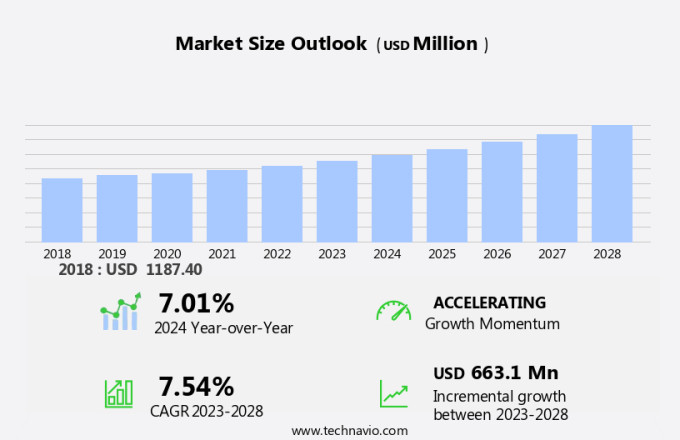

Construction Estimation Software Market Size 2024-2028

The construction estimation software market size is forecast to increase by USD 663.1 million, at a CAGR of 7.54% between 2023 and 2028. Modern construction professionals in the US are increasingly relying on estimation software to streamline project management and ensure successful project outcomes. The market for construction estimation software is experiencing significant growth due to the demand for cost-effective and efficient solutions. One trend driving this growth is the integration of advanced technologies such as 3D modeling and Building Information Modeling (BIM) into estimation software. This enables estimators and construction managers to access project specifications and communicate seamlessly, leading to improved accuracy and productivity. Additionally, the software's ability to interface with existing legacy systems and construction equipment is a major advantage for contractors. An internet connection is essential for the effective use of these solutions, making them an indispensable tool for the construction industry. By implementing estimation software, US construction companies can enhance their project management capabilities and ultimately improve their bottom line.

Market Analysis

The market is a significant contributor to the US economy, encompassing infrastructure development projects for houses, commercial buildings, bridges, and more. Traditional estimating methods, such as the use of spreadsheets and statistics, have long been the standard for cost projections. However, these methods come with challenges, including high initial costs, human error, and digital threats. To address these challenges, construction companies are increasingly turning to advanced estimation software solutions. These tools offer a structured framework for resource allocation, job costs, engineering costs, payment tracking, and more. By automating the estimation process, construction firms can gain a competitive edge, enabling them to submit more accurate and timely competitive bids.

The demand for construction estimation software is driven by several factors. First, owners, contractors, subcontractors, and consultants require precise cost projections to make informed decisions. Second, real-time adjustments to construction work schedules and labor and equipment requirements are essential for maintaining project efficiency. Construction estimation software offers several advantages over traditional methods. It streamlines the estimation process, reducing the likelihood of errors and increasing accuracy. Additionally, it provides real-time data on job costs, enabling project managers to make informed decisions and adjust budgets as needed. The software also offers features such as cost projections, labor and equipment tracking, and payment tracking.

These features help construction firms to manage their resources effectively, ensuring that projects are completed on time and within budget. Furthermore, the software can integrate with other project management tools, providing a comprehensive solution for managing construction projects. Despite the benefits, the adoption of construction estimation software is not without challenges. The initial costs can be high, and some firms may be hesitant to invest in new technology. Additionally, there is a risk of human error in the implementation and use of the software. To mitigate these challenges, construction firms should carefully evaluate the software options available and choose a solution that meets their specific needs.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Architects and builders

- Construction managers

- Contractors

- Others

- Deployment

- Cloud-based

- On-premises

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By End-user Insights

The architects and builders segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing need for accurate job costing and payment tracking in the construction industry. Architects and builders are the primary consumers of this software, as they seek efficient solutions for managing construction projects and estimating engineering costs. The market's expansion is driven by the widespread adoption of digital construction methods and cloud-based software, enabling real-time collaboration between contractors and architects. Taxation policies and digital threats have not deterred the industry's growth, with the market expected to continue expanding. Major market players compete fiercely to meet the increasing demand for construction estimation software, making it an essential tool for architects and builders.

The software's license fees may have high initial costs, but the long-term benefits of improved project management and cost estimation far outweigh these expenses. In conclusion, the market in the US is poised for continued growth, driven by the needs of architects and builders for precise cost estimation and efficient project management.

Get a glance at the market share of various segments Request Free Sample

The architects and builders segment accounted for USD 432.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, including the United States and Canada, the construction industry is experiencing significant growth due to the region's advanced economies. The adoption of construction estimation software solutions is particularly prominent in large-scale projects, such as the Mexico City New International Airport construction in Mexico. The US market is an attractive one for companies due to its early adoption of advanced technologies across various sectors. By implementing a centralized platform for documenting cost estimations, construction estimation software helps prevent misunderstandings and disputes between owners, contractors, subcontractors, and consultants. This enhances transparency and efficiency in the construction process.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for cost-effective and efficient construction management solutions is the key driver of the market. Construction estimation software is a vital tool in the infrastructure development industry, particularly for managing the costs of houses, commercial buildings, and bridges projects. Traditional estimating methods, such as using spreadsheets and statistics, can lead to human error and misunderstandings, resulting in disputes and project delays. In contrast, construction estimation software offers a structured framework for documenting cost estimations, providing real-time adjustments, and creating audit trails. The software enables construction managers, contractors, subcontractors, consultants, owners, and government entities to collaborate on project specifications, ensuring seamless communication and project success. Sage Software's construction estimation solution, for example, offers features like job estimation, change order management, and scheduling, enabling accurate cost projections for labor, equipment, engineering costs, and payment tracking.

Moreover, the market caters to various segments, including the architecture & builders segment, contractors segment, and residential projects. The market offers various licensing models, including Perpetual License, Subscription License, small and large construction companies, Cloud, and On-Premise. The adoption of digital construction technologies, such as Virtual Reality and Augmented Reality, is increasing, providing a competitive edge for modern construction professionals. However, high initial costs and digital threats, including taxation policies, can hinder market growth. Despite these challenges, the benefits of construction estimation software, such as increased transparency, improved resource allocation, and enhanced project management, make it an essential tool for the construction industry.

Market Trends

Increased integration of 3D modeling and building information modeling (BIM) technologies is the upcoming trend in the market. The market is experiencing growth due to the integration of advanced technologies such as 3D modeling and Building Information Modeling (BIM) in project planning and cost estimation. This technological integration allows architects, engineers, and contractors to collaborate more effectively, creating detailed digital models of infrastructure development projects, houses, and commercial buildings. For instance, Trimble's Vico Office Suite is a project management software that utilizes 3D modeling and BIM to estimate construction costs. It offers real-time project tracking, precise cost projections, and seamless communication among project stakeholders, including owners, contractors, subcontractors, consultants, and government entities. The software enables the documentation of cost estimations, providing transparency and reducing misunderstandings and disputes.

Further, construction estimation software also offers various licensing models, including perpetual license, subscription license, cloud segment, and on-premises segment, catering to the needs of small and large construction companies. The adoption of digital construction technologies provides a competitive edge in the industry, allowing for more accurate cost projections, efficient resource allocation, and effective payment tracking. However, high initial costs and digital threats, including taxation policies, may pose challenges to the market's growth.

Market Challenge

Integration with existing legacy systems and software is a key challenge affecting the market growth. The integration of new construction estimation software into existing infrastructure development projects poses a significant challenge for construction companies. Compatibility issues between the new software and existing systems, such as project management, accounting, and operational software, can result in data loss and other complications. For instance, integrating new estimation software with an existing Enterprise Resource Planning (ERP) system may require substantial customization to ensure seamless communication and prevent misunderstandings or disputes. These complexities can increase the initial costs of implementing new software and potentially hinder the competitive edge of contractors in the market. However, investing in digital construction solutions, such as cloud-based or subscription-based software, can provide numerous benefits, including real-time adjustments, centralized platforms, and increased transparency.

Modern construction professionals, including architects, builders, contractors, owners, consultants, and subcontractors, can document cost estimations, track payment, manage construction work schedules, and allocate resources more efficiently. Furthermore, digital construction software can help in documenting cost estimations, creating audit trails, and adhering to taxation policies. Despite the high initial costs, digital threats, and complexities, the adoption of construction estimation software is essential for project success and competitive bidding in the residential and commercial construction sectors. Both small and large construction companies can benefit from the use of software license, subscription segment, and on-premises segment offerings. Incorporating Virtual Reality (VR) and Augmented Reality (AR) technologies can further enhance the capabilities of construction estimation software, providing a more and accurate estimation experience.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AppliCad - The company offers construction estimation software, enabling contractors to accurately calculate material and labor costs for submitting competitive bids on projects.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Autodesk Inc.

- Buildsoft

- ConstructConnect Inc.

- Contractor Foreman

- Corecon Technologies Inc.

- Glodon Co. Ltd.

- Micromen Software Solution Pvt. Ltd.

- Microsoft Corp.

- Nemetschek SE

- PrioSoft Construction Software

- Procore Technologies Inc.

- REDTEAM SOFTWARE LLC

- RIB Software GmbH

- Sage Group Plc

- SAP SE

- SmarteBuild

- Takeoff Live

- Trimble Inc.

- UDA Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Construction estimation software streamlines infrastructure development projects, from houses and commercial buildings to bridges, by offering a structured framework for resource allocation and cost projections. Traditional estimating methods using spreadsheets and statistics can be time-consuming and prone to human error. Digital construction solutions provide real-time adjustments, payment tracking, and transparency, giving modern construction professionals a competitive edge. In the construction software market, there are various segments, including subscription, perpetual license, cloud, and on-premises. These options cater to small and large construction companies, architects, builders, contractors, and consultants. Digital threats, taxation policies, and high initial costs are concerns for many, but the benefits of digital construction software outweigh the risks.

In addition, the software enables project managers and estimators to document cost estimations, creating audit trails for transparency and reducing misunderstandings and disputes. Construction managers can access project specifications, work schedules, job costs, engineering costs, and labor and equipment information in a centralized platform. Seamless communication between owners, contractors, subcontractors, and consultants ensures project success. Construction estimation software offers features like virtual and augmented reality, competitive bids, win rate tracking, and project scope management. With an internet connection, construction professionals can access their software from anywhere, making it an essential tool for the industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.54% |

|

Market growth 2024-2028 |

USD 663.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.01 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 32% |

|

Key countries |

US, China, UK, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AppliCad, Autodesk Inc., Buildsoft, ConstructConnect Inc., Contractor Foreman, Corecon Technologies Inc., Glodon Co. Ltd., Micromen Software Solution Pvt. Ltd., Microsoft Corp., Nemetschek SE, PrioSoft Construction Software, Procore Technologies Inc., REDTEAM SOFTWARE LLC, RIB Software GmbH, Sage Group Plc, SAP SE, SmarteBuild, Takeoff Live, Trimble Inc., and UDA Technologies Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.