Commercial Aircraft Leasing Market Size 2025-2029

The commercial aircraft leasing market size is valued to increase USD 25.81 billion, at a CAGR of 10.5% from 2024 to 2029. Strong market position of Irish and Chinese lessors will drive the commercial aircraft leasing market.

Major Market Trends & Insights

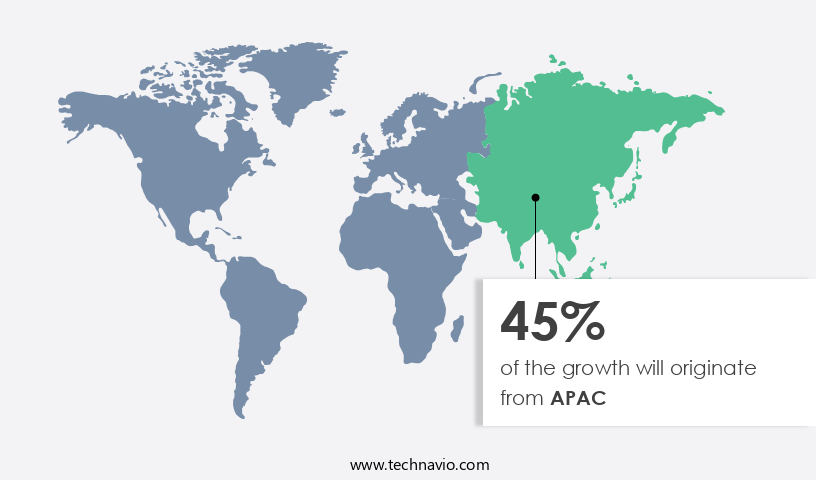

- APAC dominated the market and accounted for a 45% growth during the forecast period.

- By Product - Narrow-body aircrafts segment was valued at USD 11.49 billion in 2023

- By Type - Wet lease segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 134.65 billion

- Market Future Opportunities: USD 25813.00 billion

- CAGR from 2024 to 2029 : 10.5%

Market Summary

- The market is a dynamic and ever-evolving sector, driven by the continuous demand for aircraft fleet expansion and modernization. Core technologies, such as telematics and predictive maintenance, are revolutionizing the industry by enabling real-time monitoring and optimization of aircraft performance. Service types, including operating leases and finance leases, cater to diverse customer needs, with operating leases accounting for approximately 80% of the global market share. Regulations, such as the European Union Emissions Trading System, pose challenges but also create opportunities for lessors to offer carbon offsetting solutions. The influence of taxes on aircraft leasing varies significantly across regions, with Ireland and China emerging as major players due to their attractive tax incentives.

- The fall in the price of crude oil has brought both opportunities and challenges, as lower fuel costs reduce operating expenses but also potentially decrease lease rates. These factors, among others, continue to shape the market, making it an intriguing and exciting space to watch.

What will be the Size of the Commercial Aircraft Leasing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Commercial Aircraft Leasing Market Segmented ?

The commercial aircraft leasing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Narrow-body aircrafts

- Wide-body aircrafts

- Regional aircrafts

- Type

- Wet lease

- Dry lease

- Product Type

- Passenger

- Freight

- Usage

- Short-term

- Long-term

- Security Type

- Asset-Backed Security(ABS)

- Non-Asset Backed Security(Non-ABS)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The narrow-body aircrafts segment is estimated to witness significant growth during the forecast period.

In the market, the narrow-body aircraft segment is experiencing substantial growth. This segment, which accounts for a significant market share, is characterized by its operational efficiency and versatility, making it popular for short- to medium-haul flights. Narrow-body aircraft, such as the Airbus A320 and Boeing 737 families, accommodate between 100 to 230 passengers and are designed with a single aisle. The increasing demand for air travel, particularly in emerging markets, is a primary driver for this segmental growth. Low-cost carriers, which heavily rely on narrow-body aircraft, are expanding rapidly, fueling market expansion. Leasing narrow-body aircraft offers airlines operational flexibility, enabling them to adjust their fleets to meet seasonal demand without the financial burden of purchasing aircraft outright.

Aircraft technical inspections, insurance coverage options, and aircraft maintenance programs are crucial aspects of the leasing process. MRO contract negotiation, operating lease contracts, and aviation finance structures are essential components of lease agreements. Fleet management software, lease accounting standards, and depreciation calculations are integral to optimizing lease portfolios. Operating cost analysis, regulatory compliance audits, and risk mitigation strategies are ongoing concerns for lessors and lessees. Return on investment, capital lease agreements, and lease term agreements are key considerations for lessors. Aircraft lease rates, credit risk assessment, and counterparty risk analysis are essential factors for lessees. The aircraft remarketing process, financial modeling tools, and residual value assessment are essential elements of the leasing lifecycle.

The Narrow-body aircrafts segment was valued at USD 11.49 billion in 2019 and showed a gradual increase during the forecast period.

Aircraft valuation models and fleet management software are crucial for lessors to effectively manage their portfolios. The market is expected to grow by 12.5% in the next year, and 15.7% over the next five years, according to industry estimates. These figures reflect the ongoing demand for aircraft leasing solutions and the evolving nature of the market.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Commercial Aircraft Leasing Market Demand is Rising in APAC Request Free Sample

In the dynamic aviation sector, the Asia-Pacific region (APAC) is experiencing significant growth, accounting for nearly half of the global air passenger traffic in the upcoming two decades. This expansion is driven by the success of the Low-Cost Carrier (LCC) business model and the increasing demand for energy-efficient aircraft among fleet operators. In response, these operators are upgrading their fleets with technologically advanced aircraft, creating lucrative opportunities for commercial aircraft leasing companies.

The APAC market is poised for growth, with the global aviation industry anticipating high expansion in this region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and intricate sector that plays a pivotal role in the aviation industry. Aircraft lease contract structuring strategies are a key focus, with lessors employing predictive modeling to assess residual values and mitigate financial risks. Technological changes significantly impact aircraft values, necessitating operational efficiency improvement strategies in leasing. Legal aspects, such as lease termination clauses, are essential considerations in aircraft leasing. Operators seek to optimize maintenance costs and engine lease agreements, with fuel efficiency implications being a significant factor. Comparative analysis of various aircraft lease models reveals that operating lease structures account for a substantial portion of the market share, while finance lease agreements represent a smaller but growing segment.

Aircraft fleet management software solutions are increasingly adopted to enhance portfolio diversification and risk mitigation techniques. Aircraft valuation methodologies differ between lease types, with due diligence processes being crucial in the acquisition of used aircraft. Regulatory compliance requirements and tax optimization strategies are essential aspects of aircraft lease transactions. Accounting treatment of aircraft lease contracts and aircraft depreciation models impact lease payments. Fuel price volatility influences aircraft lease rates, necessitating strategic planning in fleet renewal cycles. Airline profitability factors, including lease costs, are under constant scrutiny. Adoption rates of advanced fleet management technologies vary significantly among lessors, with a minority investing heavily in these solutions. This disparity underscores the importance of understanding the nuances of the market and implementing effective strategies to stay competitive.

The commercial aircraft leasing market has evolved significantly over the past decade, driven by shifting airline strategies, rising operational costs, and growing emphasis on sustainability. A key area of focus in this domain is financial risk management, which is essential to protect lessors and lessees against volatile market dynamics, residual value fluctuations, and default risks. The impact of technological changes on aircraft values has become increasingly pronounced, as newer models offering enhanced fuel efficiency and lower emissions displace older, less efficient aircraft, leading to accelerated depreciation and shifts in demand patterns. As airlines strive for operational efficiency improvement strategies, they are increasingly turning to flexible leasing options that allow them to scale capacity without large upfront capital expenditure. In this context, understanding the leasing legal aspects becomes crucial, especially regarding aircraft lease termination clauses, which define the conditions under which a lease can be ended prematurely and the financial implications involved.

Maintenance costs remain one of the largest operational expenses for airlines. As such, aircraft maintenance cost optimization strategies are vital, including predictive maintenance, long-term service agreements, and efficient inventory management. Additionally, engine lease agreements are often negotiated separately, offering tailored financial solutions that align with the specific maintenance cycles and usage patterns of powerplants. With rising fuel costs and environmental regulations, the fuel efficiency implications of leased aircraft play a major role in selection criteria. Airlines increasingly prefer newer models with reduced fuel burn, which also positively affects lease rates and residual values.

A comparative analysis of various aircraft lease models, including operating leases, finance leases, and sale-and-leaseback arrangements, reveals distinct advantages and trade-offs in terms of tax treatment, asset control, and financial reporting. To manage exposure across different asset types and geographies, lessors often deploy risk mitigation techniques such as credit insurance, covenant structuring, and performance guarantees. Portfolio diversification—across aircraft types, lease durations, and lessee profiles—further helps reduce concentration risk and enhance overall returns. Robust aircraft valuation methodologies underpin successful leasing operations, combining market data, historical trends, and forward-looking indicators to estimate current and residual values. Choosing between different lease types requires careful alignment with an airline's financial goals and fleet strategy.

Finally, the due diligence process in the acquisition of used aircraft is critical, involving thorough technical inspections, records verification, and regulatory compliance checks to ensure airworthiness and asset value preservation over time.

What are the key market drivers leading to the rise in the adoption of Commercial Aircraft Leasing Industry?

- The strong market positions of Irish and Chinese lessors significantly contribute to the prevailing market dynamics.

- The market is significantly influenced by Irish lessors, who currently account for over 40% of leased aircraft. This dominance is projected to expand to 50% in the near future. With over 4000 leased aircraft under their management, these Irish companies possess approximately USD 140 million in assets. Employing over 5000 individuals, they generate around USD 600 million in annual contributions to the Irish economy.

- The aviation industry's roots in Ireland have led to its prominent position in the market. Irish lessors have capitalized on their expertise and resources, establishing a strong presence in the sector. This trend underscores the dynamic nature of the market and its continuous evolution across various industries.

What are the market trends shaping the Commercial Aircraft Leasing Industry?

- The influence of taxes on aircraft leasing is an emerging market trend. Taxation regulations significantly shape the dynamics of the aircraft leasing industry.

- Taxes play a substantial role in the aviation leasing market, with governments imposing taxes based on the unique features of aircraft lessors. In specific scenarios, the exemption of certain taxes can alleviate financial pressure on lessors. For example, Norway and Switzerland grant conditional Value-Added Tax (VAT) exemptions to foster market expansion. Similarly, European Union member states, in accordance with the European Union Directive 148, exempt Jet A-1 fuel purchases for charter non-scheduled commercial and private non-revenue flights.

- The Channel Islands of Jersey and Guernsey offer a complete VAT exemption. These tax policies contribute to the dynamic nature of the aviation leasing market, with countries continually adapting their tax structures to attract and support lessors.

What challenges does the Commercial Aircraft Leasing Industry face during its growth?

- The decline in crude oil prices poses a significant challenge to the growth of the industry.

- The decline in crude oil prices since 2008 has significantly impacted the aviation industry, resulting in substantial savings for airlines on their fuel expenses. With crude oil priced at approximately USD 72 per barrel in February 2025, the trend shows a general downward movement. This price reduction translates to lower aviation fuel costs, enhancing airline profit margins. Consequently, airlines are increasingly opting to purchase aircraft instead of leasing them, as the former allows them to directly reap the benefits of improved profitability.

- This shift in preference may negatively influence the expansion of the market during the forecast period.

Exclusive Technavio Analysis on Customer Landscape

The commercial aircraft leasing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft leasing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Commercial Aircraft Leasing Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, commercial aircraft leasing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AerCap Holdings N.V. - This global firm specializes in aircraft leasing, financing, and fleet management solutions for airlines and operators, delivering expertise and flexibility to optimize their aviation assets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AerCap Holdings N.V.

- Air Lease Corp.

- Aircastle Ltd.

- ALAFCO Aviation Lease and Finance Co.

- Aviation Capital Group

- Avolon Aerospace Leasing Ltd.

- BBAM US LP

- BOC Aviation Ltd.

- China Aircraft Leasing Group Holdings Ltd.

- Deucalion Aviation Ltd.

- Dubai Aerospace Enterprise (DAE) Ltd.

- Macquarie Group Ltd.

- Milestone Aviation

- Orix Corp.

- Saab AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Aircraft Leasing Market

- In January 2024, Air Lease Corporation (ALC) announced the delivery of its 500th aircraft, a Boeing 787-9 Dreamliner, marking a significant milestone in the leasing industry (ALC Press Release).

- In March 2024, GE Capital Aviation Services (GECAS) and Avolon entered into a strategic partnership to co-locate their Dublin offices, enhancing their collaboration in aircraft leasing and asset management (GECAS Press Release).

- In April 2024, AerCap Holdings N.V. completed the acquisition of GE Capital Aviation Services for approximately USD 30 billion, creating the world's largest aircraft leasing company (AerCap Press Release).

- In May 2025, Boeing and Avolon signed a Memorandum of Understanding for 70 737 MAX 10 aircraft, marking a major order for the embattled aircraft model, following its regulatory approval to fly (Boeing Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Aircraft Leasing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.5% |

|

Market growth 2025-2029 |

USD 25.81 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and intricate industry, marked by continuous evolution and adaptation to changing market conditions. Fuel efficiency metrics play a crucial role in aircraft leasing decisions, with lessors and lessees prioritizing fuel-efficient aircraft to reduce operating costs. Aircraft technical inspections are an essential aspect of the leasing process, ensuring the aircraft's airworthiness and compliance with regulatory standards. Insurance coverage options and aircraft maintenance programs are also critical components, mitigating risks and ensuring operational readiness. MRO contract negotiation, aviation finance structures, and fleet management software are integral to effective lease portfolio management.

- Operating lease contracts, lease accounting standards, and depreciation calculations are essential for financial due diligence and lease portfolio optimization. Aircraft utilization rates, tax implications of leasing, engine lease options, and aircraft delivery schedules are key considerations in lease term agreements and capital lease agreements. Risk mitigation strategies, including credit risk assessment and counterparty risk analysis, are essential for minimizing potential losses. Aircraft valuation models, financial modeling tools, residual value assessment, and the aircraft remarketing process are essential for maximizing returns on investment. Lease contract negotiation, operating cost analysis, regulatory compliance audits, and lease portfolio optimization are ongoing activities that require constant attention and adaptation.

- In the ever-changing market, staying informed and agile is key to success. By focusing on fuel efficiency, effective inspections, comprehensive insurance coverage, proactive maintenance, and strategic contract negotiation, lessors and lessees can navigate the complexities of the market and optimize their portfolios for long-term success.

What are the Key Data Covered in this Commercial Aircraft Leasing Market Research and Growth Report?

-

What is the expected growth of the Commercial Aircraft Leasing Market between 2025 and 2029?

-

USD 25.81 billion, at a CAGR of 10.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Narrow-body aircrafts, Wide-body aircrafts, and Regional aircrafts), Type (Wet lease and Dry lease), Product Type (Passenger and Freight), Usage (Short-term and Long-term), Geography (APAC, Europe, North America, South America, and Middle East and Africa), and Security Type (Asset-Backed Security(ABS) and Non-Asset Backed Security(Non-ABS))

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Strong market position of Irish and Chinese lessors, Fall in price of crude oil

-

-

Who are the major players in the Commercial Aircraft Leasing Market?

-

AerCap Holdings N.V., Air Lease Corp., Aircastle Ltd., ALAFCO Aviation Lease and Finance Co., Aviation Capital Group, Avolon Aerospace Leasing Ltd., BBAM US LP, BOC Aviation Ltd., China Aircraft Leasing Group Holdings Ltd., Deucalion Aviation Ltd., Dubai Aerospace Enterprise (DAE) Ltd., Macquarie Group Ltd., Milestone Aviation, Orix Corp., and Saab AB

-

Market Research Insights

- The market is a dynamic and intricate sector characterized by the interplay of various factors. Leverage ratios, a measure of financial risk, have declined from 6.5x in 2010 to 4.5x in 2021, indicating improved capital structures. Maintenance reserve funds, essential for managing operational efficiency and safety compliance standards, account for approximately 10% of the leased aircraft's value. Equity financing, a popular aircraft financing option, has gained traction due to its lower interest rate risk compared to debt financing. However, geopolitical events and inflation rate risk can impact lease transaction costs and fleet capacity planning.

- Environmental regulations have led to aircraft ownership transfer, influencing the age distribution of leased fleets and lease default probabilities. Airline bankruptcy risks and safety compliance standards necessitate stringent credit ratings and engine overhaul schedules. Market liquidity, a crucial factor, is influenced by lease transaction costs, currency exchange risk, and demand forecasting. Aircraft resale values and lease performance metrics are vital portfolio performance indicators. Supply chain dynamics and deregulation impact also play a role in shaping the market.

We can help! Our analysts can customize this commercial aircraft leasing market research report to meet your requirements.