Composite Insulated Panels Market Size 2024-2028

The composite insulated panels market size is forecast to increase by USD 158.2 million at a CAGR of 4.5% between 2023 and 2028.

- The market experiences significant growth driven by the increasing demand for energy-efficient buildings and their extensive usage in cold storage applications. These panels offer superior insulation properties, making them an ideal choice for constructing energy-efficient structures. However, high costs remain a significant barrier to large-scale acceptance of composite insulated panels. Despite this challenge, the market's future looks promising, with opportunities arising from the increasing focus on sustainable construction and the growing need for temperature-controlled infrastructure. Regulatory hurdles also impact adoption, as stringent building codes and standards necessitate the use of insulation materials that meet specific energy efficiency requirements.

- Additionally, supply chain inconsistencies can temper growth potential, as the availability and reliability of raw materials and manufacturing capacity can significantly affect market penetration. To capitalize on the market's opportunities, companies must focus on reducing production costs, improving supply chain efficiency, and addressing regulatory requirements. By addressing these challenges, market participants can effectively navigate the competitive landscape and position themselves for long-term success in the market.

What will be the Size of the Composite Insulated Panels Market during the forecast period?

- The market encompasses various product offerings, including architectural design, fire rating, and impact resistance, catering to diverse construction projects. Sound transmission class and air infiltration are crucial factors in ensuring optimal acoustic and energy performance. Finish options and color choices enable architects to enhance aesthetic appeal. Construction management software and project management tools streamline workflows, while remote monitoring and data analytics facilitate efficient maintenance. Insulated concrete forms and metal building systems offer superior fire ratings and thermal conductivity. Custom fabrication and vapor barrier integration cater to unique project requirements.

- Reclaimed materials and recycled content contribute to sustainable practices. Augmented reality (AR) and virtual reality (VR) technologies enable precise design visualization. Structural insulated panels deliver energy efficiency and low VOC emissions. Artificial intelligence (AI) and data analytics optimize production processes and improve product quality. Curtain wall systems and installation services round out the market's comprehensive offerings.

How is this Composite Insulated Panels Industry segmented?

The composite insulated panels industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

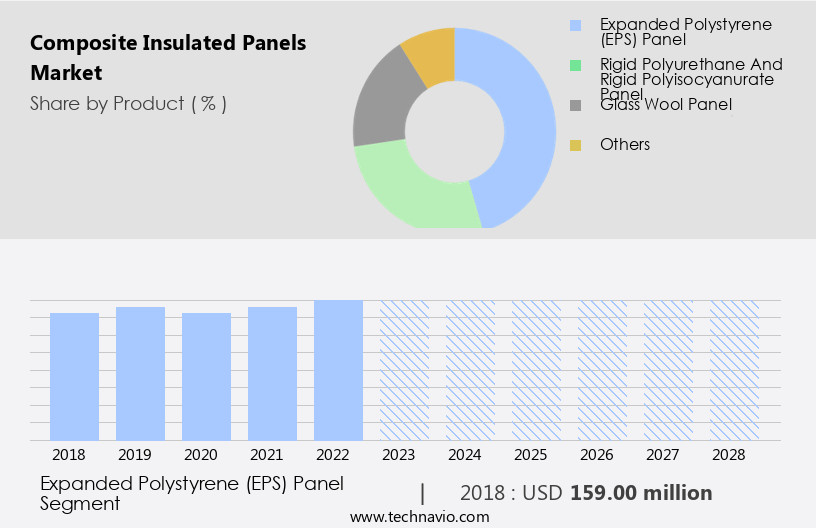

- Product

- Expanded polystyrene (EPS) panel

- Rigid polyurethane and rigid polyisocyanurate panel

- Glass wool panel

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Product Insights

The expanded polystyrene (eps) panel segment is estimated to witness significant growth during the forecast period.

EPS insulated sandwich panels, comprised of two steel faces and an expanded polystyrene insulating core, are a modern and efficient construction solution for buildings. These panels, which can be used for both load-bearing and free-standing structures, offer numerous advantages over traditional building methods. In industrial and commercial construction, EPS panels are utilized for walls, roofs, and even foundations. Their structural and maintenance benefits include strength, durability, ease of maintenance, and recyclability. EPS panels contribute significantly to energy efficiency through their insulating properties, reducing the need for excessive heating or cooling. Air sealing and thermal bridging are effectively addressed with these panels, contributing to improved building envelope performance.

In cold storage applications, EPS panels provide excellent insulation, helping to maintain stable temperatures. LEED certification and sustainable construction are increasingly important, and EPS panels meet these requirements with their low greenhouse gas emissions and high structural integrity. Fire resistance is another critical factor, with EPS panels offering excellent resistance to fire. EPS panels can be used in various industries, including cleanroom construction, industrial construction, and even residential construction. Moisture control is essential, and EPS panels offer moisture resistance, making them suitable for humid environments. Fastening systems and joint sealing are essential components of EPS panel installation, ensuring structural integrity and thermal performance.

HVAC systems and acoustic performance are also improved with the use of EPS panels. Energy modeling and simulation software are valuable tools in evaluating the energy efficiency and sustainability of buildings, and EPS panels are an excellent choice for reducing energy consumption and carbon footprint. Renewable energy sources, such as solar panels, can be integrated seamlessly with EPS panels for further energy savings. Floor panels made of EPS are also gaining popularity due to their lightweight and easy-to-install nature. Core materials, including mineral wool and expanded polystyrene, offer different thermal performance properties, allowing for customized solutions based on specific project requirements.

Hence, EPS insulated sandwich panels offer numerous benefits for the construction industry, including energy efficiency, cost savings, and structural integrity. Their versatility and adaptability make them an excellent choice for various industries and applications.

The Expanded polystyrene (EPS) panel segment was valued at USD 159.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to increasing construction activities in the region. With the US, Canada, and Mexico being major contributors, the US is expected to lead the market during the forecast period. The demand for housing in the US, driven by population growth, is a key factor fueling market expansion. In terms of market trends, energy efficiency is a significant consideration, with polyurethane foam and polyisocyanurate foam used as insulation materials. Fastening systems and joint sealing ensure structural integrity and moisture resistance. LEED certification and green building are also driving market growth, as sustainability metrics become increasingly important.

Industrial and commercial construction, including cleanroom construction and cold storage, are major applications for composite insulated panels. Fire resistance is another important factor, with metal cladding and face materials providing additional safety. Building codes require strict adherence to energy performance, thermal bridging, and acoustic performance, which are addressed through energy modeling and simulation software. Renewable energy sources, such as solar panels and geothermal energy, are also integrated into composite insulated panels for improved energy efficiency. The market is expected to continue its growth trajectory due to these trends and the need for energy-efficient, sustainable building solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Composite Insulated Panels market drivers leading to the rise in the adoption of Industry?

- The surge in demand for energy-efficient buildings is the primary market catalyst, driving growth in this sector.

- Composite insulated panels are experiencing significant growth due to their advantages, including lightweight design, enhanced aesthetic appeal, and superior thermal insulation. The global push towards energy-efficient structures is escalating, driven by increasing regulatory requirements and heightened environmental concerns. Buildings account for approximately 40% of global energy consumption and 33% of greenhouse gas emissions. With the recent shift towards remote work and increased time spent at home, energy demand patterns have become more intricate. As a result, there is a growing emphasis on reducing energy consumption and carbon footprint in the construction sector.

- Composite insulated panels, made from materials such as mineral wool, expanded polystyrene, fiber glass, and sandwich panels, offer excellent insulation, moisture resistance, and structural integrity. Energy modeling is increasingly being used to optimize building performance and reduce life cycle costs. These factors collectively contribute to the growing adoption of composite insulated panels.

What are the Composite Insulated Panels market trends shaping the Industry?

- The increasing demand for composite insulated panels is a notable trend in the cold storage market. These panels offer superior insulation properties, making them a preferred choice for cold storage applications.

- Composite insulated panels have gained significant traction in the construction industry due to their superior insulation properties, particularly in cold storage applications. These panels offer thermal insulation that surpasses other facade materials, simplifying the construction process for both commercial and residential projects. The use of composite insulated panels in sustainable construction, such as in East Africa for food preservation, ensures moisture control and adherence to building codes. These panels, with a 2mm profile, provide resistance to impacts, movements, and forces, maintaining optimal thermal insulation.

- The adoption of composite insulated panels contributes to green building initiatives and modular or prefabricated construction. Additionally, the integration of geothermal energy systems with these panels enhances sustainability metrics, offering a substantial return on investment for businesses.

How does Composite Insulated Panels market faces challenges face during its growth?

- The high costs associated with large-scale adoption of composite insulated panels represent a significant challenge impeding the growth of the industry.

- Composite insulated panels, which consist of core materials such as polyurethane, PIR, polystyrene, phenolic foam, and rockwool sandwiched between two layers of metal cladding, offer superior thermal insulation and air sealing properties compared to conventional insulators. These panels' high performance results in significant energy savings, making them an attractive option for various industries, including cold storage, cleanroom construction, and industrial construction. However, the high cost of raw materials and labor-intensive manufacturing process increase the price of composite insulation panels, limiting their use in large-scale applications.

- The use of polyurethane as the most common core material contributes to the high cost but provides favorable thermal insulation and energy efficiency benefits. Despite the higher cost, composite insulated panels' ability to reduce thermal bridging and improve the building envelope's overall performance makes them a valuable investment for energy-conscious businesses seeking LEED certification.

Exclusive Customer Landscape

The composite insulated panels market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the composite insulated panels market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, composite insulated panels market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Al Shahin Metal Industries - Composite insulated panels, including Promistyl and Ondastyl, are a key offering of the company.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Shahin Metal Industries

- Alubel Spa

- ArcelorMittal SA

- Balex Metal Sp zoo

- Composite Panel Building Systems

- Cornerstone Building Brands Inc.

- DANA Group of Companies

- Isopan Spa

- Italpannelli Srl

- Jiangsu Jingxue Insulation Technology Co. Ltd.

- Kingspan Group Plc

- Lattonedil Spa Milan

- Metecno Group

- PFB Corp.

- PortaFab Corp.

- Rautaruukki Corp.

- Romakowski GmbH and Co. KG

- Tata Steel

- Yusuf A. Alghanim and Sons WLL

- Zamil Industrial Investment Co

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Composite Insulated Panels Market

- In February 2024, Owens Corning, a leading global producer of building and industrial materials, introduced its new line of Aerogel Insulation composite insulated panels, boasting enhanced thermal insulation properties and improved energy efficiency (Owens Corning Press Release, 2024). This innovation marked a significant technological advancement in the market.

- In June 2025, BASF and Siemens announced their strategic collaboration to develop and commercialize insulated panels with integrated building services, merging insulation and smart building technologies (BASF Press Release, 2025). This partnership represented a major strategic move to cater to the growing demand for energy-efficient and intelligent building solutions.

- In September 2024, Kingspan, a global leader in high-performance insulation and building envelope solutions, acquired US-based panel manufacturer, CertainTeed Corporation, expanding its geographic reach and strengthening its market position (Kingspan Press Release, 2024). This acquisition marked a significant merger in the market.

- In January 2025, the European Union passed the new Energy Performance of Buildings Directive (EPBD), mandating a 30% reduction in energy consumption for new buildings by 2030 (European Parliament Press Release, 2025). This regulatory initiative created a strong demand for advanced insulation solutions like composite insulated panels, driving market growth.

Research Analyst Overview

The market continues to evolve, driven by the ever-increasing demand for energy efficiency and sustainable construction solutions. These panels, which consist of core materials such as polyurethane foam, mineral wool, expanded polystyrene, and polyisocyanurate foam, sandwiched between face materials and metal cladding, offer superior thermal performance and moisture resistance. In the commercial construction sector, composite insulated panels are gaining popularity due to their ability to improve building envelope efficiency, reduce energy consumption, and enhance fire resistance. Simulation software plays a crucial role in evaluating the energy modeling and carbon footprint of these structures, enabling architects and engineers to optimize design and ensure LEED certification.

Residential construction also benefits from composite insulated panels, as they provide excellent thermal performance, acoustic performance, and moisture control. Pre-fabricated and modular construction methods further streamline the installation process, reducing construction time and costs while maintaining structural integrity. Moisture control is a critical concern in various sectors, including industrial construction and cleanroom construction, where composite insulated panels offer effective solutions through joint sealing and corrosion resistance. Additionally, these panels are increasingly being used in cold storage facilities and refrigerated warehouses, ensuring optimal temperature control and energy efficiency. The ongoing focus on sustainability metrics and green building initiatives is further fueling the growth of the market.

Renewable energy sources, such as solar panels, are being integrated into these structures to minimize energy consumption and improve overall building performance. Building codes continue to evolve, requiring higher energy efficiency standards and stricter moisture control regulations. Composite insulated panels meet these requirements, offering a cost-effective and sustainable solution for both new construction and retrofitting existing structures. In summary, the market is a dynamic and evolving space, driven by the continuous demand for energy efficiency, sustainable construction, and improved building performance across various sectors. From commercial and residential construction to industrial and cleanroom applications, these panels offer a versatile and effective solution for meeting the ever-changing needs of the construction industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Composite Insulated Panels Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 158.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Composite Insulated Panels Market Research and Growth Report?

- CAGR of the Composite Insulated Panels industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the composite insulated panels market growth of industry companies

We can help! Our analysts can customize this composite insulated panels market research report to meet your requirements.