Coated Steel Market Size 2025-2029

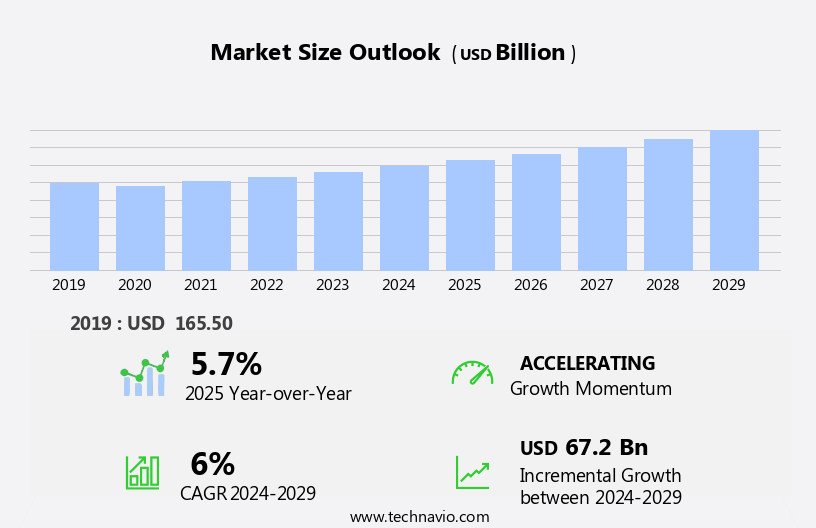

The coated steel market size is forecast to increase by USD 67.2 billion at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the surge in construction activities across various sectors, including infrastructure, residential, and commercial. New product launches, such as high-performance coatings, are further fueling market expansion. However, the market's growth trajectory is not without challenges. Fluctuating raw material prices pose a significant hurdle, as steel and coating components are essential inputs. Moreover, regulatory requirements, particularly concerning the use of eco-friendly coatings, necessitate continuous innovation and compliance. Supply chain inconsistencies also temper growth potential, as demand for coated steel can be volatile and requires a responsive and agile supply chain.

- Moreover, Market growth relies on various factors, notably the increased consumption of high-strength stainless steel, propelled by its corrosion resistance and excellent mechanical properties. Companies seeking to capitalize on market opportunities must navigate these challenges effectively by implementing price risk management strategies, investing in research and development for sustainable coatings, and fostering strong relationships with suppliers and customers. In the energy sector, coated steel plays a crucial role in the production of solar panels.

What will be the Size of the Coated Steel Market during the forecast period?

- The market encompasses various surface preparation techniques and metal surface treatments, including metal etching, cleaning, and passivation, to enhance the properties of steel sheets and strips. Inorganic coatings, such as hot dip galvanizing and chromate conversion coatings, are widely used for their durability and corrosion resistance. Color matching and coil width are essential factors in ensuring the efficient manufacturing of solar panels. Coating application processes, such as roll forming and coating curing, are critical for maintaining coating adhesion and performance. The stainless steel market forecast indicates robust expansion, driven by increasing demand for steel across various industries.

- Architectural applications also benefit from coated steel's high performance and customizable properties. Organic coatings, including phosphate and zinc coatings, provide excellent paint adhesion and resistance to weathering. Coating thickness control and durability testing are essential for ensuring long-lasting architectural applications. Coating technology continues to evolve, with advancements in multilayer coatings, coating lifespan, and hybrid coatings. Coating equipment and metal degreasing processes are also essential components of the coating line. Coating maintenance and disposal are crucial aspects of the market, ensuring the sustainability and eco-friendliness of coating processes. Key market drivers include increasing demand for high-performance coatings, growing adoption of coated steel in the solar industry, and the need for sustainable and eco-friendly coating solutions.

How is this Coated Steel Industry segmented?

The coated steel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Galvanized

- Aluminum-zinc

- Organic coated

- Application

- Construction

- Automotive

- Appliances

- Others

- Product Type

- Carbon steel

- Alloy steel

- Stainless steel

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

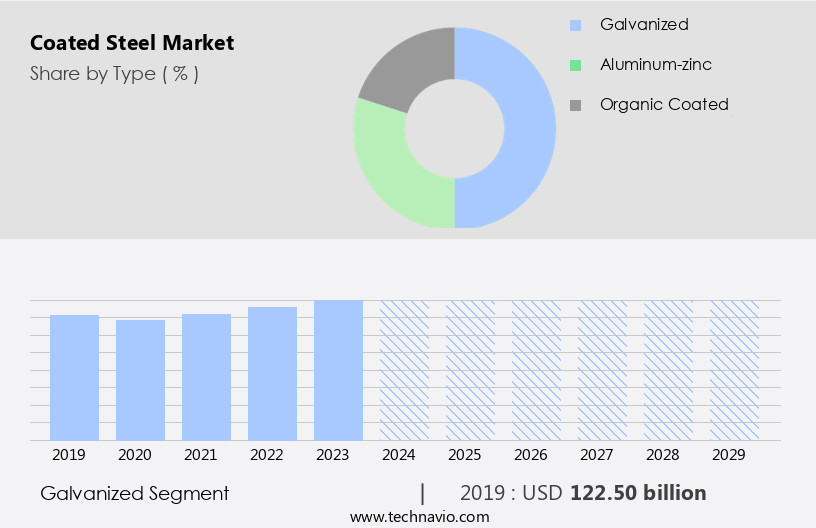

The galvanized segment is estimated to witness significant growth during the forecast period. Galvanized steel, coated with a protective zinc layer through processes like hot-dip galvanizing, is a preferred choice in numerous industries for its corrosion resistance, strength, and cost-effectiveness. The zinc coating acts as a barrier against environmental factors, including moisture, salt, and chemicals, enhancing galvanized steel's suitability for harsh conditions. Its applications span across construction, automotive manufacturing, agriculture, and appliance production. In construction, galvanized steel is extensively utilized in roofing, cladding, structural support, and water drainage systems due to its durability and minimal maintenance requirements. The coating process ensures uniformity and consistency, with testing standards in place to maintain quality.

Coil coating, including polyester, silicone, plastisol, and powder, is applied to steel sheets for various applications, such as building materials and appliance industry components. CNC machining, laser cutting, and metal stamping are essential metal processing techniques used to prepare substrates for coating applications. Epoxy, PVDF, and fluoropolymer coatings offer additional benefits like weather resistance, UV resistance, and corrosion resistance, making them suitable for the energy industry, particularly in solar panels and wind turbines. Coil diameter, width, and length, as well as coating thickness, are crucial factors in the coating process. Prepainted steel, with its vibrant colors and uniform finish, is a popular choice for architectural applications.

The metal coating industry continues to evolve, with advancements in organic coatings, roll forming, and waterjet cutting, ensuring paint adhesion and meeting stringent VOC emissions regulations.

The Galvanized segment was valued at USD 122.50 billion in 2019 and showed a gradual increase during the forecast period.

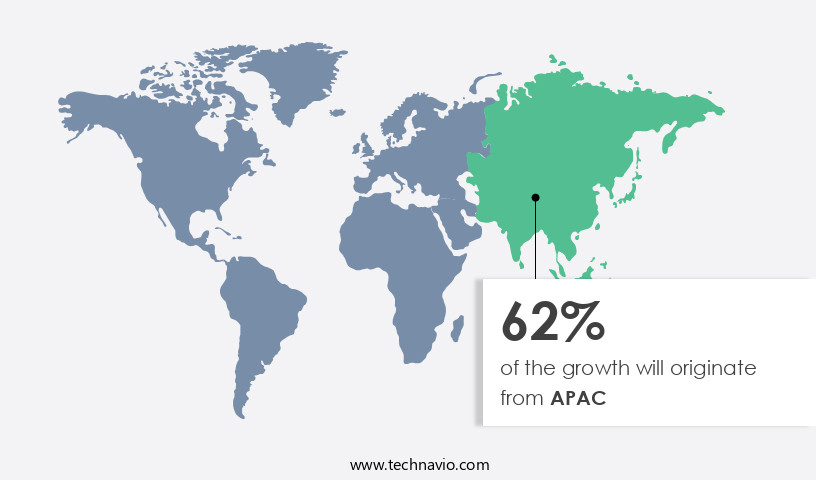

Regional Analysis

APAC is estimated to contribute 62% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is witnessing substantial growth due to various factors in the automotive, infrastructure, agriculture, and electronics sectors. This expansion is fueled by increasing automotive production in China, Japan, and South Korea, with China producing around 21 million units from January to September 2024, marking a 2% year-on-year increase. Japan's car production surged by 17% in 2023, totaling 7.5 million units, while South Korea experienced a notable increase of 13%. Coating technologies such as powder, epoxy, PVDF, and fluoropolymer are in high demand for automotive applications, ensuring corrosion resistance, UV resistance, and weather resistance.

In the infrastructure sector, coated steel is used extensively in building materials, roll forming, and metal fabrication for its durability and strength. In the appliance industry, coated steel is utilized for its color matching capabilities and surface finish, while in agriculture, it enhances the longevity of machinery. The use of recycled content in coated steel is a growing trend, contributing to the green building movement and reducing VOC emissions. CNC machining, laser cutting, and metal stamping are essential processes in coil processing, ensuring precise coating thickness and adhesion to the substrate. Coated steel is also extensively used in the energy industry, particularly in wind turbines and solar panels, for its lightweight and high-performance properties.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Coated Steel market drivers leading to the rise in the adoption of Industry?

- The surge in construction activities serves as the primary catalyst for market growth. The market is experiencing notable growth due to the increasing construction activities across various regions. In 2023, the construction sector in the United States exhibited significant spending, reaching an impressive USD 1.6 trillion. This investment encompassed residential, non-residential, and infrastructure projects, underscoring the strong demand for resilient and visually appealing materials like coated steel. Coated steel's versatility and strength make it a preferred option for diverse construction applications, ranging from building facades to structural components. India's construction sector is also thriving, with a 9.9 percent expansion in FY24.

- This growth was fueled by a substantial USD 19.67 billion allocation to the Smart Cities Mission in the Union Budget 2024-25. Coated steel, with its excellent corrosion resistance and various coatings such as polyester, silicone, plastisol, epoxy, PVDF, and fluoropolymer, is a popular choice for green building projects, ensuring durability and a desirable surface finish.

What are the Coated Steel market trends shaping the Industry?

- The trend in the market is toward new product launches. The market is experiencing significant growth due to the increasing demand for advanced materials in various industries, particularly in the energy sector for solar panels and architectural applications. Companies are focusing on innovations to offer steel products with superior corrosion resistance and paint adhesion. JSW Steel, a key player, recently introduced JSW Magsure, an advanced Zinc-Magnesium-Aluminium alloy coated steel. This product's patented chemical composition enables it to withstand extreme corrosion, reducing the reliance on imports and strengthening JSW Steel's competitive position. The coating technology used in JSW Magsure enhances its performance in high-corrosion environments, making it an attractive option for manufacturers in the energy and construction industries.

- The coil diameter and width of this steel sheet can be customized to meet specific project requirements, making it suitable for roll forming processes. Organic coatings are another trend in the market, offering excellent color matching and paint adhesion for architectural applications. The market dynamics continue to shape the coated steel industry, with companies focusing on research and development to meet evolving customer needs.

How does Coated Steel market faces challenges face during its growth?

- The volatility of raw material prices poses a significant challenge to the industry, potentially hindering its growth. The market is influenced by the volatility of key input prices, particularly zinc and aluminum, which impact production costs and profitability for manufacturers. The Commodity Markets Outlook of the World Bank reports that in 2024, zinc prices decreased by 6 percent, while aluminum prices experienced a modest increase of 2 percent. By the end of 2025, aluminum prices are projected to rise further by 4 percent, while zinc prices are anticipated to partially recover. These price fluctuations significantly impact the cost structure of coated steel producers, who utilize these metals for galvanizing and other coating processes. Metal stamping, fabrication, and cutting processes, such as waterjet cutting, also rely on coated steel in various industries, including wind turbines and construction.

- The coating weight and coil length requirements vary depending on the application, with prepainted steel being a popular choice due to its aesthetic appeal and VOC emissions reduction properties. Producers must navigate these market dynamics to maintain competitiveness and ensure consistent product quality.

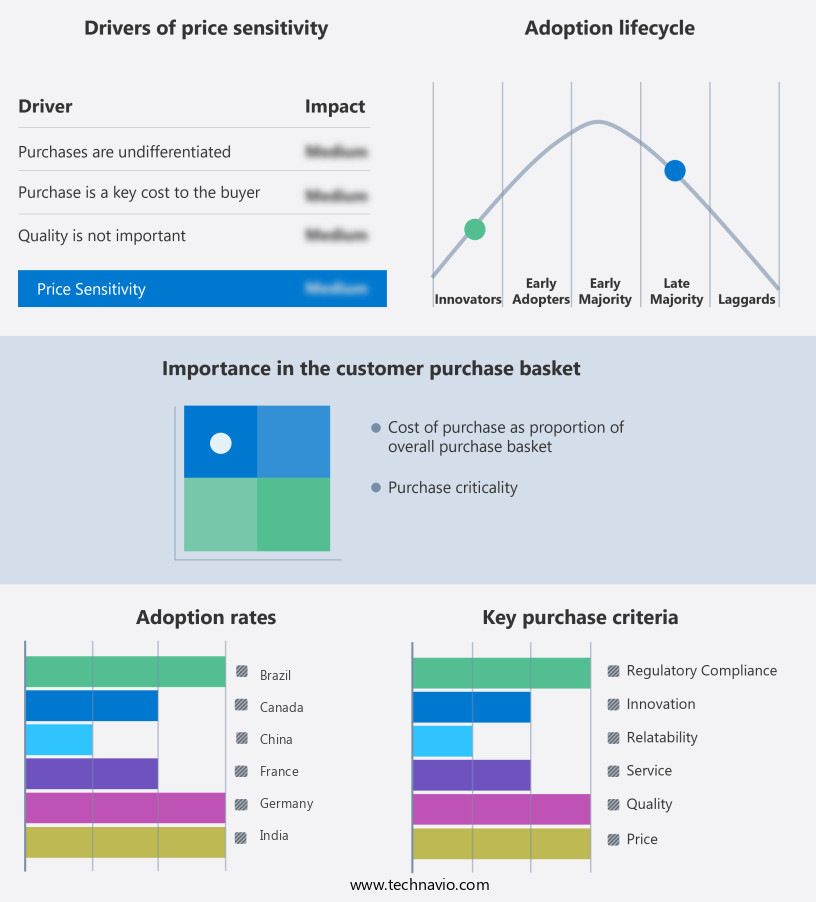

Exclusive Customer Landscape

The coated steel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coated steel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, coated steel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ArcelorMittal SA - The company offers coated steel such as organic coated steels, metallic coated steels, and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcelorMittal SA

- Baosteel Group Corp.

- BlueScope Steel Ltd.

- China Steel Corp.

- DONGKUKSTEEL MILL CO. LTD

- HBIS Group Co. Ltd.

- JFE Holdings Inc.

- Korea Zinc Co. Ltd

- NLMK Group

- Nucor Corp.

- PAO Severstal

- POSCO holdings Inc.

- PT. TATA METAL LESTARI

- SSAB AB

- Tata Steel Ltd.

- thyssenkrupp AG

- United States Steel Corp.

- voestalpine AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Coated Steel Market

- In January 2024, ArcelorMittal, the world's leading steel and mining company, announced the launch of its new line of high-performance coated steel, named "Innovation Coat 3000," in response to growing demand for sustainable and energy-efficient building solutions (ArcelorMittal Press Release, 2024). This innovative product offers enhanced durability and corrosion resistance, making it an ideal choice for infrastructure and construction projects.

- In March 2025, ThyssenKrupp AG and Tata Steel signed a strategic partnership agreement to combine their European steel businesses, aiming to create the second-largest steel producer in Europe. This collaboration is expected to strengthen their market position and improve operational efficiency (ThyssenKrupp AG Press Release, 2025).

- In May 2024, SSAB, a leading producer of advanced high-strength steel, secured a significant investment of â¬1.2 billion from the European Investment Bank to expand its production capacity and modernize its facilities, focusing on the development of more sustainable coated steel products (European Investment Bank Press Release, 2024).

- In October 2025, the European Union passed the Circular Economy Action Plan, which includes measures to increase the recycling rate of steel and promote the use of recycled steel in coated steel production. This policy change is expected to boost the demand for coated steel and contribute to the European Union's carbon neutrality goals by 2050 (European Commission Press Release, 2025).

Research Analyst Overview

The market exhibits a dynamic and evolving landscape, shaped by various trends and patterns. Coil coating, a critical process in the production of coated steel, continues to gain traction due to its ability to apply uniform and consistent coatings to steel substrates. This method is widely used in the manufacturing of building materials, appliances, and various industrial applications. UV resistance and weather resistance are essential properties in the market. The demand for coated steel with enhanced durability and longevity is on the rise, particularly in outdoor applications. CNC machining and laser cutting technologies enable precise substrate preparation, ensuring optimal coating application and superior surface finish.

Recycled content is another significant trend in the market. The use of recycled steel in coil coating applications contributes to the growth of the green building industry and reduces the environmental impact of steel production. The appliance industry also benefits from the availability of recycled steel, as it helps to minimize waste and lower production costs. Testing standards play a crucial role in ensuring the quality and performance of coated steel. Stringent testing procedures are implemented to evaluate coating thickness, adhesion, and resistance to various environmental factors. Galvanized steel, a popular choice for its corrosion resistance, undergoes rigorous testing to meet industry standards.

Metal processing techniques such as powder coating, epoxy coating, and silicone coating offer diverse benefits. Powder coating provides a durable and attractive finish, while epoxy coating offers excellent chemical resistance and adhesion properties. Silicone coating, on the other hand, is known for its weather resistance and UV stability. The energy industry, particularly the solar panel manufacturing sector, is a significant consumer of coated steel. PVDF coating is a popular choice due to its exceptional weather resistance and ability to withstand harsh environmental conditions. Color matching is essential in this industry to ensure the aesthetic appeal and uniformity of solar panels. Emerging stainless steel market trends highlight the material's increased usage in green energy solutions and electric vehicles, reflecting its adaptability and environmental benefits, ensuring its continued relevance in a rapidly evolving global market.

Coating thickness, coil diameter, and coil weight are essential factors that influence the cost and performance of coated steel. Prepainted steel, a cost-effective alternative to traditional coating methods, offers various benefits, including reduced VOC emissions and improved energy efficiency. The market caters to a wide range of applications, including architectural, wind turbines, and metal fabrication. Roll forming and waterjet cutting are essential processes in the manufacturing of coated steel components for these applications. In conclusion, the market is a dynamic and evolving industry, driven by trends such as coil coating, recycled content, and testing standards.

The demand for coated steel with enhanced durability, weather resistance, and UV stability continues to grow across various industries, from building materials and appliances to the energy sector. The adoption of advanced technologies and processing techniques, such as CNC machining, laser cutting, and powder coating, further enhances the performance and versatility of coated steel.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Coated Steel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 67.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

China, India, US, Japan, South Korea, Germany, France, Canada, Brazil, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Coated Steel Market Research and Growth Report?

- CAGR of the Coated Steel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the coated steel market growth and forecasting

We can help! Our analysts can customize this coated steel market research report to meet your requirements.