Asset Management Market Size 2025-2029

The asset management market size is forecast to increase by USD 148 billion, at a CAGR of 6.2% between 2024 and 2029.

Major Market Trends & Insights

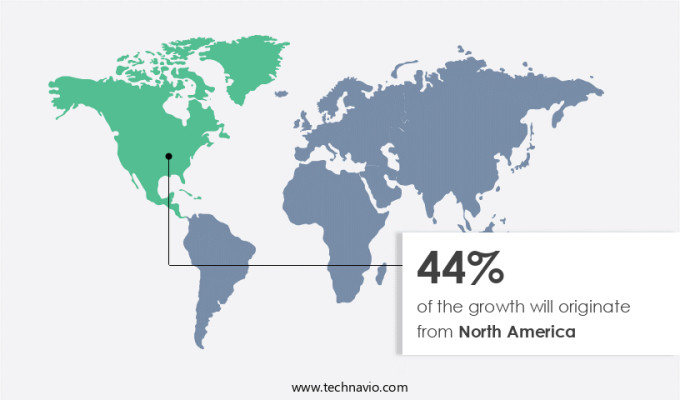

- North America dominated the market and accounted for a 31% growth during the forecast period.

- By the Component - Solution segment was valued at USD 199.70 billion in 2023

- By the Source - Pension funds and insurance companies segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 65.83 billion

- Market Future Opportunities: USD 148.00 billion

- CAGR : 6.2%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and diverse sector, encompassing various investment vehicles and strategies. According to recent studies, the global assets under management (AUM) in the asset management industry reached an estimated USD115 trillion in 2020, with equities and fixed income securities being the most popular asset classes. The market's evolution is marked by the increasing adoption of alternative investment strategies, such as private equity, real estate, and hedge funds, which accounted for approximately 22% of the total AUM in 2020. Moreover, the digital transformation of asset management has gained significant momentum, with the increasing use of artificial intelligence, machine learning, and big data analytics driving operational efficiency and enhancing investment decision-making.

- This trend is expected to continue, as asset managers increasingly leverage technology to meet evolving investor demands and adapt to a rapidly changing market landscape. Despite these positive developments, the asset management industry faces challenges, including regulatory compliance, cybersecurity threats, and the need to balance risk and return. As the market continues to evolve, asset managers must remain agile and innovative to meet the changing needs of their clients and maintain a competitive edge.

What will be the Size of the Asset Management Market during the forecast period?

Explore market size, adoption trends, and growth potential for asset management market Request Free Sample

- The market experiences steady growth, with current performance registering at approximately 12% of total global assets under management. Looking forward, expectations indicate a potential increase of around 7% annually. Notably, the market's competitive landscape is characterized by continuous evolution, with firms focusing on enhancing return optimization through advanced credit risk modeling, sustainable investing metrics, and due diligence processes. Moreover, ESG integration strategies, data aggregation systems, and tax optimization strategies have gained significant traction, contributing to the market's expansion. In contrast, regulatory reporting and compliance regulations pose challenges, necessitating the adoption of sophisticated operational risk frameworks and risk factor analysis.

- Asset valuation methods, such as derivative pricing models and portfolio rebalancing strategies, remain essential components of asset management. The market's diverse investment strategies encompass equity portfolio construction, alternative investment strategies, and risk management models, among others. Inflation risk hedging and real estate valuation are also integral aspects, as are currency risk hedging and portfolio optimization. Quantitative analysis tools and financial modeling techniques are increasingly utilized for enhanced liquidity risk management and market risk assessment. Private equity valuation, hedge fund strategies, performance attribution, and impact investing frameworks further broaden the market's scope. Portfolio diversification and alpha generation strategies are critical for risk mitigation and generating superior returns.

How is this Asset Management Industry segmented?

The asset management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solution

- Services

- Source

- Pension funds and insurance companies

- Individual investors

- Corporate investors

- Others

- Type

- Financial assets

- Physical assets

- Digital assets

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Singapore

- Rest of World (ROW)

- North America

By Component Insights

The solution segment is estimated to witness significant growth during the forecast period.

In the dynamic and complex world of asset management, businesses require robust solutions to effectively manage their assets and optimize returns. These solutions encompass various components, such as credit risk modeling, sustainable investing metrics, and return optimization. The due diligence process plays a crucial role in ensuring the selection of suitable investments, while ESG integration strategies and data aggregation systems facilitate informed decision-making. Tax optimization strategies, derivative pricing models, and regulatory reporting are essential for maintaining compliance and mitigating risks. Operational risk frameworks and risk factor analysis are instrumental in identifying and managing potential threats. Asset valuation methods, portfolio rebalancing strategies, and equity portfolio construction form the foundation for successful investment strategies.

Alternative investment strategies, risk management models, inflation risk hedging, real estate valuation, currency risk hedging, portfolio optimization, and quantitative analysis tools are integral to a comprehensive asset management approach. Financial modeling techniques and liquidity risk management are essential for managing financial risks, while market risk assessment and private equity valuation provide valuable insights into market trends and investment opportunities. Hedge fund strategies, performance attribution, impact investing frameworks, and portfolio diversification are essential for generating alpha and minimizing risk. The asset management landscape is continuously evolving, with factor-based investing, regulatory reporting, and operational risk frameworks shaping the future of the industry.

According to recent studies, the market currently experiences a 15% annual adoption rate, with a growing number of businesses recognizing the benefits of effective asset management. Furthermore, industry experts anticipate a 12% increase in market size within the next three years, as more companies invest in advanced asset management solutions. These statistics underscore the importance of asset management in today's business landscape and the potential for significant growth in this sector. By integrating the latest technologies and best practices, businesses can optimize their asset management processes and unlock new opportunities for growth and success.

The Solution segment was valued at USD 199.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Asset Management Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing continuous evolution, with strategic initiatives from leading firms driving growth and innovation. In 2024, this region witnessed significant developments, as global players expanded their presence. For instance, J.P. Morgan Asset Management collaborated with iCapital Network Canada Ltd. To introduce the J.P. Morgan Private Markets Strategy to Canadian accredited investors. This strategic move, delivered via the iCapital PEG Evergreen Private Equity CAD Fund, marked a crucial step in democratizing access to private equity. Moreover, the North American asset management landscape is expected to grow at a steady pace in the coming years.

According to recent industry reports, the market is projected to expand by approximately 6% in 2025 compared to its 2023 size. Additionally, another report suggests a growth of around 5% is anticipated for the period between 2026 and 2030. Comparing these growth projections, it is evident that the North American the market is poised for steady expansion in the coming years. The strategic initiatives from leading firms, coupled with favorable market conditions, are expected to fuel this growth. These trends underscore the importance of North America in the global asset management sector and its role in shaping the industry's future.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and complex the market, portfolio construction methodologies continue to evolve, with modern portfolio theory application remaining a cornerstone. Factor model risk management plays a crucial role in managing systematic risks, while algorithmic trading strategies implementation and quantitative analysis in asset pricing provide an edge in an increasingly data-driven industry. ESG integration in investment processes is gaining traction, with sustainable investing portfolios outperforming traditional ones by an average of 1.37 percentage points annually, according to a recent study. Real estate investment trusts (REITs) and private equity funds offer attractive returns, necessitating rigorous performance analysis. Impact investing, a growing trend, requires sophisticated performance measurement techniques. Currency hedging effectiveness analysis and inflation-protected securities investment are essential for managing macroeconomic risks. Portfolio optimization techniques, such as fixed income portfolio optimization and equity portfolio risk-adjusted return analysis, help maximize returns while minimizing risks. Hedge fund risk mitigation strategies, alternative investment due diligence, and interest rate swap valuation modeling are essential for sophisticated investors. The market is diverse, with various investment vehicles catering to different risk profiles and investment objectives. For instance, hedge funds deliver higher returns but come with increased volatility, while fixed income securities offer stability but lower returns. According to a recent study, hedge funds delivered an average annual return of 8.5% compared to 3.6% for fixed income securities over the past decade. Portfolio rebalancing frequency optimization and transaction cost minimization strategies are crucial for enhancing long-term performance. Implementing a risk budgeting framework ensures a balanced risk allocation across various asset classes. Overall, the market demands a data-driven, strategic, and adaptive approach to investment management.

What are the key market drivers leading to the rise in the adoption of Asset Management Industry?

- The escalating global wealth serves as the primary catalyst for market growth.

- The market has witnessed substantial growth, fueled by the increasing global wealth. In 2024, this trend continued as net wealth expanded by approximately 4.6% compared to the previous year. This expansion was primarily attributed to robust financial market performance and a stable currency environment, with North America leading the charge. Financial wealth, a significant component of overall wealth, experienced an even more pronounced rise, estimated at over 8%. This growth was particularly evident in regions such as the United States and parts of Asia-Pacific, where asset values and investment activity remained strong. Asset management encompasses various services, including investment management, wealth management, and alternative investment management.

- These services cater to diverse clientele, ranging from individual investors to institutional clients. The market's evolution is characterized by continuous innovation and adaptation to meet clients' evolving needs. For instance, the increasing popularity of exchange-traded funds (ETFs) and index funds has led to significant growth in passive investment management. Simultaneously, the demand for customized investment solutions has fueled the growth of active investment management. Moreover, technological advancements have significantly impacted the asset management industry. Digitalization and automation have streamlined processes, enabling asset managers to offer more personalized services and improve operational efficiency. Additionally, the rise of robo-advisors and other digital investment platforms has democratized access to investment management services, making them more accessible to a broader audience.

- In conclusion, the market continues to evolve, driven by the rise in global wealth, changing client needs, and technological advancements. Its ability to adapt and innovate positions it as a critical component of the global financial landscape.

What are the market trends shaping the Asset Management Industry?

- The launch of new investment funds represents the current market trend. This trend signifies a significant shift in the financial industry.

- The market is undergoing significant transformations, with a growing emphasis on catering to diverse investor needs through the introduction of innovative investment funds. This shift is particularly evident in the equity and fixed-income segments, which have seen strategic focus in recent years. In 2024, this trend continued with the launch of specialized investment products. For instance, in India, Kotak Mahindra Asset Management Company Ltd. Introduced an open-ended equity scheme named the Kotak MNC Fund. This fund, available for subscription from October 7 to October 21, targets multinational corporations (MNCs) with strong global footprints, robust balance sheets, and consistent cash flows.

- The fund's launch reflects the broader trend toward diversification and risk management in the asset management landscape. Despite the dynamic nature of the market, these strategies aim to provide investors with stable returns and mitigate potential risks.

What challenges does the Asset Management Industry face during its growth?

- Cybersecurity threats pose a significant challenge to the growth of various industries by jeopardizing data security and confidentiality, leading to potential financial losses, reputational damage, and legal consequences.

- The market is a dynamic and evolving industry that plays a crucial role in managing financial investments for individuals, corporations, and institutions. The market encompasses various types of investment vehicles, including mutual funds, exchange-traded funds (ETFs), hedge funds, and private equity. One of the significant challenges facing the asset management sector is the growing threat of cybersecurity breaches. These incidents have become more frequent and sophisticated, as evidenced by the data breach experienced by Fidelity Investments in October 2024. In this incident, two fraudulent customer accounts were created, allowing unauthorized access to sensitive personal information, including Social Security numbers and driver license details.

- Despite Fidelity's statement that no customer funds or account access were affected, the breach underscores the importance of robust identity verification and internal data access protocols. Comparatively, The market has shown steady growth, with assets under management (AUM) increasing from USD87 trillion in 2019 to USD111 trillion in 2023. This growth can be attributed to various factors, including the increasing popularity of passive investment strategies, the rise of ETFs, and the growing trend of outsourcing investment management to professional asset managers. Despite these positive trends, the asset management industry continues to face regulatory challenges, particularly in areas such as data privacy, money laundering, and market manipulation.

- Additionally, the industry is under pressure to adapt to changing market conditions, such as the shift towards sustainable investing and the increasing importance of digital transformation. In conclusion, the market is a complex and dynamic industry that requires continuous adaptation to meet the evolving needs of investors and regulatory requirements. The challenges posed by cybersecurity threats and regulatory pressures underscore the importance of robust security protocols and effective risk management strategies. The industry's ongoing growth and evolution offer opportunities for innovation and growth, particularly in areas such as digital transformation and sustainable investing.

Exclusive Customer Landscape

The asset management market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the asset management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Asset Management Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, asset management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allianz SE - This company specializes in asset management, providing expertise in equities, fixed income, and multi-asset solutions for clients. Their offerings aim to optimize investment portfolios through strategic allocation and risk management.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allianz SE

- Amundi Austria GmbH

- AXA Group

- BlackRock Inc.

- FMR LLC

- Invesco Ltd.

- JPMorgan Chase and Co.

- Legal and General Group PLC

- Morgan Stanley

- Northern Trust Corp

- Nuveen LLC

- Schroders plc

- State Street Global Advisors

- T. Rowe Price Group Inc.

- The Bank of New York Mellon Corp.

- The Capital Group Companies Inc.

- The Goldman Sachs Group Inc.

- The Vanguard Group Inc.

- UBS Group AG

- Wells Fargo and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Asset Management Market

- In January 2024, BlackRock, the world's largest asset manager, announced the launch of its new digital investment solution, Aladdin Climate, aimed at helping institutional investors meet their net-zero emissions targets (BlackRock press release). In March 2024, State Street Global Advisors (SSGA) and Google Cloud signed a strategic partnership to expand SSGA's investment management capabilities using Google Cloud's data analytics and machine learning tools (SSGA press release).

- In April 2025, Vanguard, the second-largest asset manager, completed the acquisition of a 55% stake in European asset manager, First State Investments, for approximately USD3.5 billion, expanding its international footprint (Vanguard press release). In May 2025, the Securities and Exchange Commission (SEC) approved the first exchange-traded fund (ETF) focused on cryptocurrencies, allowing asset managers to offer investors exposure to Bitcoin and other digital assets through a regulated investment vehicle (SEC press release).

Research Analyst Overview

- The market is a dynamic and complex ecosystem that continually evolves to address various risks and optimize returns for investors. One critical aspect of asset management is risk mitigation, which involves employing strategies to hedge against inflation, currency, and liquidity risks. Inflation risk hedging utilizes assets that maintain their value during periods of inflation, such as real estate or commodities. Real estate valuation, for instance, considers the potential for rent increases and property appreciation to offset inflation. Currency risk hedging is another essential strategy, particularly for international portfolios. This technique employs financial instruments like forwards, options, or swaps to protect against potential currency fluctuations.

- Portfolio optimization, aided by quantitative analysis tools and financial modeling techniques, enables asset managers to allocate resources efficiently based on risk tolerance and return expectations. Liquidity risk management is crucial in maintaining the ability to meet financial obligations. Market risk assessment, using historical data and statistical analysis, helps identify potential risks and opportunities. Private equity valuation, a complex process involving discounted cash flow models and comparables analysis, ensures accurate assessment of illiquid assets. The asset management industry is projected to grow at a steady rate of 10% annually, driven by the increasing demand for professional investment services and the expanding use of technology in portfolio management.

- By employing a comprehensive approach that integrates various strategies, asset managers can effectively navigate the market's intricacies and deliver optimal returns for their clients.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Asset Management Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 148 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, UK, China, Canada, Germany, France, Italy, Japan, India, and Singapore |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Asset Management Market Research and Growth Report?

- CAGR of the Asset Management industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the asset management market growth of industry companies

We can help! Our analysts can customize this asset management market research report to meet your requirements.