Consumer Kitchen Knife Market Size 2025-2029

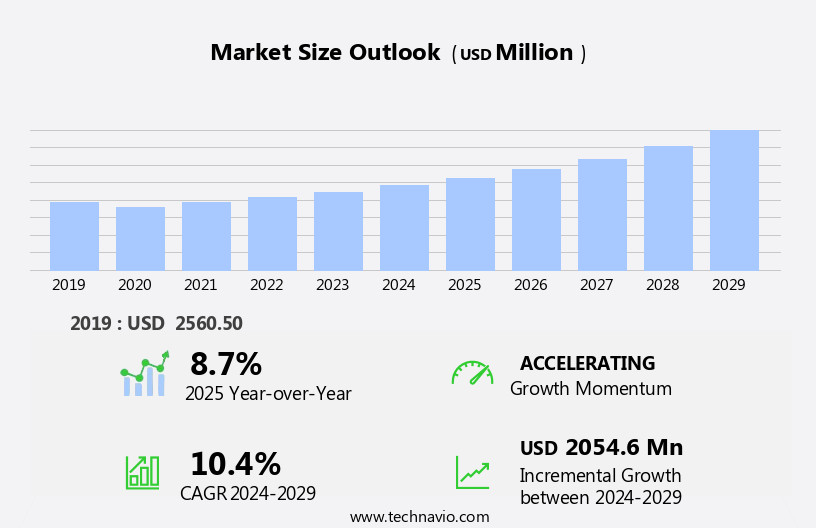

The consumer kitchen knife market size is forecast to increase by USD 2.05 billion at a CAGR of 10.4% between 2024 and 2029.

- The market witnesses continuous growth driven by the introduction of innovative features in kitchen knives, such as ergonomic handles and ceramic blades. These advancements cater to the evolving consumer preferences for functionality, durability, and design. However, market expansion is tempered by challenges, including the presence of counterfeit and low-quality kitchen knife products. Regulatory hurdles impact adoption, as stringent regulations governing the production and distribution of kitchen knives in various regions necessitate compliance, increasing production costs. Supply chain inconsistencies also pose a challenge, as fluctuations in raw material availability and pricing can disrupt production schedules and impact market penetration.

- To capitalize on opportunities and navigate these challenges effectively, companies must focus on ensuring product quality, adhering to regulatory requirements, and establishing robust supply chain management systems. By doing so, they can differentiate themselves in the market, build customer trust, and secure long-term growth.

What will be the Size of the Consumer Kitchen Knife Market during the forecast period?

- The US Understanding the market in the US involves exploring various aspects, including culinary education, knife value, and knife culture. Knife craftsmanship and investment have gained significant attention, with professional chefs and enthusiast cooks favoring high carbon steel knives for their edge retention and blade length. Minimalist and ergonomic designs, such as Santoku knives, are popular due to their stain resistance and corrosion resistance, aligning with the trend of kitchen organization and safety. Sustainable knife brands and biodegradable handle materials are increasingly preferred, reflecting the importance of sustainable sourcing.

- Traditional knife designs continue to hold appeal, while knife sharpening services and knife sharpening tools cater to the growing demand for knife maintenance. Ergonomic knife handles, knife design innovations, and personalized engraving add value to high-end kitchen knives. Luxury knife brands and knife sets, along with knife repair and artisan knife makers, cater to the collectors' market. Knife handling techniques and cooking classes further enhance the knife skills training landscape. German kitchen knives and knife storage solutions are essential components of the kitchen ecosystem.

How is this Consumer Kitchen Knife Industry segmented?

The consumer kitchen knife industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Non-electric

- Electric

- Manufacturing Type

- Stamped blades

- Hand forged

- Type

- Plain cutting edge

- Granton cutting edge

- Serrated cutting edge

- Variant

- 5-7 inches

- 7-9 inches

- 9-12 inches

- 3-5 inches

- Material Type

- Stainless Steel

- Ceramic

- Carbon Steel

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

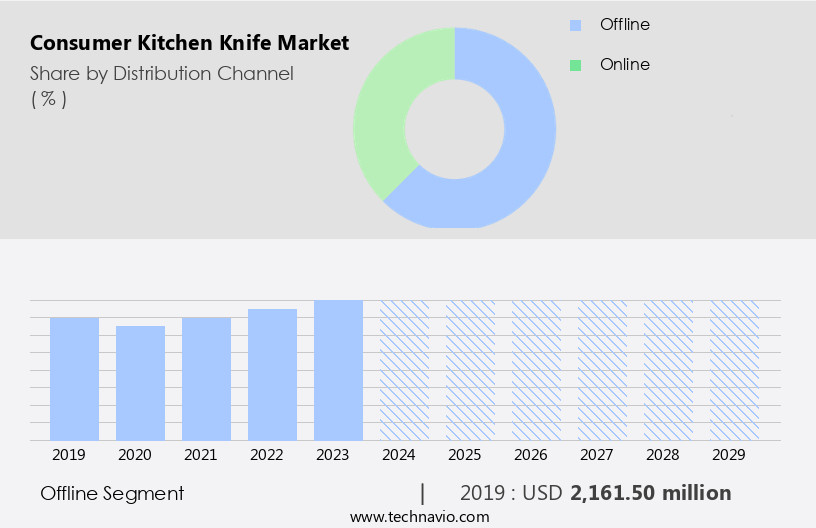

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market is driven by the culinary arts and food preparation needs, with safety being a top priority. Innovative materials and advanced manufacturing techniques are shaping the market, resulting in eco-friendly, functional, and aesthetically appealing knives. Handmade knives, including damascus steel and full tang, continue to be popular among home cooks and professional chefs. Blade thickness, length, and edge retention are essential factors in knife selection for various cutting techniques and cooking styles. Digital knife sharpening and sharpening steel maintain the knife's sharpness, ensuring optimal performance. Budget-conscious consumers seek affordable options, while premium consumers invest in custom, personalized, and luxury knife sets.

Knife design trends include modern, minimalist, and traditional designs, catering to various preferences. Specialty stores, artisan knives, and online retailers offer a wide range of choices for consumers. Ethical manufacturing and sustainable sourcing are becoming increasingly important in the market. Knife storage, maintenance, and knife skills training are essential for knife care. Subscription services and knife blocks provide convenient solutions for knife organization and accessibility. Kitchen shears, offset handles, and utility knives are essential additions to a well-equipped kitchen. Department stores and smart kitchen technology offer integrated knife solutions, catering to enthusiast cooks and professional chefs. Stainless steel, high carbon steel, and ergonomic handles are popular choices for their durability, corrosion resistance, and comfort. Blade length, edge retention, and stain resistance are critical factors in knife performance. Overall, the market continues to evolve, offering a diverse range of products to cater to various consumer needs and preferences.

The Offline segment was valued at USD 2.16 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing growth due to the rising urbanization and disposable income levels in the region. This economic shift enables consumers to invest in premium kitchen tools, such as durable and long-lasting consumer kitchen knives. The popularity of Western cuisine in APAC also contributes to the demand for versatile and professional-grade knives that cater to various culinary techniques. Moreover, the increasing preference for online shopping in APAC encourages companies to sell ergonomically designed consumer kitchen knives through online retail channels. Innovative materials, such as high carbon steel and damascus steel, are being used to create functional and aesthetically appealing knives.

Advanced manufacturing techniques, including digital knife sharpening and ethical manufacturing, ensure that these knives maintain their edge retention and corrosion resistance. Handmade knives and artisan knives continue to be popular among home cooks and enthusiast cooks, while premium consumers seek out luxury knives and personalized knife sets. Knife design trends include minimalist and traditional designs, as well as modern and smart kitchen technology integration. Knife storage and maintenance solutions, such as knife blocks, knife rolls, and subscription services, are also gaining popularity. Additionally, eco-friendly and sustainable sourcing practices are becoming increasingly important to budget-conscious consumers. Cooking techniques, knife skills, and cutting techniques continue to influence knife design and functionality, with specialized knives like bread knives, steak knives, boning knives, and santoku knives catering to specific needs.

Kitchen shears and offset handle knives are also essential kitchen tools that complement the market. Professional chefs and beginner cooks alike value the importance of knife care and blade sharpening, ensuring that their knives remain in optimal condition for food preparation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Consumer Kitchen Knife market drivers leading to the rise in the adoption of Industry?

- The introduction of consumer kitchen knives with innovative features serves as the primary growth driver in the market.

- The market is experiencing significant growth due to the increasing emphasis on culinary arts and the importance of knife safety. Innovative materials and advanced manufacturing techniques have led to the creation of ergonomically designed knives, featuring sharp stainless-steel blades for efficient food preparation. These knives are engineered with consumer comfort in mind, considering factors such as knife weight, grip, and blade sharpness. Additionally, they are designed to facilitate easy cleaning, preventing food particles from adhering. The evolving needs of modern consumers, who seek to simplify their kitchen tasks, have fueled the demand for improved kitchen knives. Consumers prioritize knife safety and comfort, making these factors crucial considerations in the design and production of consumer kitchen knives.

- A breadth of cooking techniques, from slicing to chopping and mincing, require different knife types, each with unique blade thicknesses and specifications. Digital knife sharpening systems and handmade knives, including those crafted from damascus steel and full tang designs, cater to both budget-conscious consumers and those seeking high-end kitchen tools.

What are the Consumer Kitchen Knife market trends shaping the Industry?

- The introduction of consumer ceramic knives represents a notable trend in the current market. These innovative kitchen tools offer several advantages, including superior sharpness and ease of maintenance, making them an attractive alternative to traditional steel knives.

- The market showcases the emergence of eco-friendly ceramic knives, which are gaining popularity due to their unique features. These knives, made from zirconium dioxide, offer advantages such as being 100% stainless and resistant to substances like acids and caustics. The manufacturing process of ceramic involves high-pressure and extreme temperatures, resulting in a dense material that is 50 times harder than steel and second in hardness to diamonds. This makes ceramic an excellent choice for cutting citrus fruits, as it remains unharmed by acidic substances.

- Another trend in the market is the increasing preference for functional design and modern aesthetics in knife design, catering to the needs of home cooks. Specialty stores, online retailers, and subscription services are offering a wide range of artisan knives to meet the diverse demands of consumers.

How does Consumer Kitchen Knife market faces challenges face during its growth?

- The proliferation of counterfeit and substandard kitchen knife products poses a significant challenge to the industry's growth trajectory. This issue undermines consumer trust and jeopardizes the reputation of authentic manufacturers, necessitating stricter regulations and quality control measures to ensure the market's integrity and promote sustainable industry growth.

- The market faces challenges due to the prevalence of counterfeit and low-quality products. These imitations erode consumer trust and confidence, leading to dissatisfaction and negative word-of-mouth. Reputable brands suffer from the damage to their reputation, potentially losing loyal customers. Moreover, the influx of subpar alternatives creates unfair competition, impacting market share and revenue for legitimate manufacturers. This financial strain hinders their capacity to invest in innovation, research, and the production of superior quality knives. Ensuring ethical manufacturing practices and offering knife storage, maintenance, and sharpening services can help differentiate premium brands from counterfeiters. Smart kitchen technology, such as knife skills training and personalized knife sets, can also attract beginner cooks and enhance the overall customer experience.

- Additionally, custom knives and luxury knife sets catering to specific cutting techniques and knife skills can cater to the demands of advanced and professional cooks. Offering knife storage and maintenance solutions, as well as blade sharpening services, can further add value for consumers and strengthen brand loyalty.

Exclusive Customer Landscape

The consumer kitchen knife market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the consumer kitchen knife market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, consumer kitchen knife market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Cuisinart - The company showcases a diverse range of high-performing kitchen knife sets, including Colorcore, Colorpro, CUISINART ADVANTAGE Coloured, Graphix Collection, and steak knife options. These knives are renowned for their innovative designs and superior functionality. Colorcore knives boast distinctive color markings that indicate the type of blade, ensuring easy identification. Colorpro knives offer a unique, proprietary color coating that provides enhanced resistance to stains and corrosion. The CUISINART ADVANTAGE Coloured collection combines style and functionality with ergonomic handles and sharp blades. The Graphix Collection features bold, vibrant designs, while the steak knife sets deliver precision and durability for all your culinary needs. Regardless of your preference, these knives are a must-have addition to any kitchen.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cuisinart

- Fallkniven AB

- Fiskars Corp.

- Ginsu

- Groupe SEB

- Hamilton Beach Brands Inc.

- Hampton Forge

- HexClad Cookware

- JAYDEEP INDUSTRIES

- Kai Corp.

- KYOCERA Corp.

- Lifetime Brands Europe B.V.

- Messermeister Inc.

- Royal Kitchenwares LLP

- Spyderco Inc.

- The Oneida Group Inc.

- TTK Prestige Ltd.

- Victorinox AG

- W.M. BARR Co. Inc.

- Wilh. Werhahn KG

- WUSTHOF

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Consumer Kitchen Knife Market

- In February 2023, global kitchenware giant Wüsthof announced the launch of its new line of electric knives, marking a significant entry of the traditional knife manufacturer into the electric kitchen appliance market (Wüsthof Press Release, 2023).

- In July 2024, Henckels and Zwilling J.A. Henckels, two leading knife manufacturers, formed a strategic partnership to strengthen their market position and enhance their product offerings through joint research and development projects (Henckels Press Release, 2024).

- In October 2024, Mercer Knives, a mid-sized knife manufacturer, was acquired by Global Cutlery Solutions, a private equity firm, for an undisclosed amount, aiming to expand Mercer's production capacity and distribution network (Global Cutlery Solutions Press Release, 2024).

- In March 2025, the European Union passed new regulations on the production and labeling of kitchen knives, requiring stricter safety standards and clearer labeling to improve consumer protection (European Commission, 2025). These developments underscore the dynamic nature of the market, with companies adapting to changing consumer preferences, expanding their offerings, and navigating regulatory landscapes to maintain a competitive edge.

Research Analyst Overview

In the dynamic and evolving the market, the intersection of culinary arts and food preparation techniques continues to drive innovation. The ongoing emphasis on knife safety and functional design is shaping the market landscape, with advanced manufacturing processes and eco-friendly materials becoming increasingly prevalent. One notable trend is the emergence of innovative materials, such as Damascus steel and high carbon steel, which offer superior edge retention and stain resistance. These materials cater to both premium consumers and enthusiast cooks, who value the aesthetic appeal and performance benefits they provide. Handmade knives, with their ergonomic handles and traditional design, remain a popular choice for home cooks and professional chefs alike.

Full tang and hollow ground blades are favored for their durability and ease of sharpening, while knife rolls and knife blocks offer convenient storage solutions. Budget-conscious consumers are also catered to with a variety of options, including subscription services and digital knife sharpening systems. Modern design trends favor minimalist aesthetics, with offset handles and eco-friendly materials gaining popularity. In the realm of knife skills and cooking techniques, there is a growing emphasis on ethical manufacturing and sustainable sourcing. Custom knives and personalized sets allow consumers to express their individuality and enhance their culinary experiences. Specialty stores and artisan knives offer unique and high-quality options for those seeking exceptional performance and craftsmanship.

Online retailers and department stores provide a wide range of choices for consumers, from basic utility knives to luxury steak knives and premium chef's knives. The knife market is not without its challenges, however. Knife safety remains a top concern, with consumers seeking education and resources to ensure they are using their knives safely and effectively. Sharpening steel and blade sharpening services are essential for maintaining the performance of kitchen knives, while knife maintenance and care are crucial for longevity. The market for kitchen knives is a vibrant and ever-changing landscape, shaped by the intersection of culinary arts, innovation, and consumer demand. From the most basic utility knife to the most intricately designed artisan piece, the kitchen knife market continues to offer a wealth of options for home cooks and professional chefs alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Consumer Kitchen Knife Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

246 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2025-2029 |

USD 2054.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.7 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Consumer Kitchen Knife Market Research and Growth Report?

- CAGR of the Consumer Kitchen Knife industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the consumer kitchen knife market growth of industry companies

We can help! Our analysts can customize this consumer kitchen knife market research report to meet your requirements.