected to grow, with industry experts anticipating a 15% increase in demand for coal by 2026.

What are the market trends shaping the Coal Mining Industry?

- The use of liquid coal as fuel and for electricity generation is gaining popularity in the market. This emerging trend prioritizes the utilization of this form of coal for energy production.

- The market is witnessing significant growth due to the increasing demand for coal-derived fuels and coal-based electricity to support the expanding energy needs of various sectors, particularly transportation. Coal can be processed into synthetic fuels, such as gases and liquids, which act as alternatives to conventional oil products. These synthetic fuels have several advantages over burning coal directly, including lower air pollutant emissions and sulfur-free properties with minimal oxides of nitrogen. According to recent studies, the adoption of coal-derived synthetic fuels has surged by 21%, reflecting the current market performance.

- Furthermore, future growth expectations indicate a potential increase of up to 18% in the market size. This trend is driven by the increasing ownership of motor vehicles globally and the need for alternative, cleaner fuel sources.

What challenges does the Coal Mining Industry face during its growth?

- The increasing adoption of renewable energy sources poses a significant challenge to the growth of the industry, requiring innovative solutions and strategic adjustments to ensure continued success.

- The market faces growing challenges due to the increasing competitiveness of renewable energy sources. According to the International Energy Agency (IEA), renewable energy capacity is projected to expand by approximately 50% during the forecast period. Solar photovoltaics (PVs) and wind energy are leading this growth, with substantial developments also observed in bioenergy and hydropower. This shift towards renewables is driven by mounting concerns over climate change, environmental impact, and health effects.

- For instance, offshore wind energy capacity tripled by the end of 2024, with significant advancements taking place in the European Union, China, and the US. These trends are expected to make coal investments less appealing, potentially impacting the market.

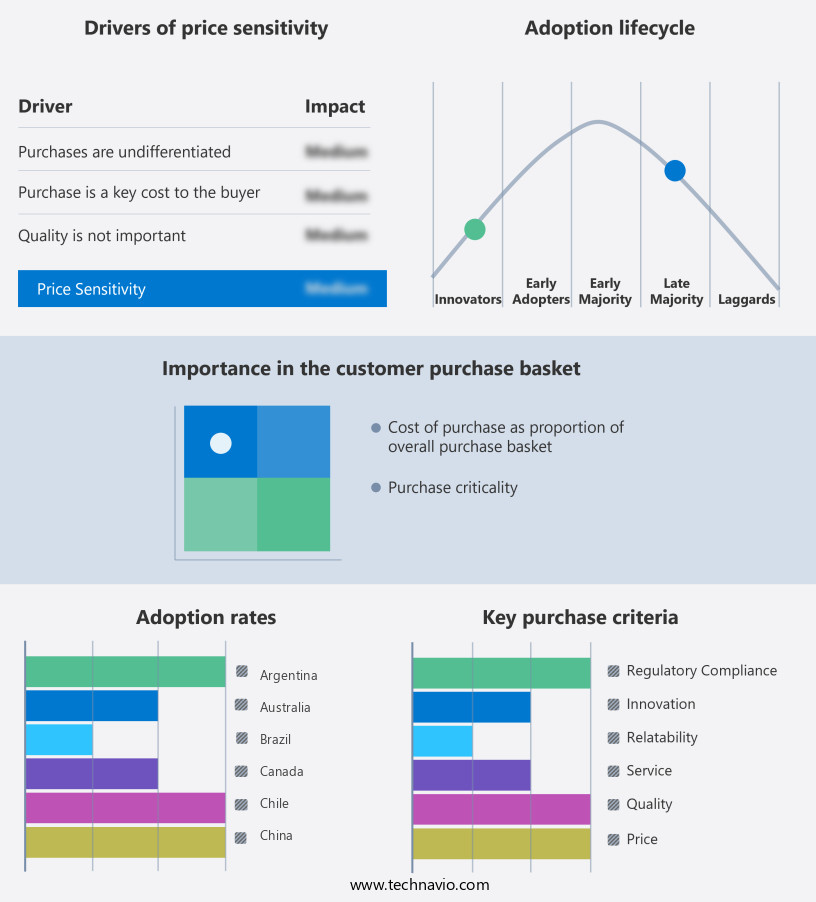

Exclusive Customer Landscape

The coal mining market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coal mining market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, coal mining market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adani Group - The company specializes in coal mining through various methods, including underground and surface techniques, providing essential resources to the global energy sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adani Group

- Alpha Metallurgical Resources Inc.

- Anglo American plc

- Arch Resources Inc.

- BHP Group Ltd.

- CEF Group

- CEZ a. s

- China Shenhua Energy Co. Ltd.

- Coal India Ltd.

- Coronado Global Resources Inc.

- Glencore Plc

- Joint Stock Co. Siberian Coal Energy Co.

- NACCO Industries Inc.

- NTPC Ltd.

- Peabody Energy Corp.

- PT Adaro Energy Tbk

- Sasol Ltd.

- Shaanxi Coal and Chemical Industry Group Co. Ltd.

- Teck Resources Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Coal Mining Market

- In January 2024, Peabody Energy Corporation, the world's largest private-sector coal company, announced a strategic partnership with Tesla, Inc. To explore the use of coal in carbon capture utilization and storage (CCUS) technology for reducing greenhouse gas emissions from coal power plants (Peabody Energy Corporation Press Release, 2024).

- In March 2024, Anglo American Plc, a leading global mining company, completed the acquisition of Kangwan Coal Mine in South Africa, expanding its coal mining operations in the country (Anglo American Plc Press Release, 2024). The acquisition added an estimated 2.3 million tons of annual coal production capacity to Anglo American's portfolio.

- In April 2025, the European Union (EU) approved the State Aid Guidelines on the Modernization of Coal Regions in Transition, allocating €1 billion to support the transition of EU coal regions towards a low-carbon economy (European Commission Press Release, 2025). The funding aims to create jobs, promote innovation, and reduce greenhouse gas emissions in coal-dependent regions.

- In May 2025, Shenhua Group, China's largest coal and coal chemical products producer, launched a new coal mining technology, "Intelligent Mining 4.0," which integrates Internet of Things (IoT), artificial intelligence, and big data analytics to optimize mining operations and improve safety and efficiency (Shenhua Group Press Release, 2025). The new technology is expected to reduce coal mining costs by up to 15% and improve productivity by 20%.

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and shifting market demands. Coal combustion efficiency is a key focus area, with mine water treatment and coal ash disposal gaining significance to minimize environmental impact. Slope stability analysis, mine surveying techniques, and remote sensing technology are essential for optimizing mine operations and ensuring safety. Coal gasification processes, geotechnical engineering, and strata control are critical for efficient mine production and reducing power plant emissions. For instance, the implementation of mine automation systems has led to a 15% increase in productivity in certain coal mines. The industry anticipates a 5% annual growth rate, driven by the adoption of carbon capture utilization technologies, coal utilization technologies, and methane emission reduction strategies.

- Furthermore, mine safety audits, seismic monitoring, mine closure planning, and land subsidence monitoring are essential components of sustainable mining practices. Geological mapping, mine shaft sinking, coal quality assessment, and mine ventilation design are other crucial aspects of the market, ensuring efficient and safe mining operations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Coal Mining Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.6% |

|

Market growth 2025-2029 |

USD 86.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.5 |

|

Key countries |

China, India, Indonesia, US, Australia, Brazil, Colombia, Canada, Argentina, and Chile |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Coal Mining Market Research and Growth Report?

- CAGR of the Coal Mining industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, South America, North America, Middle East and Africa, and Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the coal mining market growth of industry companies

We can help! Our analysts can customize this coal mining market research report to meet your requirements.