Coffee Machine Market Size 2025-2029

The coffee machine market size is forecast to increase by USD 9.45 billion, at a CAGR of 7.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing availability and demand for these appliances in organized retailing sectors. The incorporation of advanced technologies, such as smart connectivity and automation, is transforming the market, offering consumers enhanced convenience and customization. However, environmental concerns pose a significant challenge to the market's growth. The production and disposal of coffee machines contribute to e-waste and carbon emissions, necessitating the development of sustainable manufacturing processes and recycling initiatives. Companies seeking to capitalize on market opportunities must focus on addressing these environmental concerns while continuing to innovate and meet evolving consumer preferences.

- The integration of eco-friendly materials and energy-efficient technologies can help mitigate these challenges and position brands as industry leaders. In summary, the market is witnessing robust growth due to increasing demand and the adoption of advanced technologies. However, environmental sustainability remains a critical challenge that requires immediate attention and innovation from market participants.

What will be the Size of the Coffee Machine Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The coffee market continues to evolve, with dynamic shifts in consumer preferences, technological advancements, and sustainability initiatives shaping its landscape. Coffee shops, a key application sector, are experimenting with various brewing methods such as automatic drip machines, French press, pour over, and espresso machines, among others. Coffee packaging, from bags to pods, is innovating to preserve the aroma and freshness of beans. Brewing technologies are advancing, with water filtration systems addressing water hardness and coffee extracts enhancing flavor profiles. Commercial coffee machines cater to diverse needs, from high-pressure espresso machines to energy-efficient automatic drip machines. Sustainability is a growing concern, with organic and fair trade coffee, sustainable cultivation, and waste management gaining traction.

Coffee processing, from bean sourcing to roasting techniques, plays a crucial role in the final product's quality. Decaf coffee, flavored coffee, and single-origin beans cater to diverse consumer tastes. Milk frothers and barista skills add to the artisanal experience. Home brewing continues to gain popularity, with pour over and French press methods offering a personal touch. Technological innovations, such as super-automatic machines and instant coffee, cater to convenience and affordability. Roasting techniques, coffee oils, and temperature control further influence the final product's taste and aroma. The coffee market's continuous dynamism underscores its enduring appeal and the ongoing quest for the perfect cup.

How is this Coffee Machine Industry segmented?

The coffee machine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Drip coffee machines

- Espresso machines

- Single-serve pod machines

- Others

- Technology

- Semi-automatic machines

- Fully automatic machines

- Manual machines

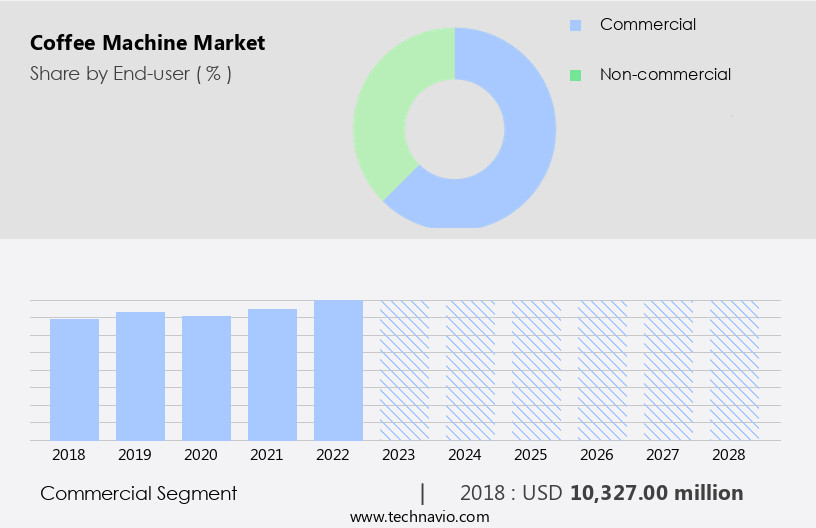

- End-user

- Commercial

- Non-commercial

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

The drip coffee machines segment is estimated to witness significant growth during the forecast period.

The coffee market is experiencing significant evolution between 2025 and 2029, with the drip coffee machines segment showcasing notable shifts. Consumer preferences, technological advancements, and operational efficiencies are driving changes in both residential and commercial settings. Manufacturers are focusing on precision brewing, programmability, and energy efficiency, aligning with the increasing demand for convenience and sustainability. Digital controls and smart connectivity are being integrated to enhance user experience and differentiate offerings. Coffee bean processing and roasting techniques continue to influence the market, with a growing emphasis on organic, fair trade, and single-origin beans. Grinding settings and coffee oils are also key considerations, as consumers seek optimal brewing experiences.

Decaf and flavored coffee options cater to diverse tastes, while sustainable coffee practices and water filtration systems address environmental concerns. Brewing methods, such as French press, pour over, and automatic espresso machines, cater to various preferences. Commercial coffee machines and coffee shops are adopting advanced technology and automation for increased efficiency and consistency. Home brewing, including pour over and moka pot methods, remains popular for their simplicity and cost-effectiveness. Milk frothers, coffee pods, and instant coffee cater to the convenience-driven market, while barista skills and coffee tasting are valued for their ability to create unique, artisanal experiences. Coffee storage and coffee packaging are essential for maintaining bean freshness and product quality.

Energy efficiency and electricity consumption are becoming increasingly important factors, as sustainability concerns grow. Water filtration and water hardness are also crucial considerations for optimal brewing results. Coffee waste management is a developing area of focus, as the industry seeks to minimize its environmental impact. Pressure control and temperature regulation are essential features for optimal brewing, with coffee extracts and brewing methods playing a significant role in the final product's taste and quality. Overall, the coffee market is dynamic and evolving, with a focus on innovation, sustainability, and consumer preferences.

The Drip coffee machines segment was valued at USD 7.78 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Europe is the largest market for coffee machines, accounting for a significant share due to the region's high consumption of coffee. Countries like Finland, Norway, Iceland, Denmark, the Netherlands, and Sweden, with their high per capita coffee consumption, significantly influence the market. The trend toward premium and gourmet coffee categories is prominent in developed European economies, driving the demand for coffee machines. Consumers seek to recreate the taste of specialty coffee at home, leading to the growth of the market despite premium prices. Coffee cultivation and bean sourcing play crucial roles in the production of high-quality coffee.

Roasting techniques, including temperature control and extraction time, significantly impact the taste and aroma of the coffee. Single origin and organic coffee, fair trade practices, and sustainable farming methods are increasingly popular. Drip coffee makers, single-serve brewers, French press, espresso machines, and moka pots cater to various brewing preferences. Automatic drip machines and super-automatic machines offer convenience, while pour over and manual methods provide a more immersive experience. Milk frothers and coffee pods are popular add-ons for coffee machines. Energy efficiency and waste management are essential considerations for coffee machine manufacturers. Commercial coffee machines cater to businesses, while home brewing continues to gain popularity.

Water filtration and water hardness impact the taste of coffee, making water quality a crucial factor. Coffee shops and packaging play a significant role in the coffee market. Instant coffee and coffee extracts offer convenience, while barista skills and coffee tasting are essential for a premium coffee experience. Coffee oils, flavored coffee, and pressure control are other factors influencing the market. Overall, the European the market is characterized by a focus on taste, quality, and innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive the market, various types of coffee makers cater to diverse consumer preferences. From traditional drip coffee makers to advanced espresso machines, this market offers a wide range of options. Automatic drip coffee makers with programmable features and thermal carafes ensure consistent brewing and temperature control. Single-serve coffee machines, like Keurig and Nespresso, provide convenience with their pod systems and quick brewing capabilities. Espresso machines, with their frothing wands and pressure settings, create authentic café-style drinks at home. Smart coffee machines integrate technology, allowing users to control brewing through apps or voice commands. Sustainable coffee machines prioritize eco-friendliness, using features like reusable filters and energy-saving modes. Commercial coffee machines, designed for heavy usage, offer large capacities and robust construction. French press coffee makers, manual and stylish, offer a rich and full-bodied brew. Coffee grinders, integrated or separate, ensure freshness by grinding beans right before brewing. The market caters to every need, delivering a perfect cup every time.

What are the key market drivers leading to the rise in the adoption of Coffee Machine Industry?

- Organized retailing's expansion has led to increased market demand and availability, serving as the primary driver for its growth.

- Coffee machines have gained significant popularity in organized retail channels, including supermarkets and hypermarkets, worldwide. These retailers are crucial distribution points for coffee machines, contributing to the growth of the market. According to IBISWorld, there were around 77,021 supermarkets and grocery stores in the US in 2024, marking a 1.5% increase from the previous year. This growth signifies a steady expansion in the number of grocery retail locations. Coffee machines cater to various consumer preferences, such as energy efficiency, temperature control, and extraction time. Energy-efficient coffee machines help reduce electricity consumption, making them an attractive choice for consumers. Home brewing methods, like pour over and French press, continue to be popular, while coffee pods offer convenience.

- Bean varieties and barista skills are essential factors influencing coffee taste. Proper coffee storage ensures the beans' freshness, enhancing the overall coffee experience. The market dynamics are driven by factors like the increasing demand for specialty coffee, the rise in disposable income, and the growing popularity of coffee culture. Consumers are increasingly seeking high-quality coffee experiences, leading to the adoption of advanced coffee machines with features like temperature control and customizable extraction times. The market is expected to continue growing, offering opportunities for businesses to cater to the evolving needs of coffee consumers.

What are the market trends shaping the Coffee Machine Industry?

- Advanced technologies are increasingly being incorporated into coffee machines, reflecting a significant market trend. This innovation aims to enhance the user experience and improve the overall performance of coffee machines.

- The market is experiencing significant growth due to the increasing popularity of coffee shops and the demand for convenient and advanced coffee brewing solutions. Automatic drip machines and other commercial coffee machines are in high demand as businesses seek to offer their customers a wide range of brewing methods and coffee packaging options. Manufacturers are focusing on innovation, integrating water filtration systems to address water hardness concerns and enhance coffee extracts' flavor. Smart technology, such as pressure control and IoT integration, is also becoming increasingly important, allowing for automated operations and real-time monitoring.

- These advanced features cater to consumers' preferences for customizable coffee servings and a more immersive and harmonious coffee experience. Overall, the market is expected to continue growing as technology advances and consumer expectations evolve.

What challenges does the Coffee Machine Industry face during its growth?

- The growth of the coffee industry is confronted by significant environmental concerns linked to coffee machines. These environmental threats pose a substantial challenge that must be addressed to ensure sustainable industry expansion.

- The market faces a significant challenge due to the environmental impact of these appliances. Coffee machines produce more waste per serving compared to traditional coffee packaging methods, and global waste management systems struggle to address this issue. The manufacturing of coffee machines utilizes materials like plastic and aluminum, contributing negatively to the environment. In the US, the Environmental Protection Agency (EPA) plays a crucial role in regulating waste disposal, solid waste management, and recycling through various acts such as the Resource Conservation and Recovery Act (RCRA), the Clean Air Act, the Clean Water Act, and the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA).

- The increasing environmental concerns and regulations are key factors influencing the market dynamics. Organic coffee, decaf coffee, and fair trade coffee are gaining popularity among consumers, driving demand for coffee machines that cater to these preferences. Coffee cultivation methods also impact the market, with sustainable and ethical sourcing becoming increasingly important. Both drip coffee makers and single-serve brewers have their unique advantages, while French press and super-automatic machines cater to different consumer preferences. Coffee bean processing and grinding settings are also essential factors in the market, with consumers seeking optimal taste and convenience.

Exclusive Customer Landscape

The coffee machine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coffee machine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, coffee machine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bunn O Matic Corp. - The company provides a selection of high-performing coffee machines, including the ICBDV Dual Volt Platinum Edition available in both 120V and 120V-240V versions. These machines offer advanced features and sleek designs, ensuring a premium coffee experience. The ICBTwin Platinum Edition, another option, caters to diverse voltage requirements. By providing a range of innovative coffee machines, the company maintains its commitment to delivering exceptional beverage solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bunn O Matic Corp.

- Caffe d Italia Srl

- DeLonghi Group

- Dualit Ltd.

- Electrolux Group

- Glen Dimplex Group.

- Hamilton Beach Brands Inc.

- Illycaffe S.p.A.

- JACOBS DOUWE EGBERTS B.V.

- Keurig Dr Pepper Inc.

- Koninklijke Philips NV

- LUIGI LAVAZZA SPA

- Magimix SAS

- Massimo Zanetti Beverage Group

- maxingvest AG

- Melitta Group

- Nestle SA

- Panasonic Holdings Corp.

- Tata Sons Pvt. Ltd.

- The J.M. Smucker Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Coffee Machine Market

- In January 2024, Nestle's Nespresso brand announced the launch of its new VertuoPlus coffee machine, featuring a barcode technology that identifies the type of Nespresso capsule for optimal brewing. (Nestle Press Release)

- In March 2024, Starbucks Corporation and Nestle entered into a global coffee and tea partnership, granting Nestle the rights to sell Starbucks packaged goods worldwide. This collaboration expanded Starbucks' reach beyond its traditional retail channels. (Starbucks Press Release)

- In April 2025, JAB Holding Company, the parent company of Keurig Dr Pepper, completed the acquisition of a 43.3% stake in Dunkin Brands, the parent company of Dunkin' Donuts and Baskin-Robbins. This strategic move aimed to strengthen JAB's presence in the quick-service restaurant industry and coffee market. (JAB Holding Company Press Release)

- In May 2025, Dyson, known for its vacuum cleaners and haircare products, unveiled its new Dyson's Core Coffee machine, which uses a patented centrifugal extraction process to create a perfect espresso. This technological advancement disrupted the market with its innovative brewing technology. (Dyson Press Release)

Research Analyst Overview

- In the dynamic coffee market, various factors influence consumer preferences and industry trends. Caffeine content and roast development continue to shape coffee culture, with retailers offering a diverse range of light, medium, and dark roasts to cater to different tastes. Coffee magazines and books delve into the intricacies of coffee chemistry and sensory evaluation, while food safety standards ensure the quality of coffee imports and exports. Retail coffee sales thrive, with online retailers and subscription services gaining popularity. Coffee competitions showcase the art of latte art and espresso blend creation. Roast level plays a significant role in coffee flavor, with third-wave coffee enthusiasts favoring lighter roasts for their distinct taste profiles.

- Quality control is crucial in coffee production, with defect detection and filter blend optimization essential for maintaining consistent coffee density and grind size. Water quality and coffee filters are also vital components in coffee extraction yield. Coffee distribution channels have evolved, with wholesale coffee sales and coffee tourism contributing to the industry's growth. Coffee culture continues to evolve, with a focus on specialty coffee and coffee accessories, creating new opportunities for businesses.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Coffee Machine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 9449.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Germany, France, Japan, Italy, China, Canada, Brazil, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Coffee Machine Market Research and Growth Report?

- CAGR of the Coffee Machine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the coffee machine market growth of industry companies

We can help! Our analysts can customize this coffee machine market research report to meet your requirements.