Command And Control Systems Market Size 2025-2029

The command and control systems market size is forecast to increase by USD 2.79 billion at a CAGR of 2.2% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing demand for integrated situation awareness systems and the preference for comprehensive C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems. These systems enable real-time monitoring, decision-making, and coordinated responses to dynamic operational environments. However, market expansion is not without challenges. Regulatory hurdles impact adoption due to stringent compliance requirements and lengthy approval processes. Additionally, supply chain inconsistencies temper growth potential, as the dependence on various suppliers for technology and equipment can lead to delays and quality concerns.

- To capitalize on market opportunities and navigate these challenges effectively, companies must focus on building robust partnerships, investing in research and development, and ensuring regulatory compliance. By staying agile and responsive to market demands, organizations can position themselves as strategic partners to their clients and drive long-term growth in the market.

What will be the Size of the Command And Control Systems Market during the forecast period?

- In the dynamic US market for command and control systems, cutting-edge intelligence plays a pivotal role in public safety and strategic decisionmaking. Satellite-based Geographic Information Systems (GIS) are increasingly adopted for effective transport and traffic management, enhancing operational efficiency. Centralized command centers, equipped with Facial Recognition technology and criminal databases, enable law enforcement to identify offenders swiftly. Military infrastructure and intelligence communities strengthen contractual agreements for secure communications and infrastructure safety. Deployable command systems, a cost-effective solution, are essential for strategic activities, particularly in regions with complex transportation networks. Multiple sources of essential information, including satellite communications and monitoring activities, ensure comprehensive situational awareness.

- Manufacturing locally supports the US economy while maintaining the highest security standards. Fire departments and law enforcement agencies benefit from these advanced systems, improving their response capabilities and ensuring public safety. As the market continues to evolve, cost-effective items and innovative technologies will remain key drivers for growth.

How is this Command And Control Systems Industry segmented?

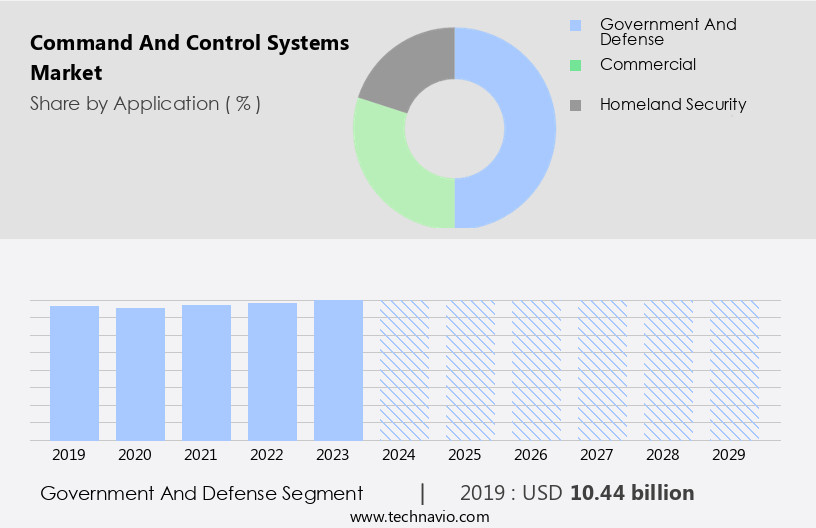

The command and control systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Government and defense

- Commercial

- Homeland security

- Platform

- Land

- Airborne

- Naval

- Space

- Solution

- Software

- Hardware

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The government and defense segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities, including secure network routers, contractual agreements, deployed vehicles, multiple sources, video management systems, operational costs, and cutting-edge intelligence. Effective transport, signaling and traffic, military modernization, public safety, dismounted personnel, command and control, deployable command, military infrastructure, secure communications, infrastructure safety, centralized centers, intelligence communities, strategic decision-making, regional transportation, satellite-based GIS, fixed command, satellite communications, monitoring activities, criminal databases, strategic activities, cloud-based servers, satellite technologies, essential information, cost-effective items, fire departments, cross-border conflicts, composite picture, command centers, traffic management, deployed headquarters, and deployable command. The government and defense segment dominates the market, with command and control systems integral to sectors such as military air traffic management and control, weapons control, and information systems.

These systems are crucial for collecting vital information in mission planning and execution, with expansion driven by the need to boost situational awareness, bolster ecological safety, and protect infrastructure, borders, and seashores. Additionally, advancements in satellite technologies and cloud-based servers facilitate cost-effective and efficient communication networks, enabling facial recognition and identifying offenders for law enforcement. The integration of these entities in the command and control systems landscape underlines the market's significance in ensuring public safety, military modernization, and strategic decision-making.

The Government and defense segment was valued at USD 10.44 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US Department of Defense (DoD) is significantly investing in command and control systems due to the evolving nature of warfare. This market is witnessing growth as the country prioritizes the deployment of advanced IT technologies in defense systems. The increasing focus on electronic warfare (EW) systems is driving market expansion. Various companies cater to the demand for command and control solutions for military and other critical operations. For example, Northrop Grumman Corporation offers the Command and Control Personal Computer (C2PC), specifically designed for the US Marine Corps. This system enables users to view and edit the Common Operational Picture (COP), apply overlays, display imagery, send and receive tactical messages, and gain overall battlefield situation awareness.

Other entities contributing to the market include secure network routers, contractual agreements, deployed vehicles, multiple sources, video management systems, operational costs, cutting-edge intelligence, effective transport, signaling and traffic, military modernization, public safety, dismounted personnel, command and control, deployable command, military infrastructure, secure communications, infrastructure safety, centralized centers, intelligence communities, strategic decisionmaking, regional transportation, satellite-based GIS, fixed command, satellite communications, monitoring activities, criminal databases, strategic activities, cloud-based servers, satellite technologies, essential information, cost-effective items, fire departments, cross-border conflicts, composite picture, command centers, traffic management, deployed headquarters, and deployable command. These entities play a crucial role in shaping the market dynamics and trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Command And Control Systems market drivers leading to the rise in the adoption of Industry?

- The increasing demand for situation awareness systems that seamlessly integrate information from various sources is the primary market driver.

- In the current business landscape, there is a growing demand for command and control systems that provide secure network routers and effective transport of real-time data for decision-making in critical sectors, including defense and public safety. These systems integrate multiple sources, such as video management systems, satellite imagery, and signaling and traffic information, to offer cutting-edge intelligence and situational awareness. Operational costs are a significant concern, leading companies to offer flexible contractual agreements to cater to various client needs. Dismounted personnel and deployed vehicles require continuous access to precise and timely information for effective response to potentially dangerous situations.

- Military modernization initiatives and the need for enhanced operational efficiency further fuel the market's growth. Companies provide integrated solutions that combine various inputs, including live video feeds, federated databases, and security systems, to augment the situational awareness of decision-makers.

What are the Command And Control Systems market trends shaping the Industry?

- The preference for integrated Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) systems is a notable market trend. Professionals in this field prioritize the adoption of comprehensive C4ISR systems to enhance operational efficiency and effectiveness.

- Command and control systems play a crucial role in military infrastructure, enabling secure communications, infrastructure safety, and strategic decision-making. Traditional systems, however, have limitations. They consist of separate, stand-alone units and equipment for various functions, leading to a complex and time-consuming process. To streamline these operations, defense agencies are adopting an enterprise integration approach. This approach advocates the integration of secure and interoperable command and control networks and systems. The shift is towards open and government-owned architectures that ensure comprehensive data integration.

- This transition will enhance situational awareness, improve monitoring activities, and facilitate information sharing between centralized centers, intelligence communities, and regional transportation networks. Furthermore, satellite-based Geographic Information Systems (GIS), fixed command, and satellite communications will be integral components of these integrated systems. This evolution will enable more effective criminal database access and monitoring, ultimately enhancing overall operational efficiency.

How does Command And Control Systems market faces challenges face during its growth?

- The implementation of new technology and equipment in the industry encounters significant barriers, posing a substantial challenge to its growth.

- The market: Adhering to Regulatory Norms and Overcoming Technology Challenges the market involves the development, deployment, and maintenance of strategic activities for various sectors, including military, emergency services, and traffic management. These systems rely on advanced technologies, such as Cloud-based servers and satellite communications, to provide essential information in real-time. Government agencies and departments of defense worldwide collaborate with private companies and technology providers to ensure the implementation of command and control systems that meet stringent regulatory requirements. Compliance with federal, state, and local regulations is mandatory to maintain security and efficiency. Military forces face challenges in adopting new technologies due to their short lifespan and high costs.

- The introduction of new technologies also brings certification requirements, technology risks, and a need for high technical expertise. Technologically advanced equipment undergoes rigorous testing and evaluation prior to certification. Despite these challenges, the importance of command and control systems in various sectors is undeniable. They play a crucial role in cross-border conflicts, deployable command centers, and traffic management, providing a composite picture of the situation at hand to decision-makers. As the market continues to evolve, companies must stay informed about the latest trends and technologies to remain competitive.

Exclusive Customer Landscape

The command and control systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the command and control systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, command and control systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BAE Systems Plc - This company specializes in advanced command and control solutions, encompassing C4ISR systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BAE Systems Plc

- Booz Allen Hamilton Holding Corp.

- CACI International Inc.

- Codan Ltd

- Cubic Corp.

- Elbit Systems Ltd.

- General Dynamics Corp.

- Kongsberg Gruppen ASA

- Kratos Defense and Security Solutions Inc.

- L3Harris Technologies Inc.

- Leonardo Spa

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- RGB Spectrum

- Rheinmetall AG

- Rolta India Ltd.

- RTX Corp.

- Saab AB

- Thales Group

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Command And Control Systems Market

- In February 2024, Lockheed Martin Corporation announced the successful integration of its new Open Architecture Command and Control (OA-C2) system into the F-35 Lightning II aircraft. This technological advancement marks a significant shift towards open architecture systems in military aviation, enabling greater interoperability and flexibility (Lockheed Martin Corporation, 2024).

- In March 2025, Thales and Raytheon Technologies entered into a strategic partnership to develop advanced command and control solutions for defense and security applications. This collaboration combines Thales' expertise in command and control systems with Raytheon's capabilities in mission systems and intelligence, surveillance, and reconnaissance (Thales, 2025).

- In July 2024, Elbit Systems Ltd. Secured a USD135 million contract from the U.S. Army to provide command and control systems for the Joint All-Domain Command and Control (JADC2) program. This strategic investment underscores the growing importance of advanced command and control systems in military modernization efforts (Elbit Systems, 2024).

- In October 2025, Saab AB announced the successful deployment of its new 9LV Mk4 Command and Control System onboard the Swedish Navy's Visby-class corvettes. This system integrates advanced sensors, weapons, and communication systems, providing enhanced situational awareness and command capabilities (Saab AB, 2025).

Research Analyst Overview

Command and control systems continue to play a pivotal role in ensuring effective and efficient management of various operations, from military modernization to public safety. The market for these systems is characterized by ongoing dynamics and evolving patterns, with multiple sources driving innovation and growth. Secure network routers are becoming increasingly essential for command and control systems, enabling secure and reliable communication between deployed vehicles and centralized centers. Contractual agreements between various entities, such as military infrastructure and intelligence communities, are crucial for the deployment and implementation of these systems. Video management systems are another critical component of command and control, providing cutting-edge intelligence for effective transport and traffic management.

Signaling and traffic systems help ensure smooth operational flow, while satellite-based GIS and satellite communications facilitate real-time monitoring activities. Military infrastructure and public safety are two primary sectors driving the demand for command and control systems. Military modernization and strategic decision-making require robust and reliable communication networks, while regional transportation and law enforcement agencies rely on these systems for identifying offenders and maintaining infrastructure safety. Deployable command and control systems are becoming increasingly popular, enabling effective communication and coordination in warfare situations and cross-border conflicts. Fixed command centers and cloud-based servers offer cost-effective solutions for strategic activities, while facial recognition technology enhances security and surveillance capabilities.

Satellite technologies are revolutionizing command and control systems, providing essential information for strategic decision-making and real-time monitoring. Military expenditure on these systems continues to rise, reflecting the importance of secure communications and effective transport management. Legacy systems are being replaced with more advanced and integrated solutions, offering better interoperability and scalability. Fire departments and dismounted personnel are also benefiting from these systems, enabling real-time communication and coordination during emergencies. In the realm of defense capabilities, command and control systems are essential for maintaining a composite picture of operational activities. The command chain relies on these systems for effective communication and coordination, ensuring that strategic activities are carried out efficiently and effectively.

The market for command and control systems is expected to continue growing, driven by advancements in technology and the increasing need for secure and reliable communication networks. The integration of cloud-based servers and satellite technologies is expected to further enhance the capabilities of these systems, providing cost-effective and scalable solutions for various sectors. In conclusion, the market is characterized by ongoing dynamics and evolving patterns, with multiple sources driving innovation and growth. Secure communications, effective transport management, and real-time monitoring are key drivers of demand, with military modernization and public safety being the primary sectors benefiting from these systems.

The integration of advanced technologies, such as satellite-based GIS and facial recognition, is expected to further enhance the capabilities of command and control systems, providing essential tools for strategic decision-making and operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Command And Control Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.2% |

|

Market growth 2025-2029 |

USD 2.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

US, China, Canada, Germany, Japan, UK, India, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Command And Control Systems Market Research and Growth Report?

- CAGR of the Command And Control Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the command and control systems market growth of industry companies

We can help! Our analysts can customize this command and control systems market research report to meet your requirements.