Cocktail Mixers Market Size 2024-2028

The cocktail mixers market size is forecast to increase by USD 6.82 billion at a CAGR of 10.87% between 2023 and 2028. The market is experiencing significant growth due to shifting consumer preferences toward sophisticated tastes and health-conscious beverage options. Alcoholic beverages continue to dominate the market, but there is a rising demand for non-alcoholic alternatives, including plant-based beverages, fortified products, and those infused with minerals and vitamins. Juices and energy drinks are also popular choices. The trend toward health-consciousness is driving innovation in the market, with companies introducing new and unique flavors and ingredients to cater to consumers' evolving preferences. However, increasing campaigns against alcohol consumption on television and social media may pose a challenge to the market's growth. Overall, the market is expected to continue expanding, offering opportunities for both established and new players.

Market Analysis

The cocktail mixers market has witnessed significant growth in recent years, fueled by the increasing popularity of alcoholic beverages and the emergence of innovative products and packaging. This market caters to a wide range of consumers, from those with sophisticated tastes to those seeking healthier alternatives. One major trend in the cocktail mixer industry is the introduction of new flavors and low-alcohol cocktails. Consumers are increasingly seeking out mixers that offer unique and exciting taste experiences, while also catering to their health-conscious preferences. Innovative mixer flavors, such as fruit-infused and botanical blends, have gained significant traction in the market. Another trend in the cocktail mixer industry is the focus on sustainable and eco-friendly packaging. As consumers become more environmentally conscious, there is a growing demand for mixers that come in recyclable or biodegradable containers. This not only benefits the environment but also enhances the brand image of companies that prioritize sustainability.

Further, the coronavirus pandemic and resulting lockdown orders have had a significant impact on the cocktail mixer market. With bars and restaurants closed, there has been a wave in home bartending, leading to an increase in demand for mixers. This has also led to changes in distribution channels, with more companies turning to e-commerce platforms to reach consumers directly. Despite these challenges, the cocktail mixer market continues to grow, driven by consumer inclination towards cocktail drinks and their evolving taste preferences. The extensive range of mixers available caters to various alcohol content levels, from traditional mixers for strong cocktails to low-alcohol and non-alcoholic options. Emerging economies are also becoming key players in the cocktail mixer market. With growing disposable income and a rising trend towards Westernized lifestyles, there is a significant demand for cocktail mixers in these regions. Companies are investing in local production and distribution to tap into this growing market. In conclusion, the cocktail mixer market is driven by a combination of factors, including consumer preferences, innovation, and sustainability.

Market Segmentation

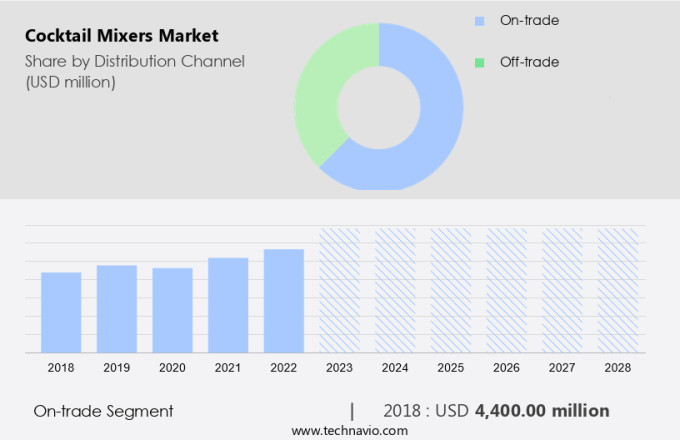

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- On-trade

- Off-trade

- Product

- Tonic water

- Club soda

- Ginger

- Others

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Distribution Channel Insights

The on-trade segment is estimated to witness significant growth during the forecast period. The market encompasses various outlets, including bars, restaurants, cafes, and nightclubs, for its revenue generation. In contrast to retail sales, the distribution and sale of these mixers in the on-premise consumption segment necessitate unique strategies. Bartenders and waitstaff significantly influence sales through tactics such as tastings, giveaways, contests, and discounts.

Consequently, these approaches cater to specific products and types of outlets. In the US market, the popularity of botanical ingredients has been on the rise, leading to an increased demand for mixers infused with these flavors. The off-trade segment, which includes sales through retail channels, also contributes significantly to the market's growth. Base ingredients like water, mixers, and various foods are essential components of the cocktail-making process, making this market a vital player in the US alcohol industry.

Get a glance at the market share of various segments Request Free Sample

The on-trade segment accounted for USD 4.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

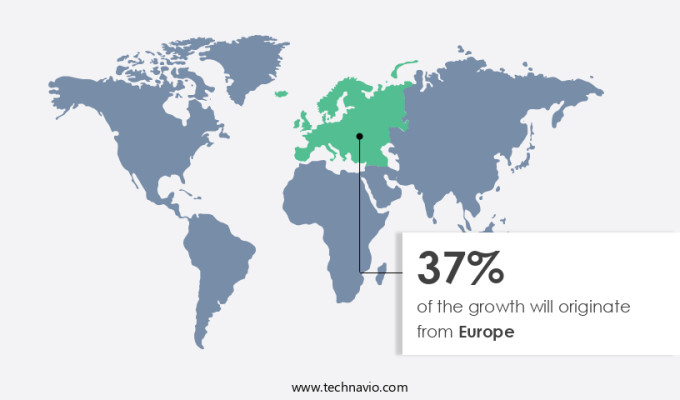

Europe is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market holds a significant position in the global market, catering to the increasing preference for ready-to-drink alcoholic beverages among the millennial population. Factors such as the rise in health-conscious consumers seeking low-calorie and enhanced-flavored cocktails have fueled the market's expansion in this region. The European market is divided into Germany, France, Italy, the UK, Russia, and the Rest of Europe. In 2023, the UK and Germany dominated the European market share. The growing trend of consuming low-alcohol and low-sugar beverages has significantly boosted the demand for cocktail mixers in Europe. Major players in this industry are introducing innovative products and packaging to cater to evolving consumer preferences and meet the increasing demand.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for low-alcoholic drinks is the key driver of the market. The market in the US is witnessing significant growth as consumers show a strong inclination towards alcoholic beverages, particularly cocktails, with innovative products and packaging gaining popularity. Major trends in the industry include the emergence of botanical ingredients, such as ginger, quinine, and lavender, in mixers. These flavors cater to the sophisticated tastes of millennials and younger generations, who prefer premium products. The coronavirus pandemic and subsequent lockdown orders have led to a revival of at-home cocktail parties, driving demand for mixers in the off-trade segment. The on-trade distribution channel, including bars, restaurants, hotels, and nightclubs, is also adapting to the changing landscape by offering low-alcohol and healthier cocktail options.

Botanical beverages, including tonic water and quinine-based mixers, are in high demand due to their health benefits and unique flavors. These mixers are not only used for alcoholic beverages but also for non-alcoholic drinks, such as iced teas and energy drinks. The market is further driven by collaborations between prominent players and the introduction of fortified products with added minerals, vitamins, and juices. The market is expected to continue its growth trajectory, with developed nations, such as the US, leading the way. Supermarkets, hypermarkets, off-license retailers, and e-commerce platforms are the major distribution channels for cocktail mixers.

Market Trends

Growing adoption of flavored alcoholic drinks is the upcoming trend in the market. The market encompasses a wide range of taste enhancers used in the creation of alcoholic beverages, including vodka and gin. These mixers, which can be made with innovative products and packaging, cater to various consumer preferences and taste inclinations. The industry's growth is driven by major trends such as the increasing popularity of cocktail drinks, emerging economies, and the revival of cocktails. The coronavirus pandemic and subsequent lockdown orders have led to a shift in trade, with an at-home party culture and an ontrade distribution channel decline. Flavors like ginger, quinine, and lavender are increasingly sought after by millennials and younger generations, leading to the development of premium products and innovative package designs.

Health-conscious consumers are also driving demand for low-alcohol cocktails, plant-based beverages, fortified products, and those containing minerals and vitamins. Tonic water and quinine substance, with their medical advantages, continue to be popular base ingredients in the offtrade segment.

Market Challenge

Increasing anti-alcohol campaigns on television and social media is a key challenge affecting the market growth. The alcoholic beverages industry, specifically the market, has experienced significant growth in recent years due to the increasing popularity of cocktail drinks among various consumer demographics. Vodka and gin are major base ingredients for many cocktails, and innovative products and packaging have emerged to cater to diverse taste preferences and sophisticated tastes. One major trend in the industry is the consumer inclination towards healthier options, leading to the development of low-alcohol cocktails and non-alcoholic beverages. Flavors such as ginger, quinine, lavender, and botanical ingredients have gained popularity, appealing to health-conscious consumers and millennials. The coronavirus pandemic and subsequent lockdown orders have disrupted the supply chain and distribution channels of the market.

However, the industry has shown resilience, with an ontrade distribution channel shift towards at-home parties and off-premise consumption. The market is witnessing collaborations between prominent players and premium brands to launch innovative products and packaging. The market offers an extensive range of mixers, including tonic water, quinine-based drinks, and energy drinks, among others. Socioeconomic factors such as changing lifestyles, urbanization, and the working population's younger generation have contributed to the revitalization of cocktail culture. Premium spirits and mixers have gained popularity, with consumers seeking unique and health-conscious options. The market for cocktail mixers includes various segments, such as tonic water, quinine-based drinks, and other mixers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

American Beverage Marketers - The company provides a selection of high-quality cocktail mixers for your beverage needs. Among these offerings are the Mango Puree Mix, Banana Puree Mix, and Lime Juice Concentrate.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bittermilk L L C

- Britvic plc

- East Imperial Beverages Corp.

- Fentimans Ltd.

- Fevertree Drinks Plc

- Keurig Dr Pepper Inc.

- Liber and Co.

- Monin Inc.

- Q Tonic LLC

- Round The Cocktails Pvt. Ltd.

- Royal Rose Syrups

- SUCKERPUNCH GOURMET LLC

- Sunny Sky Products

- The Coca Cola Co.

- The London Essence Co.

- Thomas Henry GmbH

- Three Cents Ltd.

- Tres Agaves Products LLC

- True Fabrications Inc. d.b.a. Collins

- White Rock Products Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The cocktail mixers market, a vibrant segment of the alcoholic beverages industry, is experiencing significant growth due to the emergence of innovative products and packaging. Vodka and gin are major players in this industry, with their distinctive tastes enhancing the flavor profiles of classic cocktail drinks. The industry's growth is driven by the increasing consumer inclination towards sophisticated tastes and healthier options. Innovative mixers, such as those infused with ginger, quinine, lavender, and other botanical ingredients, cater to the health-conscious younger generations. The coronavirus pandemic and lockdown orders have led to a rebirth of at-home cocktail parties, driving demand for off-trade distribution channels.

Further, premium brands are leading the charge with innovative packages, expanding their portfolios to include low-alcohol and non-alcoholic cocktails. Major trends in the industry include the use of plant-based beverages, fortified products with minerals and vitamins, and the popularity of juices, energy drinks, and botanical ingredients. The on-trade distribution channel, including bars, restaurants, hotels, and nightclubs, continues to be a significant market for base ingredients. The off-trade segment, including supermarkets, hypermarkets, off-license retailers, and e-commerce platforms, is also seeing increased demand for extensive ranges of mixers and tonic waters. The resurrection of cocktail culture is a response to changing lifestyles, urbanization, and socioeconomic factors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 6.82 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 37% |

|

Key countries |

UK, US, Germany, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Beverage Marketers, Bittermilk L L C, Britvic plc, East Imperial Beverages Corp., Fentimans Ltd., Fevertree Drinks Plc, Keurig Dr Pepper Inc., Liber and Co., Monin Inc., Q Tonic LLC, Round The Cocktails Pvt. Ltd., Royal Rose Syrups, SUCKERPUNCH GOURMET LLC, Sunny Sky Products, The Coca Cola Co., The London Essence Co., Thomas Henry GmbH, Three Cents Ltd., Tres Agaves Products LLC, True Fabrications Inc. d.b.a. Collins, and White Rock Products Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch