Commercial Vehicle ADAS Market Size 2025-2029

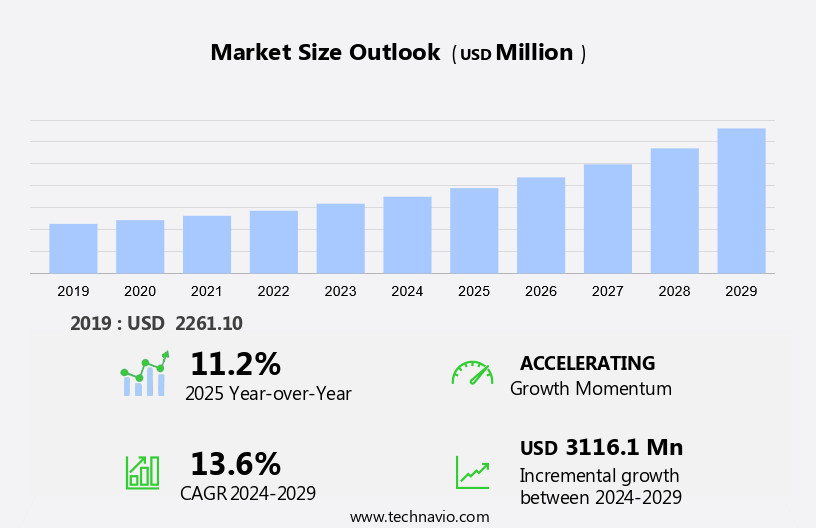

The commercial vehicle ADAS market size is forecast to increase by USD 3.12 billion at a CAGR of 13.6% between 2024 and 2029.

- The market is experiencing significant growth due to the introduction of advanced sensor technology. LIDAR sensors, in particular, are gaining popularity for their ability to provide accurate distance measurements and create 3D maps of the environment. This data is essential for automation and autonomous vehicle applications. Night vision systems, another crucial component of commercial vehicle ADAS, are also advancing with the use of advanced lighting and smart sensors. These systems enhance road safety by improving visibility in low-light conditions. However, the development of highly accurate map content for commercial vehicle ADAS poses a challenge.

- Existing regulations may have a potential negative impact on market growth, as they may limit the adoption of certain technologies. Overall, the market is digitalizing at a rapid pace, with software solutions and smart sensors becoming increasingly important.

What will be the Size of the Commercial Vehicle ADAS Market During the Forecast Period?

- The market encompasses a range of technologies designed to enhance safety and efficiency in commercial vehicles. This market is experiencing significant growth due to increasing demand for vehicle automation and electrification. Traditional ADAS systems, such as radar, Lidar, and camera sensors, continue to dominate the market, with applications including night vision systems, drowsiness monitoring, and blind spot detection. Road sign recognition systems are becoming essential in self driving technology, with the integration of locator telescope camera to enhance accuracy and improve navigation and safety for autonomous vehicles.

- Newer trends include vehicle electrification and the integration of software for parking assist systems, adaptive front lighting, and self-driving capabilities. The market's size is substantial, with commercial vehicles representing a significant portion of global vehicle sales. As the industry moves towards more automated and electrified vehicles, the role of ADAS systems in ensuring vehicle safety and improving operational efficiency is becoming increasingly crucial.

How is this Commercial Vehicle ADAS Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- LCV

- HCV

- Technology

- TPMS

- PAS

- FCW

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- North America

By Application Insights

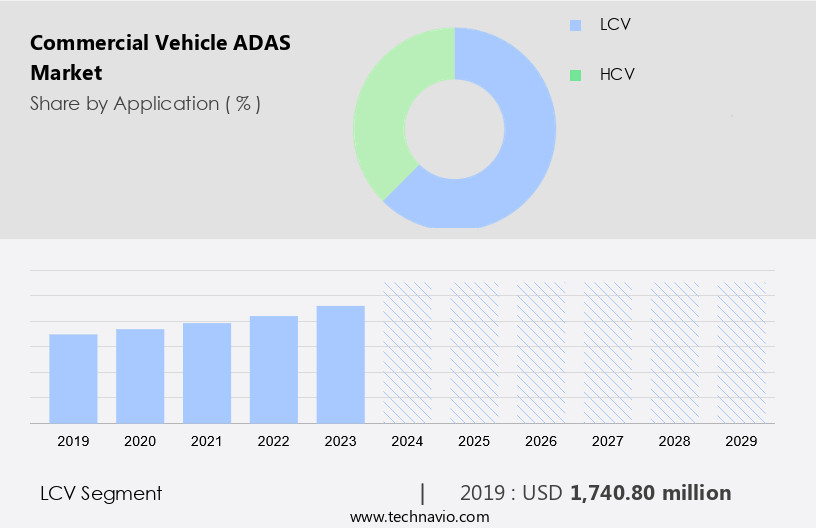

- The LCV segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the increasing demand for vehicle safety and regulatory requirements. Traditional ADAS systems, such as Automatic Braking Systems (ABS), Lane Departure Warning, and Blind Spot Detection, continue to dominate the market. However, technological advancements in sensors, including radar, LIDAR, and cameras, are enabling the development of multifunctional systems, such as Night Vision Systems, Parking Assist Systems, Adaptive Front lighting, and Traffic Sign Recognition. Vehicle electrification and automation are also driving the adoption of ADAS in commercial vehicles, including passenger cars and LCVs. In North America, the demand for pick-up trucks and SUVs is increasing, leading to a larger market share for the LCV segment.

APAC and MEA markets, which exclude pick-up trucks and SUVs from the LCV segment, are also expected to experience substantial growth. Government regulations and road safety concerns are key factors driving the adoption of ADAS in commercial vehicles. Key technological innovations, such as self-driving and automated vehicles, are also expected to impact the market significantly.

Get a glance at the market report of share of various segments Request Free Sample

The LCV segment was valued at USD 1.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

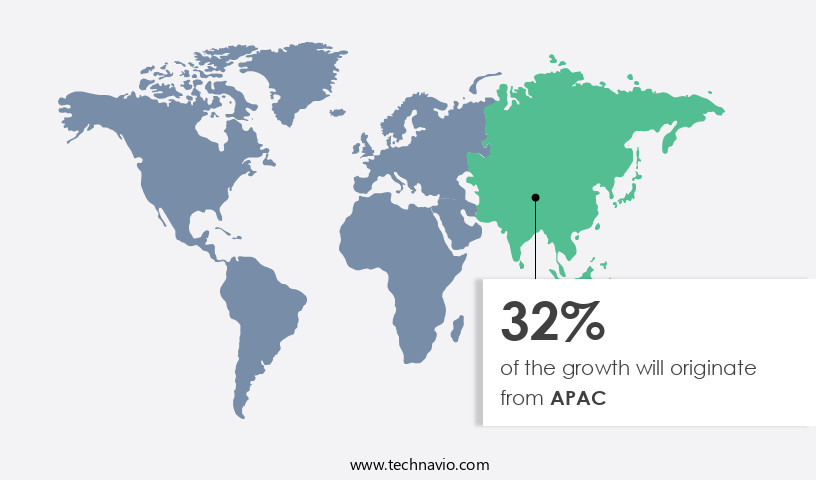

- APAC is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth due to technological advancements in the automotive industry and increased adoption of new technology. Safety concerns, driven by regulations from the US National Highway Traffic Safety Administration (NHTSA) and the National Highway Traffic Safety Administration (NCAP), are also fueling market growth. The US mandate for TPMS in all light vehicles since 2014, including cars, SUVs, trucks, and vans, requiring a backup camera, has further boosted the market. ADAS technologies, such as Night Vision Systems, Blind Spot Detection, Collision Warning, and Adaptive Cruise Control, are increasingly being adopted to enhance comfort and safety in commercial vehicles.

Furthermore, the integration of sensors, including radar, LIDAR, and cameras, along with software, is enabling multifunctional systems and autonomous driving innovations. Global safety regulations continue to evolve, emphasizing the importance of vehicle safety features in both passenger cars and commercial vehicles.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Commercial Vehicle ADAS Industry?

Introduction of sensor technology is the key driver of the market.

- Commercial vehicles, similar to passenger cars, are integrating advanced driver-assistance systems (ADAS) to enhance safety and comfort. Traditional ADAS systems, such as Anti-lock Braking System (ABS), are being supplemented with sensor-based innovations like Night Vision Systems, Parking Assist System, Adaptive Front lighting, and Blind Spot Detection. These systems utilize sensors, including radar, LIDAR, and cameras, to detect environmental changes and execute automated functions. With the rise of vehicle electrification and automation, the number of sensors per vehicle is increasing.

- Technological advancements have led to multifunctional systems, such as Collision Warning, Driver Drowsiness Alert, Traffic Sign Recognition, and Adaptive Cruise Control. Global safety regulations are driving the adoption of these systems, aiming to reduce road accidents and improve overall vehicle safety. Camera-based sensors, specifically image sensors, play a crucial role in collision avoidance and autonomous driving innovations. The integration of these sensors and software solutions is transforming the commercial vehicle industry.

What are the market trends shaping the Commercial Vehicle ADAS Industry?

Development of highly accurate map content for commercial vehicle ADAS is the upcoming market trend.

- The market is witnessing significant advancements, driven by the integration of technological innovations and regulatory requirements. Traditional ADAS systems, which primarily rely on sensors such as radar, LIDAR, and cameras, are being enhanced with map data from sources like TomTom International BV. This data enables ADAS to make decisions beyond the line-of-sight limitations of sensors, improving functionalities like adaptive cruise control (ACC) and transmission select switch reverse (TSR). Vehicle electrification and automation are also fueling the growth of the market, as commercial vehicles adopt multifunctional systems for self-driving and automated vehicles.

- Regulations and governments worldwide are emphasizing vehicle safety, leading to the adoption of safety features such as Night Vision System, Blind Spot Detection, Collision Warning, Driver Drowsiness Alert, Traffic Sign Recognition, and Lane Departure Warning. Technological advancements in image sensors, collision avoidance, and software are further contributing to the market's expansion. Overall, the market is poised for growth, with a focus on enhancing comfort, safety, and efficiency in commercial vehicles.

What challenges does the Commercial Vehicle ADAS Industry face during its growth?

Potential negative impact of existing regulations is a key challenge affecting the industry growth.

- The market is witnessing significant growth due to increasing regulations and the need for enhanced vehicle safety. The European Union's Digital Tachograph legislation (Regulation (EU) No 165/2014) and (EC) No 561/2006 are driving the adoption of ADAS in commercial vehicles. These regulations enforce rules on driving times and rest periods for professional truck drivers, negatively impacting connected truck technologies, such as truck platooning. However, the potential benefits of these technologies, including improved fuel efficiency and reduced emissions, may outweigh the regulatory challenges. ADAS sensors, including radar, LIDAR, and cameras, are integral to these systems.

- Technological advancements in these sensors, along with software innovations, are enabling multifunctional systems, such as Night Vision Systems, Parking Assist Systems, Adaptive Front lighting, Blind Spot Detection, Collision Warning, Driver Drowsiness Alert, Traffic Sign Recognition, Lane Departure Warning, and Adaptive Cruise Control. These systems not only enhance comfort but also contribute to collision avoidance and global safety regulations. Vehicle electrification and automation are also influencing the market. As commercial vehicles transition towards self-driving and automated vehicles, the demand for advanced safety features is increasing. The integration of these systems is essential to ensure vehicle safety, especially in premium cars and passenger cars.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv Plc

- Autoliv Inc.

- Brandmotion LLC

- Continental AG

- DENSO Corp.

- Gentex Corp.

- Hyundai Motor Co.

- Intel Corp.

- Knorr Bremse AG

- Magna International Inc.

- Mobileye Technologies Ltd.

- Panasonic Holdings Corp.

- Renesas Electronics Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Sensata Technologies Inc.

- Tata Motors Ltd.

- Valeo SA

- Wabtec Corp.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for enhanced safety and productivity in the transportation sector. Traditional ADAS systems have been a mainstay in the industry, offering features such as Adaptive Cruise Control (ACC), Lane Departure Warning (LDW), and Blind Spot Detection (BSD). However, the market is witnessing a shift towards more advanced technologies, including night vision systems and vehicle automation. Vehicle electrification is also playing a role in the evolution of the market. The integration of sensors, software, and cameras in electric and hybrid vehicles is enabling the development of multifunctional systems.

Moreover, these systems offer features such as collision avoidance, driver drowsiness alert, and traffic sign recognition, enhancing both safety and efficiency. Radar and Lidar sensors are key components of these advanced systems. Radar sensors use radio waves to detect objects and measure their distance, speed, and size. Lidar sensors, on the other hand, use laser beams to create a 3D map of the environment, enabling more precise object detection and localization. The integration of these sensors with advanced software and cameras is leading to the development of self-driving and automated commercial vehicles. These vehicles offer significant benefits, including increased productivity, reduced fuel consumption, and improved safety.

However, the development of these vehicles is facing regulatory challenges, as governments and regulatory bodies grapple with the safety and liability implications of fully autonomous vehicles. The market is also being driven by technological advancements in areas such as comfort and convenience. For example, locator telescope cameras and parking assist systems are becoming increasingly popular, offering drivers improved visibility and ease of use. Adaptive front lighting and collision warning systems are also gaining traction, providing enhanced safety features for commercial vehicle drivers. Global safety regulations are also driving the adoption of ADAS technologies in commercial vehicles. These regulations require manufacturers to incorporate safety features such as Anti-lock Braking Systems (ABS) and Electronic Stability Control (ESC) in their vehicles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.6% |

|

Market growth 2025-2029 |

USD 3.12 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.2 |

|

Key countries |

US, China, Germany, Canada, Japan, India, France, UK, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Vehicle ADAS Market Research and Growth Report?

- CAGR of the Commercial Vehicle ADAS industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial vehicle adas market growth of industry companies

We can help! Our analysts can customize this commercial vehicle adas market research report to meet your requirements.