Construction Lubricants Market Size 2025-2029

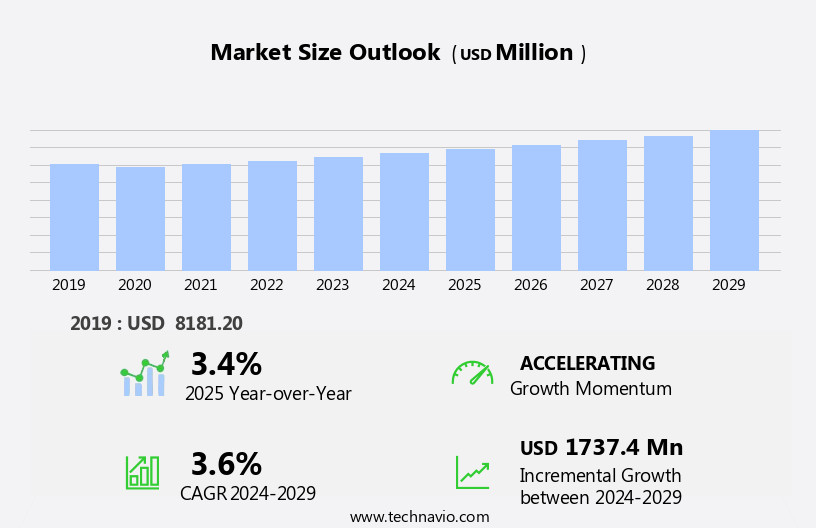

The construction lubricants market size is forecast to increase by USD 1.74 billion at a CAGR of 3.6% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rapid urbanization and infrastructure development occurring globally. This trend is leading to an increased demand for construction lubricants to ensure the efficient operation of machinery and equipment in the construction industry. Another key trend influencing market growth is the development of zinc-free lubricants, which offer environmental benefits and improved performance. However, the market faces challenges as well. Automation in various industries, including manufacturing, power generation, and transportation, is leading to a higher demand for reliable and efficient gear oils to ensure smooth operations. Volatility in raw material prices poses a significant obstacle, as the cost of key ingredients, such as base oils and additives, can fluctuate significantly. Additionally, regulatory hurdles impact adoption, as stringent environmental regulations require the use of specific lubricants that meet certain standards.

- Supply chain inconsistencies also temper growth potential, as the construction industry relies on a steady supply of lubricants to keep projects on schedule. The expanding industrial sector necessitates the implementation of hydraulic systems, thereby propelling the market forward. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on supply chain resilience, regulatory compliance, and the development of cost-effective, high-performance lubricants.

What will be the Size of the Construction Lubricants Market during the forecast period?

- The construction industry relies heavily on optimal engine performance to ensure productivity and minimize operational downtime. Lubricants play a crucial role in achieving this goal, with oil filters acting as a critical line of defense against contaminants. The use of advanced lubricant additives enhances performance and extends equipment life cycle, particularly in harsh operating conditions. Biodegradable lubricants and environmentally friendly alternatives are gaining traction in the market due to increasing environmental concerns. Lubricant compatibility and formulation engineering are essential considerations for maintaining complex systems, such as hydraulic systems and transmission systems. Lubrication training, condition-based maintenance, and predictive maintenance strategies are essential for maximizing equipment efficiency and minimizing lubricant degradation. Other emerging trends include the adoption of predictive analytics for lubrication intervals, digital twin technology for remote diagnostics, and the use of low-emission lubricants and bio-based additives for sustainability.

- Temperature stability and load-carrying capacity are critical factors in lubricant selection for various applications. Lubricant testing, recycling, and certification are essential aspects of cost-effective lubrication practices. Renewable lubricants and water resistance offer potential solutions for reducing environmental impact and improving wear resistance. Corrosion protection and lubricant viscosity are essential factors in ensuring optimal performance and minimizing contamination risks. Lubricant blending, grease gun technology, and lubrication engineering are key areas of innovation in the market, addressing the evolving needs of the construction industry. Overall, the market is dynamic, with a focus on cost-effective solutions, environmental sustainability, and advanced technologies to improve equipment performance and reduce downtime. These specialized lubricants are designed to provide superior performance in high-load, high-stress applications, ensuring the longevity and productivity of hydraulic systems, construction machinery, marine gears, wind turbines, and other industrial gearboxes.

How is this Construction Lubricants Industry segmented?

The construction lubricants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Engine oil

- Hydraulic fluid

- Transmission oil

- Greases

- End-user

- Earthmoving equipment

- Material handling equipment

- Paving and concrete equipment

- Others

- Type

- Mineral-base

- Synthetic-base

- Bio-base

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

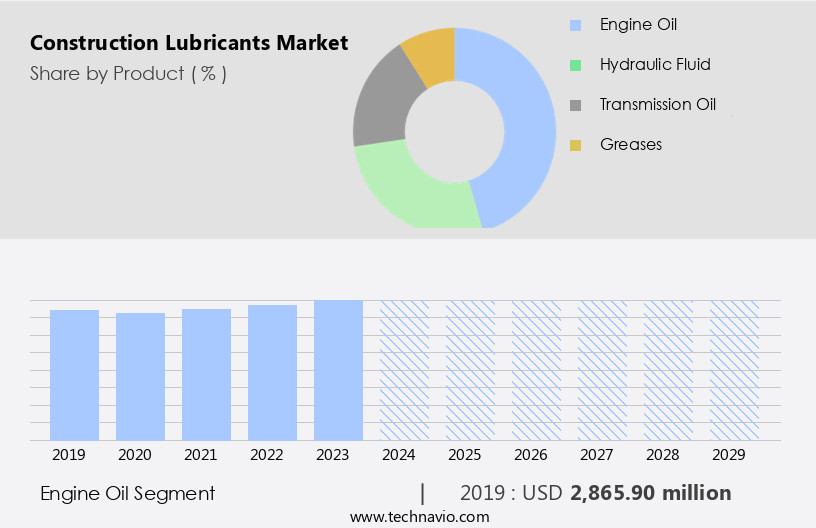

By Product Insights

The engine oil segment is estimated to witness significant growth during the forecast period. Engine oils are essential lubricants for the internal combustion engines of construction vehicles, such as bulldozers, excavators, dump trucks, and cranes. Their primary function is to reduce friction between engine components, preventing wear and tear, which ensures optimal performance and longevity. Additionally, engine oils play a crucial role in cooling the engine by dissipating heat and transferring it away from the components, preventing overheating. The market offers various engine oil types, including mineral, semi-synthetic, and synthetic options. Mineral oils, derived from crude oil, provide basic lubrication properties and are suitable for older or less demanding machinery.

Synthetic oils, on the other hand, offer superior performance in extreme temperatures and provide better wear protection, making them a popular choice for heavy-duty machinery and heavy-duty trucks. In the context of construction projects, the use of engine oils contributes to emissions reduction by ensuring efficient combustion and reducing fuel consumption. Furthermore, condition monitoring and lubrication management systems enable maintenance optimization, allowing for extended drain intervals and reducing downtime. Construction equipment manufacturers often specify particular engine oils to meet performance standards, ensuring reliability and compatibility. Synthetic lubricants, such as synthetic gear oils and hydraulic fluids, are also gaining popularity in various industries, including agriculture, mining, and infrastructure development.

The Engine oil segment was valued at USD 2.87 billion in 2019 and showed a gradual increase during the forecast period. These advanced lubricants offer improved wear prevention, friction reduction, and extended service life, contributing to the overall efficiency and productivity of the machinery. Moreover, the trend towards sustainable lubrication is driving the adoption of bio-based lubricants and lubricating greases. These eco-friendly alternatives offer reduced environmental impact and improved performance in low-temperature conditions. Automatic lubrication systems and centralized lubrication systems further streamline the lubrication process, ensuring consistent and efficient lubrication, and reducing labor costs.

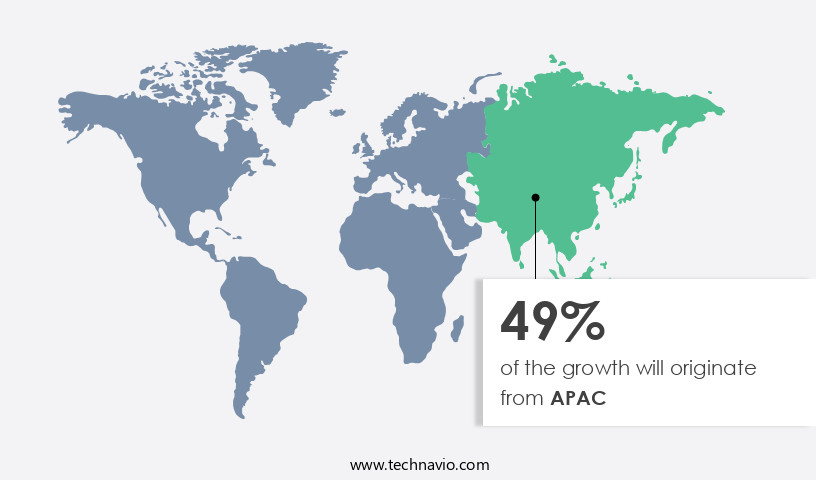

Regional Analysis

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is experiencing notable growth due to the in infrastructure development and construction projects. China, being the world's largest construction market, is a significant contributor to this growth. With initiatives like the Belt and Road Initiative (BRI), urban expansion, and high-rise construction, the demand for lubricants is escalating to maintain and operate machinery efficiently. New infrastructure investments have increased by 16.2 percent in the first half of 2023, emphasizing the importance of lubricants in the construction sector. Furthermore, the industrial sector's remarkable growth, with a 5.8 percent year-on-year increase in industrial production in 2024, propels the demand for industrial lubricants to support manufacturing and construction activities.

Synthetic lubricants, engine oils, and hydraulic fluids are essential for heavy-duty machinery and heavy-duty trucks used in construction and mining operations. Condition monitoring, oil sampling, and lubrication management ensure reliability improvement and wear prevention. Extreme pressure additives and anti-wear additives extend drain intervals and enhance performance in extreme operating conditions. Centralized lubrication systems and automatic lubrication systems optimize maintenance and reduce friction. Sustainable lubrication, such as bio-based lubricants, aligns with the industry's shift towards reducing emissions and promoting eco-friendliness. Construction vehicles and construction equipment, including concrete production and agricultural machinery, require lubricants to operate effectively and efficiently. Fuel efficiency and performance standards are crucial factors influencing the selection of lubricants.

Lubricant analysis and lubricant dispensing systems ensure the optimal use and maintenance of lubricants. Overall, the market in APAC is witnessing significant growth due to the increasing demand for lubricants in infrastructure development, industrial production, and construction activities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Construction Lubricants market drivers leading to the rise in the adoption of Industry?

- The primary catalyst for market growth is the rapid urbanization and infrastructure development. This process not only expands economic opportunities but also necessitates the construction of essential facilities and services to accommodate growing populations and businesses. The market is experiencing significant growth due to the increasing number of construction projects and the utilization of construction vehicles. With approximately 55 percent of the global population residing in urban areas as of 2023, and this figure projected to reach 68 percent by 2050, the demand for infrastructure development is on the rise. The Infrastructure Investment and Jobs Act (IIJA), enacted in November 2021, has allocated USD1.2 trillion for infrastructure projects in the US through 2031. This extensive investment aims to modernize existing infrastructure and support new projects, including roads, bridges, public transit, and utilities.

- High-performance lubricants are essential for construction vehicles and equipment to ensure optimal condition monitoring, wear prevention, and emissions reduction during concrete production. Synthetic lubricants offer superior high-temperature performance and extended service life, making them a popular choice for the construction industry.

What are the Construction Lubricants market trends shaping the Industry?

- Zinc-free lubricant development is gaining significant traction in the market. This trend reflects the growing demand for eco-friendly and sustainable lubrication solutions. The market is witnessing significant growth due to the increasing focus on lubrication management for improving equipment reliability and reducing downtime. Traditional engine oils are being replaced with sustainable alternatives, such as zinc-free or ashless lubricants, which provide superior wear protection and enhanced thermal stability. These lubricants are crucial for construction equipment operating under heavy loads and extreme conditions, as they reduce deposits and prevent equipment failure. Sustainability is a key factor driving market growth, as zinc-based additives in traditional lubricants contribute to harmful ash formation during combustion, leading to engine sludge and reduced machinery efficiency.

- Furthermore, the use of extreme pressure additives and oil sampling for maintenance optimization ensures optimal lubrication performance, even in low-temperature environments. Performance standards continue to evolve, requiring lubricants to meet stringent requirements for fuel efficiency, emissions reduction, and extended oil drain intervals.

How does Construction Lubricants market faces challenges face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain competitiveness and profitability, businesses must closely monitor and adapt to fluctuations in the cost of essential inputs. The market faces volatility in raw material prices as a significant challenge from 2025-2029. In early 2024, Brent crude oil prices experienced a notable , reaching a peak of USD91.17 per barrel on April 5, primarily due to escalating geopolitical tensions in the Middle East. However, this upward trend was short-lived, and by September 10, prices had declined to USD68.83 per barrel, the lowest in two years, due to waning demand from major consumers like China and increased production from non-OPEC countries. The U.S. Energy Information Administration (EIA) further adjusted its forecasts in October 2024, lowering the expected average Brent price to USD78 per barrel for 2025, citing reduced global demand growth.

- Automatic lubrication systems and centralized lubrication systems are increasingly popular in various industries, including agriculture and mining operations, due to their ability to extend drain intervals. OEM specifications require the use of lubricating greases with anti-wear additives to ensure machinery performance and longevity. The adoption of bio-based lubricants is also on the rise due to their environmental benefits and cost-effectiveness. These trends are expected to drive market growth, despite the challenges posed by raw material price volatility.

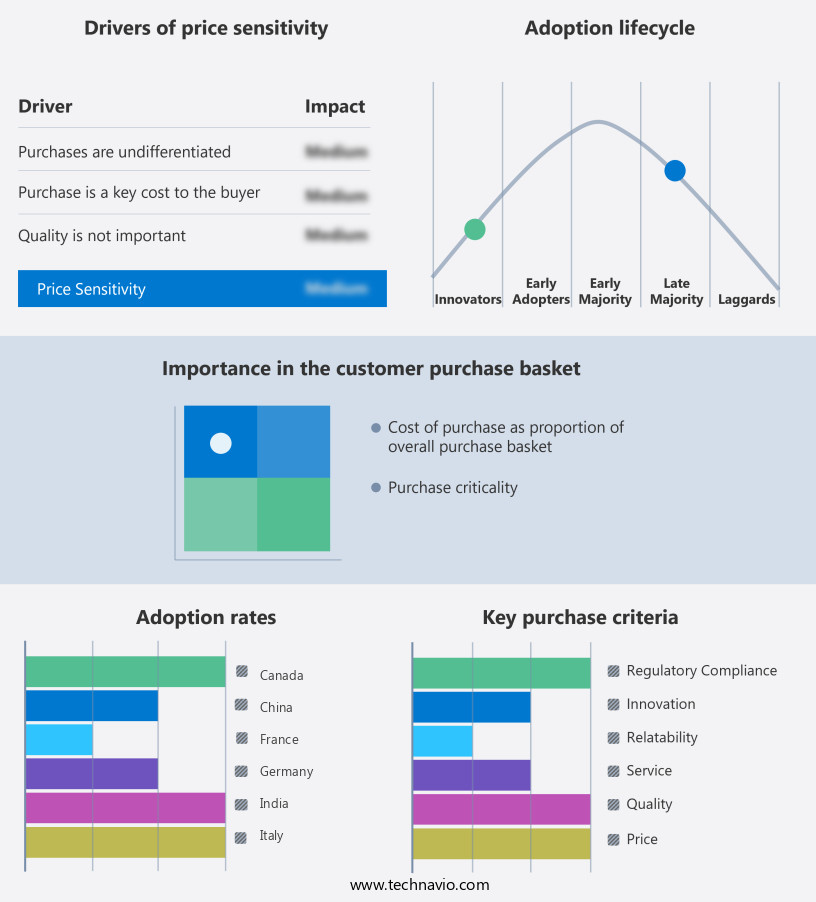

Exclusive Customer Landscape

The construction lubricants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the construction lubricants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, construction lubricants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Addinol Lube Oil GmbH - This company specializes in the production and distribution of high-performance lubricants for the construction industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Addinol Lube Oil GmbH

- AFRILUBE

- BP Plc

- Calumet Specialty Products Partners L.P.

- Chevron Corp.

- Eni SpA

- Exxon Mobil Corp.

- FUCHS SE

- Indian Oil Corp. Ltd.

- LIQUI MOLY GmbH

- Morris Lubricants

- Penrite Oil Co. Pty. Ltd.

- PetroChina Co. Ltd.

- Phillips 66 Co.

- PJSC LUKOIL

- Schaeffer Manufacturing Co.

- Shell plc

- Sinopec Shanghai Petrochemical Co. Ltd.

- TotalEnergies SE

- Valvoline Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Construction Lubricants Market

- In January 2024, Würth Group, a leading international wholesale company, expanded its construction lubricants portfolio with the acquisition of the lubricants business of Fuchs Petrolub SE. This strategic move strengthened Würth's position in the market and broadened its product offerings (Würth Group Press Release, 2024).

- In March 2025, Shell Lubricants, a global market leader, launched a new line of biodegradable construction lubricants under its Gadus brand. This innovative product line catered to the growing demand for eco-friendly solutions in the construction industry (Shell Lubricants Press Release, 2025).

- In May 2025, ExxonMobil Chemical Company announced a significant investment of USD 1 billion to expand its lubricants manufacturing capacity in the United States. This expansion aimed to meet the increasing demand for construction lubricants and enhance the company's market presence (ExxonMobil Press Release, 2025).

- In October 2025, the European Union passed new regulations limiting the use of certain lubricants containing heavy metals in the construction industry. This regulatory change forced key players to adapt and invest in alternative, compliant lubricant solutions (European Commission Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by the dynamic nature of the construction industry and the diverse applications of lubricants in various sectors. Construction projects rely on a range of vehicles and equipment, from concrete production to heavy-duty trucks and agricultural machinery, all requiring effective lubrication management. Emissions reduction is a key focus in the industry, leading to the adoption of sustainable lubrication solutions. Synthetic lubricants, such as those with extreme pressure additives, offer improved reliability and wear prevention, particularly in heavy-duty machinery and mining operations. Condition monitoring and oil sampling are essential for maintaining optimal performance and identifying potential issues before they become costly repairs.

Low-temperature performance is crucial in colder climates, while performance standards and OEM specifications ensure compatibility and reliability. Automatic lubrication systems and centralized lubrication systems enable maintenance optimization, reducing downtime and increasing efficiency. Fuel efficiency is another important consideration, with lubricants playing a role in improving the overall performance of construction vehicles. Bio-based lubricants and lubricating greases are gaining popularity due to their environmental benefits and extended drain intervals. Friction reduction and lubricant dispensing systems further enhance the functionality and productivity of construction equipment. Infrastructure development projects require specialized lubricants, such as gear oils and hydraulic fluids, to ensure the smooth operation of complex machinery and heavy-duty trucks. The ongoing evolution of the market reflects the continuous demands and innovations in the construction industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Construction Lubricants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2025-2029 |

USD 1.74 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.4 |

|

Key countries |

China, US, India, Japan, Germany, UK, Canada, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Construction Lubricants Market Research and Growth Report?

- CAGR of the Construction Lubricants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the construction lubricants market growth of industry companies

We can help! Our analysts can customize this construction lubricants market research report to meet your requirements.