Calcium Chloride Market Size 2025-2029

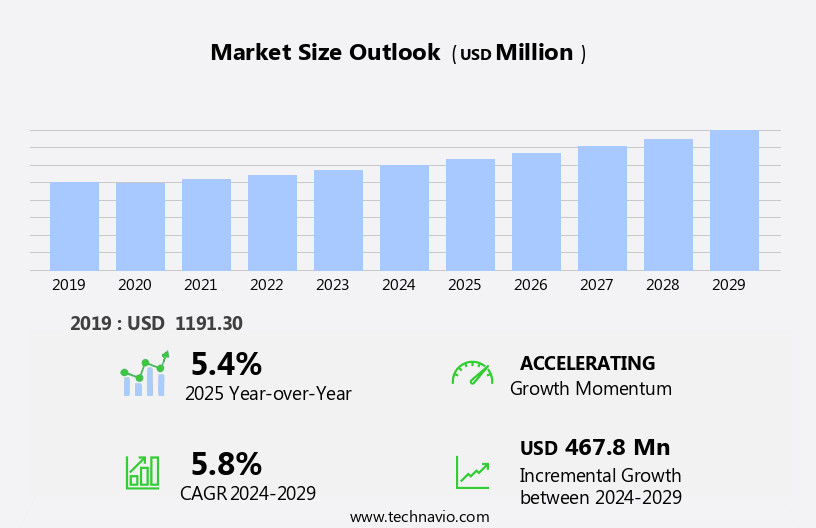

The calcium chloride (CaCl2) market size is forecast to increase by USD 467.8 mn at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends and factors. The recovery of the oil and gas industry, particularly in North America, is driving demand for Cacl2 in frac services. The shale gas boom in the region is increasing the usage of Cacl2 as a proppant and a brine solution in hydraulic fracturing. However, the market is also facing challenges such as the diminishing reserves of limestone, a major source of calcium carbonate production. Strict regulations on water treatment and the increasing demand for Cacl2 in the food processing industries, particularly in the food and beverage sectors, are also contributing to market growth. Additionally, the use of Cacl2 as a de-icing agent in the salt industry is another significant application area. Overall, the market is expected to witness steady growth in the coming years due to these trends and factors.

What will be the Size of the Calcium Chloride (Cacl2) Market During the Forecast Period?

- The market encompasses the global trade of this versatile inorganic compound, primarily used in various industries for its high water solubility and anhydrous forms. Cacl2 is a colorless crystalline solid, widely employed as a concrete accelerator, desiccant, drying agent, and in water treatment applications. Its usage extends to hydraulic fracturing processes for well completion and drilling fluids, as well as de-icing agents. In the realm of environmental sustainability, calcium chloride is increasingly being explored as an alternative to sodium chloride for de-icing roads. Additionally, calcium chloride plays a crucial role in addressing wastewater problems and urbanization. With its hygroscopic nature and ability to absorb moisture, it functions effectively as a desiccant.

- The calcium chloride market is driven by the expanding industrial processes that require efficient water management and effective de-icing solutions. Despite the widespread use of calcium chloride, it's important to note that calcium carbonate and other compounds may be used as alternatives in certain applications.

How is this Calcium Chloride (CaCl2) Industry segmented and which is the largest segment?

The calcium chloride (CaCl2) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- De-icing and dust control

- Oil and gas

- Construction

- Pharmaceuticals

- Others

- Product Type

- Hydrated solid

- Anhydrous solid

- Liquid

- End-user

- Construction

- Chemical

- Food processing

- Agriculture

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

By Application Insights

- The de-icing and dust control segment is estimated to witness significant growth during the forecast period.

Calcium chloride (CaCl2), an inorganic salt and colorless crystalline solid, holds significant importance in various industries due to its high water solubility and versatility. Anhydrous forms of calcium chloride serve as effective desiccants and drying agents, absorbing moisture from the environment. In the construction sector, it is utilized in industrial processes, well completion, drilling fluids, and hydraulic fracturing. The oil & gas sector employs calcium chloride as a de-icing agent and in hydraulic fracturing processes to manage wastewater problems. Urbanization and agriculture also benefit from calcium chloride, which aids in dust control. Furthermore, calcium chloride finds applications in the food processing sector and healthcare industry, where it is available in food grade, pharmaceutical grade, and agricultural grade.

Its anhydrous form and hygroscopic nature make it an essential component in de-icing agents, replacing sodium chloride, magnesium chloride, and calcium carbonate in certain applications.

Get a glance at the Calcium Chloride (Cacl2) Industry report of share of various segments Request Free Sample

The De-icing and dust control segment was valued at USD 559.50 mn in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

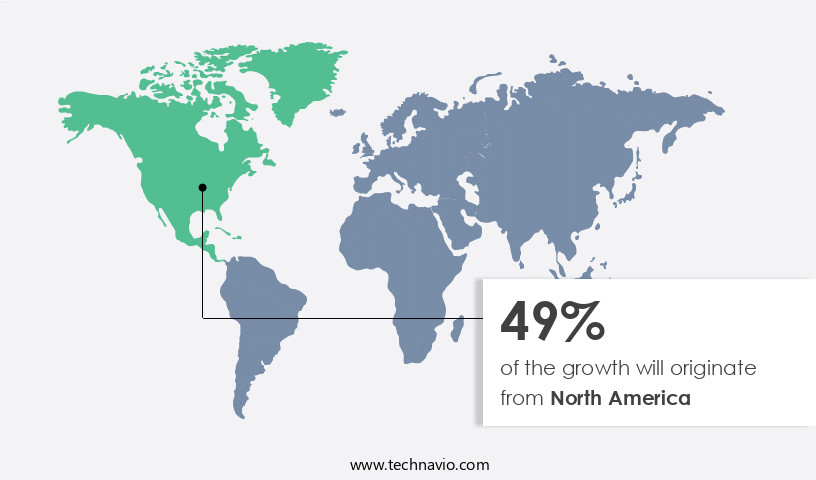

- North America is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Calcium Chloride (CaCl2), an inorganic salt and colorless crystalline solid, holds significant importance in various industries due to its high water solubility and versatility. The market for CaCl2 is expansive, with key applications including concrete accelerator, environmental-friendly alternative desiccant, drying agent, water treatment, hydraulic fracturing processes, and wastewater problems. In North America, the largest market for CaCl2, its usage is predominantly driven by the oil & gas sector, urbanization, construction activities, and food processing sector. The US, Canada, and Mexico are the primary contributors to the North American market's growth. Cacl2 is a crucial component in de-icing agents, making it indispensable during winter seasons in cold regions.

Additionally, it is used in agriculture, healthcare, construction, food & beverages, and other industries. Anhydrous forms of CaCl2 are popular due to their hygroscopic properties, which make them effective in dust control. Furthermore, CaCl2 is used in industrial processes, such as well completion, drilling fluids, and hydraulic fracturing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Calcium Chloride (Cacl2) Industry?

Recovery of oil and gas industry is the key driver of the market.

- Calcium chloride, an inorganic salt with high water solubility, serves various industries due to its versatility. In concrete applications, it functions as a concrete accelerator, enhancing the setting time and improving the workability of concrete. As an environmental-friendly alternative to sodium chloride and magnesium chloride, it is used as a desiccant and drying agent in water treatment applications. The oil & gas sector utilizes it in hydraulic fracturing processes for well completion and as a component in drilling fluids. Urbanization and industrial processes require it for de-icing agents and dust control. Additionally, the food processing sector, agriculture, healthcare, construction, food & beverages, and mining sector rely on different grades, including food grade, pharmaceutical grade, agricultural grade, and industrial grade.

- China, as the largest producer and consumer of petrochemical products, drives the demand in APAC markets. The recent stability in oil and gas pricing has further boosted the demand in the oil & gas industry.

What are the market trends shaping the Calcium Chloride (CaCl2) Industry?

Shale gas boom in North America is the upcoming market trend.

- Calcium chloride (CaCl2), an inorganic compound in anhydrous form, is a colorless crystalline solid with high water solubility. It is versatile and widely used in various industries due to its hygroscopic property, making it an effective desiccant and drying agent. In the construction industry, it is employed as a concrete accelerator. In the oil and gas sector, it is utilized in hydraulic fracturing processes as a proppant and in drilling fluids. The environmental-friendly alternative to traditional de-icing agents, such as sodium chloride and magnesium chloride, is gaining popularity in urbanization and transportation sectors. Additionally, it is used in water treatment applications, agriculture, healthcare, food & beverages, and mining sectors.

- The increasing urbanization and non-oil growth in various industries are driving the demand. Despite its numerous applications, it should not be confused with calcium carbonate. The market dynamics for calcium chloride are influenced by technological advancements, increasing prices of oil and gas, and the need to address wastewater problems in various industries.

What challenges does the Calcium Chloride (Cacl2) Industry face during its growth?

Diminishing limestone reserves and stringent regulations is a key challenge affecting the industry growth.

- Calcium chloride, an inorganic compound in anhydrous form, is a colorless crystalline solid with high water solubility, making it a versatile ingredient in various industries. It is primarily produced as a by-product of the Solvay process from limestone. Despite its abundant reserves, the market growth is challenged by the economic impracticality of mining due to its geographical separation from major consuming regions. Environmental and public concerns over limestone mining, leading to increased compliance costs, further hinder market expansion. Additionally, cheaper imports from other countries are pressuring prices and profit margins in North America. It is widely used as a concrete accelerator, desiccant, drying agent, and in water treatment applications.

- In the construction industry, it is employed in hydraulic fracturing processes, drilling fluids, and well completion. The oil & gas sector utilizes it as a de-icing agent, while the mining sector relies on it for dust control. Furthermore, it is used in the food processing sector for various applications, including kidney stones, muscle spasms, and irregular heartbeats. It is available in food grade, pharmaceutical grade, agricultural grade, and industrial grade. In summary, the market faces challenges due to the economic and environmental implications of mining, as well as price pressures from imports. Despite these challenges, it remains a crucial component in various industries, including construction, agriculture, healthcare, food & beverages, and non-oil growth sectors.

Exclusive Customer Landscape

The calcium chloride (CaCl2) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the calcium chloride (Cacl2) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, calcium chloride (CaCl2) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ECPlaza Network Inc. - The company offers calcium chloride which is in lumps and powder form and it has diverse roles in various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Auro Chemical Industries Pvt. Ltd.

- Hawkins Inc.

- Keg River Chemical Corp.

- Koruma Klor Alkali San

- Nedmag BV

- Occidental Petroleum Corp.

- Sameer Chemicals

- Sitara Chemical Industries Ltd.

- Solvay SA

- Sulaksh Chemiclas

- Tengfei Chemical Calcium Co. Ltd.

- TETRA Technologies Inc.

- Tiger Calcium Services Inc.

- Ward Chemical Inc.

- Weifang Haibin Chemical Co. Ltd.

- Weifang Taize Chemical Industry Co. Ltd

- Zirax

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Calcium chloride (CaCl2), a versatile inorganic compound, holds a significant role in various industries due to its unique properties. This anhydrous form of calcium salt is a colorless crystalline solid with high water solubility, making it an essential component in numerous applications. This functions as an effective desiccant and drying agent in diverse industries. In the construction sector, it is used as a concrete accelerator to enhance the setting time of concrete mixtures, thereby reducing the overall construction time. In the oil & gas sector, this plays a crucial role in hydraulic fracturing processes, serving as a vital component of drilling fluids.

Moreover, this is extensively used in water treatment applications to address wastewater problems. Its high water solubility enables it to absorb moisture effectively, making it an ideal choice for de-icing agents in colder climates. In the mining sector, it is employed for dust control, improving working conditions and ensuring safety. The food processing sector benefits as a food additive, primarily in the production of cheese and other dairy products. In the healthcare sector, it is available in various grades, including food grade, pharmaceutical grade, and agricultural grade, catering to the specific requirements of each industry.

Calcium chloride's versatility extends beyond these industries. It is used in the production of inorganic salts, such as calcium carbonate, and serves as a vital ingredient in the manufacture of anhydrous forms of other salts. Its hygroscopic nature makes it an effective desiccant, absorbing moisture from the environment and preventing the formation of undesirable conditions. Calcium chloride's applications are not limited to industrial processes. It is also used in everyday life, such as in the treatment of kidney stones, muscle spasms, and irregular heartbeats. Its anhydrous forms are used in de-icing agents and as a dust-control agent in agriculture.

In summary, it is a versatile inorganic compound with a wide range of applications across various industries. Its unique properties, including high water solubility, anhydrous forms, and hygroscopic nature, make it an indispensable component in numerous processes and applications. From construction and oil & gas to healthcare and agriculture, it continues to play a vital role in driving industrial growth and addressing everyday challenges.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 467.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, Canada, Germany, UK, China, France, Japan, Italy, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Calcium Chloride (CaCl2) Market Research and Growth Report?

- CAGR of the Calcium Chloride (CaCl2) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the calcium chloride (CaCl2) market growth of industry companies

We can help! Our analysts can customize this calcium chloride (CaCl2) market research report to meet your requirements.