Culinary Tourism Market Size 2025-2029

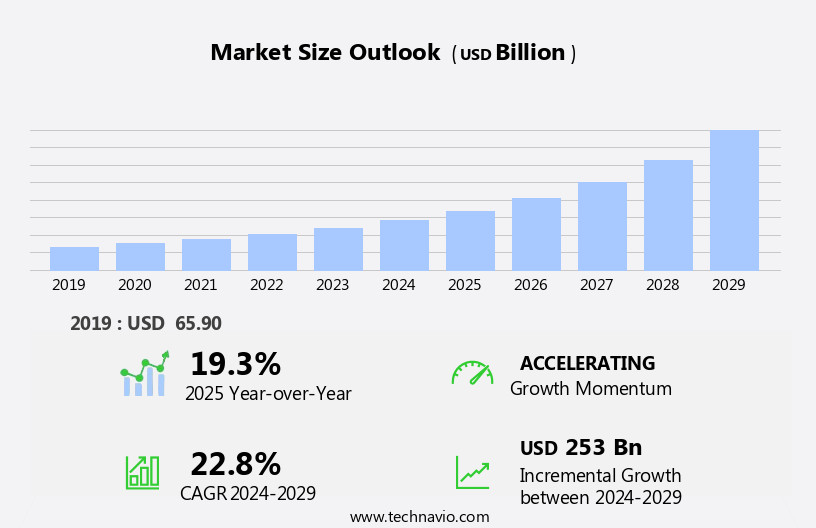

The culinary tourism market size is forecast to increase by USD 253 billion at a CAGR of 22.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of food festivals and events. These gatherings provide unique opportunities for travelers to immerse themselves in local cultures and cuisines, fostering a deeper connection to their destinations. Another key trend is the rising preference for sustainable and organic culinary tourism, reflecting a growing awareness of the environmental and ethical implications of food production and consumption. This shift presents both opportunities and challenges for market participants. On the one hand, there is a growing demand for authentic, locally-sourced food experiences. On the other hand, ensuring the sustainability and authenticity of offerings can be complex and costly, requiring robust supply chain management and certification processes.

- Additionally, the eliteness quotient attached to luxury travels continues to influence the market, with high-end consumers seeking exclusive, personalized experiences. Companies seeking to capitalize on these opportunities must navigate these challenges effectively, investing in sustainable sourcing, building strong relationships with local suppliers, and offering personalized, high-end experiences to meet the demands of luxury travelers.

What will be the Size of the Culinary Tourism Market during the forecast period?

- Culinary tourism continues to evolve as a dynamic and intriguing market, with culinary tourism agencies spearheading the exploration of diverse food and beverage offerings across the globe. The culinary landscape is shaped by various factors, including food sustainability, trends, regulations, and science. Culinary destinations and tourism hotspots emerge and transform, providing unique experiences for travelers. Food festivals showcase regional specialties, fostering a deeper appreciation for local cuisine and culinary history. Cooking classes and workshops offer hands-on learning opportunities, while food demonstrations provide insights into traditional recipes and techniques. Wine tasting tours and gourmet travel packages cater to the discerning palate.

- Culinary tourism businesses and operators adapt to the ever-changing market, focusing on food safety standards, food culture, and authenticity. Food technology and innovation drive improvements in food processing, packaging, and distribution. Food certifications and regulations ensure transparency and sustainability in the food supply chain. Food and drink experiences remain at the heart of culinary tourism, with a growing emphasis on food sustainability and traceability. Culinary tourism itineraries cater to diverse preferences, from adventurous foodies to those seeking traditional recipes and gastronomic experiences. The continuous unfolding of market activities and evolving patterns underscores the enduring appeal of culinary tourism.

How is this Culinary Tourism Industry segmented?

The culinary tourism industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food festival

- Culinary trails

- Cooking classes

- Others

- Product

- Domestic

- International

- Type

- Recreational

- Diversionary

- Existential

- Experimental

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Norway

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

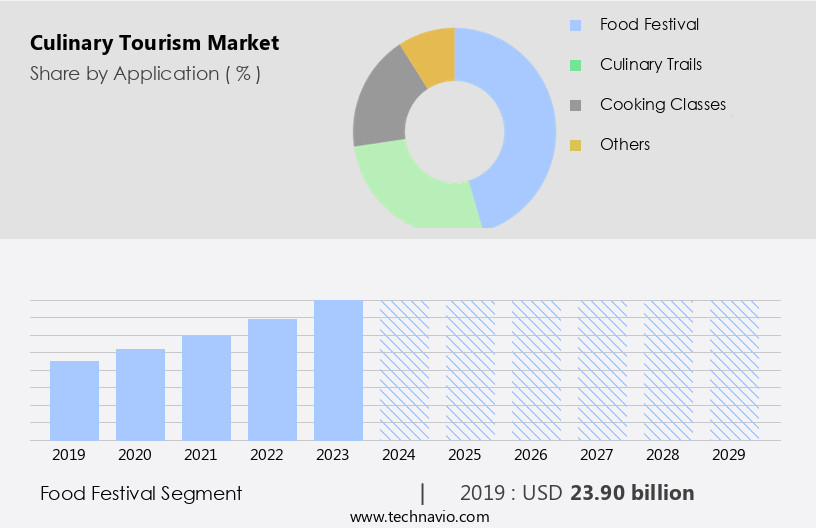

By Application Insights

The food festival segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in 2024, with food festivals playing a pivotal role in its popularity. These events offer tourists an immersive and harmonious experience into the local culture and cuisine of a destination. Food festivals showcase a diverse range of traditional dishes, innovative culinary creations, and locally sourced ingredients, attracting food enthusiasts and a broader audience seeking authentic experiences. Interactive elements, such as live cooking demonstrations, workshops, and tastings, further enhance the appeal, making food festivals a must-visit for culinary travelers. Culinary tourism strategies often incorporate food processing, food markets, and food production to provide a comprehensive experience.

Food safety standards are emphasized to ensure a harmonious and enjoyable experience for tourists. Culinary tourism businesses offer various packages, including wine tasting tours, culinary workshops, and restaurant experiences, catering to diverse preferences and interests. Food heritage, certifications, and sustainability are essential aspects of culinary tourism, with a focus on preserving traditional recipes and promoting food authenticity and traceability. The food supply chain, from production to distribution, plays a crucial role in ensuring the availability and quality of local and regional specialties. Food trends, regulations, and science influence culinary tourism development and research, shaping the future of this dynamic and evolving industry.

The Food festival segment was valued at USD 23.90 billion in 2019 and showed a gradual increase during the forecast period.

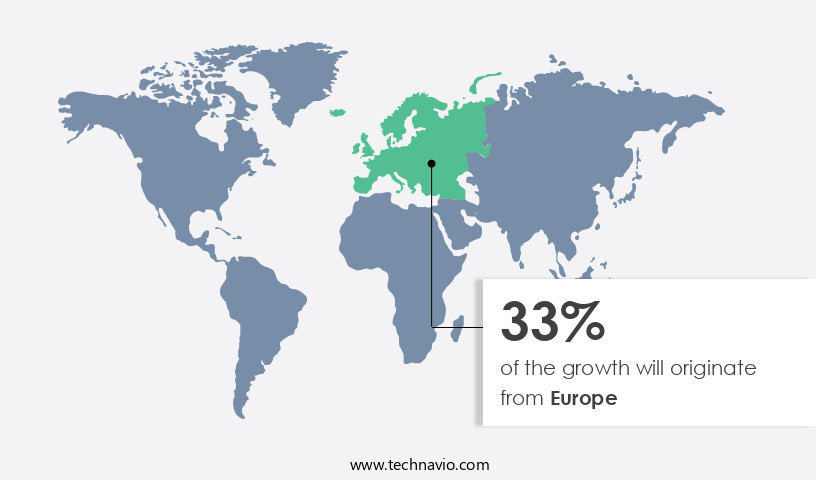

Regional Analysis

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Culinary tourism is experiencing significant growth, particularly among leisure and recreational travelers in Europe. Germany, France, and the UK are currently the most popular destinations for this type of tourism, attracting visitors with their rich culinary histories, wine regions, and diverse food offerings. To maintain their competitive edge, industry players are investing heavily in research and development, launching innovative tours, and collaborating with local food producers and chefs. Food safety standards and sustainability are also becoming key priorities. Online platforms are increasingly used for marketing and distribution, making it easier for tourists to plan and book their culinary experiences.

The increasing number of tourists seeking authentic food and beverage experiences, along with the availability of luxury cruises, is driving market growth in Europe. Food processing, markets, and production play a crucial role in the supply chain, while food festivals and regional specialties showcase the unique culinary heritage and innovation of each destination. The culinary tourism landscape is dynamic, with a focus on food safety, authenticity, and traceability. Food trends, regulations, and science influence the industry, and cooking classes and workshops offer visitors hands-on experiences. Culinary tourism agencies and operators collaborate to create itineraries that cater to diverse interests, from gourmet travel and wine tasting to food preservation and traditional recipes.

The market is expected to continue evolving, with a focus on food sustainability, food technology, and gastronomic experiences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Culinary Tourism Industry?

- The surge in popularity of food festivals and events serves as the primary catalyst for market growth in this sector.

- Culinary tourism has emerged as a significant market, offering travelers unique experiences that go beyond traditional sightseeing. Brands focusing on this niche can leverage various strategies to engage tourists, such as culinary events and tours. These experiences allow visitors to delve deeper into the local culture by exploring culinary history, traditions, and ingredients. Culinary events, including food festivals, showcase regional specialties, cooking methods, and locally sourced ingredients, promoting lesser-known dishes and fostering demand for local food products. These platforms also provide opportunities for chefs and food companies to experiment with new recipes and concepts, driving culinary innovation. Wine tasting tours, food demonstrations, and visits to food processing facilities and markets are popular culinary tourism offerings.

- These experiences provide visitors with a comprehensive understanding of food production and the role it plays in the local economy. The marketing and promotion can further enhance the value proposition, attracting a diverse range of tourists. Culinary tourism professionals play a crucial role in curating these experiences, ensuring authenticity and immersive experiences for tourists. The variety of culinary tourism packages caters to various interests, from wine and cheese festivals to street food fairs and seafood celebrations. By offering a wide range of experiences, culinary tourism brands can cater to the evolving preferences of travelers and position themselves as leaders in this growing market.

What are the market trends shaping the Culinary Tourism Industry?

- The growing trend in the tourism industry is the increasing popularity of sustainable and organic culinary experiences. Sustainable and organic culinary tourism is becoming a significant market segment.

- The market is experiencing significant growth due to various factors. Consumers are increasingly seeking authentic and unique food experiences, leading to a surge in demand for sustainable and organic offerings. Culinary tourism operators are responding to this trend by providing immersive and harmonious experiences that emphasize food safety standards and food heritage. Sustainable practices, such as supporting local farmers, producers, and businesses, are becoming a priority for both tourists and operators. Additionally, there is a growing preference for healthy and organic food options, free from pesticides, chemicals, and genetically modified organisms (GMOs). This trend is driven by increasing consumer awareness about health and the environment.

- Culinary workshops and restaurant experiences are popular offerings in the culinary tourism industry, providing tourists with a deeper understanding of local food culture and the food supply chain. Food certifications and culinary arts education are also important aspects of the market, ensuring that businesses meet high standards and provide authentic and educational experiences for tourists. Overall, the market is a dynamic and evolving industry that offers unique opportunities for businesses to provide memorable and sustainable food experiences for travelers.

What challenges does the Culinary Tourism Industry face during its growth?

- The eliteness quotient, or exclusivity, associated with luxury travel represents a significant challenge to the industry's growth. This challenge stems from the perception that luxury travel is only accessible to a select few, limiting its potential customer base and hindering industry expansion.

- Culinary tourism, a niche segment of the travel industry, caters to the growing demand for unique and authentic food and beverage experiences. Culinary tourism agencies offer a range of services, from cooking classes and food festivals to private dining experiences with renowned chefs and access to regional specialties. This market is driven by several factors, including food trends, sustainability, and food science. HNWIs and affluent travelers seek immersive and harmonious experiences that reflect their status and discerning tastes. However, maintaining authenticity while offering luxury and managing high costs are challenges.

- Sustainability is a critical concern, with a focus on preserving local cuisine and food traditions. Food regulations play an essential role in ensuring safety and quality. The market dynamics are shaped by these factors, making it an exciting and dynamic industry for businesses and travelers alike.

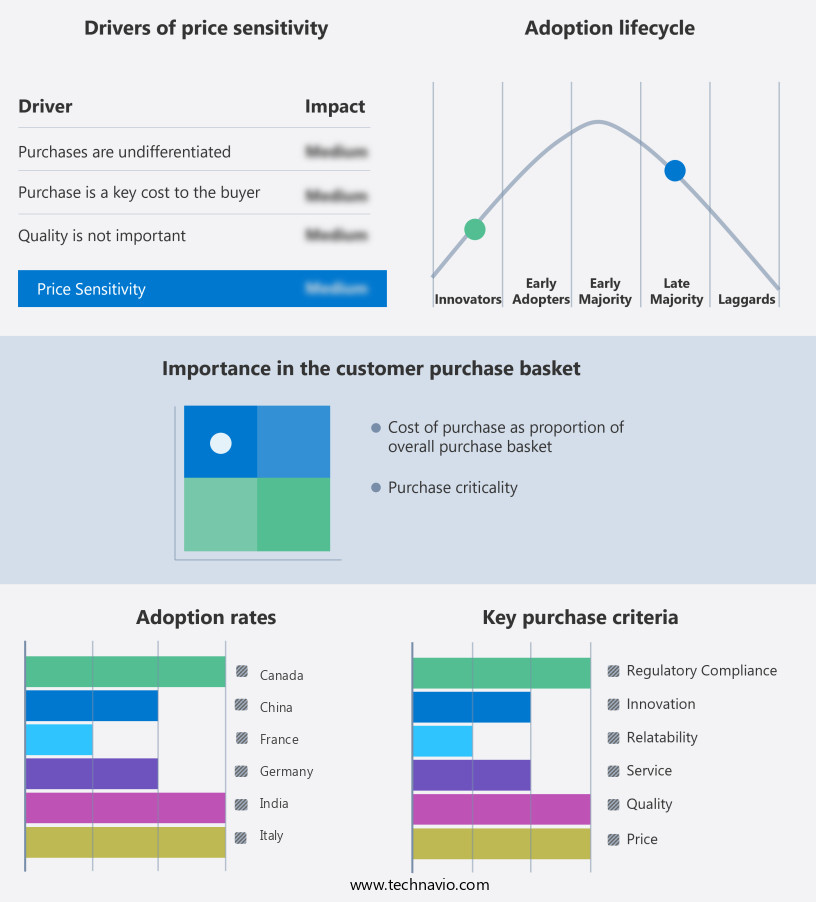

Exclusive Customer Landscape

The culinary tourism market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the culinary tourism market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, culinary tourism market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abercrombie & Kent - The organization specializes in curating immersive culinary experiences through a selection of exclusive offerings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abercrombie & Kent

- Arigato Japan Food Tours

- Classic Journeys

- Contiki

- Context Travel

- Cookly

- Eating Europe

- Exodus Travels

- G Adventures

- GetYourGuide AG

- Intrepid Travel

- Klook Travel Technology Limited

- Secret Food Tours

- The Foodie Travel Co.

- The International Kitchen

- TourRadar

- Trafalgar Travel

- Travel Spoon

- TripAdvisor Inc.

- Viator (TripAdvisor)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Culinary Tourism Market

- In February 2023, the International Culinary Tourism Association (ICTA) announced a strategic partnership with World Food Travel Association (WFTA) to create a unified platform for the global culinary tourism industry. This collaboration aims to enhance industry education, networking, and marketing efforts, benefiting over 30,000 members from both organizations (ICTA Press Release).

- In May 2024, TripAdvisor, the world's largest travel platform, launched a new feature called "Food Experiences" to cater to the growing demand for culinary tourism. This feature allows users to search, compare, and book cooking classes, food tours, and other gastronomic activities in various destinations (TripAdvisor Press Release).

- In August 2024, the European Union (EU) approved a â¬50 million funding program to promote culinary tourism in member countries. The program, called "Taste Europe," aims to boost the sector's economic growth, create jobs, and promote cultural exchange (European Commission Press Release).

Research Analyst Overview

In the dynamic market, gourmet tours and culinary experiences have gained significant traction, fueled by the hospitality industry's shift towards immersive, interactive offerings. Online booking platforms have streamlined the reservation process, making it easier for travelers to plan their food-focused journeys. Digital marketing strategies, including content marketing and social media marketing, have become essential tools for tourism businesses looking to reach food influencers and bloggers. Fusion cuisine and ethnic cuisine continue to captivate consumers, driving demand for cultural tourism experiences. Virtual and augmented reality technologies are transforming culinary storytelling, providing unique, immersive experiences for travelers. Food photography and food videography are increasingly important in digital marketing efforts, showcasing the visual appeal of culinary offerings.

Destination management companies are embracing the trend towards gastronomic tourism, offering food trails and agricultural tours to provide authentic, educational experiences. The travel industry recognizes the potential of culinary tourism to attract diverse demographics and generate revenue. Food security and culinary education are also becoming key considerations in the development of tourism infrastructure. Mobile applications have revolutionized the way travelers discover and book culinary experiences, making it easier to access information on-the-go. The restaurant industry is adapting to the trend by offering virtual tours and interactive menus, enhancing the dining experience for guests. Overall, the market is a vibrant and evolving sector, with endless opportunities for innovation and growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Culinary Tourism Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.8% |

|

Market growth 2025-2029 |

USD 253 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

19.3 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Norway |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Culinary Tourism Market Research and Growth Report?

- CAGR of the Culinary Tourism industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the culinary tourism market growth of industry companies

We can help! Our analysts can customize this culinary tourism market research report to meet your requirements.