Cold Roll Steel Market Size 2024-2028

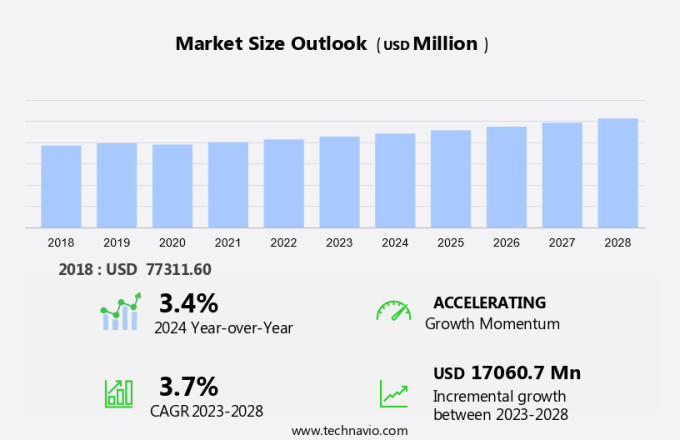

The cold roll steel market size is forecast to increase by USD 17.06 billion at a CAGR of 3.7% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. Infrastructural development in emerging economies is a primary factor fueling market expansion. The increasing demand for heavy machinery and household appliances in these regions is leading to a rise in the consumption of cold roll steel. Additionally, industrial development in countries like China and India is driving up the demand for this product. Moreover, the thickness and weight of cold-roll steel make it an ideal choice for various industries, including automotive, construction, and packaging. companies in the market are focusing on inorganic growth strategies, such as mergers and acquisitions, to expand their market presence. However, stringent regulations associated with cold roll steel production and usage pose a challenge to market growth. Compliance with these regulations requires significant investments in technology and research and development, which can increase the cost of production. In conclusion, the market is witnessing steady growth due to the increasing demand from various industries and developing economies. However, the market faces challenges in the form of regulatory compliance and increasing production costs. Despite these challenges, the market is expected to continue growing due to the versatility and durability of cold-roll steel.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth, driven by the increasing demand from various sectors such as automotive and construction. This market is characterized by the production of flat steel products through the cold rolling process, which results in a smooth, even surface finish. In the automotive sector, the shift towards electric vehicles (EVs) is a major factor fueling the demand for cold-rolled steel coils. These steels are used extensively in the manufacturing of EV structural components due to their high strength-to-weight ratio and formability. Cold-rolled steel coils are also used in the production of commercial vehicles and in residential building projects for structural framing members. The construction sector is another significant consumer of cold-rolled steel coils. These steels are used in various applications such as roofing, wall cladding, and flooring due to their excellent dimensional tolerances and surface finish. The use of low-carbon steel in cold-rolled steel coils makes them an attractive option for sustainable construction projects.

- The fabricating and machining industries also contribute to the demand for cold-rolled steel coils. These industries require high-strength and low-carbon steels for various applications, including appliances, general engineering, and consumer goods. Cold-rolled steel coil, including low carbon steel and high-strength steel, is widely used in manufacturing industries for producing durable, high-performance products that require both flexibility and strength. The cold rolling process enables the production of flat steel products with precise dimensions and excellent surface finish, making them ideal for these industries. The market for cold-rolled steel coils is expected to grow at a steady pace due to the increasing demand from various end-use industries. The ability of cold-rolled steel coils to offer superior strength, formability, and surface finish makes them a preferred choice over hot rolled steel in many applications.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Construction and Infrastructure

- Consumer durables

- Machineries

- Others

- Product Type

- Cold rolled steel coil

- Cold rolled steel sheet

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- US

- Middle East and Africa

- South America

- Brazil

- APAC

By Application Insights

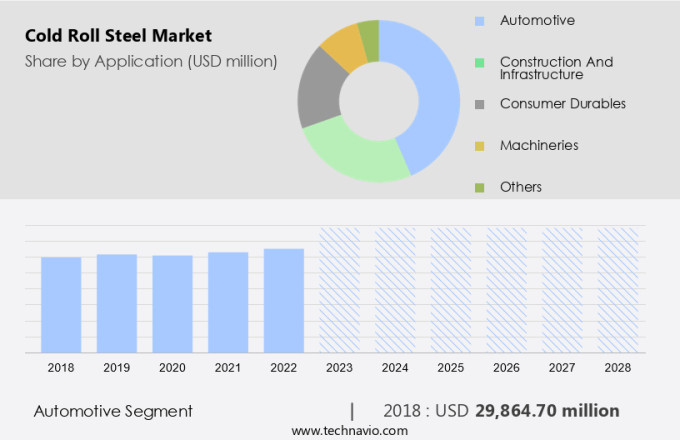

- The automotive segment is estimated to witness significant growth during the forecast period.

Cold-roll steel coils are extensively utilized in various industries, with a significant application being in the residential and automotive sectors. In the residential sector, cold roll steel is employed in construction activities due to its superior mechanical properties, such as high tensile strength and excellent surface finish. These properties contribute to the durability and longevity of buildings. In the automotive industry, the demand for cold-rolled steel coils is increasing due to the need for fuel economy and reduced emissions.

The automotive sector is a major consumer of cold roll steel, as it is used to manufacture lightweight yet strong components, enhancing vehicle performance and fuel efficiency. voestalpine's Metal Forming Division recently secured new long-term contracts with two major global truck manufacturers in North America, necessitating an expansion of production capacity

Get a glance at the market report of share of various segments Request Free Sample

The automotive segment was valued at USD 29.86 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

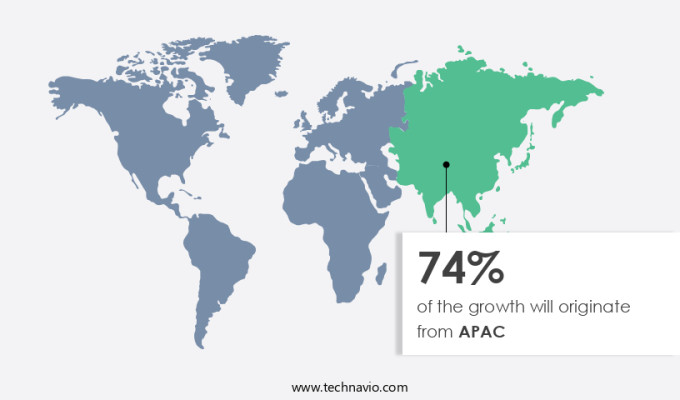

- APAC is estimated to contribute 74% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific (APAC) region leads the market due to strong economic growth, industrialization, and substantial investments in infrastructure. In May 2023, Jamshedpur Continuous Annealing and Processing Company Pvt. Ltd. (JCAPCPL) reached a notable accomplishment, selling over 2.0 million tonnes of cold rolled steel to automotive manufacturers. This milestone highlights the substantial demand for cold rolled steel in the automotive sector within the region. India, a significant player in the APAC market, was a net importer of finished steel during the 2023-2024 fiscal year, bringing in 8.3 million metric tons, marking a 38% increase from the previous year.

The automotive sector, particularly in the production of electric vehicles (EVs), is a significant consumer of cold rolled steel in the APAC region. Structural framing members in the construction sector are another major application area for cold rolled steel. The demand for cold rolled steel in these sectors is expected to continue growing, driven by increasing industrialization and urbanization in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Cold Roll Steel Market?

Increasing steel production in developing countries is the key driver of the market.

- The market in the global arena is witnessing a notable expansion, primarily fueled by the escalating steel production in emerging economies. This expansion can be attributed to strategic government initiatives aimed at enhancing steel consumption and investment, particularly in rural regions. In the financial year 2023-2024, India's Ministry of Steel reported a substantial increase in crude steel production, reaching 144.3 million tonnes, a significant jump from the 109.14 million tonnes produced in 2019-2020. This remarkable growth underscores the success of various initiatives designed to bolster the steel industry. One such initiative is the Indian government's focus on infrastructure development through the Gati-Shakti Master Plan.

- In the commercial sector, the demand for low carbon steel is on the rise, particularly in the manufacturing of commercial vehicles. In residential building projects, hot rolled steel continues to be a preferred choice due to its durability and cost-effectiveness. Companies such as Tata Steel are at the forefront of this growth, supplying high-quality cold roll steel to various industries. This trend is expected to continue, driven by the increasing demand for steel in various sectors and the ongoing infrastructure development initiatives.

What are the market trends shaping the Cold Roll Steel Market?

Increasing inorganic growth by companies is the upcoming trend in the market.

- The market is experiencing notable growth through strategic mergers and acquisitions among key industry players. In December 2023, US Steel was acquired by NSC, a significant move that strengthened NSC's manufacturing and technological capabilities. This acquisition enables NSC to better cater to its stakeholders, including customers and the community, while also expanding its global presence. The acquisition increases NSC's production capacity in the US, complementing its existing operations in Japan, ASEAN, and India.

- With this expansion, NSC's total annual crude steel capacity reaches 86 million tonnes. This strategic move enhances the competitive landscape of the market and underscores the industry's role in infrastructural development and the manufacturing of home appliances and machinery. The thickness and weight of steel are essential factors driving industrial development, making this market a vital component of various sectors.

What challenges does Cold Roll Steel Market face during the growth?

Stringent regulations associated with cold roll steel is a key challenge affecting the market growth.

- The market is currently navigating complex regulatory landscape, with recent legislative initiatives targeting environmental regulations. In June 2024, key political figures introduced a bill to repeal the Environmental Protection Agency's (EPA) Clean Power Plan 2.0 regulations. These regulations, implemented earlier in the year, set new greenhouse gas (GHG) emission limits for coal- and natural gas-fired power plants. The proposed legislation, under the Congressional Review Act (CRA), aims to overturn these rules. Compliance with these stringent regulations necessitates significant investment in advanced technologies and infrastructure to reduce emissions. Machining processes for cold roll steel, a key component in various industries such as construction, vehicle components, and stainless steel, will be impacted.

- High-strength and low-carbon steel manufacturers will need to upgrade their facilities to meet the new emission standards. These changes will influence the market dynamics. The construction industry, for instance, may experience a shift towards the use of alternative materials or processes to reduce its carbon footprint. Similarly, the automotive sector may explore new manufacturing methods to minimize emissions. The market will need to adapt to these regulatory changes to remain competitive and sustainable.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecasts, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ansteel Group Corp. Ltd.

- ArcelorMittal SA

- China BaoWu Steel Group Corp. Ltd.

- Cleveland Cliffs Inc.

- Hyundai Steel Co.

- JFE Holdings Inc.

- JSW Group

- LIBERTY Steel Group

- National Aluminium Co. Ltd.

- Nippon Steel Corp.

- Outokumpu Oyj

- POSCO holdings Inc.

- SSAB AB

- Steel Authority of India Ltd.

- Surya Roshni Ltd

- Tata Steel Ltd.

- thyssenkrupp AG

- U. S. Steel Kosice s.r.o

- voestalpine AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cold-rolled steel coils, also known as CRC or cold-rolled flat steel products, are widely used in various industries due to their excellent formability and superior surface finish. The automotive sector is a significant consumer of cold-rolled steel, with its usage in EVs (electric vehicles) and commercial vehicles for manufacturing vehicle components such as body panels, structural framing members, and chassis. In the construction sector, cold-rolled steel is utilized in residential building projects and infrastructural development for fabricating and machining beams, columns, and other structural elements. The demand for low-carbon steel in cold-rolled steel coils is increasing due to the growing focus on reducing emissions and improving fuel economy.

Further, the construction sector's demand for cold-rolled steel is also driven by the need for high-strength and lightweight materials for constructing buildings and other structures. The cold rolling process allows for precise dimensional tolerances, making cold-rolled steel an ideal choice for various applications in the manufacturing industry, including home appliances, machinery, and general engineering. Cold-rolled steel coils are available in various thicknesses and can be used as an alternative to hot-rolled steel and stainless steel in certain applications. The versatility of cold-rolled steel makes it a popular choice for various industries, contributing to the growth of the global cold-rolled steel market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.7% |

|

Market growth 2024-2028 |

USD 17.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.4 |

|

Key countries |

China, India, Japan, South Korea, US, Germany, UK, France, Brazil, and Turkey |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch