Commercial Aircraft Aftermarket Parts Market Size 2025-2029

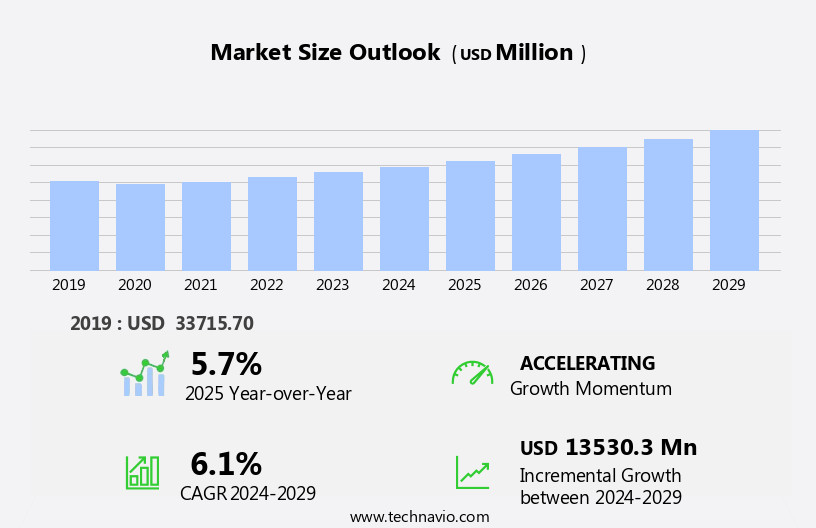

The commercial aircraft aftermarket parts market size is forecast to increase by USD 13.53 billion, at a CAGR of 6.1% between 2024 and 2029.

- The market is witnessing significant dynamics, driven by the increasing preference for collaborative efforts within the aerospace industry. This trend is fostering growth opportunities as OEMs and MROs collaborate to enhance efficiency and reduce costs. Furthermore, the aviation sector's growing emphasis on sustainability is fueling demand for aftermarket parts that contribute to improved fuel efficiency and reduced emissions. However, challenges persist, with rising concerns related to the shortage of resources, particularly raw materials and skilled labor, posing a significant threat to market expansion.

- Companies seeking to capitalize on opportunities must focus on innovation, strategic partnerships, and workforce development to navigate these challenges effectively. The market's strategic landscape is shaped by these key drivers and challenges, offering potential for growth and competitiveness in the aerospace sector.

What will be the Size of the Commercial Aircraft Aftermarket Parts Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by dynamic market conditions and diverse applications across various sectors. Parts distribution and supply chain management play a crucial role in ensuring the smooth operation of this complex ecosystem. FAA regulations and service bulletins guide the industry, shaping safety standards and compliance requirements. Emergency exits, engine parts, and landing gear are essential components undergoing constant innovation, with titanium alloys and steel alloys leading the materials evolution. Obsolescence management and engineering support are vital for maintaining aircraft fleets, while maintenance schedules and propulsion systems ensure optimal performance. Environmental control systems, health monitoring, and inventory management are essential for enhancing passenger comfort and safety.

Predictive analytics and digital twin technologies facilitate proactive maintenance and spare parts management. Training programs and lease agreements ensure a skilled workforce and efficient fleet utilization. Safety improvements, such as safety regulations, safety equipment, and emergency systems, are continually being refined to minimize risks. Engine performance monitoring, repairs, and overhauls, and corrosion prevention are essential for maintaining engine efficiency and longevity. The market's continuous dynamism extends to avionics systems, cabin interior components, cabin pressure systems, retrofit kits, and galley equipment. Navigation systems, communication systems, technical documentation, and airworthiness directives are crucial for ensuring regulatory compliance and operational efficiency.

Ultrasonic inspection, non-destructive testing, and 3D printing are transforming maintenance processes, while logistics optimization and fire suppression systems ensure efficient and safe operations. Pilot training and cockpit displays are essential for maintaining high levels of aviation expertise. The market's ongoing evolution reflects the industry's commitment to safety, efficiency, and innovation.

How is this Commercial Aircraft Aftermarket Parts Industry segmented?

The commercial aircraft aftermarket parts industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Narrow-body

- Wide-body

- Regional jet

- Application

- MRO parts

- Rotable scrap replacement parts

- Component

- Engine parts

- Airframe parts

- Avionics

- Landing gear parts

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

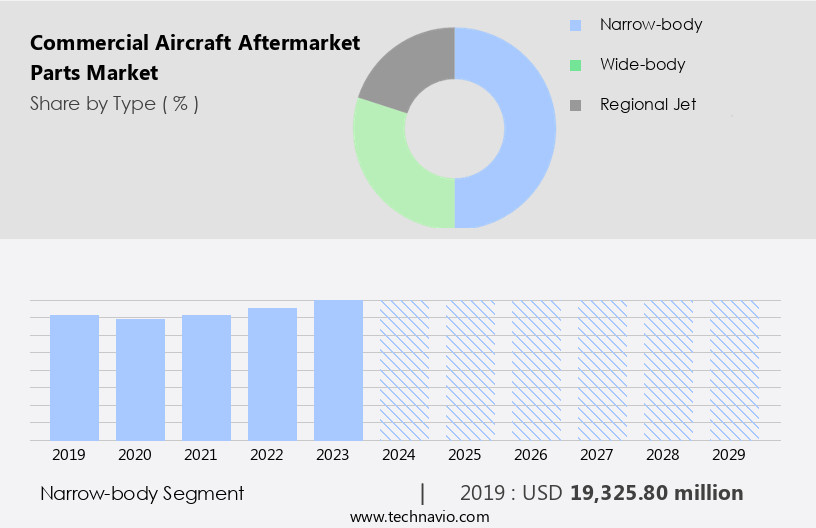

The narrow-body segment is estimated to witness significant growth during the forecast period.

The narrow-body segment in The market caters to various types of aircraft, such as the Airbus A320 and Boeing 737 families, which are widely used for short to medium-haul routes with high frequency. Aftermarket parts for these aircraft encompass a broad spectrum, including avionics, engines, airframes, landing gear, cabin interiors, and auxiliary systems. Renowned companies provide these components globally to ensure a steady supply for airline operators. RTX Corp. Is one such player, recognized for its extensive offerings of aircraft systems and components. Avionics maintenance and upgrades, radiographic inspection, aluminum alloys, composite materials, navigation systems, cabin interior components, cabin pressure systems, retrofit kits, training programs, galley equipment, safety regulations, and avionics systems are essential components of the aftermarket.

Predictive analytics, safety equipment, spare parts, hydraulic systems, used aircraft parts, airframe components, component repair, supply chain management, ultrasonic inspection, in-flight entertainment, and communication systems are other critical areas of focus. Engine performance monitoring, repairs and overhauls, safety improvements, life vests, pneumatic systems, flight data recorders, engine maintenance, overhaul services, and engineering support are essential for maintaining aircraft efficiency and safety. Compliance with regulations, such as EASA and FAA, is crucial, with service bulletins and airworthiness directives guiding maintenance schedules and upgrades. Corrosion prevention, cockpit displays, avionics parts, non-destructive testing, oxygen systems, flight controls, electrical systems, and airframe parts are integral to the ongoing maintenance and optimization of aircraft performance.

Logistics optimization, 3D printing, and fire suppression systems are emerging trends in the aftermarket, enhancing efficiency and reducing downtime. In conclusion, the market is dynamic, with a focus on ensuring the highest quality components for a diverse range of aircraft models. Companies like RTX Corp. Play a vital role in providing these essential parts and services, enabling airlines to maintain their fleets efficiently and safely.

The Narrow-body segment was valued at USD 19.33 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

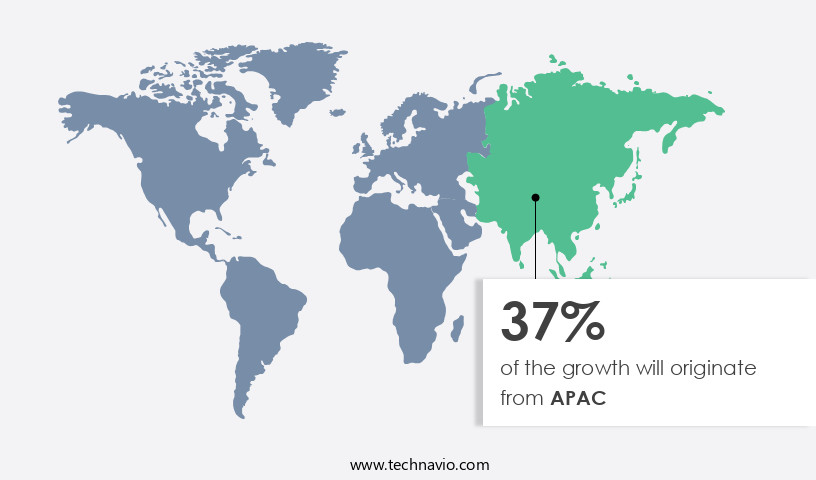

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In Europe's maturing aviation market, passenger numbers continue to rise, driving airlines to invest in modern aircraft for improved services and cost efficiency. The European aerospace industry boasts advanced technological and production capabilities, with key players including the UK, France, Germany, Italy, Sweden, Spain, and Poland, due to their expertise, research investments, and partnerships with international component and part suppliers. Although growth is slower than in North America, major European carriers are upgrading their fleets with new aftermarket parts to replace aging components. Avionics maintenance is a significant focus, with radiographic inspection ensuring structural integrity, while aluminum alloys and composite materials are used extensively in airframe components.

Navigation systems and communication systems are essential for safe and efficient flights, while cabin interior components, cabin pressure systems, and safety equipment cater to passenger comfort and safety. Retrofit kits and training programs enable airlines to adapt to new technologies and regulations. Warranty claims, engine performance monitoring, repairs, and overhauls are ongoing requirements for maintaining fleet reliability. Safety improvements, such as life vests, pneumatic systems, and flight data recorders, are crucial for emergency situations. Engine maintenance, overhaul services, predictive analytics, and engineering support ensure optimal engine performance. Safety regulations, including EASA and FAA, mandate compliance with airworthiness directives, engine upgrades, and corrosion prevention measures.

Logistics optimization, inventory management, and maintenance training are essential for efficient supply chain management. Digital twin technologies, 3D printing, and airframe maintenance enable cost savings and improved performance. Galley equipment, hydraulic systems, used aircraft parts, and spare parts are essential for daily operations, while landing gear and obsolescence management ensure fleet readiness. Propulsion systems, environmental control systems, health monitoring, and inventory management are crucial for maintaining operational efficiency. In summary, the European aviation industry is undergoing continuous evolution to meet the growing demand for air travel. Airlines invest in new technologies, components, and training to enhance services, maintain regulatory compliance, and optimize operational efficiency.

The market for aftermarket parts and services is thriving, with a focus on innovation, quality, and cost savings.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The commercial aircraft aftermarket parts industry is a dynamic and essential sector, supplying replacement components for the worldwide fleet of commercial aircraft. This market encompasses a vast array of products, including engines, avionics, landing gear, and structural parts. Manufacturers, distributors, and repair stations worldwide cater to the constant demand for aftermarket parts, ensuring the continued operation and safety of commercial aircraft. The industry's growth is driven by factors such as fleet expansion, aging aircraft, and the increasing popularity of leasing and MRO services. OEMs, independent distributors, and repair stations leverage advanced technologies like 3D printing, digital inventory management, and logistics optimization to meet the evolving needs of their customers. The market is a global, competitive landscape, with players focusing on innovation, quality, and customer service to stay ahead.

What are the key market drivers leading to the rise in the adoption of Commercial Aircraft Aftermarket Parts Industry?

- The aerospace industry's market growth is primarily attributed to the prevailing preference for collaborative endeavors.

- The market is experiencing significant growth due to the increasing demand for maintenance, repair, and overhaul services for various aircraft components. This includes pneumatic systems, hydraulic systems, engine maintenance, and safety equipment. OEMs are encouraging new entrants to invest in the market, particularly in areas of expertise such as component repair and supply chain management. Strict regulatory norms have limited newcomers in the aerospace manufacturing sector, but the prolonged development phases of aircraft and evolving demand for spare parts present opportunities.

- Predictive analytics and ultrasonic inspection technologies are being adopted to enhance maintenance efficiency and safety. The market for used aircraft parts and airframe components is also growing, driven by cost savings and the availability of technical documentation and communication systems. EASA regulations ensure safety and standardization in the market, while IFE and other systems continue to evolve, creating ongoing demand for aftermarket parts.

What are the market trends shaping the Commercial Aircraft Aftermarket Parts Industry?

- The aviation industry is increasingly focusing on sustainability as the next major market trend. This shift towards more eco-friendly practices is not only mandatory for regulatory compliance but also for maintaining a positive public image.

- The commercial aircraft aftermarket parts industry is experiencing a significant shift towards sustainability, driven by the aviation sector's increasing focus on reducing its carbon footprint. Airlines prioritize eco-friendly practices in their maintenance and repair activities, leading to a growing demand for components and solutions that contribute to environmental conservation. In response, aftermarket parts suppliers are innovating by offering lightweight materials, energy-efficient systems, and fuel-minimizing components. Furthermore, the supply chain in the aftermarket parts industry is subject to disruptions due to FAA regulations, service bulletins, and maintenance schedules. To mitigate these challenges, suppliers provide engineering support, inventory management, and maintenance training to ensure seamless integration of new parts into aircraft systems.

- Propulsion systems and environmental control systems are critical components in commercial aircraft, requiring regular maintenance and replacement. Engine parts, such as titanium alloys and steel alloys, are essential for optimal engine performance. Landing gear components, too, undergo rigorous maintenance and replacement schedules to ensure aircraft safety. Obsolescence management is another crucial aspect of the aftermarket parts industry, as aging aircraft require constant updates to comply with regulatory requirements and maintain operational efficiency. Health monitoring systems help identify potential issues before they become critical, reducing the risk of unexpected downtime and minimizing costs. Lease agreements between airlines and parts suppliers play a significant role in the aftermarket parts market, ensuring a steady demand for replacement parts and services.

- Overall, the commercial aircraft aftermarket parts industry continues to evolve, driven by the need for sustainability, regulatory compliance, and operational efficiency.

What challenges does the Commercial Aircraft Aftermarket Parts Industry face during its growth?

- The industry's growth is significantly impacted by escalating concerns regarding resource scarcity.

- The global commercial aircraft aftermarket parts industry is experiencing significant growth, mirroring the expansion of the commercial aviation sector. However, challenges persist, particularly in the engine overhaul segment, which faces a supply-demand imbalance. This issue is particularly relevant to the widespread Boeing 737 and Airbus A320 families. Moreover, engine shop visits are taking longer due to the scarcity of certain narrow-body aircraft engine components, posing a potential threat to market growth. Additionally, the shortage of airframe and powerplant mechanics and avionics technicians is a multifaceted issue stemming from low employment, retirements, and competition in various industries.

- To mitigate these challenges, digital twin technologies are increasingly being adopted for predictive maintenance and inventory optimization. Airworthiness directives are being addressed through engine upgrades and corrosion prevention measures. Cockpit displays, avionics parts, and electrical systems are being enhanced through advanced NDT techniques. Oxygen systems, fire suppression systems, and passenger entertainment systems are being modernized for improved safety and passenger experience. Logistics optimization and 3D printing are also being employed for airframe maintenance and spare parts production. Pilot training programs are being updated to accommodate these technological advancements and ensure a skilled workforce.

Exclusive Customer Landscape

The commercial aircraft aftermarket parts market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft aftermarket parts market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial aircraft aftermarket parts market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A J Walter Aviation Ltd. - This company specializes in supplying aftermarket parts for commercial aviation, including landing gear, auxiliary power units (APUs), and inlet cowls, enhancing aircraft performance and durability. Our offerings cater to the aviation industry's demands for reliable, high-quality components.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A J Walter Aviation Ltd.

- AAR Corp.

- Bombardier Inc.

- Eaton Corp. plc

- General Electric Co.

- Honeywell International Inc.

- Parker Hannifin Corp.

- RTX Corp.

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Aircraft Aftermarket Parts Market

- In January 2024, Rolls-Royce, a leading provider of commercial aircraft engines, announced the launch of its new digital platform, 'IntelligenceCare,' designed to optimize aircraft maintenance and reduce downtime for airlines (Rolls-Royce Press Release, 2024). This technological advancement marks a significant shift towards digitalization in the commercial aircraft aftermarket parts industry.

- In March 2024, Honeywell Aerospace and GE Aviation, two major players in the commercial aircraft aftermarket, entered into a strategic partnership to expand their MRO (Maintenance, Repair, and Overhaul) services collaboration. This alliance aimed to enhance their combined capabilities and provide more comprehensive solutions to airline customers (Honeywell Press Release, 2024).

- In May 2024, Lufthansa Technik AG, a leading independent MRO provider, acquired a majority stake in Joramco, a Jordanian MRO, to expand its presence in the Middle East and Africa. This strategic move strengthened Lufthansa Technik's global network and market reach (Lufthansa Technik Press Release, 2024).

- In April 2025, the European Union Aviation Safety Agency (EASA) approved the first additive manufacturing (AM) part for use in commercial aircraft. GE Additive, a subsidiary of GE Aviation, produced the part using its Arcam EBM (Electron Beam Melting) technology, marking a milestone in the adoption of AM in the commercial aircraft aftermarket parts industry (GE Aviation Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant transformation, driven by digital advancements and the need for enhanced operational efficiency. Aircraft performance is a critical focus area, with system upgrades, quality control, and component testing integral to maintaining optimal fleet performance. Digital transformation is revolutionizing the industry through technology integration, including machine learning (ML), IoT sensors, and blockchain technology, enabling remote diagnostics and inventory optimization. Quality assurance and certification are paramount in this sector, with material science and augmented reality (AR) playing crucial roles in ensuring component durability and efficient maintenance contracts. The integration of AI and extended reality (XR) technologies facilitates engine overhaul and fuel efficiency improvements, contributing to sustainability initiatives and global supply chain resilience.

- Data security and data analytics are essential elements of the digital thread, ensuring data-driven decision-making and risk management. Performance optimization, fuel efficiency, and cost optimization are primary concerns for airlines, with virtual reality (VR) and digital twin simulations offering effective training solutions. Aircraft modifications and certification processes continue to evolve, with industry standards and technology advancements shaping the market landscape. The use of lightweight materials and green technologies further underscores the industry's commitment to sustainability and operational excellence.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Aircraft Aftermarket Parts Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 13530.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, Germany, UK, France, Canada, China, Japan, Italy, Spain, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Aircraft Aftermarket Parts Market Research and Growth Report?

- CAGR of the Commercial Aircraft Aftermarket Parts industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial aircraft aftermarket parts market growth of industry companies

We can help! Our analysts can customize this commercial aircraft aftermarket parts market research report to meet your requirements.