Concrete Superplasticizer Market Size 2024-2028

The concrete superplasticizer market size is forecast to increase by USD 2.55 billion at a CAGR of 8.09% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increase in residential and commercial construction activities worldwide. This trend is particularly prominent in emerging economies, where infrastructure development is a priority. Additionally, the market is witnessing new application areas in industries such as precast concrete and ready-mix concrete, expanding its reach beyond traditional applications. However, market growth is not without challenges. The volatility in raw material prices, particularly those of key ingredients like calcium chloride and naphthalene formaldehyde sulfonate, poses a significant threat to market stability. Producers must navigate these price fluctuations through strategic sourcing and supply chain management. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on innovation, cost management, and geographic expansion. By staying abreast of industry trends and adapting to market dynamics, players can position themselves for long-term success In the market.

What will be the Size of the Concrete Superplasticizer Market during the forecast period?

- The market encompasses a range of performance-enhancing chemicals used In the production of concrete and cement materials. These admixtures, including carboxyl grafted copolymers, modified lignosulfonates, phosphonate-based superplasticizers, and poly-carboxylates (PCE), enable the reduction of water content in concrete mixtures, thereby increasing load-bearing capacity and mechanical strength. The market's growth is driven by the expanding construction sector, with applications spanning from housing and commercial construction to high-rise building projects and infrastructure development. In the building sector, superplasticizers are essential for producing high-performance concrete (HPC) and enhancing the workability of concrete in large-scale projects such as malls and industrial structures.

- The use of these admixtures in precast concrete production also contributes to the market's growth. Despite the environmental concerns surrounding the use of chlorides in some superplasticizers, the market continues to expand due to the increasing demand for sustainable and low-dosage alternatives. The cement industry's shift towards the production of finer cement grades and the growing popularity of liquid admixtures further bolster market growth. Overall, the market is poised for continued expansion, driven by the construction industry's relentless pursuit of high-performance, sustainable, and cost-effective concrete solutions.

How is this Concrete Superplasticizer Industry segmented?

The concrete superplasticizer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Ready-mix concrete

- Precast concrete

- High-performance concrete

- Others

- Type

- Sulfonated naphthalene formaldehydes (SNF)

- Modified lignosulfonates (MLS)

- Polycarboxylic acid (PC)

- Sulfonated melamine formaldehydes (SMF)

- Geography

- APAC

- China

- Japan

- Europe

- France

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

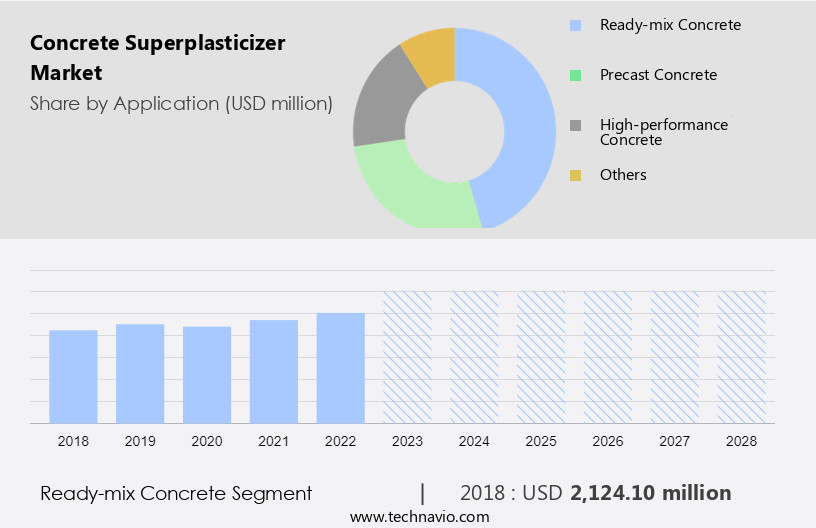

The ready-mix concrete segment is estimated to witness significant growth during the forecast period. The market is experiencing notable growth due to the increasing demand for high-performance concrete (HPC) and ready-mix concrete (RMC) in various sectors. Superplasticizers, such as poly-carboxylates (PCE), carboxyl grafted copolymers, and sulfonated melamine formaldehydes, enhance the workability of concrete without compromising its mechanical strength, early strength growth, and durability. These performance products are essential in high-rise building construction, infrastructure development, and housing markets. The use of superplasticizers also reduces surface defects, improves slump protection, and ensures quality consistency in cementitious materials, including cement, mortar, and grout. In the building sector, superplasticizers are employed in flooring, roofing, waterproofing, and sealing & bonding applications.

Get a glance at the market report of share of various segments Request Free Sample

The ready-mix concrete segment was valued at USD 2.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing steady growth due to increasing construction activities in countries like India, China, and Japan. This growth is driven by the demand for new infrastructure to accommodate the expanding urban population. In India, for instance, the government invested USD 8.58 billion in 2020 for the Odisha Economic Corridor Project, which includes six industrial clusters and eight residential clusters. The market is also fueled by the expansion of the commercial and residential sectors in emerging economies. Concrete superplasticizers, such as carboxyl grafted copolymers, phosphonate-based superplasticizers, and poly-carboxylates (PCE), are essential for enhancing the workability and durability of concrete in high-performance applications, including high-rise building construction, precast concrete, and ready-mix concrete.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Concrete Superplasticizer Industry?

- Rise in residential and commercial construction activities is the key driver of the market. The market is experiencing significant growth due to the increasing demand for infrastructure development in various sectors. Urbanization and rising consumer confidence In the use of chemicals are primary drivers for this expansion. Construction projects, both residential and non-residential, are on the rise as governments and private entities invest in new initiatives. The need for greater volume stability and increased abrasion resistance in construction materials is also increasing, leading to increased demand for concrete superplasticizers. Moreover, during lockdowns, construction companies with government contracts experienced fewer project suspensions, providing a steady stream of business opportunities.

- The healthcare sector, in particular, has seen significant investment as governments focus on enhancing healthcare infrastructure to accommodate the growing number of patients. Overall, the market for concrete superplasticizers is poised for continued growth as the construction industry continues to expand.

What are the market trends shaping the Concrete Superplasticizer Industry?

- Emerging new application areas is the upcoming market trend. The Asia Pacific market for concrete superplasticizers has experienced growing demand due to their expanding applications In the construction industry. In addition to their traditional uses, these adhesives are now being employed for advanced applications such as bonding floor structures to beams, attaching interior wallboards to studs, and creating seamless wall surfaces. A notable development is the utilization of structural sealants to secure curtain wall panels without mechanical fastenings. This trend is projected to propel market growth during the forecast period.

- Concrete superplasticizers offer several benefits including improved workability, enhanced flow properties, and increased strength, making them indispensable in modern construction projects. The increasing focus on infrastructure development and urbanization In the Asia Pacific region is further fueling the market's growth.

What challenges does the Concrete Superplasticizer Industry face during its growth?

- Volatility in raw material prices is a key challenge affecting the industry growth. The market faces challenges due to the volatile prices of raw materials used in its production. Raw materials such as polyglycol, naphthalene sulfonate, and related by-products, which are derived from the oil industry, experience frequent price fluctuations.

- Additionally, the scarcity of base chemicals for resins used as additives in concrete further drives up the cost. These elevated costs result in increased manufacturing expenses and decreased profit margins for companies. A primary factor fueling the global increase in demand for concrete superplasticizers is the growing construction sectors in Asia Pacific and Europe.

Exclusive Customer Landscape

The concrete superplasticizer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the concrete superplasticizer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, concrete superplasticizer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema SA

- BASF SE

- Chembond Chemicals Ltd.

- Compagnie de Saint Gobain

- Enaspol A.S.

- Forming America Ltd.

- Fosroc International Ltd.

- Fritz Pak Corp.

- Ha Be Betonchemie GmbH

- Henan Kingsun Chemical Co. Ltd.

- Holcim Ltd.

- Kao Corp.

- Mapei SpA

- Rhein Chemotechnik GmbH

- Riteks Inc.

- Sakshi Chem Sciences

- Sika AG

- Taian Tianrun Gome New Materials Co. Ltd.

- The Euclid Chemical Co.

- Xiamen All Carbon Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of specialty chemicals used to enhance the properties of cementitious materials, primarily concrete. These admixtures play a crucial role in improving the workability, durability, and mechanical strength of concrete. Among the various types of concrete admixtures, superplasticizers have gained significant attention due to their ability to increase the fluidity of concrete without altering its other properties. Superplasticizers, also known as high-range water reducers, are used to reduce the water content in concrete mixtures while maintaining or even improving its workability. This leads to several benefits, including increased load-bearing capacity, early strength growth, and reduced surface defects.

In addition, the use of superplasticizers is particularly prevalent in high-performance concrete (HPC) applications, where high mechanical strength and durability are essential. Carboxyl grafted copolymers, poly-carboxylates (PCE), phosphonate-based superplasticizers, and sulfonated melamine formaldehydes are some of the common types of superplasticizers. These chemicals are added to concrete mixtures in small dosages, typically less than 1% by weight of cement, to achieve the desired effects. The demand for superplasticizers is driven by the building sector, which is the largest consumer of concrete. This includes housing construction, high-rise building construction, and infrastructure projects. The use of superplasticizers is not limited to new construction; they are also employed in refurbishment and repair projects, as well as In the production of precast concrete and ready-mix concrete (RMC).

Moreover, superplasticizers are also used in various industries, such as the motor vehicle industry, where they are employed In the production of engine blocks and other components. They are also used In the flooring industry, where they help to improve the flow properties of concrete during installation, ensuring satisfactory keeping slump and improving the quality consistency of the final product. In the construction industry, superplasticizers are used in various applications, including in the production of concrete for malls, high-rise buildings, and other large-scale projects. They are also used in the production of concrete for specialized applications, such as waterproofing systems and residential roofing, where high workability and durability are essential.

Furthermore, superplasticizers are also used In the production of concrete for various specialty applications, such as sealing and bonding, and In the secondary cooling circuit of power plants (PWRs) to improve the workability of the concrete used In the primary cooling circuit. The use of superplasticizers is not limited to concrete; they are also used In the production of mortar and grout. In the construction industry, superplasticizers are used to improve the workability of concrete mixtures, which in turn leads to improved mechanical strength and durability. Superplasticizers are also used In the production of high-performance concrete (HPC), which is used in various applications where high mechanical strength and durability are essential.

In addition, HPC is used In the construction of high-rise buildings, bridges, and other large-scale infrastructure projects. Superplasticizers are also used In the production of concrete for the manufacturing industry, particularly In the production of components for the mechanical engineering industry. They are also used In the production of concrete for the chemical industry, where they help to improve the workability of the concrete used In the production of various chemical products. Superplasticizers are also used In the production of concrete for the construction of various types of structures, including roads, bridges, and other infrastructure projects. They are also used In the production of concrete for the production of various types of precast concrete products, such as pipes, beams, and slabs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 2.55 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

China, Germany, US, Japan, France, |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Concrete Superplasticizer Market Research and Growth Report?

- CAGR of the Concrete Superplasticizer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, South America,

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the concrete superplasticizer market growth of industry companies

We can help! Our analysts can customize this concrete superplasticizer market research report to meet your requirements.