Compound Feed Market in Mexico Size 2024-2028

The compound feed market in Mexico size is forecast to increase by USD 1.76 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by the rising demand for meat and meat-based products. This trend is fueled by the increasing population and growing economic prosperity, leading to an increased consumption of animal protein. Additionally, technological advancements in compound feed production are contributing to market growth. These innovations include the use of automation and digitalization in feed mills, as well as the development of new formulations to improve animal health and productivity. However, the market also faces challenges from stringent regulations associated with compound feed manufacturing. These regulations aim to ensure food safety and animal welfare, but they can increase production costs and limit market entry for new players. Overall, the market is characterized by robust growth, driven by consumer demand and technological advancements, while facing regulatory challenges that require careful navigation.

The Mexico Compound Feed Market plays a significant role in the animal production sector, particularly for livestock farmers raising species such as ruminants and poultry. Compound feed manufacturers formulate feeds using cereal crops and energy sources to meet the nutritional requirements of animals. However, energy fluctuation and metabolic processes can impact livestock performance, leading to diseases and decreased productivity. In the food production chain, compound feeds are essential for animal farming, especially in regions with grassland degradation and high animal density. Early weaning and infectious diseases, including zoonotic diseases, pose challenges to livestock farmers. Policymakers and retailers play crucial roles in ensuring the availability and affordability of compound feeds.

Poultry, such as chickens, are a significant consumer of compound feeds in the animal production industry. The market's growth is influenced by the demand from hotels, restaurants, and other food service industries for milk, meat, and eggs. Disease outbreaks and energy price fluctuations can impact the market's dynamics. Animal species, livestock farmers, and feed formulations are essential factors shaping the Compound Feed Market's trends and growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

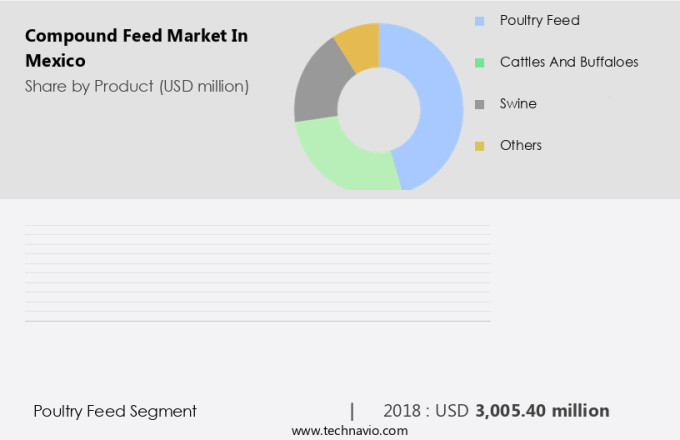

- Poultry feed

- Cattles and Buffaloes

- Swine

- Others

- Geography

- Mexico

By Product Insights

The Poultry feed segment is estimated to witness significant growth during the forecast period. The Mexico compound feed market caters to the nutritional requirements of various livestock populations, including those in the poultry sector, dairy cattle, goats, and fish. Cakes and meals, supplements, enzymes, acidifiers, probiotics, and prebiotics are essential components of compound feed, ensuring optimal animal growth and health. With increasing meat consumption among high- and middle-income consumers, environmental and health concerns have emerged, driving the demand for sustainable and nutritious animal feed. The feed industry is a significant contributor to the food production sector, providing essential inputs for animal protein production. Feed manufacturers produce commercial feed to meet the nutritional needs of animals in the livestock sector, including those in hotels, restaurants, and animal husbandry.

Policymakers and retailers play a crucial role in regulating and promoting the use of additives and feed to ensure animal welfare and food safety. Moreover, the poultry sector, which is the world's fourth-largest consumer of chicken, relies heavily on compound feed to maintain its productivity. Ensuring the availability of high-quality feed is essential for the growth of the livestock sector, which contributes significantly to livelihoods and diets in many countries. Animal feed production is a critical component of animal nutrition, with milk consumption and milk production also depending on the availability of proper feed. In conclusion, the compound feed market plays a vital role in the animal feed production sector, providing essential nutrients for various livestock populations, including poultry, dairy cattle, goats, and fish.

The use of supplements, enzymes, acidifiers, probiotics, and prebiotics ensures optimal animal growth and health, while addressing environmental and health concerns. The feed industry's contribution to food production and animal protein production makes it a crucial sector for policymakers, retailers, and livestock sector stakeholders.

Get a glance at the market share of various segments Request Free Sample

The Poultry feed segment was valued at USD 3 billion in 2018 and showed a gradual increase during the forecast period.

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising demand for meat and meat-based products is the key driver of the market. In the intricate food production chain, compound feed manufacturers play a pivotal role in meeting the nutritional requirements of various animal species, including livestock such as ruminants and monogastrics like swine, poultry, and aquaculture. The metabolic processes of these animals necessitate specific dietary patterns, which are addressed through scientifically formulated compound feeds. Energy fluctuation and the need for optimal nutrition during different growth stages, as well as disease prevention and animal performance enhancement, are key considerations in compound feed formulations. Functional additives, derived from protein sources like seeds, plant leaves, and cereals, are incorporated into compound feeds to improve livestock health and productivity.

These additives may include vitamins, minerals, protein, and amino acids, which are essential for the growth and development of different animal species. Farmers and livestock breeders rely on these feeds to ensure their livestock receive the necessary nutrients for optimal performance, regardless of energy fluctuations or environmental challenges. The increasing animal density on farms and the need for early weaning and disease prevention have led to a greater focus on compound feeds in the livestock industry. Infectious diseases, including zoonotic diseases, pose a significant threat to both animal health and human safety, making the use of high-quality compound feeds crucial for maintaining a healthy herd or flock.

Cereal crops, a primary source of raw materials for compound feed production, are also essential for the livestock industry, as they provide the energy and nutrients necessary for optimal livestock growth and development. The demand for higher quality meat and animal products, driven by increased consumer spending power, has led to a growing market for compound feeds. This trend is particularly evident in the production of cattle meat, which has seen significant growth in Mexico and other developing countries due to government initiatives aimed at boosting the livestock industry. The use of compound feeds helps to ensure food safety, epidemic safety, environmental protection, and climate change adaptation, making them an essential component of the modern livestock production system.

Market Trends

Technological advancements in compound feed production in Mexico is the upcoming trend in the market. In the food production chain, compound feed manufacturers play a pivotal role in catering to the nutritional needs of various livestock species. Technological advancements have significantly transformed the production process, enabling the formulation of feeds that optimally support the metabolic processes of animals. Energy fluctuations and diseases can impact livestock performance, making it essential to address their nutritional requirements accurately. Functional additives and protein sources are crucial components of feed formulations, ensuring the health and growth of animals. Farmers and livestock breeders rely on compound feeds to maintain animal density and improve livestock productivity. The integration of technology, such as precision nutrition systems, allows for data-driven approaches to formulate feed compositions that meet the specific nutritional requirements of different species.

This not only enhances the overall productivity of compound feed production but also optimizes the nutritional value and safety of the feed. Raw materials, including seeds, plant leaves, cereals, and protein sources, undergo rigorous testing and processing to ensure their quality and safety. Ruminants, such as cattle and sheep, require specialized feeds to maintain optimal health and productivity. Grassland degradation and early weaning practices necessitate the use of high-quality compound feeds to support the nutritional needs of livestock. Infectious diseases and zoonotic diseases pose a significant threat to livestock health and food safety. Compound feeds fortified with vitamins, minerals, protein, and amino acids help strengthen the immune system of animals, reducing their susceptibility to diseases.

In the case of poultry, chickens, and other livestock, the nutritional value of the feed plays a crucial role in the production of meat and eggs. The compound feed market encompasses various sectors, including swine, aquaculture, and cereal crops. Technological advancements continue to shape the industry, with a focus on optimizing nutritional value, improving animal health, and reducing the environmental impact of feed production. Dietary patterns and feed formulations are continually evolving to meet the changing demands of the livestock industry and consumers.

Market Challenge

Stringent regulation associated with the manufacturing of compound feed in Mexico is a key challenge affecting market growth. In the food production chain, compound feed manufacturers play a pivotal role in formulating and producing feed for various animal species, including livestock and ruminants, to ensure optimal livestock performance and nutritional requirements. The manufacturing process involves sourcing and utilizing raw materials such as seeds, plant leaves, cereals, and protein sources, which are subject to stringent regulations to maintain safety, quality, and compliance standards. Energy fluctuation and metabolic processes in animals necessitate the inclusion of functional additives and nutrients like vitamins, minerals, protein, and amino acids in feed formulations. The presence of infectious diseases and zoonotic diseases in livestock populations necessitates the use of feed ingredients that bolster animal health and immunity.

Raw materials used in compound feed production must undergo rigorous quality control measures to mitigate the risk of contamination and the presence of harmful substances. This is crucial for maintaining animal health, promoting food safety, and upholding environmental sustainability. Farmers and livestock breeders rely on compound feed to optimize livestock performance, particularly during early weaning and periods of high animal density. Stringent regulations also address issues such as grassland degradation and the environmental impact of livestock farming. In the case of ruminants, feed formulations may include mash feed and dietary patterns tailored to their unique metabolic processes. Swine and aquaculture industries also benefit from compound feed formulations designed to meet their specific nutritional needs.

Cereal crops, such as corn and soybeans, are significant sources of protein and energy for various animal species. The compound feed industry must adapt to energy fluctuations in the agricultural sector and ensure a consistent supply of raw materials to maintain production levels and meet the nutritional demands of livestock farmers. In summary, the compound feed market plays a vital role in the food production chain by providing animal species with the necessary nutrients for optimal performance and health. Stringent regulations ensure the safety, quality, and compliance of raw materials and feed formulations, while addressing environmental sustainability concerns and promoting animal health and food safety.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- BASF SE

- Cargill Inc.

- Charoen Pokphand Foods PCL

- De Heus Voeders BV

- Evonik Industries AG

- Feed One Co. Ltd.

- Guangdong Haid Group Co. Ltd.

- International Flavors and Fragrances Inc.

- Kent Corp.

- Koninklijke DSM NV

- Land O Lakes Inc.

- Mitsui and Co. Ltd.

- New Hope Group Co. Ltd.

- Novozymes AS

- Nutreco N.V.

- Sojitz Corp.

- United Animal Health Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Compound Feed Market in Mexico is a significant sector in the global agriculture industry, catering to the nutritional requirements of livestock and poultry. The production of compound feed involves the mixing of various grains, proteins, vitamins, and minerals. The market for compound feed is driven by several factors, including the increasing demand for meat and dairy products, the need for efficient livestock farming, and the availability of advanced feed production technologies. The market for compound feed is diverse and dynamic, with various players competing based on product quality, pricing, and innovation. The market is segmented based on animal type, feed type, and geography.

The major animal types include poultry, swine, ruminants, and aquaculture. The feed types include premixes, concentrates, and complete feeds. The compound feed market is a growing industry, with several trends shaping its future. These trends include the increasing use of organic and natural feed ingredients, the adoption of automation and digitalization in feed production, and the growing demand for sustainable and eco-friendly feed production methods. The market for compound feed is expected to grow at a steady pace in the coming years, driven by the increasing demand for meat and dairy products and the need for efficient livestock farming.

The market is also expected to be influenced by various factors, including government regulations, consumer preferences, and technological advancements. In conclusion, the compound feed market is a dynamic and growing industry, driven by various factors and influenced by several trends. The market is segmented based on animal type, feed type, and geography, and is expected to grow at a steady pace in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key companies profiled |

Alltech Inc., Archer Daniels Midland Co., BASF SE, Cargill Inc., Charoen Pokphand Foods PCL, De Heus Voeders BV, Evonik Industries AG, Feed One Co. Ltd., Guangdong Haid Group Co. Ltd., International Flavors and Fragrances Inc., Kent Corp., Koninklijke DSM NV, Land O Lakes Inc., Mitsui and Co. Ltd., New Hope Group Co. Ltd., Novozymes AS, Nutreco N.V., Sojitz Corp., and United Animal Health Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Mexico

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch