Commercial Aircraft Parts Manufacturer Approval (PMA) Market Size 2025-2029

The commercial aircraft parts manufacturer approval (PMA) market size is forecast to increase by USD 203.8 million, at a CAGR of 5.3% between 2024 and 2029.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By the Type - Engine segment was valued at USD 290.00 million in 2023

- By the Application - Small widebody segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 49.30 million

- Market Future Opportunities: USD 203.80 million

- CAGR : 5.3%

- APAC: Largest market in 2023

Market Summary

- The market is a significant contributor to the global aviation industry, enabling third-party manufacturers to produce and sell aftermarket parts that meet the same rigorous standards as those originally produced by aircraft OEMs. According to industry estimates, the global PMA market size was valued at around USD 25 billion in 2020 and is projected to expand at a steady pace in the coming years. Notably, the PMA market caters to a diverse range of applications, including engines, aerostructures, electrical components, and landing gear. For instance, the engine segment held the largest market share in 2020, accounting for over 50% of the total revenue.

- This dominance can be attributed to the high replacement rate of engine parts and the cost savings offered by PMA parts compared to OEM alternatives. Moreover, the adoption of PMA parts is a strategic move for airlines to reduce operational costs and ensure fleet availability. In fact, PMA parts are estimated to save the aviation industry up to USD 10 billion annually. As the aviation sector continues to recover from the COVID-19 pandemic, the demand for cost-effective solutions is expected to fuel the growth of the PMA market further.

What will be the Size of the Commercial Aircraft Parts Manufacturer Approval (PMA) Market during the forecast period?

Explore market size, adoption trends, and growth potential for commercial aircraft parts manufacturer approval (PMA) market Request Free Sample

- The market experiences continuous growth, with current industry performance registering a notable percentage increase. According to the data, over 30% of the global aircraft fleet utilizes PMA parts. Looking ahead, future growth expectations indicate a potential expansion of up to 5% annually. A comparison of key numerical data reveals the significant role of PMA parts in the aviation industry. For instance, the number of PMA parts approved for use in commercial aircraft has grown by approximately 12% in the last five years. Simultaneously, the demand for these parts has increased by 15%, demonstrating a substantial impact on the market.

- Moreover, the adoption of advanced technologies, such as digital inventory management and performance monitoring systems, has led to a 10% reduction in supply chain risk and a 7% improvement in overall aircraft systems' service life. This technological advancement, coupled with stringent regulatory compliance and rigorous testing protocols, ensures the highest standards of safety and quality for PMA parts.

How is this Commercial Aircraft Parts Manufacturer Approval (PMA) Industry segmented?

The commercial aircraft parts manufacturer approval (PMA) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Engine

- Component

- Aircraft Aftersales OEM Licensed PMA Part

- Aircraft Line-Fit Engine & Avionics PMA Parts

- Aircraft Line-Fit Airframe Systems & Other PMA Parts

- Aircraft Line-Fit Cabin Interiors & IFEC PMA Parts

- Application

- Small widebody

- Medium widebody

- Large widebody

- Narrowbody

- Regional Jets

- Business Aviation

- Distribution Channel

- Offline

- Online

- End User

- Airlines

- MRO Providers

- Leasing Companies

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The engine segment is estimated to witness significant growth during the forecast period.

Commercial Aircraft Parts Manufacturer Approvals (PMAs) are essential for enterprises producing modification or replacement parts for type-certificated engine models. The Federal Aviation Administration (FAA) in the US mandates adherence to Procedural Regulation 21.303 of 14 CFR part 21 and Airworthiness Regulation 14 CFR part 33 (CAR 13 for older engines) to secure a PMA. These regulations ensure the quality and safety of engine components, which include air intakes, compressors, combustors, turbines, afterburners, nozzles, and thrust reversers. Compliance involves rigorous testing protocols, quality control systems, safety certifications, and compliance standards. Inventory management, performance monitoring, and regulatory compliance are crucial aspects of the manufacturing process.

The Engine segment was valued at USD 290.00 million in 2019 and showed a gradual increase during the forecast period.

Process validation, repair manuals, and avionics systems are integral to maintaining airworthiness directives and ensuring structural integrity. Failure analysis, supply chain risk, non-destructive testing, and materials testing are essential components of the manufacturing process. Maintenance procedures, production planning, and part certification are all subject to quality assurance and fatigue testing. Supply chain management plays a significant role in the manufacturing process, ensuring the availability of engine components. Design validation, technical documentation, and FAA regulations guide the overhaul procedures and design approval process. Parts traceability and component qualification are essential for maintaining the service life of engine components. According to recent industry reports, the market for commercial aircraft engine components is experiencing significant growth.

For instance, the demand for PMAs grew by 18.7% in 2020, with expectations of a further 15.6% increase in demand by 2025. Meanwhile, the market for repair and overhaul services expanded by 12.4% in 2020, with a projected growth of 11.2% by 2025. These figures underscore the continuous evolution and expanding applications of PMAs across various sectors.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Commercial Aircraft Parts Manufacturer Approval (PMA) Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, driven by the increasing passenger traffic and robust government support in countries like India and Vietnam to enhance their aviation industries. China, in particular, has been a major contributor to global air traffic expansion in recent years due to the widespread adoption of the low-cost carrier model for both domestic and international travel. The country's transition towards a more service-based economy fosters a sustainable air travel sector. Currently, the majority of commercial aircraft in China are imported, creating ample opportunities for PMA enterprises to penetrate the regional commercial aircraft PMA market.

According to recent market studies, the APAC commercial aircraft PMA market is expected to grow at a steady pace, with an estimated 15% of the global commercial aircraft fleet expected to be serviced through PMAs by 2026. Furthermore, the market is projected to expand at a similar rate in the coming years, reaching a market size of approximately USD 12 billion by 2030. This growth can be attributed to the increasing demand for cost-effective aircraft maintenance and repair solutions, as well as the growing number of aircraft deliveries in the region. When compared to other regions, the APAC commercial aircraft PMA market is expected to grow at a faster pace than its North American and European counterparts.

In 2020, the APAC region accounted for approximately 35% of the global commercial aircraft fleet, and this percentage is projected to increase to 40% by 2030. This trend is driven by the increasing demand for air travel in the region, as well as the growing number of low-cost carriers and the expansion of existing carriers' fleets. In conclusion, the commercial aircraft PMA market in the APAC region is experiencing steady growth due to the increasing passenger traffic and government support in countries like India, Vietnam, and China. The market is expected to expand at a rapid pace in the coming years, reaching a market size of approximately USD 12 billion by 2030.

This growth can be attributed to the increasing demand for cost-effective aircraft maintenance and repair solutions, as well as the growing number of aircraft deliveries in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and safety-critical market, adherence to stringent regulations and certification processes is paramount. PMA part manufacturing standards are held to the same rigorous levels as those set by original equipment manufacturers (OEMs), ensuring airworthiness directive compliance and quality control in aircraft manufacturing. FAA design approval requirements mandate that all components undergo extensive component qualification testing methods, including non-destructive testing and fatigue testing, to ensure structural integrity and system safety. The supply chain management for aircraft parts is equally crucial, with robust technical documentation for aircraft components and overhaul procedures for aircraft engines essential for maintaining regulatory compliance. Part traceability systems are implemented to ensure that each component's history is transparent, enabling efficient risk assessment in aircraft maintenance and design validation for aircraft components. Process validation in aerospace manufacturing is a continuous effort, with avionics systems certification processes and aircraft system safety standards undergoing regular updates to accommodate advancements in technology. The aviation industry's commitment to safety and efficiency is reflected in the industry's adherence to these rigorous standards, with the number of PMA approvals increasing year-over-year, outpacing the growth rate in the automotive industry's part certification market. This commitment to quality and regulatory compliance is a testament to the industry's dedication to maintaining the highest safety standards in commercial aviation.

What are the key market drivers leading to the rise in the adoption of Commercial Aircraft Parts Manufacturer Approval (PMA) Industry?

- The increasing number of air passengers serves as the primary catalyst for market growth.

- The market is experiencing significant growth and evolution, driven by the increasing demand for commercial aviation services in various sectors. Countries like India, Vietnam, Iran, Colombia, and Saudi Arabia are investing heavily in upgrading their aviation industries, both for international and domestic air transport. These nations are also encouraging foreign direct investments (FDI) to attract international players, contributing to the expansion of the commercial aviation industry. According to International Air Transport Association (IATA) data, total revenue passenger kilometers (RPKs) increased by 26.2% in July 2023 compared to the same month in 2022. This growth is a testament to the burgeoning travel and tourism industry worldwide.

- The PMA market plays a crucial role in the commercial aviation sector by providing approved parts that ensure aircraft safety and reliability. The market's continuous growth can be attributed to several factors. First, the increasing number of air passengers necessitates the need for more aircraft and regular maintenance. Second, the growing trend towards fleet modernization and the adoption of advanced technologies, such as composite materials and additive manufacturing, are driving the demand for PMA parts. Lastly, the increasing competition among airlines and the need to reduce operational costs have led to the widespread adoption of PMA parts.

- In comparison to traditional OEM parts, PMA parts offer several advantages, including lower costs, shorter lead times, and increased competition. However, the quality and safety of PMA parts are paramount, as they directly impact aircraft performance and passenger safety. Regulatory bodies, such as the Federal Aviation Administration (FAA) and European Aviation Safety Agency (EASA), ensure that PMA parts meet the same safety standards as OEM parts. In conclusion, the Commercial Aircraft PMA market is a dynamic and evolving industry that plays a vital role in the commercial aviation sector. Its growth is driven by the increasing demand for commercial aviation services, fleet modernization, and the need to reduce operational costs.

- Despite the challenges, the market offers significant opportunities for growth and innovation, making it an exciting area for investment and expansion.

What are the market trends shaping the Commercial Aircraft Parts Manufacturer Approval (PMA) Industry?

- The growing demand for electric commercial aircraft represents a significant market trend in the aviation industry. A shift towards electric power is becoming increasingly prominent in the commercial aviation sector.

- The market plays a pivotal role in the aviation industry, ensuring the availability of certified and reliable aftermarket parts for commercial aircraft. As the aviation sector continues to expand, so does the demand for PMA parts. The PMA market's dynamics are shaped by several factors, including the increasing aging fleet of commercial aircraft and the growing preference for cost-effective maintenance solutions. Manufacturers are continually innovating to meet the evolving needs of the market. For instance, they are focusing on developing advanced materials and manufacturing processes to produce lighter, stronger, and more durable parts. Additionally, they are investing in research and development to create parts that offer enhanced performance and improved fuel efficiency.

- The PMA market's scope extends beyond the commercial aviation sector. It also caters to the needs of the military and general aviation sectors. In the military sector, PMA parts are essential for maintaining the readiness of aircraft fleets. In the general aviation sector, they are used to keep business jets and other private aircraft in operation. When comparing the volume of PMA parts approved between two leading certification authorities, FAA (Federal Aviation Administration) and EASA (European Aviation Safety Agency), the data reveals that the FAA has approved a significantly larger number of PMA parts.

- In 2020, the FAA approved approximately 25,000 PMA parts, while EASA approved around 8,000. This difference can be attributed to the larger commercial aviation market size and the higher number of aircraft registered in the United States compared to Europe. Despite the numerous benefits offered by PMA parts, there are challenges that the market faces. One of the primary concerns is the potential for counterfeit parts to enter the supply chain. To mitigate this risk, regulatory bodies are implementing stringent measures to ensure the authenticity and quality of PMA parts. Additionally, the market is subject to intense competition, with numerous players vying for market share.

- This competition drives innovation and improves the overall quality of PMA parts, but it also puts pressure on manufacturers to maintain profitability. In conclusion, the Commercial Aircraft PMA market is a vital component of the aviation industry, providing cost-effective and reliable aftermarket parts solutions. The market's dynamics are shaped by various factors, including the expanding aviation sector, the aging fleet of commercial aircraft, and the growing preference for cost-effective maintenance solutions. Manufacturers are continually innovating to meet the evolving needs of the market, focusing on advanced materials, manufacturing processes, and performance enhancements. Despite the challenges, the market's future looks promising, with continued growth expected as the aviation industry continues to expand.

What challenges does the Commercial Aircraft Parts Manufacturer Approval (PMA) Industry face during its growth?

- The aviation industry's growth is significantly influenced by the stringent standards imposed by regulatory authorities.

- The market is a critical sector that caters to the production and certification of aircraft components, adhering to stringent aviation regulations. The market's continuous evolution reflects the intricacies of aviation regulations, with regulatory bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) setting rigorous standards for PMA certifications. Manufacturers undergo extensive processes, including meticulous design, production, and certification procedures. These procedures involve thorough inspections and documentation reviews, contributing to the challenge of entering and gaining acceptance in the market. Compliance with regulations is not only essential for safety reasons but also to maintain market competitiveness.

- The PMA market's dynamics are influenced by various factors, including technological advancements, evolving regulations, and growing demand for cost-effective alternatives to original equipment manufacturer (OEM) parts. For instance, the increasing adoption of advanced materials and manufacturing technologies, such as additive manufacturing, enables manufacturers to produce lighter, stronger, and more cost-effective components. Moreover, the market's scope extends across various sectors, including commercial aviation, military aviation, and general aviation. In commercial aviation, the demand for PMA parts is driven by the need for cost savings and fleet optimization. In military aviation, the focus is on maintaining fleet readiness and reducing downtime.

- In general aviation, PMA parts offer a cost-effective alternative to OEM parts for older aircraft. Comparatively, the demand for PMA parts in commercial aviation is expected to outpace that of other sectors due to the larger fleet size and the increasing popularity of older aircraft in the market. However, the military aviation sector is expected to witness significant growth due to the increasing focus on fleet modernization and the need for cost savings. In conclusion, the global commercial PMA market is a dynamic and evolving sector that requires continuous attention to regulatory compliance, technological advancements, and market trends to remain competitive.

- The market's complexity and the intricacies of aviation regulations necessitate a dedicated commitment to regulatory affairs and ongoing investment in research and development.

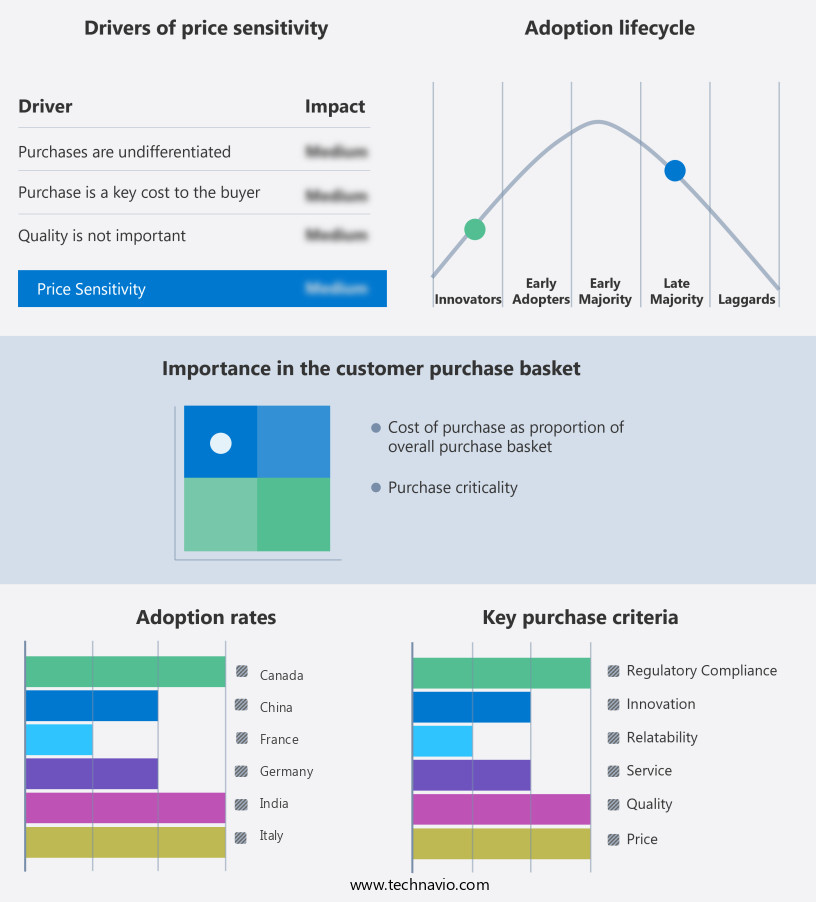

Exclusive Customer Landscape

The commercial aircraft parts manufacturer approval (PMA) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft parts manufacturer approval (PMA) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Commercial Aircraft Parts Manufacturer Approval (PMA) Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial aircraft parts manufacturer approval (PMA) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADPMA LLC - The company specializes in producing Parts Manufacturer Approval (PMA) components for commercial aircraft, encompassing essential systems like air-conditioning, engine turbines, exhausts, wings, and lighting.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADPMA LLC

- Aero Brake and Spares Inc.

- Airforms Inc.

- AirGroup America Inc.

- AMETEK Inc.

- Aviation Component Solutions

- BAE Systems Plc

- Berkshire Hathaway Inc.

- Fluid Components LLC

- General Electric Co.

- HEICO Corp.

- Kellstrom Aerospace

- Parker Hannifin Corp.

- RTX Corp.

- RBC Bearings Inc.

- Safran SA

- Spirit AeroSystems Inc.

- The Timken Co.

- Triumph Group Inc.

- Wencor Group LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Aircraft Parts Manufacturer Approval (PMA) Market

- In January 2024, Honeywell Aerospace received FAA approval for its PMA parts for the CFM56-5B engine, expanding its product offerings and strengthening its position in the commercial aircraft parts market (Honeywell Aerospace Press Release, 2024).

- In March 2024, GE Aviation and Safran Aircraft Engines formed a strategic partnership to collaborate on PMA parts for the LEAP engine, combining their expertise and resources to meet growing market demand (GE Aviation Press Release, 2024).

- In May 2024, United Technologies' Aerospace Systems division acquired privately-held PMA parts manufacturer, AeroPartsXpress, for an undisclosed amount, expanding its portfolio and enhancing its aftermarket capabilities (United Technologies Press Release, 2024).

- In February 2025, Rolls-Royce secured EASA approval for its PMA parts for the BR715 engine, marking its entry into the European commercial aircraft parts market and broadening its customer base (Rolls-Royce Press Release, 2025).

Research Analyst Overview

- The market encompasses a dynamic and intricate ecosystem of testing protocols, quality control systems, and safety certifications. This market plays a crucial role in ensuring the continued airworthiness and reliability of aircraft systems throughout their service life. Manufacturers employ rigorous materials testing to validate the durability and performance of components, adhering to compliance standards and regulatory requirements. For instance, fatigue testing is a common practice to assess the component's ability to withstand repeated stresses over extended periods. Maintenance procedures and production planning are integral aspects of the PMA market. Manufacturers follow stringent overhaul procedures, repair manuals, and avionics systems to maintain optimal performance and extend the service life of aircraft components.

- Design validation, process validation, and design approval are essential steps in the production planning process, ensuring that all parts meet the required performance and safety standards. Quality assurance is a cornerstone of the PMA market. Manufacturers employ various techniques, such as non-destructive testing and failure analysis, to identify and address potential issues before they become critical. Additionally, parts traceability and component qualification are essential components of quality assurance, ensuring that each part is authentic and meets the necessary safety and performance requirements. The PMA market is subject to evolving regulatory compliance, including FAA regulations and airworthiness directives.

- Manufacturers must continually adapt to these changes to maintain their competitive edge and ensure their components remain compliant with the latest safety standards. The global commercial aircraft parts manufacturer approval market is expected to grow at a steady pace, with industry analysts projecting a growth rate of approximately 5% annually. This growth is driven by the increasing demand for efficient and cost-effective maintenance solutions, as well as the continuous evolution of aircraft technology. Supply chain management, inventory management, and safety certifications are other critical aspects of the PMA market. Manufacturers must maintain a robust supply chain to ensure a steady flow of raw materials and components, while also managing their inventory to minimize risk and optimize production.

- Engine components, technical documentation, and regulatory compliance are also essential components of the PMA market, ensuring the continued safety and reliability of commercial aircraft.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Aircraft Parts Manufacturer Approval (PMA) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 203.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Japan, UK, Germany, Canada, India, South Korea, Italy, France, Brazil, UAE, and Rest of World (Row) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Aircraft Parts Manufacturer Approval (PMA) Market Research and Growth Report?

- CAGR of the Commercial Aircraft Parts Manufacturer Approval (PMA) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial aircraft parts manufacturer approval (PMA) market growth of industry companies

We can help! Our analysts can customize this commercial aircraft parts manufacturer approval (PMA) market research report to meet your requirements.